Case Summary: Linqto Chapter 11

Linqto has filed for Chapter 11 bankruptcy after uncovering widespread securities law violations and halting its platform, supported by $60 million in DIP financing to preserve asset value and explore strategic alternatives.

Business Description

Linqto Texas, LLC, along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Linqto" or the "Company"), previously operated⁽²⁾ a financial technology platform designed to provide accredited investors with indirect access to private-market startups and pre-IPO companies.

- The Company's mission was to democratize private equity by offering an intuitive platform for individual investors to invest in unicorns and other leading private companies, such as SpaceX and Anthropic.

- Linqto has facilitated over $460 million in transactions for a user base spanning more than 110 countries. The platform utilizes special purpose vehicles (SPVs) to enable investors to trade equity without directly joining each target company's cap table.

As of the Petition Date, Debtor Liquidshares holds securities in 111 private companies with an estimated fair market value exceeding $500 million, according to the Debtors, including approximately 4.7 million shares of Ripple.

- These investments were acquired through secondary market transactions exempt from registration under federal and state securities laws, with liquidity for investors dependent on exit events or limited internal programs⁽³⁾, as no public market exists for the units.

Linqto, Inc. and its affiliates filed for Chapter 11 protection on July 7, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $500 million to $1 billion in both assets and liabilities.

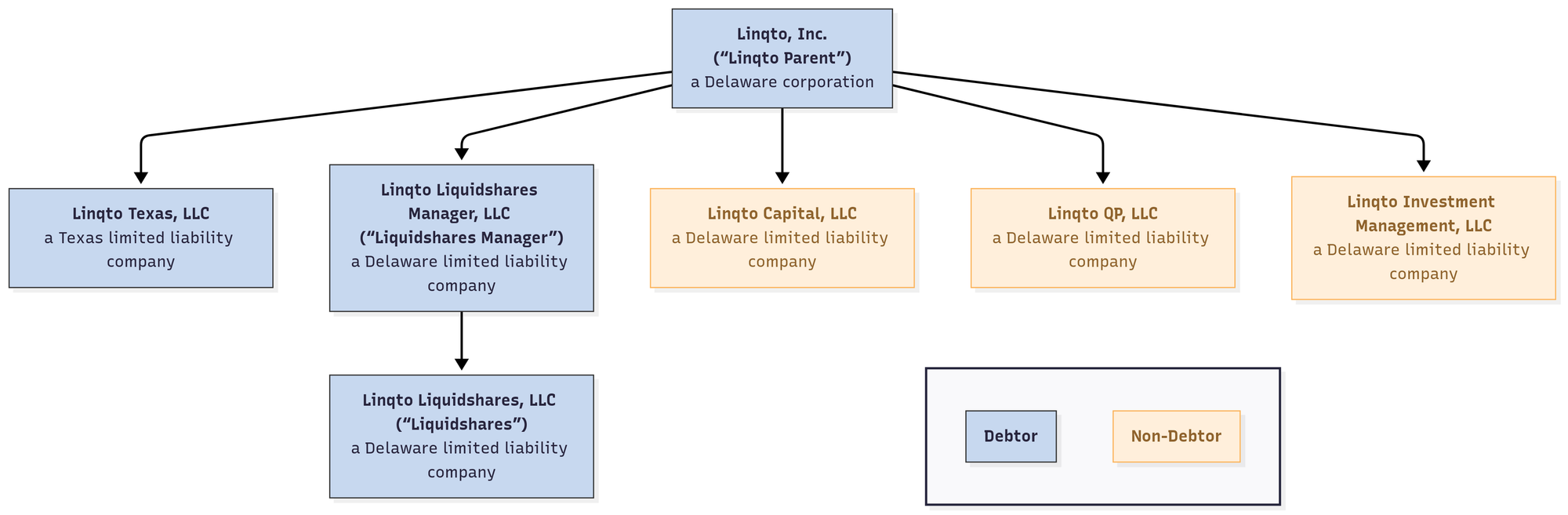

⁽¹⁾ For a complete list of Debtor entities, see the organizational structure chart below. ⁽²⁾ The Company shut down its platform on March 13, 2025. ⁽³⁾ In April 2023, Linqto started providing liquidity to customers by allowing them to redeem their units — effectively selling them back to Liquidshares.

Corporate History

Linqto was founded in 2010 by Bill Sarris, a former financial services architect at Intuit, and Vicki Sarris. Initially a technology and software development company serving fintech firms, the business evolved to become a platform for indirect investments in private companies.

