Case Summary: Ligado Networks Chapter 11

Ligado Networks has filed for Chapter 11 bankruptcy amid regulatory hurdles and spectrum disputes with the U.S. Government.

Business Description

Headquartered in Reston, VA, Ligado Networks LLC ("Ligado"), along with its Debtor affiliates (collectively, the “Company”), operates as a mobile communications company.

- Ligado provides mobile satellite services ("MSS") to government and commercial customers across North America.

- Additionally, the Company holds significant spectrum assets authorized for terrestrial and satellite operations.

The Company's satellite network supports a range of mission-critical applications and is evolving to integrate terrestrial and satellite communications for both public and private 5G networks leveraging its licensed and leased spectrum in the “L-Band,” a prime 1-2 GHz lower mid-band range.

- Ligado is licensed as an MSS operator in the L-Band in ITU Region 2, covering the U.S. and Canada, and maintains over 40 MHz of spectrum for MSS operations.

- The spectrum is coordinated with other North American L-Band operators through multilateral agreements to ensure interference-free operations.

As of the Petition Date, the Debtors reported assets and liabilities totaling $1-$10 billion.

Corporate History

The Company has been providing mobile satellite services across North America for over 25 years.

- Over time, Ligado has secured key agreements, developed satellite infrastructure, and negotiated strategic partnerships to advance its satellite and terrestrial communication capabilities.

Major Contractual Developments

- 2006: Boeing Agreement

- The Company entered into a contract with Boeing Satellite Systems International, Inc. (“Boeing”) to build and launch two next-generation satellites, SkyTerra-1 and SkyTerra-2.

- SkyTerra-1 was successfully launched in November 2010, completing in-orbit testing by February 2011.

- SkyTerra-2 construction finished in 2011 but remains in storage pending a refurbishment arrangement, currently the subject of disputes and negotiations under the Boeing Agreement.

- 2007: Inmarsat Cooperation Agreement

- The Company and Inmarsat Global Limited (“Inmarsat”, later acquired by Viasat Inc.) signed a long-term agreement coordinating the L-Band spectrum to facilitate Ligado’s provision of both MSS and Ancillary Terrestrial Component (“ATC”) services in North America.

- The agreement extends until December 31, 2107, requiring Ligado to make substantial payments—more than $1.7 billion to date. Inmarsat committed to deliver contiguous spectrum and ensure “terminal resilience” by modifying or replacing terminals operating near Ligado’s planned ATC services.

- Ligado made a $700 million lump-sum prepayment in 2020, covering 60% of future obligations. Numerous amendments followed to adjust payment schedules and address spectrum delivery, with disputes ongoing regarding Inmarsat’s fulfillment of certain interference resolution obligations.

Operations Overview

Ligado operates a MSS network across the U.S., Canada, and Mexico, with plans to enhance and commercialize its MSS capabilities.

The Company is working to deploy 35 MHz of L-Band spectrum for innovative communication solutions, including direct-to-device satellite communications and terrestrial 5G private networks, leveraging the 1670-1675 MHz band for both consumer and enterprise markets.

Spectrum and 5G Initiatives

Ligado’s development of terrestrial communications services has been hindered by U.S. Government restrictions on 30 MHz of its spectrum, prompting ongoing litigation.

- Despite this, the Company remains focused on integrating satellite and terrestrial capabilities to unlock 5G market opportunities, having made significant investments in 4G and 5G technologies.

- This includes successfully standardizing the L-Band through collaboration with the Third Generation Partnership Project, the global wireless standard-setting body.

