Case Summary: Liberated Brands Chapter 11

Liberated Brands has filed for Chapter 11 bankruptcy, citing macroeconomic pressures and shifting consumer preferences, with plans to wind down North American operations and sell international assets.

Business Description

Liberated Brands LLC, along with its Debtor and non-Debtor affiliates (collectively, “Liberated” or the “Company”), is a global leader in the sport, outdoor, and lifestyle apparel industry. The Company operates as an omnichannel apparel licensee with expertise in trend forecasting and brand development, offering products under prominent brands such as Volcom, Billabong, Quiksilver, Spyder, RVCA, Roxy, and Honolua.

- As of the Petition Date, Liberated manages 124 retail locations across the U.S. and maintains a presence in over 100 countries through various distribution channels.

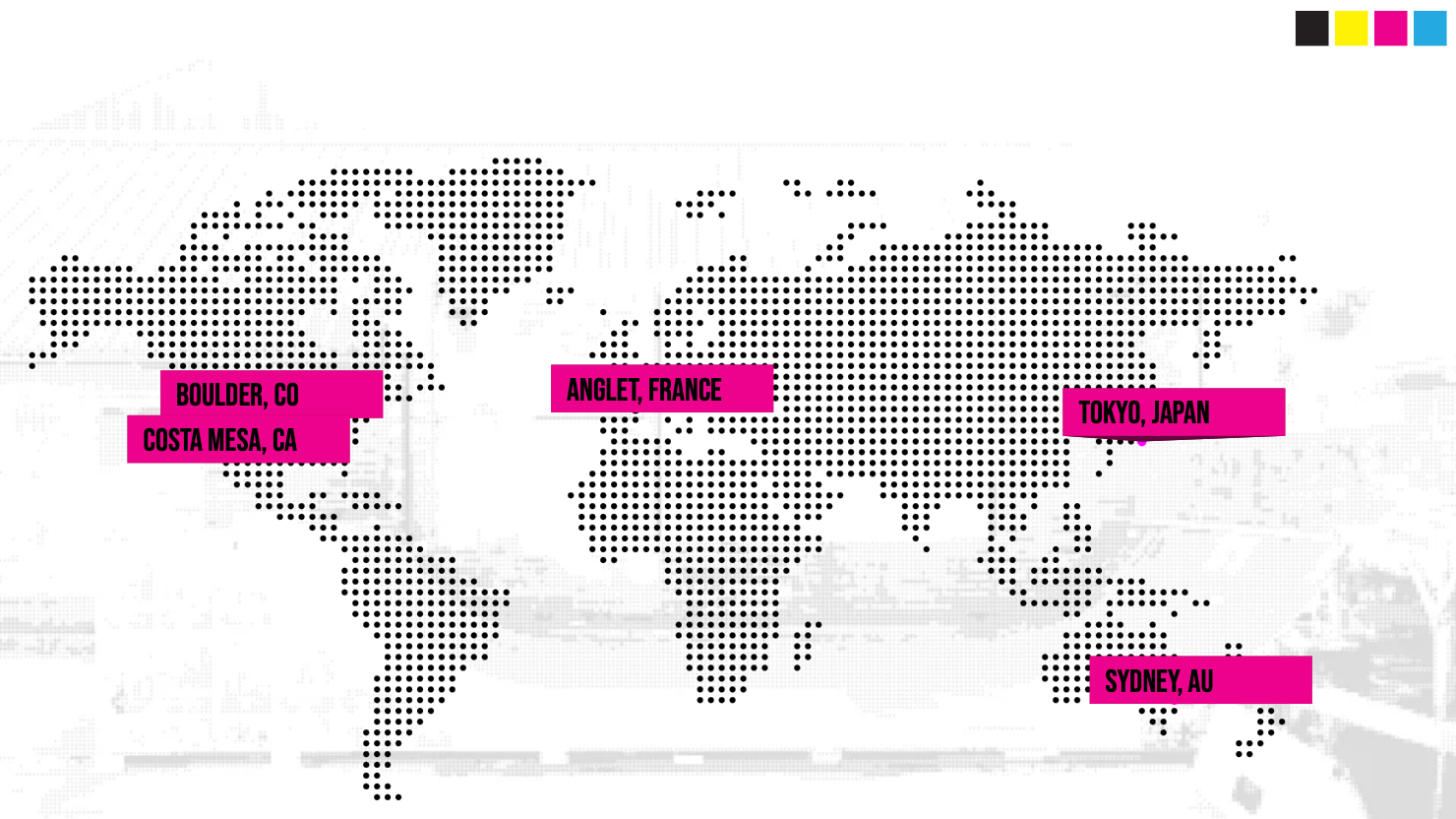

- The Company operates regional headquarters in North America, Europe, Japan, and Australia, facilitating its global operations and brand management.

