Case Summary: LifeScan Chapter 11

LifeScan has filed for Chapter 11 bankruptcy amid structural disruption in the diabetes device market and an overleveraged balance sheet, supported by a pre-arranged restructuring agreement to eliminate approximately $1.4 billion in liabilities and transfer ownership to lenders.

Business Description

Headquartered in Malvern, PA, LifeScan Global Corporation, along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "LifeScan" or the "Company"), is a leading global provider of diabetes management products and digital health solutions, primarily focused on blood glucose monitoring ("BGM") technology.

- LifeScan designs, manufactures, and markets the OneTouch® brand of glucose monitoring devices, test strips, lancets, and integrated software/mobile applications.

- Its products are known for simplicity, accuracy, and trust, with over 20 million people worldwide relying on OneTouch® devices to manage their diabetes.

- The Company's comprehensive portfolio includes handheld glucose meters for home use, point-of-care devices for hospitals, and digital platforms like the OneTouch Reveal mobile app for tracking, analysis, and data sharing.

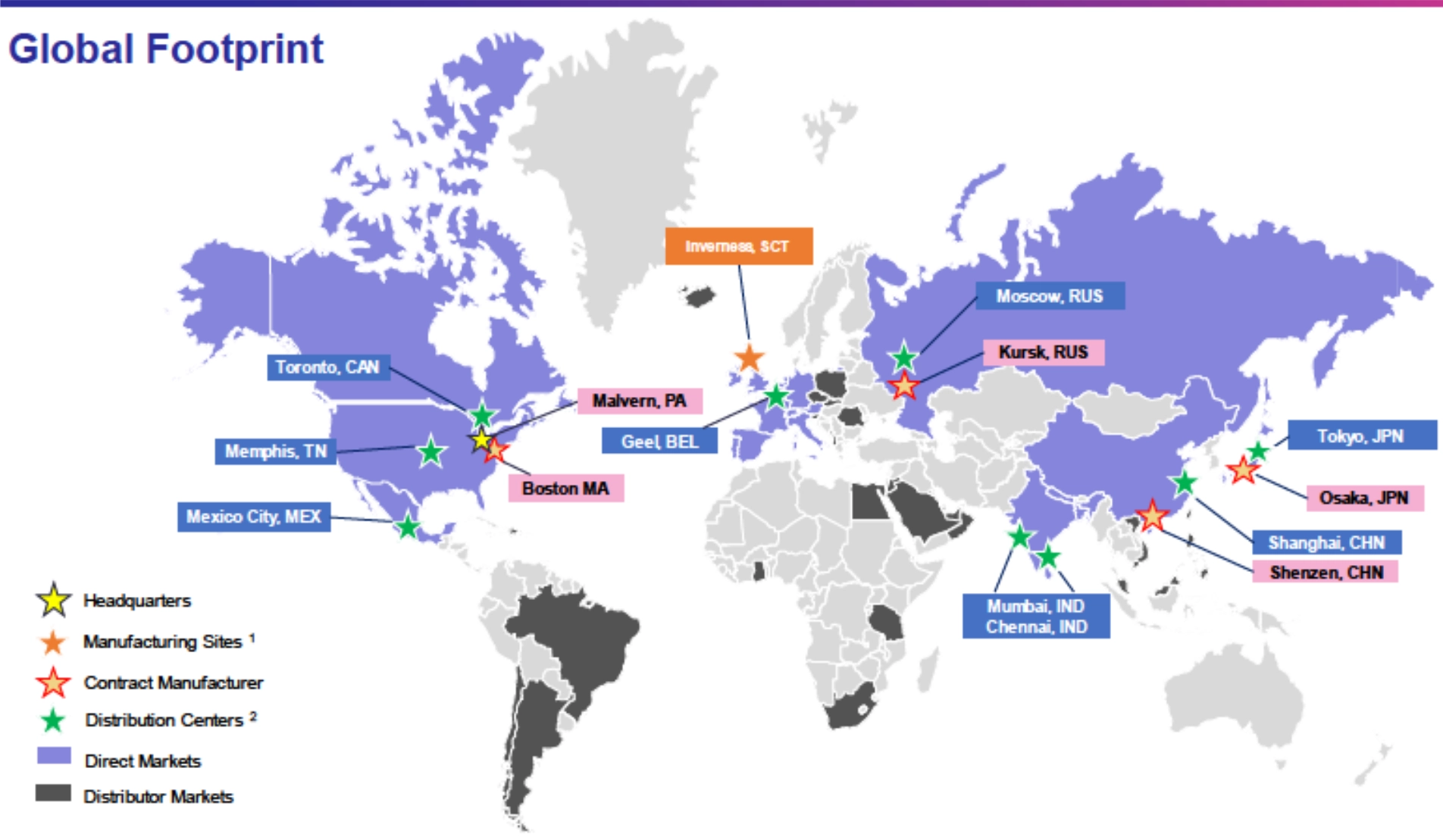

As of the Petition Date, LifeScan maintains a significant global presence, with direct commercial operations in over 50 countries across North America, Europe, and Asia, supported by approximately 1,300 employees. The Company holds a substantial share of the worldwide BGM market, with about 30% global volume share as of April 2025.