Spectrum Assets, Licenses, and Related Agreements

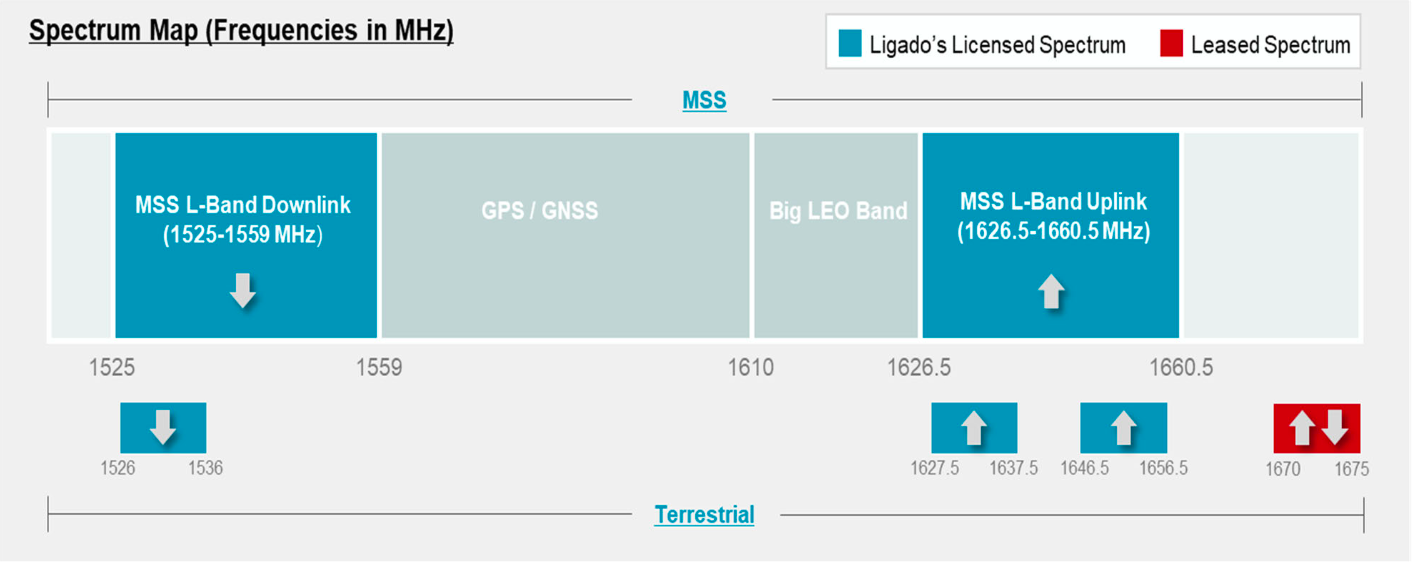

- The Company holds licenses from the Federal Communications Commission (“FCC”) and Innovation, Science & Economic Development Canada (“ISED”) to operate mobile satellites in the 1525–1559 MHz (downlink) and 1626.5–1660.5 MHz (uplink) portions of the L-Band, supporting MSS throughout North America.

- It also has FCC authorization for ATC operations in several L-Band sub-bands:

- 1526–1536 MHz (Lower Downlink)

- 1627.5–1637.5 MHz (Lower Uplink)

- 1646.5–1656.5 MHz (Upper Uplink)

- Through the One Dot Six Lease (as defined below), the Company additionally accesses 5 MHz of terrestrial spectrum in the 1670–1675 MHz band.

- It also has FCC authorization for ATC operations in several L-Band sub-bands:

- Ligado's spectrum holdings also include:

- A license to operate SkyTerra-1 (positioned at 101.3°W) and a license to launch and operate SkyTerra-2 (authorized for 107.5°W, with an ISED launch milestone of March 31, 2029, and an International Telecommunication Union (“ITU”) “Bring Into Use” date of March 28, 2030).

- An ITU filing for a satellite at 106.5°W, requiring “Bring Into Use” prior to February 19, 2031.

- Additional spectrum licenses for Ku-band frequencies (12.75–13.25 GHz uplink; 10.7–10.95, 11.2–11.45 GHz downlink) used as feeder links to support MSS in Canada and the United States via SkyTerra-1 and SkyTerra-2.

Multilateral Spectrum Coordination

- The Company’s use of its licensed L-Band spectrum is governed by treaty commitments with the United States and Canada, as well as bilateral and multilateral coordination agreements under ITU Radio Regulations.

- Five national administrations—the United States, Canada, the United Kingdom, Russia, and Mexico—are parties to the “Mexico City MoU” (1996). This framework allocates annual MSS L-Band assignments in ITU Region 2, ensuring coexistence and shared usage among satellite operators.