The Debtors filed for Chapter 11 protection on Feb. 2 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

Corporate History

Liberated was founded in 2019 by the former management team of Volcom, coinciding with Kering's sale of Volcom's intellectual property rights to Authentic Brands Group ("Authentic"), a global brand development company.

- This transaction established a strategic alignment between Authentic and Liberated, with Liberated assuming responsibility for Volcom's operations in the United States, France, Australia, and Japan, as well as overseeing its global product development, athlete marketing, and retail and wholesale businesses under a licensing agreement.

Key Milestones and Acquisitions

- In 2021, Volcom partnered with Netflix to launch a collection inspired by the popular series Outer Banks, and in January 2022, Volcom was named the official apparel partner of the U.S. Snowboard Team for the 2022 Olympic Winter Games in Beijing.

- Following these successes, Liberated acquired Authentic's core licenses for Spyder, a leading active lifestyle brand, in October 2021. This marked the beginning of a series of transactions where Liberated obtained master licensing rights and operational responsibilities for additional sport and entertainment brands under Authentic's platform.

- In September 2023, Liberated and Authentic entered into a new agreement granting Liberated the license and e-commerce operational rights for Authentic's newly acquired brands, including Quiksilver, Billabong, Roxy, RVCA, Honolua, and Boardriders, in the United States and Canada (the "U.S. Boardriders Transaction").

- In December 2023, Liberated and Authentic completed the Australian Boardriders Transaction (together with the U.S. Boardriders Transaction, the “Boardriders Transaction”), expanding Liberated's role as the licensee and operator for certain Authentic brands in the Asia-Pacific region, including the management of over 200 retail locations.

- The Boardriders Transaction was executed in two phases, with HLB Group Holdings LLC ("HLB") making initial and subsequent investments in Liberated to facilitate these acquisitions. As a result, HLB became the majority owner of Liberated.