- LifeScan’s manufacturing model is highly efficient, producing high-volume test strips at its dedicated facility in Inverness, Scotland, while outsourcing meters and other components to contract manufacturers.

- Its products are distributed through various channels, including retail pharmacies, durable medical equipment suppliers, e-commerce, and direct-to-consumer sales.

- LifeScan’s OneTouch meters and strips are available over-the-counter in the U.S., a channel the Company is leveraging to expand patient access beyond traditional insurance reimbursement.

LifeScan’s BGM products have historically been successful, generating over $1 billion in annual revenue prior to 2021. However, revenues declined to $909 million in 2022 and approximately $750 million in 2023.

LifeScan Global Corporation and its affiliates filed for Chapter 11 protection on July 15, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in both assets and liabilities.

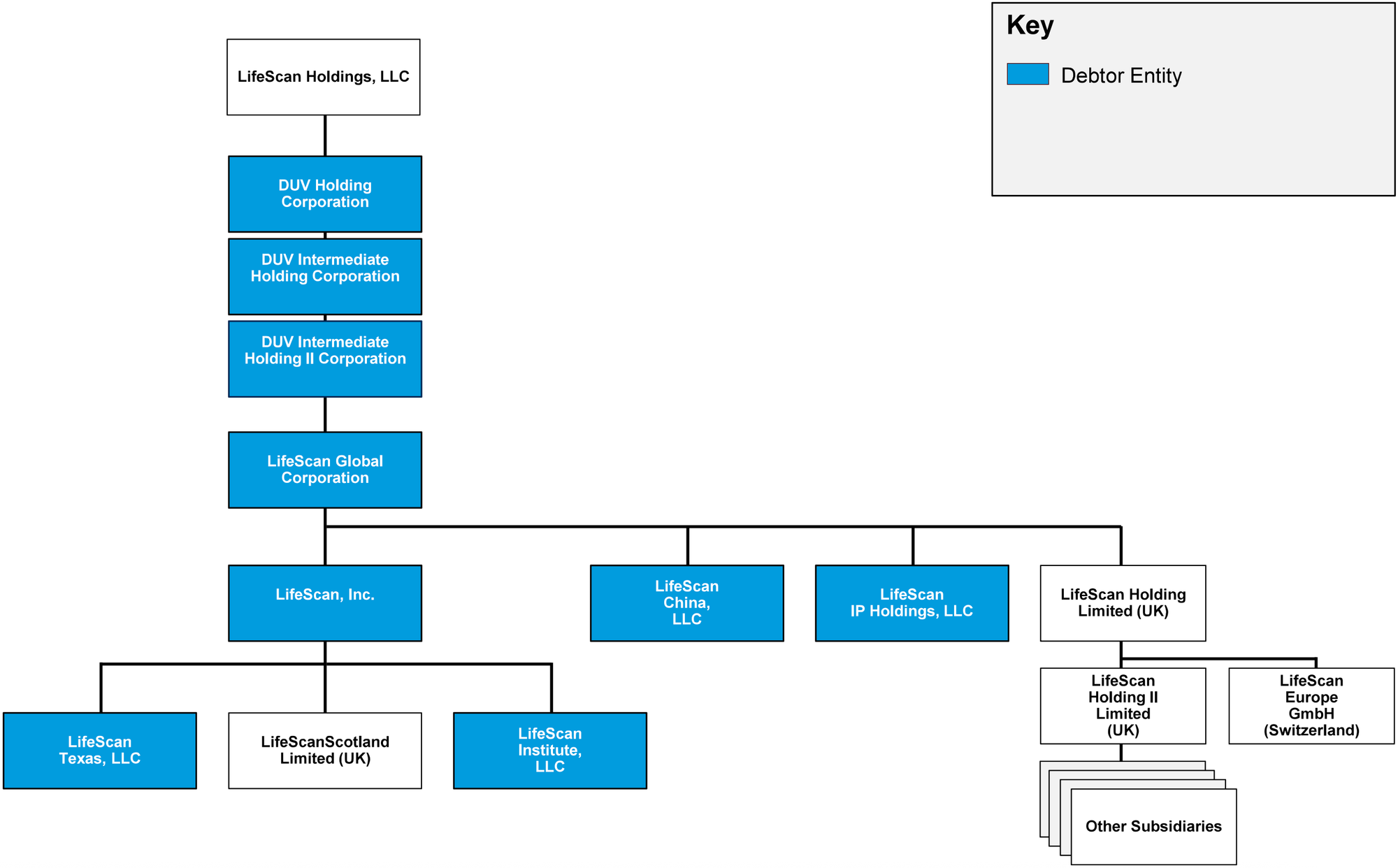

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

LifeScan’s history spans over four decades, originating in 1981 with a focus on improving diabetes management for patients. The company quickly became a pioneer in blood glucose monitoring technology, developing one of the first user-friendly at-home glucose meter systems.

Acquisition by Johnson & Johnson and Product Innovation

- In 1986, LifeScan was acquired by Johnson & Johnson ("J&J"), becoming a central feature of J&J’s diabetes device business for over 30 years.

- Under J&J, LifeScan launched the OneTouch product line in 1987, introducing a revolutionary meter-and-strip system that simplified blood sugar testing with automated timing and measurement. This innovation delivered faster, more accurate results, transforming self-testing for diabetic patients.