Platform Launch and Growth

- Linqto launched its trading platform for accredited investors in 2020.

- In August 2022, the Company acquired Trustline (which was dissolved prior to the Petition Date) to advance its efforts in building a decentralized exchange for private securities.

- Between 2020 and 2022, Linqto experienced rapid growth, expanding to over 55,000 investors across 110 countries, with total investments exceeding $175 million. The platform’s relatively low investment minimums (~$5,000) broadened access to private markets traditionally limited to institutional investors.

- In November 2022, FINRA approved Linqto Capital’s license to operate an alternative trading system for secondary trading of private securities; however, the platform was never fully launched.

- In April 2024, Linqto entered into a definitive agreement to go public via a merger with Blockchain Coinvestors Acquisition Corp. I, a SPAC, at an implied valuation of approximately $700 million. The transaction was terminated in September 2024 amid unfavorable SPAC market conditions and emerging internal issues, triggering a $5 million termination fee.

- Following the discovery of significant operational and compliance failures, the platform was shut down on March 13, 2025, ceasing all customer-facing, revenue-generating activities.

Leadership and Governance Overhaul

- By late 2024, deficiencies in Linqto’s management and compliance framework became evident. In October 2024, the Company’s former Chief Revenue Officer, Gene Zawrotny, initiated litigation against then-CEO Bill Sarris and President Joseph Endoso, alleging fraud and compliance failures. Around the same time, both the SEC and FINRA commenced investigations into Linqto’s business practices, prompting the board to implement a comprehensive leadership and governance overhaul.

- In December 2024, Sean Bowden, a FINRA-licensed principal, was appointed CEO of Linqto Capital LLC to strengthen regulatory oversight. Effective January 2, 2025, Daniel “Dan” Siciliano, a corporate governance expert and co-founder of regtech firm Nikkl, Inc., assumed the role of CEO of Linqto, Inc., replacing founder Bill Sarris. Several members of Siciliano’s team from Nikkl joined Linqto’s new leadership group.

- To further stabilize governance amid escalating challenges, the board appointed Jeremy Rosenthal as an independent director in May 2025 to support asset preservation and stakeholder value maximization.

- On June 3, 2025, the General Committee formed a Special Subcommittee of independent directors, vested with exclusive authority to investigate claims involving related parties (including former executives) and to approve related-party transactions. Concurrently, the General Committee ratified the engagement of Breakpoint to designate Jeffrey S. Stein as Chief Restructuring Officer (CRO). Stein also serves as a non-voting advisor to the Special Subcommittee.

Corporate Organizational Structure

- Linqto's non-Debtor affiliate, Linqto Capital LLC, is an SEC-registered broker-dealer and FINRA member. Although it has never operated as a broker-dealer, the Company believes ownership of this entity enhances the going-concern value of the business and may be beneficial for its restructuring.

- Other non-Debtor affiliates are non-operational with de minimis assets and are slated for dissolution.