One Dot Six Lease (2007–Present)

- Since July 2007, Ligado has leased 5 MHz of spectrum in the 1670–1675 MHz band (the “One Dot Six Lease”) through its subsidiary One Dot Six LLC.

- A December 2022 amendment grants an option to purchase this license on January 1, 2025, for $196.1 million, with subsequent biennial options at an inflation-adjusted price.

- An FCC renewal in April 2024 extended the license through October 1, 2033, with a potential further renewal to December 31, 2034.

- Following that amendment, Ligado made several lump-sum payments totaling ~$14.4 million to cover the initial term, plus a $3.6 million payment in October 2023 for the remainder of 2023.

- Starting in 2024, the Company began annual payments of $14.9 million, rising by 4% each year, alongside operating and maintenance costs for a DVB-H network in this band.

Satellite Operations

Ligado’s advanced satellite network, featuring SkyTerra-1 and SkyTerra-2, provides robust communications across North America.

- These satellites, equipped with 22-meter antennas, form up to 1,500 beams and support a range of devices, from IoT sensors to smartphones.

- The system’s ground-based beam-forming technology enables dynamic adjustments in beam shapes, bandwidth, and power allocation.

Customer Base and Applications

Ligado serves public safety, utilities, and transportation sectors with solutions for emergency response, remote monitoring, and mission-critical communications.

- Notable offerings include mobile satellite push-to-talk and telephony services, enabling interoperable communication for national and regional SMART talk groups across agencies and departments.

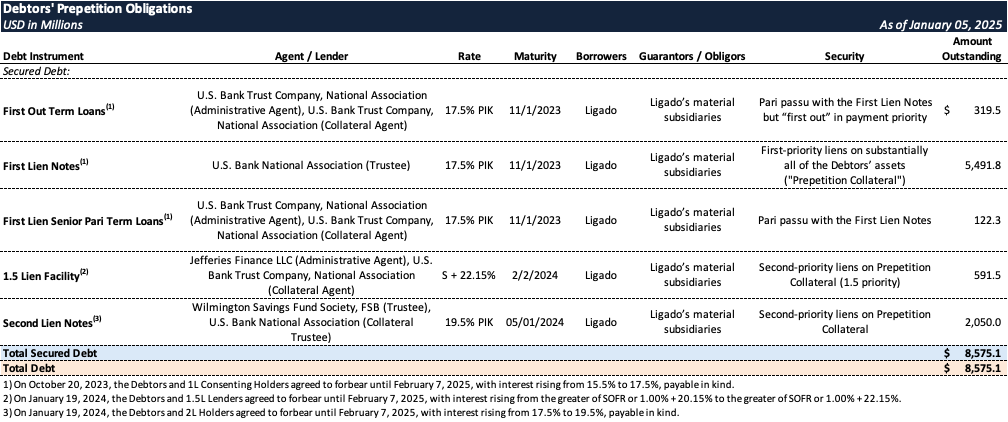

Prepetition Obligations

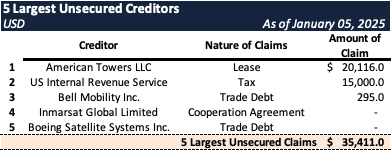

Top Unsecured Claims

Events Leading to Bankruptcy

Development of Terrestrial Communication Services

- In 2001, believing that adding an ATC to its existing satellite operations would optimize use of its MSS spectrum, Ligado became the first company to apply to the FCC for authority to implement a new ground-based wireless service alongside its MSS.

- As the FCC began adopting rules in 2003 to permit MSS licensees to offer ground-based mobile services using MSS-allocated spectrum, Ligado filed a compliant application seeking authorization to provide terrestrial communication services.

- In 2004, the FCC granted the Company this authority, making it the first MSS licensee authorized to deploy and operate a terrestrial network in conjunction with its satellite lines of business.

- Relying on these regulatory approvals, Ligado manufactured and launched two next-generation satellites—SkyTerra-1 and SkyTerra-2—and built related ground infrastructure, investing billions of dollars from lender financing and shareholder capital.