- Throughout the 1990s and 2000s, LifeScan continued refining its technology with notable products like the FastTake meter (1998) for on-the-go testing, the OneTouch Ultra (2001) offering five-second readings and result storage, and the OneTouch Verio and OneTouch Reveal systems (2010s) with wireless data syncing to mobile apps.

- These continuous improvements in ease-of-use and connectivity helped LifeScan set industry standards while the global diabetes epidemic fueled growing demand for its products.

Divestiture to Platinum Equity

- In 2018, J&J divested LifeScan to private investment firm Platinum Equity for approximately $2.1 billion, as part of a portfolio restructuring. LifeScan became an independent entity, with Platinum Equity as its majority owner.

- Platinum Equity installed new leadership, including CEO Valerie Asbury, a healthcare industry veteran and former J&J executive, who assumed leadership in October 2018 to guide LifeScan as a standalone company.

Post-Divestiture Strategic Initiatives

- In 2019, LifeScan initiated a strategic partnership to develop a continuous glucose monitoring ("CGM") device, securing exclusive rights to a third-party CGM system with LifeScan responsible for its commercialization. This aimed to complement the legacy OneTouch fingerstick products and maintain competitiveness in the evolving technology landscape.

- LifeScan’s corporate structure includes various subsidiaries like LifeScan, Inc. (U.S. operating entity), manufacturing arms, IP holding entities, and international affiliates in Europe and Asia.

- The Company has been reassessing its geographic footprint, with plans to exit the China market in the near to medium term and ongoing monitoring of risks in markets like Russia and India, reflecting strategic adjustments to changing industry dynamics and financial constraints.

Corporate Organizational Structure

Operations Overview

LifeScan’s operations span North America, Europe, Asia, and other regions, leveraging a combination of direct distribution and partner networks. The United States serves as LifeScan’s largest market and headquarters.

Market Reach and Distribution Channels

- In the U.S., OneTouch products are sold through retail pharmacies, durable medical equipment (DME) suppliers, e-commerce, direct-to-consumer channels, mail-order suppliers, and healthcare systems.

- Internationally, LifeScan maintains direct subsidiaries or branches in key countries such as France, Germany, Spain, Russia, Japan, China, and India, managing local sales and marketing.

- In other territories, LifeScan relies on third-party distributors to supply OneTouch products to hospitals, pharmacies, and clinics, contributing to OneTouch’s global presence.

- While products are used in both consumer home settings and professional healthcare settings (hospital glucose monitoring), the majority of revenue is derived from high-frequency sales of disposable test strips to individual diabetes patients.