Operations Overview

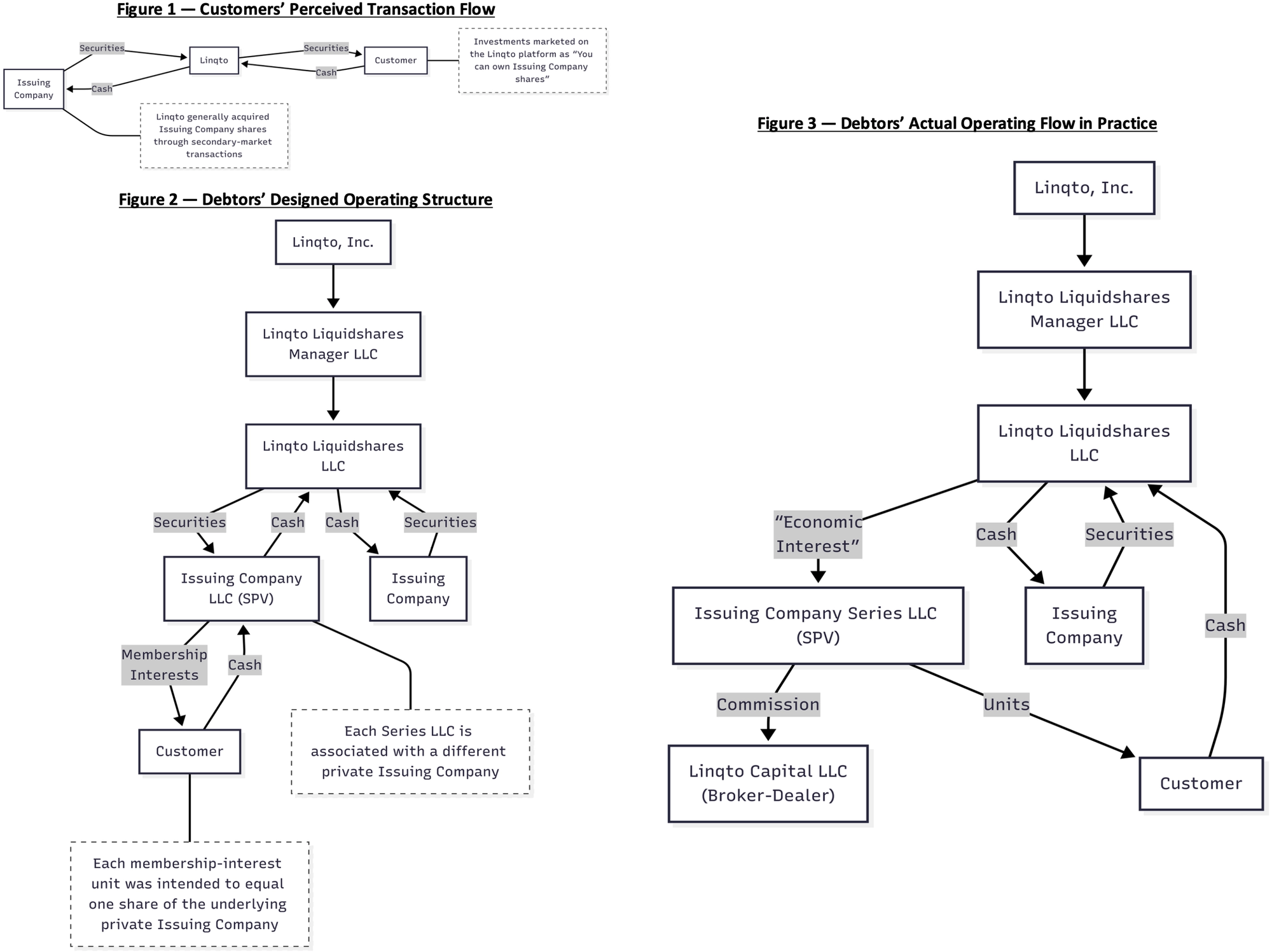

Linqto operated on a model where Debtor LiquidShares acquired private company securities and offered corresponding membership interests to customers through series LLCs. Customers purchased units in these series, realizing returns via unit buybacks or liquidity events (mergers, acquisitions, or IPOs) involving the underlying company. However, an internal investigation by new management revealed that the platform’s actual operations systematically failed to align with its intended legal structure and securities law requirements.

Systemic Operational and Compliance Failures

- Defective Legal Structure: For over a year after its formation, LiquidShares' Certificate of Formation was legally deficient and failed to properly establish it as a series LLC under Delaware law. Even after the certificate was amended in August 2021, the Company never created or maintained the separate series schedules required to legally segregate the assets and liabilities of each investment.

- No Transfer of Title: Contrary to customer understanding, the private company shares acquired by LiquidShares were never legally transferred to a specific series or segregated for the benefit of investors. LiquidShares remained the sole owner of record for all 111 securities, meaning customers held only an indirect contractual claim against LiquidShares, not a direct or beneficial interest in the underlying stock.

- Incomplete Documentation: Key legal documents, such as the Master Investment Securities Purchase Agreement governing the sale of units to customers, were not executed until June 2024, years after the platform began operating and processing transactions.

Revenue Model

- The Company generated revenue through significant markups on the assets it sold. LiquidShares would acquire private shares at a certain price and sell units on the platform at a substantial premium.

- Internal reviews and whistleblower allegations indicate these markups were algorithmically set at a baseline of 30-35% and in some cases exceeded 150%, practices that likely violated regulatory guidelines on excessive spreads. These profits funded aggressive marketing campaigns and insider compensation.