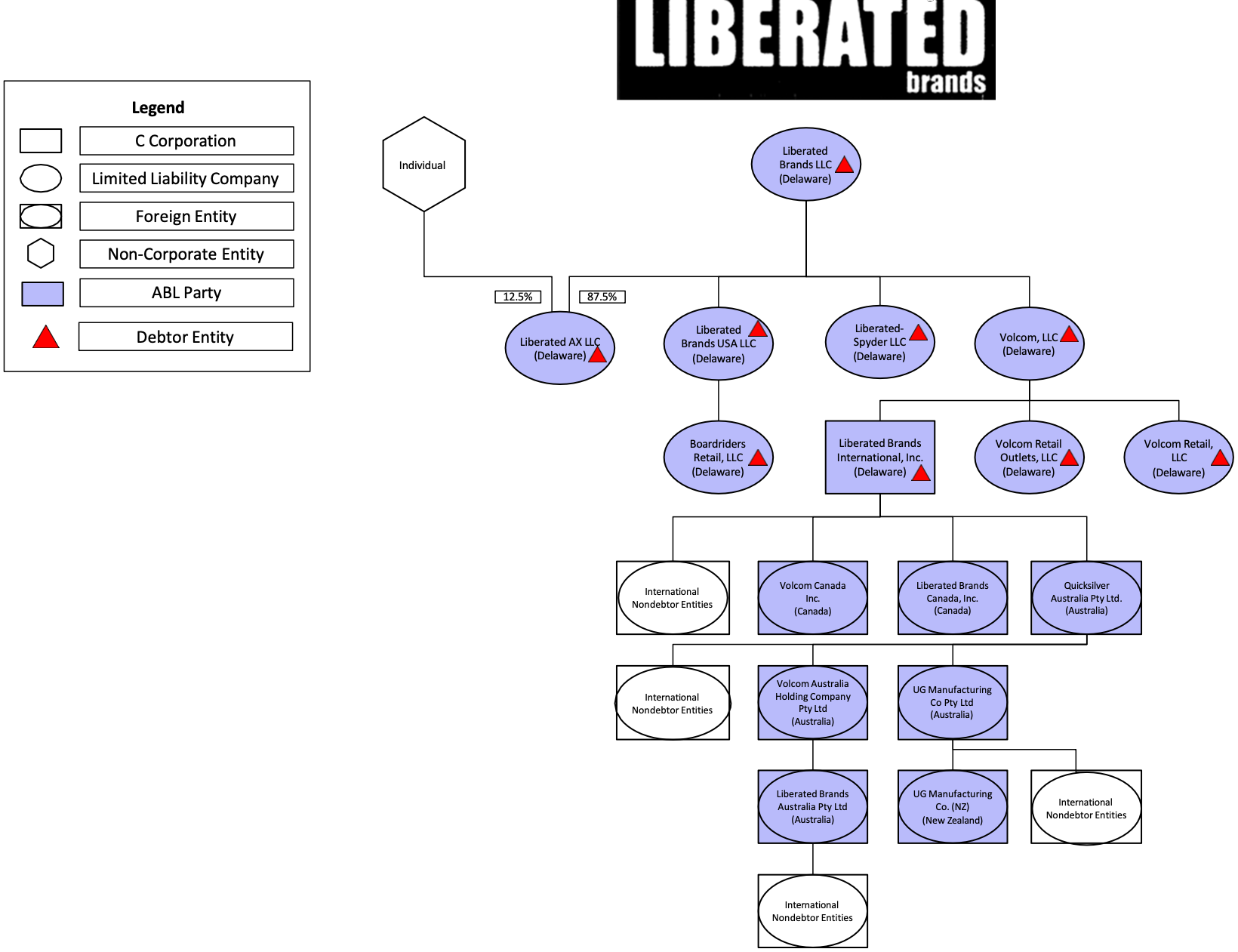

Organizational Chart

Liberated serves as the parent entity for the eight Debtor entities, as well as 32 non-Debtor affiliates. The majority equity interest in Liberated is held by HLB, with a 19.9% stake owned by ABG Intermediate Holdings 2 LLC (an affiliate of Authentic), while the remaining ownership is held by the Company’s management team.

Operations Overview

Liberated operates a diversified portfolio of brands, each specializing in distinct categories of sport and lifestyle apparel. The Company's product offerings include surf gear, beach apparel, ski and snowboarding equipment, activewear, and outerwear, distributed across three primary sales channels: wholesale, e-commerce, and retail storefronts.

Brand Specializations

- Surf and Beach Apparel: Brands such as Billabong, Quiksilver, Roxy, Honolua, and RVCA offer products like wetsuits, swimwear, and activewear.

- Winter Sports: Spyder and Volcom provide premium ski and snowboarding gear.

*As of the Petition Date, Liberated’s North American license rights for Volcom, Billabong, RVCA, and Spyder have been terminated or transferred.

Sales Channels

- Wholesale: The Company distributes products to retailers worldwide, accounting for approximately 50% of its revenue in 2024.

- Direct-to-Consumer: The remaining 50% of revenue is generated through e-commerce platforms and retail sales in leased storefronts.

Operational Capabilities

- Liberated manages all aspects of its operations, including product design, sourcing, branding, and logistics, ensuring a seamless experience across all sales channels.

- The Company emphasizes sustainability and brand cultivation through immersive storytelling, leveraging its 30 years of expertise in the sport, entertainment, and outdoor gear retail space.