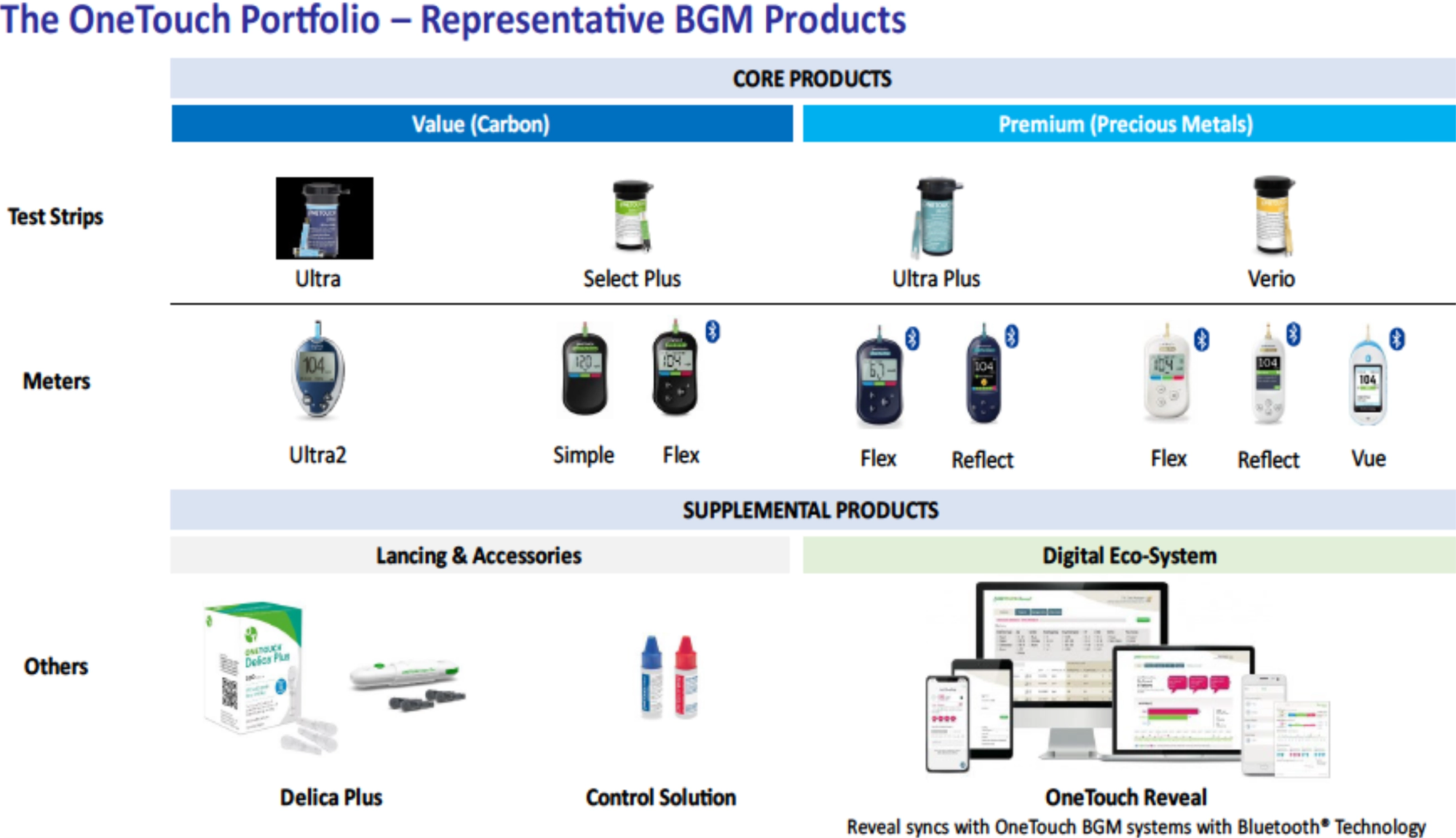

Product Portfolio

- The core of LifeScan’s business is the OneTouch® Blood Glucose Monitoring system, which comprises handheld glucose meter devices and compatible disposable test strips.

- The Company sells various models of OneTouch meters, from basic models to Bluetooth-enabled devices, along with ancillary products like lancing devices, lancets, and control solutions.

- LifeScan also provides digital health tools, including the OneTouch Reveal mobile app and web portal, which sync with meters to record readings, display trends, and enable data sharing, empowering patients with actionable insights.

- The Company offers point-of-care systems for healthcare providers (e.g., hospital glucose analyzers) and operates the LifeScan Diabetes Institute, providing training and education in diabetes management.

- Though current revenue is primarily BGM-centric, LifeScan aims to expand into the CGM segment through its strategic partnership, capturing a growing market of patients using sensor-based technology.

Manufacturing and Supply Chain

- LifeScan’s manufacturing operations are optimized for high-volume, cost-efficient production, with its dedicated facility in Inverness, Scotland, producing the critical OneTouch test strips.

- Meters and electronic devices are largely produced by contract manufacturers, allowing LifeScan to focus internal resources on proprietary strip production and avoid heavy capital expenditure on device assembly.

- LifeScan’s distribution centers manage global shipments of products, ensuring supply across all markets.

- From 2019 to 2024, LifeScan implemented cost reduction initiatives, resulting in over $400 million in savings by optimizing its supply chain, simplifying IT systems, and right-sizing its workforce and salesforce. Despite these efforts, efficiency gains could not fully offset revenue declines in its core business.

Sales and Reimbursement Model

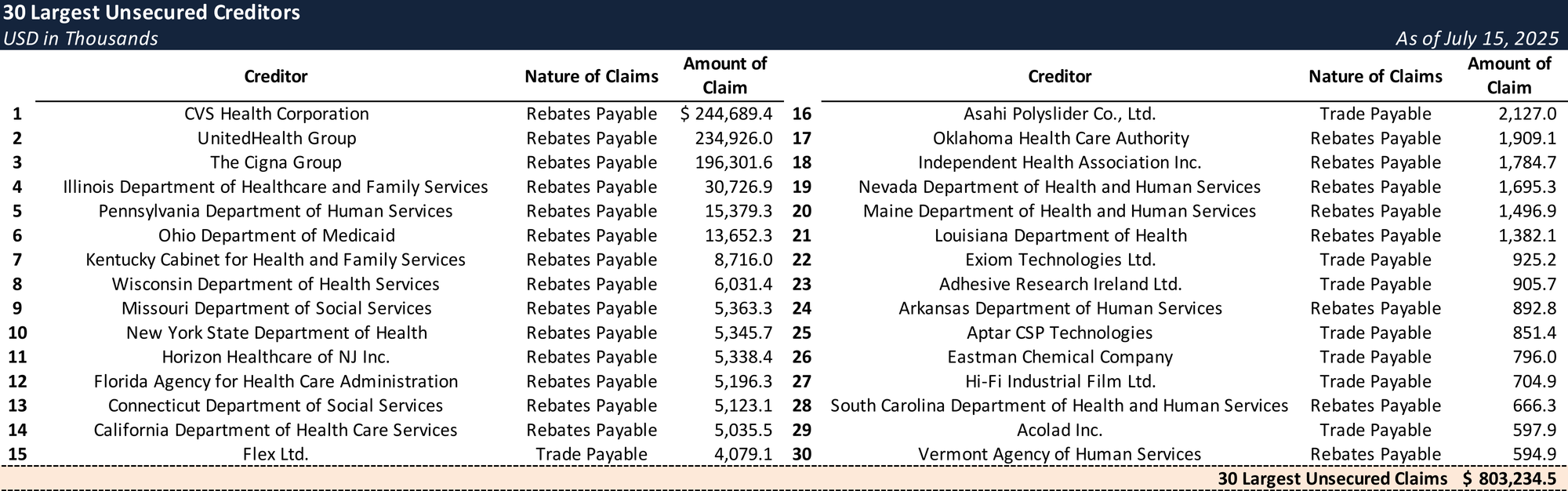

- In the U.S., a significant portion of LifeScan’s sales relies on insurance reimbursement, facilitated by rebate agreements with major pharmacy benefit managers ("PBMs") and insurers.