- In 2010, the FCC approved a change of control for the Debtor entity holding the MSS license but required an aggressive terrestrial network build-out schedule to cover:

- At least 100 million people by December 31, 2012;

- 145 million by December 31, 2013, and;

- 260 million by December 31, 2015.

- In reliance on this approval, the Company continued investing billions of dollars and entered into various agreements to facilitate nationwide terrestrial services.

Barriers to Full Utilization of FCC License and Authorization

- As the Company invested further after the FCC’s 2010 approval, technical objections emerged from the Global Positioning System ("GPS") industry and the United States GPS Industry Council, claiming that Ligado’s proposed power levels could interfere with GPS.

- Ligado collaborated with public and federal agencies, agreeing to reduce power levels and adopt additional technical modifications—costing hundreds of millions of dollars—to mitigate potential out-of-band emissions and overload interference.

- Nevertheless, in February 2012, the National Telecommunications and Information Administration notified the FCC that it could not support the Company’s then-proposed terrestrial services, prompting the FCC to propose an indefinite suspension of Ligado’s ATC authority.

- The ensuing disputes and regulatory uncertainties severely strained Ligado’s resources.

- Attempts to negotiate with major creditors and Inmarsat were ultimately unsuccessful, and in May 2012, Ligado sought Chapter 11 protection to preserve asset value while continuing to address GPS-related concerns.

Continued Regulatory Efforts Post-Emergence from Prior Chapter 11 Cases

- The Company emerged from the prior Chapter 11 proceedings on December 7, 2015, expecting an FCC decision to resolve GPS interference concerns within a reasonable time.

- GPS Settlement Agreements (December 2015): Shortly after emergence, the Company signed settlement and cooperation agreements with various GPS manufacturers. Ligado agreed to reduced power and out-of-band emission limits, relinquished the 1545–1555 MHz authorization, and secured manufacturers’ agreement not to oppose Ligado’s updated spectrum plan, provided those limits were codified by the FCC.

- Omnibus Filing (December 31, 2015): Ligado requested modifications to its terrestrial license that reflected the newly reduced power and out-of-band emission limits. Specifically, Ligado asked the FCC to:

- Incorporate into its license the reduced operational levels outlined in the GPS settlement agreements;

- Remove unconditional authorization for terrestrial services at 1545–1555 MHz, and;

- Add conditions requiring compatibility with future aviation GPS standards in the 1526–1536 MHz band.

- By 2017, Ligado and the Federal Aviation Administration identified an appropriate power range to protect certified aviation devices, leading to further studies and an April 2018 Department of Transportation report endorsing specific power levels.

- The Company then amended its Omnibus Filing on May 31, 2018, to adopt that power level (9.8 dBW) and proposed monitoring and mitigation measures.

- Ligado also addressed Inmarsat customers’ opposition. By 2016, some of Inmarsat’s aviation clients (e.g., Boeing, Aviation Spectrum Resources Inc.) filed objections regarding interference with Inmarsat terminals. According to the Company, rather than providing a detailed mitigation plan, Inmarsat submitted only vague filings to the FCC, leading to sustained concerns from the aviation industry.

- Despite continued efforts and multiple studies—some arranged under a Cooperative Research and Development Agreement with the National Advanced Spectrum and Communications Test Network—the Department of Defense ("DOD") and the Department of Commerce ("DOC") began opposing Ligado’s proposed services in 2018, asserting potential GPS interference.

- The Company contends these objections masked DOD’s undisclosed use of Ligado’s spectrum.

- On April 22, 2020, the FCC unanimously approved Ligado’s license modification request ("FCC Order"), rejecting the DOD and DOC’s claims of harmful GPS interference. The FCC concluded that mitigating measures (including a 23 MHz guard band, restricted power limits, base station monitoring, and device replacement commitments) adequately protected GPS operations.

- Although this FCC Order remains in effect, the DOD and DOC, along with other government and non-government entities, have filed petitions for reconsideration.

- The Company remains confident that the unanimous FCC decision stands on solid technical grounds.

- Although this FCC Order remains in effect, the DOD and DOC, along with other government and non-government entities, have filed petitions for reconsideration.