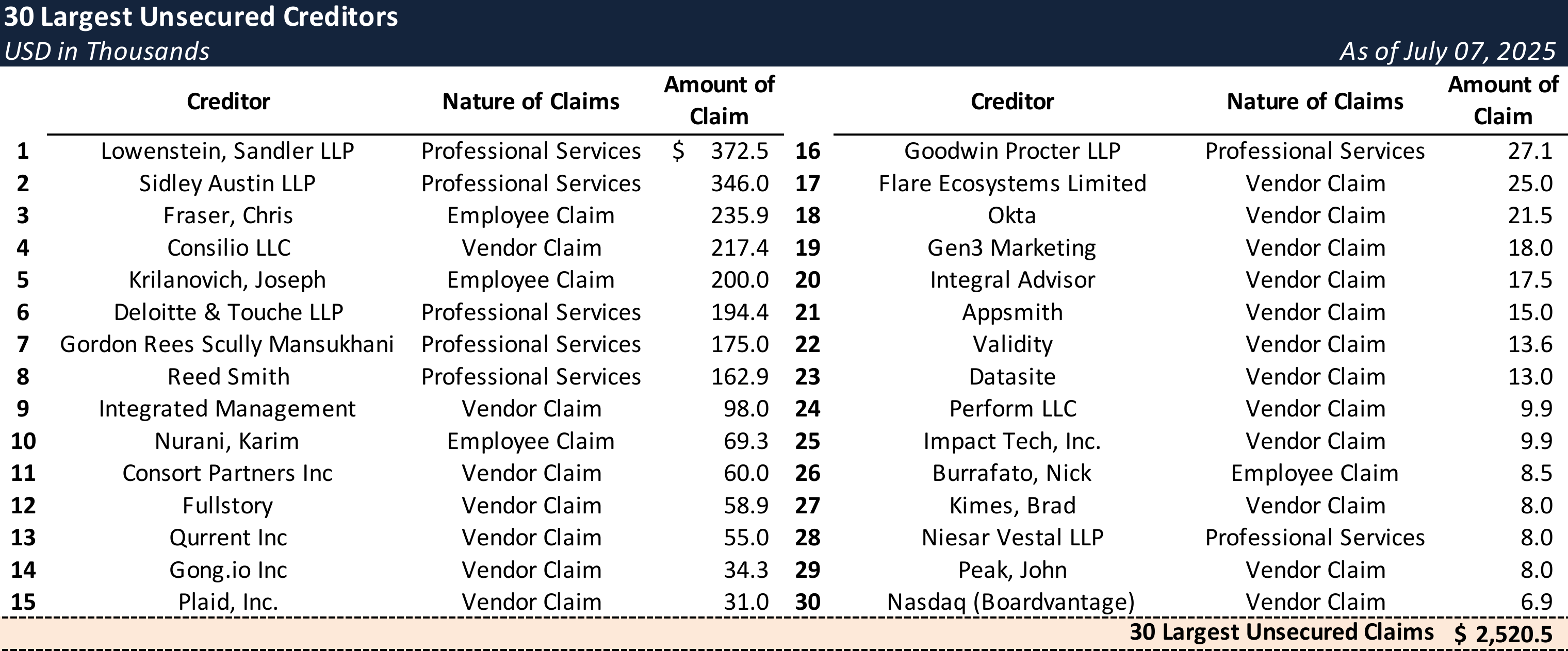

Top Unsecured Claims

Events Leading to Bankruptcy

Discovery of Misconduct and Platform Shutdown

- Upon his appointment in January 2025, new CEO Dan Siciliano learned the Company was under active investigation by the SEC and FINRA for potential securities law violations dating back to 2020.

- An internal review launched by the new leadership team quickly uncovered the depth of the operational and compliance failures. The team found that prior management had been aware of these issues for over a year but failed to take corrective action.

- Recognizing that continuing to operate would "only exacerbate the existing securities law violations," management suspended all new transactions in February 2025 before officially shutting down the investment platform on March 13, 2025. This move effectively cut off the Company’s primary source of revenue.

Liquidity Crisis and Cost-Cutting Measures

- With its platform shuttered, Linqto faced an immediate liquidity crisis. To preserve cash, the new management team implemented drastic cost-saving measures throughout the first half of 2025:

- Workforce Reductions: The Company reduced its full-time employee headcount from 87 to 28, a 68% decrease that cut monthly payroll costs by approximately $1.1 million.

- Operational Cuts: All expenses related to advertising, platform operations, and other discretionary costs were eliminated, resulting in an additional $7.8 million in annualized savings.

- Asset Sales: From March 6, 2025, through the Petition Date, the Company generated approximately $10.2 million in net revenue by selling portions of its unallocated securities inventory in compliant, private block trades.