- Under these agreements, LifeScan pays substantial rebates to PBMs and insurers in exchange for formulary inclusion, ensuring patient access but severely compressing net margins; by 2025, LifeScan retained less than 9% of the list price per test strip sold under insurance contracts.

- These cumulative rebate obligations became substantial, with over $1.03 billion owed in accrued rebate payments to PBM and insurance counterparties as of the Petition Date, creating an unsustainable financial model.

- LifeScan’s post-restructuring strategy aims to reduce reliance on high-rebate insurance channels by expanding cash-pay, retail, and direct-to-consumer distribution channels.

- Internationally, reimbursement varies by country, with products sold through pharmacies and covered by national health systems or out-of-pocket payments depending on local healthcare systems.

- Managing a global diabetic customer base of over 20 million requires LifeScan to balance supply chain efficiency, stringent quality and regulatory compliance, and the economics of distribution agreements in each market.

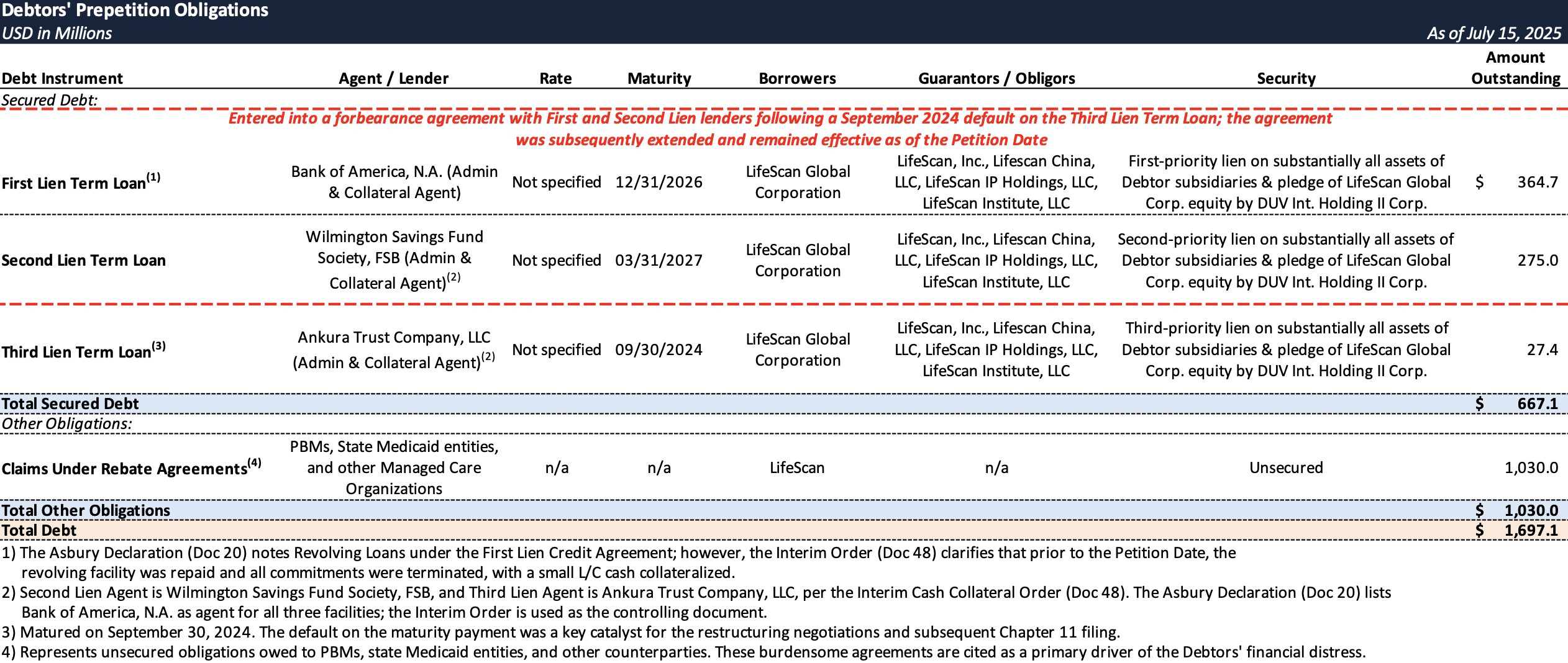

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

LifeScan Global Corporation’s Chapter 11 filing in July 2025 was driven by a convergence of industry disruption, declining revenues, significant debt from its 2018 leveraged buyout, and onerous commercial agreements.

Market Disruption – Rise of Continuous Glucose Monitors (CGMs)

- The diabetes care industry experienced a technological shift from traditional BGMs to CGM devices, which offer continuous, real-time blood sugar readings without finger pricks.

- The introduction of Abbott’s FreeStyle Libre CGM in 2017, followed by wider adoption of CGM technology by other players, led many diabetic patients to switch from finger-stick meters.