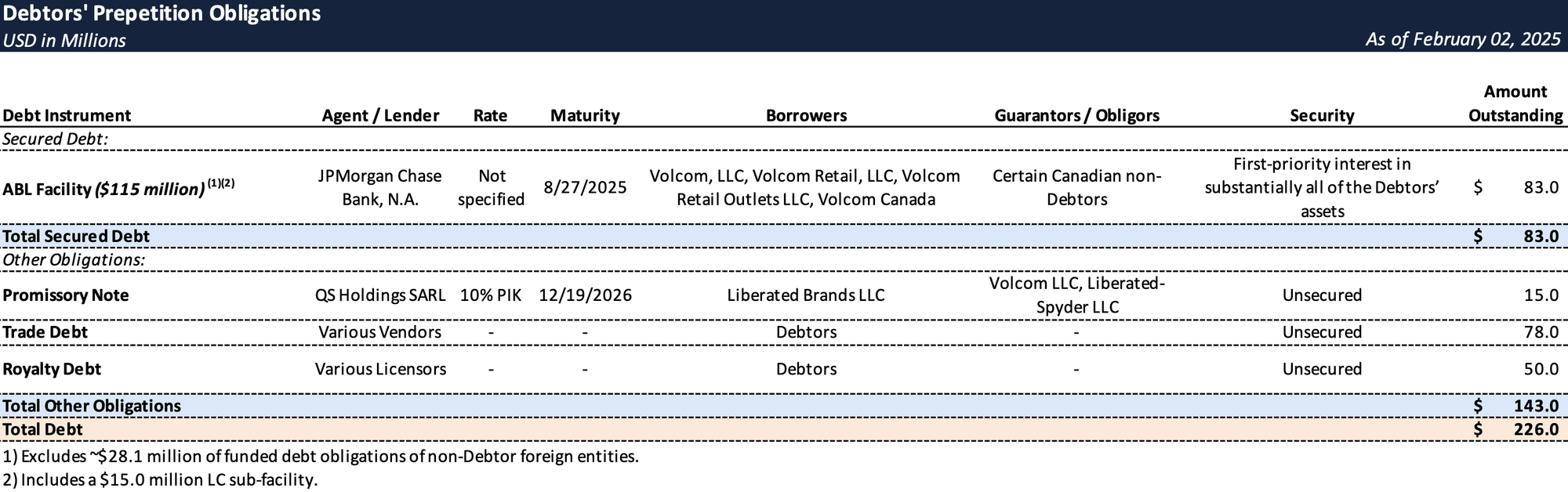

Prepetition Obligations

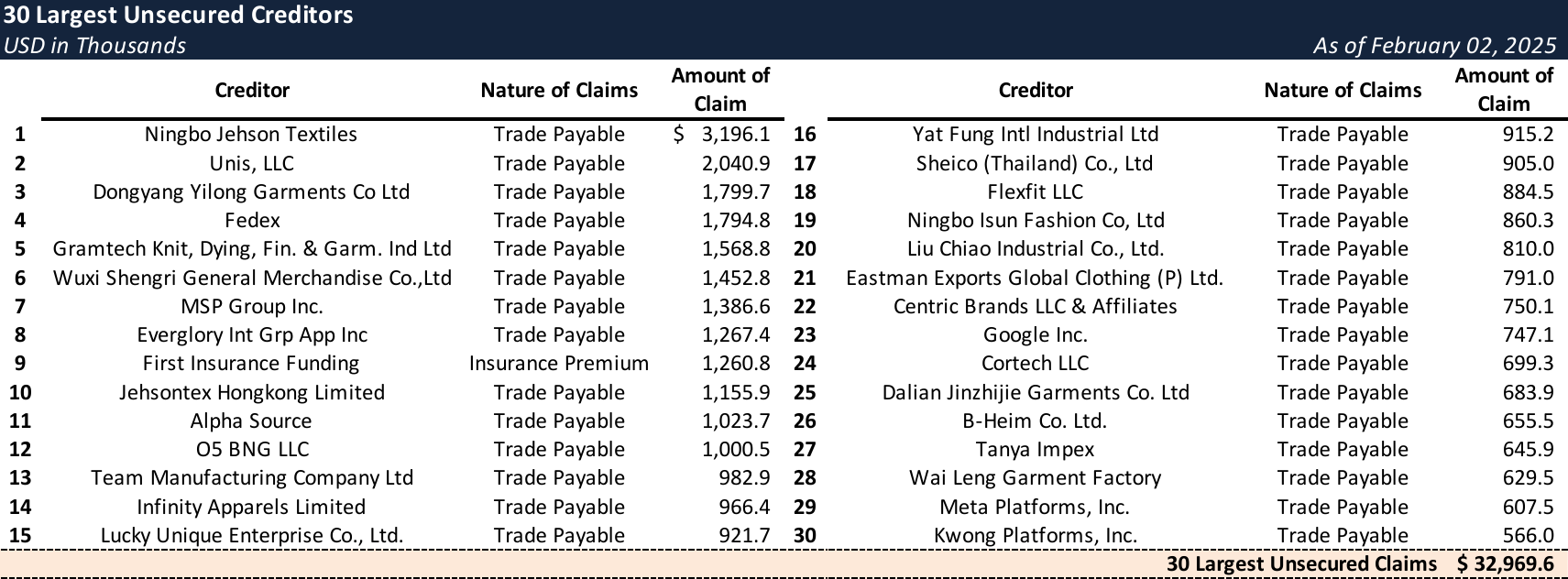

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic and Industry Challenges

- The Company faced significant macroeconomic pressures, including rapidly rising interest rates, persistent inflation, supply chain disruptions, and a decline in customer demand below historical trends. These factors, coupled with shifting consumer preferences and elevated fixed costs, strained the Company’s revenue and cost structure.

- The COVID-19 pandemic initially drove growth for the Company, enabling it to expand its retail footprint from 67 to 140 stores and increase headcount from 638 to 1,480 through the Boardriders Transaction. However, the post-pandemic environment brought challenges as consumer demand weakened, with overall purchase volumes declining and shifting away from the Company’s products.

- Supply chain disruptions persisted, leading to shipping delays, increased costs of materials, labor, and fuel, and reduced margins across the Company’s brand portfolio. Inventory updates were further delayed due to transportation shortages and port congestion.