2020 Recapitalization and Inmarsat Payment

- When the FCC Order was issued in April 2020, the Company had $8.9 billion of maturing funded debt and sought to make a substantial payment (the "Inmarsat 2020 Prepayment") under a Cooperation Agreement with Inmarsat.

- In June 2020, Ligado and Inmarsat executed Amendment No. 5 to the Cooperation Agreement, requiring a $700 million prepayment that would reduce future quarterly payments by 60% and create significant net present value savings.

- However, funding this prepayment hinged on raising approximately $3.6 billion in financing.

- In September 2020, Ligado reached agreement with stakeholders on a broader restructuring of its junior capital structure, resulting in a restructuring support agreement signed by 100% of second lien lenders, preferred unit holders, and common unit holders.

- In June 2020, Ligado and Inmarsat executed Amendment No. 5 to the Cooperation Agreement, requiring a $700 million prepayment that would reduce future quarterly payments by 60% and create significant net present value savings.

- Ligado ultimately issued $2.85 billion of Prepetition First Lien Notes and $1.0 billion of Prepetition Second Lien Notes, using proceeds to refinance existing first-lien obligations, fund the final $664.5 million of the Inmarsat 2020 Prepayment, and provide working capital.

2023 Takings Lawsuit Against U.S. Government

- In October 2023, Ligado initiated a lawsuit in the U.S. Court of Federal Claims (Ligado Networks LLC v. United States, et al.), alleging that the DOD and DOC effected a taking of Ligado’s licensed spectrum under the U.S. Constitution by:

- Physically occupying Ligado’s exclusively licensed spectrum without compensation;

- Preventing Ligado from using its FCC-authorized terrestrial services;

- Spreading misleading information, threatening potential Ligado partners, and refusing to provide data necessary for Ligado to deploy its network;

- Supporting or influencing legislation that impedes the Company’s ability to realize the value of its 5G ATC authority.

- The Court partially denied the Government’s motion to dismiss in November 2024, finding that Ligado has plausibly alleged physical, regulatory, and categorical takings claims (but not a legislative taking), and recognizing Ligado’s property interest in its FCC license as against the DOD.

Inmarsat’s Breach of Cooperation Agreement

- The Cooperation Agreement aimed to coordinate the Company’s licensed and leased L-band spectrum for Ligado’s terrestrial use and Inmarsat’s MSS, with Inmarsat contractually obligated to help secure the necessary FCC approvals and resolve interference issues near airports and waterways.

- Despite accepting more than $1.7 billion from Ligado (including $250 million intended to address terminal interference), Inmarsat failed to implement required technical fixes, leaving some of its aviation and maritime customer terminals unmodified and fueling additional regulatory concerns.

- Ligado later learned the DOD was using Ligado’s spectrum, ensuring continued government opposition to the Company’s terrestrial deployment.

- The Company stated that Inmarsat was aware of this but did not disclose it, continuing to accept Ligado’s payments even though the underlying path to deployment was effectively blocked.

2022-24 Liquidity Issues and Financing Efforts

- Despite progress on the technical and commercial ecosystem needed for deploying Ligado’s combined satellite and terrestrial services, the DOD and DOC’s opposition hindered the realization of any significant revenue from these operations. As a result, liquidity rapidly declined.

- By mid-2022, Ligado’s cash reserves were near depletion, prompting the Company to seek incremental financing from certain secured parties and to retain Perella Weinberg Partners LP for restructuring advice.

- Between August 2022 and November 2023, Ligado entered into multiple amendments to its Prepetition Secured Documents and Cooperation Agreement, deferring payments to Inmarsat and drawing additional Prepetition First Out Term Loans to bridge its recurring liquidity shortfalls.

- Ligado engaged extensively with Viasat (Inmarsat’s new parent) in 2024 to craft a comprehensive resolution. However, unexpected tax structuring demands from Viasat and its refusal to extend further payment deadlines without significant cash outlays left the Company with no viable out-of-court option.

- Ultimately, with major payments owed to Inmarsat coming due and insufficient liquidity—a situation, according to the Company, rooted in the U.S. Government’s uncompensated use of Ligado’s spectrum—the Company commenced the present Chapter 11 proceedings on January 5, 2025, to preserve and protect its assets.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.