- Expanded insurance coverage for CGMs, including Medicare’s global expansion since 2019 and further expansion in 2023 to nearly all insulin-using diabetics, accelerated the decline of the BGM market.

- LifeScan’s internal analysis (with FTI Consulting in 2024) projected the global BGM market to shrink by approximately 9% per year through 2030, eroding LifeScan’s core profitability.

- Consequently, LifeScan’s annual revenues sharply declined from over $1 billion prior to 2021, to $909 million in 2022, and approximately $750 million in 2023, raising concerns about its ability to service long-term debt.

Debt Burden from 2018 LBO and Capital Structure

- LifeScan carried a substantial debt load from Platinum Equity’s $2.1 billion leveraged buyout in 2018, which included a $1.9 billion credit agreement with a revolving credit facility and senior secured term loans.

- With original maturities set for 2024–2025, the deteriorating business performance posed a significant refinancing risk.

- By early 2023, it became clear LifeScan could not repay or refinance its looming debt maturities, including a $75 million super-senior revolver due July 2024 and over $1 billion in first lien term loans due September 2024.

- LifeScan’s Board of Directors recognized that this over-leveraged capital structure jeopardized the Company's future health and necessitated an extension of maturities to focus on launching CGM products.

2023 Transaction (Out-of-Court Restructuring)

- In May 2023, LifeScan executed an out-of-court debt restructuring, negotiating amendments with lenders to extend maturities by two years (First Lien to December 31, 2026; Second Lien to March 31, 2027), and extending all revolving loans.

- All consenting lenders received a 50 bps consent fee; First Lien lenders received partial cash pay-down (funded by a $50 million equity contribution) and higher interest; and Second Lien lenders received a payment-in-kind (PIK) interest feature to ease near-term cash pressure.

- Despite credit rating downgrades following the transaction, management believed this provided crucial time to stabilize and launch its CGM product.

Delayed CGM Launch and Liquidity Squeeze

- The anticipated CGM product faced regulatory and technical delays from LifeScan’s development partner, pushing FDA approval to 2027 at the earliest.

- This delay transformed the CGM project into a cost center with no short-term payoff, further exacerbating LifeScan’s financial challenges.

- Potential new partners in CGM were hesitant to engage due to LifeScan’s over-leveraged balance sheet and concerns about its ability to fund launch expenditures.

- In FY 2024, the Company generated approximately $325 million of EBITDA, which it stated was insufficient to cover mandatory debt service obligations and required investment in CGM.

- LifeScan projected an inability to make its scheduled debt payments in 2024, including approximately $82.4 million in annual debt amortization and the $27.4 million Third Lien Term Loan maturity in September 2024.

Missed Third Lien Payment and Forbearance Agreement

- In September 2024, LifeScan defaulted on its Third Lien Term Loan by failing to make a $27.4 million principal payment.

- LifeScan entered into a forbearance agreement with its major First Lien and Second Lien lender groups, who agreed to temporarily forgo exercising default remedies; the forbearance was extended multiple times and remained in effect as of the Petition Date.

- Following execution of the forbearance, the Company engaged in months of negotiations with stakeholders and, in January 2025, began outreach to key rebate counterparties to renegotiate burdensome agreements.

- Under the forbearance, LifeScan was required to halt rebate payments to preserve liquidity while negotiations proceeded, and as of the Petition Date outstanding customer-program obligations totaled ~$1.03 billion.

Restructuring Support Agreement and Pre-Arranged Plan Development

- On February 17, 2025, LifeScan entered into the Original RSA with Platinum Equity and an ad hoc group holding ~84% of First Lien Term Loans and ~73% of Second Lien Term Loans (the "Ad Hoc Group"). The RSA was subsequently opened to all secured lenders and ultimately supported by nearly all First and Second Lien Term Loan holders.

- Pursuant to the Original RSA, LifeScan launched a First Lien Term Loan repurchase auction for up to ~$167 million face at 60% of par; the offer was fully subscribed and closed on March 5, 2025. In consultation with the Ad Hoc Group, the Company then conducted a second auction for up to ~$136 million face at 55% of par, with ~$114 million subscribed and closing on March 11.

- Under the Revised RSA (as described below), the Company completed a third repurchase of ~$140 million face of First Lien Term Loans for $119 million on July 15, 2025.

- Across the three offers, LifeScan eliminated $576 million of first lien debt and captured approximately $139 million of discount.

- However, rebate negotiations failed, as most major PBMs refused material concessions on the $1.03 billion owed, rendering the out-of-court path unfeasible.

- The decision to halt rebate payments created an unforeseen tax problem, resulting in a "significant income tax liability" for 2024 due to lost tax deductions, which would become a priority claim.

- In response, the Company and its advisors resumed negotiations, leading to a Revised RSA on July 15, 2025, supported by nearly unanimous lender consent.

- The Revised RSA and proposed Plan of Reorganization would use Chapter 11 to:

- Eliminate approximately $1.4 billion of obligations through debt equitization and discharge of rebate liabilities.

- Satisfy priority obligations, including payment of all outstanding 2024 taxes.

- Transfer ownership of the reorganized company to the lender group, significantly de-leveraging the balance sheet.

- Under the Plan, First Lien Term Loan lenders would receive new first lien term loan debt with the principal amount sized by the cash available at emergence, plus an option to participate in a potential 20% equity allocation.