Challenges in the Retail Landscape

- Liberated’s substantial brick-and-mortar retail presence became a drag on profitability, as consumer demand for in-store shopping did not fully recover post-pandemic. The rise of fast fashion further exacerbated pressures, as consumers increasingly favored affordable, quickly produced garments over traditional retail models.

- Fast fashion competitors, capable of responding to micro-trends with rapid production and delivery, eroded the Company’s market share and pricing power, leading to decreased profit margins.

Operational and Integration Challenges

- The Company faced operational losses stemming from significant fixed costs, including guaranteed royalties under license agreements with Authentic, underperforming retail locations, and heightened competition in the apparel retail industry.

- Post-Boardriders Transaction, Liberated incurred duplication of operating expenses while maintaining legacy businesses and establishing its own infrastructure. Additionally, miscommunications with third-party logistics providers compounded operational inefficiencies.

Liquidity Crisis

- The confluence of macroeconomic shocks, retail challenges, and declining consumer demand led to a severe liquidity crisis. The Company experienced a dramatic decline in financial performance, with EBITDA plummeting from $2.3 million in 2022 to negative $12.5 million in 2024, a more than 600 percent decline over the course of two years.

Prepetition Initiatives

- In mid-2024, Liberated launched cost-cutting measures and a Prepetition Marketing Process to address its liquidity challenges. Initiatives included workforce reductions, stretching trade payables, and exploring strategic transactions such as the sale of certain business lines in Japan, Australia, Europe, and the North American Spyder business.

- Despite engaging with multiple potential transaction parties, the Prepetition Marketing Process did not yield actionable proposals, prompting the Company to retain financial and legal advisors to explore restructuring options.

Cost-Cutting Measures

- The Company implemented a hiring freeze in July 2024, followed by the termination of 47 employees in August 2024. Additionally, the Company negotiated payment plans with vendors to extend trade payables.

- By October 2024, the Company suspended certain vendor payments, leading to heightened vendor tensions and reputational challenges that disrupted operations.

Advisor Retention and Governance Enhancements

- In November 2024, Liberated retained Alixpartners as its financial advisor and Kirkland as legal counsel. Additionally, in January 2025, the Company retained Klehr Harrison as local Delaware and conflicts counsel and Stretto was appointed as the claims and noticing agent.

- On November 14, 2024, Mark Hootnick, a seasoned restructuring expert, was appointed as an independent and disinterested manager to oversee strategic initiatives and investigate transactions for potential claims in the Chapter 11 Cases.

Recent Transactions

- In November 2024, the Company divested its North American Spyder business to Q4D, shedding liabilities and future operating expenses related to this unprofitable segment. The transaction allowed the Company to continue selling remaining Spyder inventory while offloading associated risks.

- Despite the transfer of certain assets and liabilities, the Company faced challenges in forwarding payments to Q4D due to its cash dominion position, resulting in an ongoing dispute that will be addressed in the Chapter 11 Cases.

- In December 2024, following Liberated’s default on its licensing agreements and failure to make required guaranteed royalty payments, Authentic terminated its licenses for the U.S. and Canadian wholesale and e-commerce operations related to Volcom, RVCA, and Billabong.

- A limited reinstatement agreement allowed Liberated to sell prior-season branded merchandise while entering transition agreements with new operators, including O5 Apparel for Billabong North America and the Levy Group for Volcom North America Wholesale.

- With minimal prospects for continued operations in North America, Liberated subsequently closed its corporate offices and laid off approximately 350 corporate employees and 1,040 retail staff.

DIP Facility & Path Forward

Proposed DIP Facility

- The Company seeks court approval for a $35 million senior secured superpriority DIP ABL Facility from JPMorgan Chase Bank, N.A., ensuring liquidity to fund operations and an orderly restructuring.

- The facility provides $25.0 million upon interim approval and supports the Chapter 11 process.

Anticipated Path Forward

- The Company’s restructuring strategy focuses on maximizing stakeholder value through:

- Orderly Wind-Down of North American Operations: Liquidation of retail inventory via store closures and monetization of wholesale inventory through a Company-led process.

- Strategic Disposition of Non-U.S. Assets: Sale of Australian, European, Japanese, and Canadian operations through going-concern transactions or asset liquidations.

- Accelerated Chapter 11 Timeline: Filing and confirmation of a Chapter 11 plan to ensure value-maximizing distributions to creditors.

Subscribe for access to coverage of all Chapter 11 bankruptcy cases with liabilities exceeding $10 million.