Regulatory Pressure and Litigation

- The ongoing SEC and FINRA investigations created substantial contingent liabilities that likely rendered the Company insolvent.

- A whistleblower lawsuit filed in October 2024 by a former executive brought public attention to the alleged fraudulent practices.

- Immediately following the bankruptcy filing, a putative class-action lawsuit was filed against former CEO Bill Sarris, alleging he and Linqto fraudulently misled investors into believing they were purchasing direct ownership of shares.

Chapter 11 Filing and Path Forward

- After determining that an out-of-court restructuring was impossible due to the scale of its legal, regulatory, and structural problems, the Company filed for Chapter 11 to preserve the value of its investment portfolio and resolve its liabilities in a controlled process.

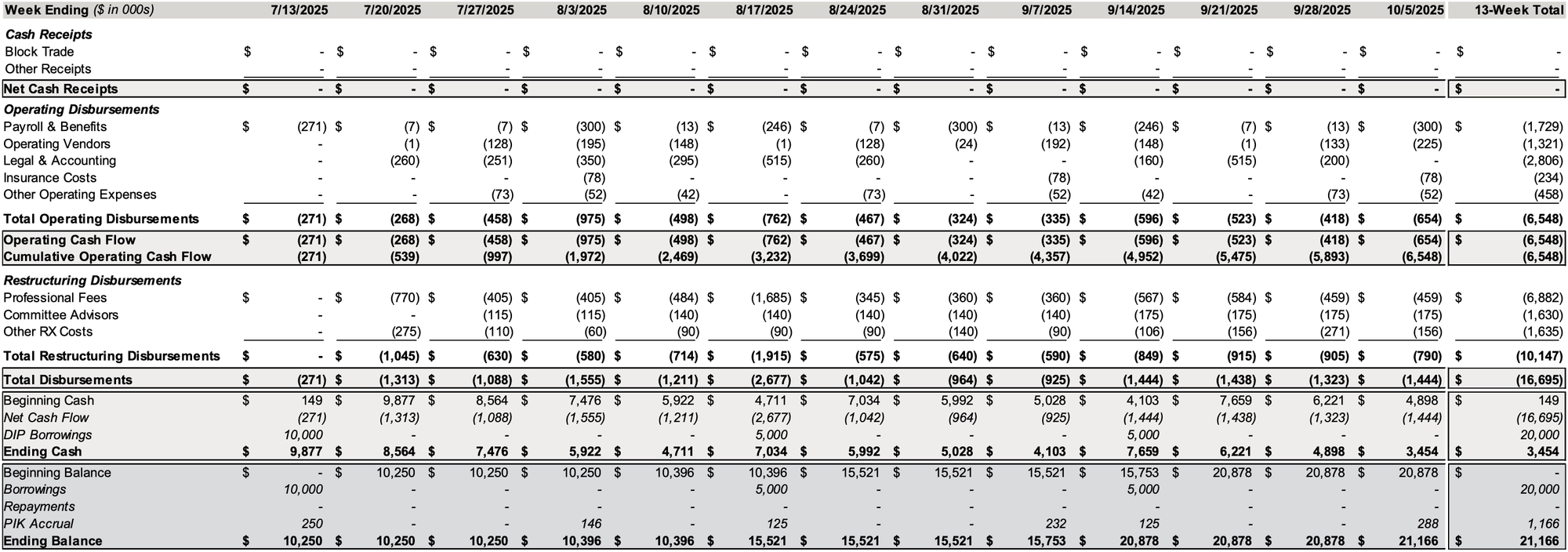

- To fund operations through the restructuring, Linqto secured a commitment for a $60 million DIP financing facility from Sandton Capital Partners.

- The Company’s stated goals in Chapter 11 are to fully cooperate with regulators, develop a reorganization plan that addresses customer and creditor claims equitably, and restructure its operations into a compliant, law-abiding business.

- The case has been met with early opposition from a majority coalition of equity holders, led by Sapien Group, which has signaled its intent to challenge the current management's restructuring strategy.

Key Parties

- Schwartz, PLLC (general bankruptcy counsel); Sullivan & Cromwell LLP (special regulatory & corporate counsel); Jefferies LLC (investment banker); Triple P TRS, LLC (financial advisor); Breakpoint Partners LLC (restructuring advisor / CRO, Jeffrey S. Stein); ThroughCo Communications, LLC (public relations agent); Epiq Corporate Restructuring, LLC (claims agent).

Approved DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.