- Second Lien lenders would convert their entire $275 million debt into equity, receiving 95% of the equity (subject to dilution by any first lien equity allocation).

- General unsecured claims, including all Third Lien Term Loan claims and any Second Lien Term Loan deficiency claims, would share pro rata in a $10 million cash pool.

- Existing equity interests would be cancelled, with Platinum Equity receiving 5% "Advisory Equity" for transitional consulting services.

Chapter 11 Filing and Path Forward

- On July 15, 2025, LifeScan Global Corporation and certain subsidiaries filed voluntary Chapter 11 petitions in the U.S. Bankruptcy Court for the Southern District of Texas to implement the pre-arranged restructuring plan.

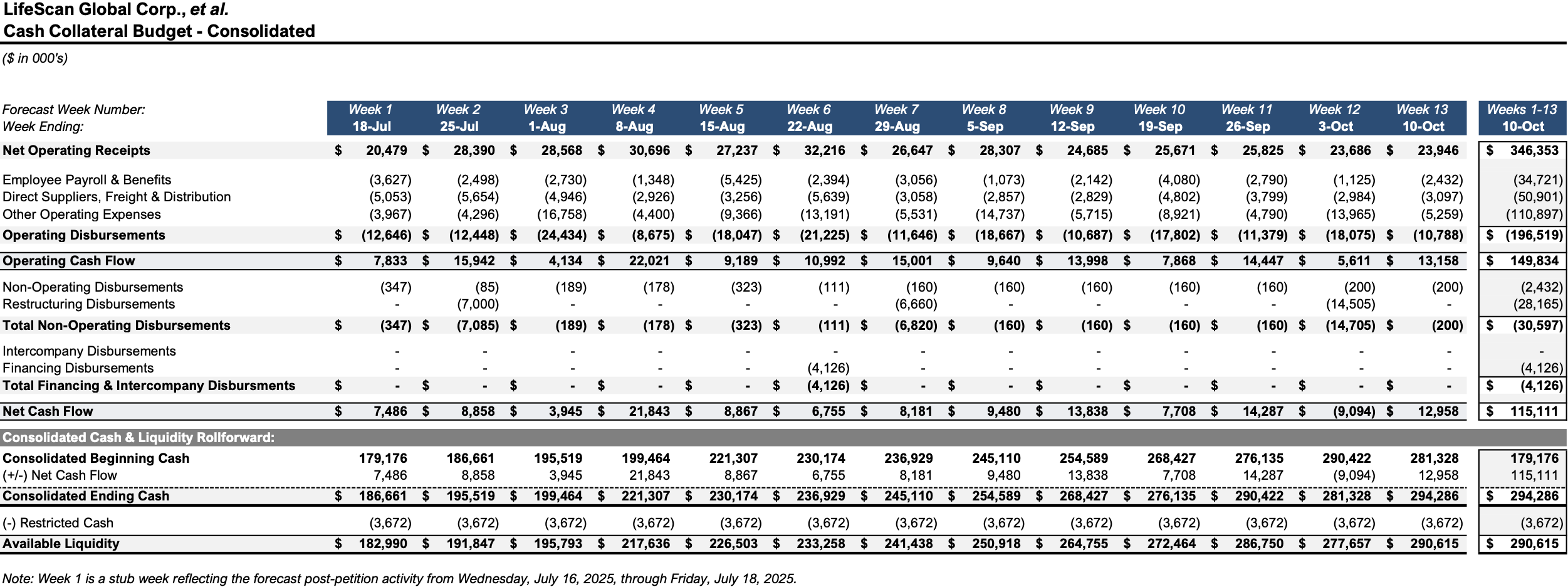

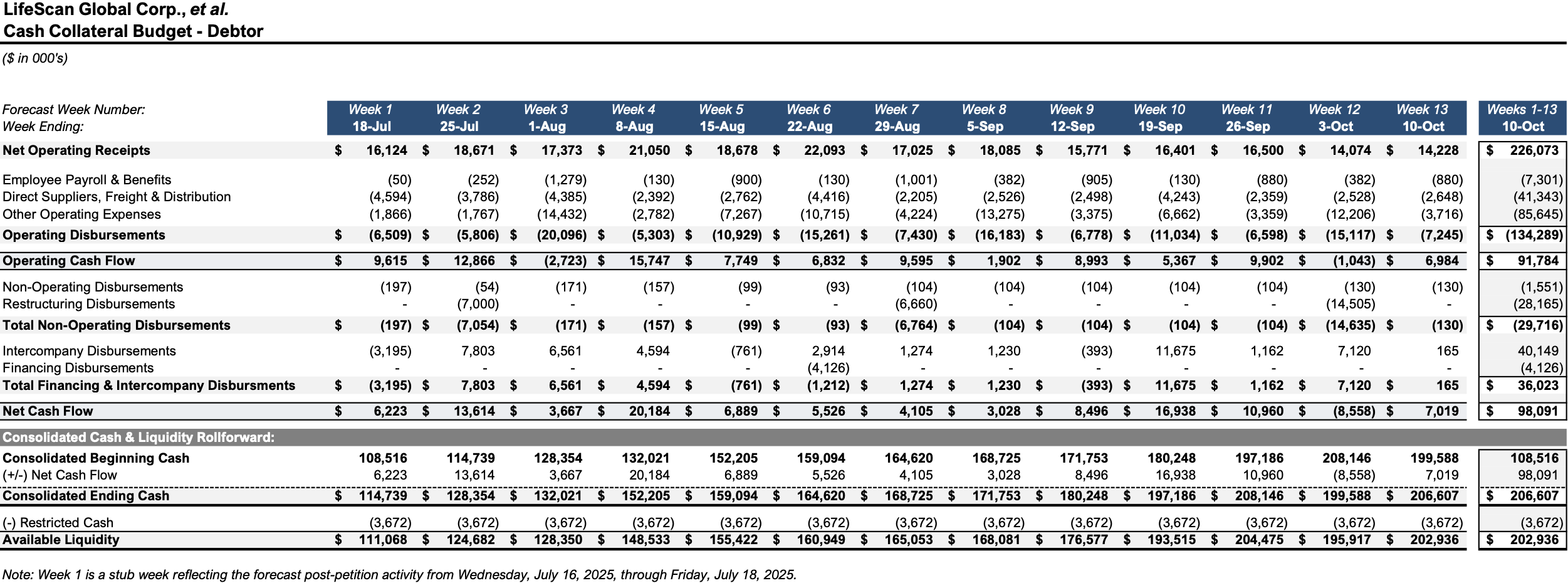

- The Company obtained court approvals to continue normal operations through consensual use of its cash collateral, without needing new DIP financing.

- The Bankruptcy Court approved bidding procedures for a "dual-track" process, allowing LifeScan to solicit higher offers for the business in a court-supervised sale, serving as a market test.

- LifeScan aims to emerge from Chapter 11 by the end of 2025, with a significantly reduced debt load and greater financial flexibility.

- The reorganized LifeScan plans to pursue growth by entering the CGM market and implementing new commercial strategies in the U.S., shifting away from the costly rebate-dependent model toward more direct sales and affordable consumer pricing.

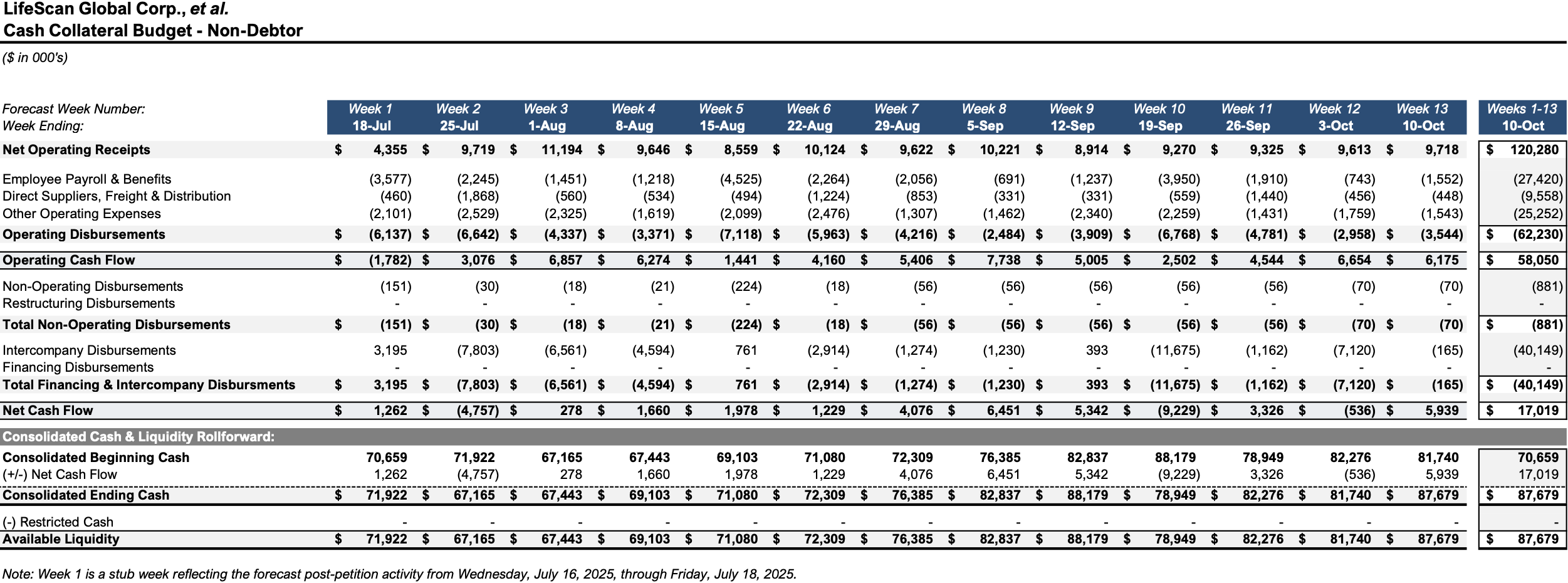

Initial Budgets

Key Parties

Porter Hedges LLP (local bankruptcy counsel); Milbank LLP (general bankruptcy counsel); PJT Partners LP (investment banker); Alvarez & Marsal North America, LLC (financial advisor); Epiq Corporate Restructuring, LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.