Filing Alert: Linqto Chapter 11

Linqto Files Chapter 11 in Southern District of Texas

Linqto Texas, LLC and its debtor affiliates⁽¹⁾, a Houston, TX-based financial technology company focused on providing a platform for investing in private market securities, filed for Chapter 11 protection on Jul. 7 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing follows the abrupt March 2025 shutdown of Linqto’s investment platform after new leadership uncovered widespread securities law violations, noncompliant corporate structures, and serious governance failures under prior management. Facing an SEC investigation, a FINRA referral, and potential contingent liabilities to customers that could render it balance-sheet insolvent, the company cut staff, halted operations, and launched an internal compliance overhaul.

The company reports $500 million to $1 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-90186.

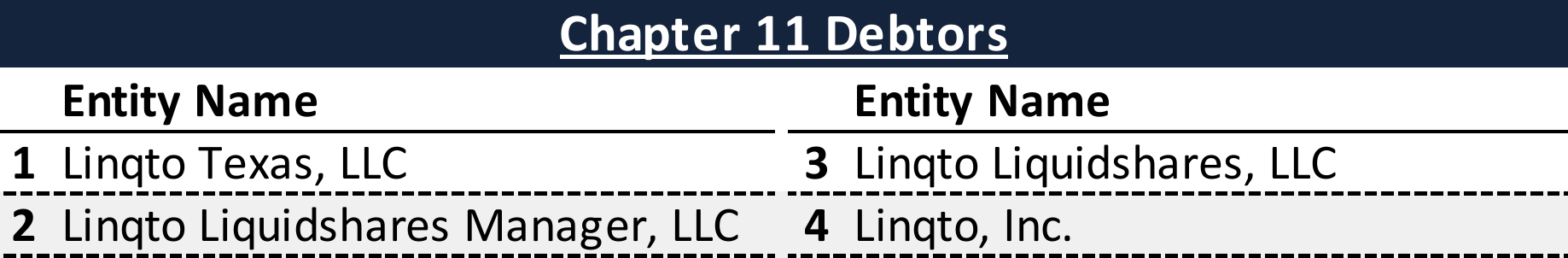

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

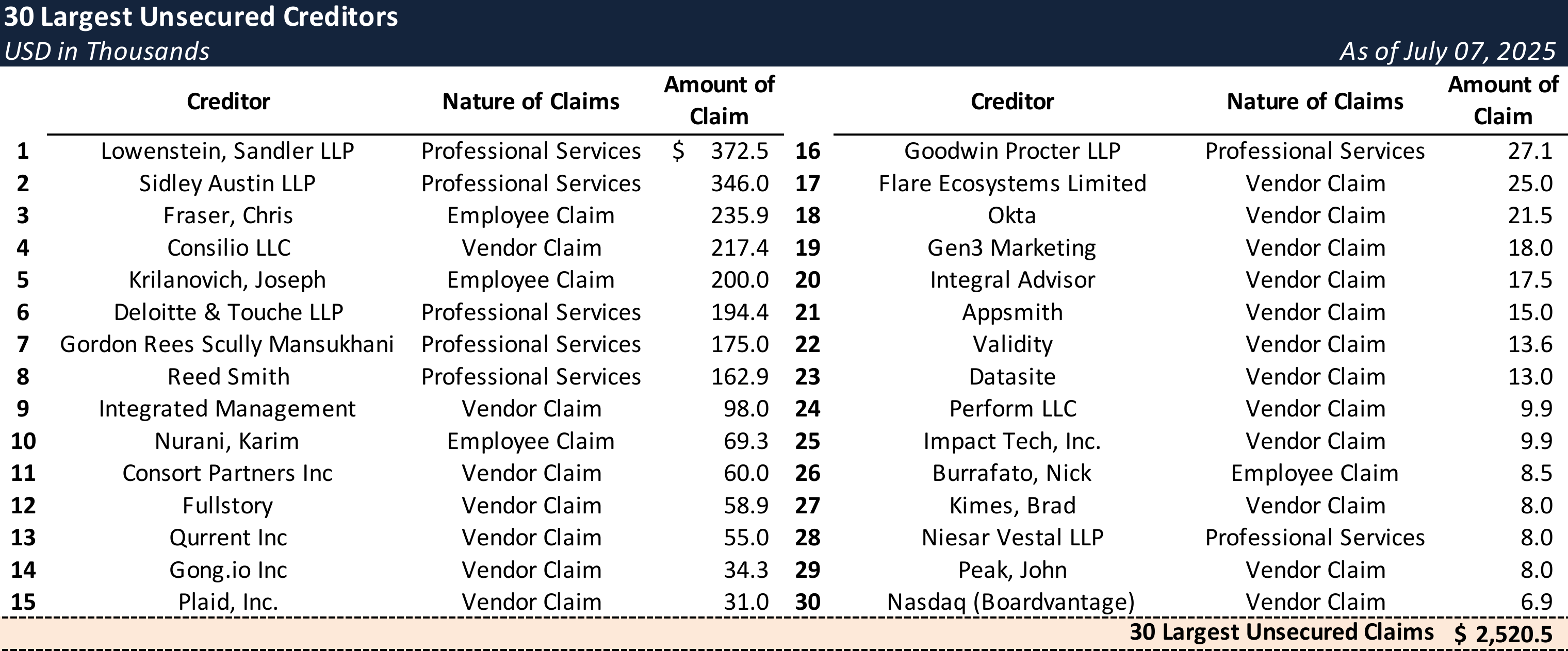

Top Unsecured Claims

Key Parties

General Bankruptcy Counsel:

- Gabrielle A. Hamm

- Schwartz, PLLC

- Email: [email protected]

Special Regulatory & Corporate Counsel:

- Sullivan & Cromwell, LLP

Investment Banker:

- Jefferies LLC

Financial Advisor:

- Triple P TRS, LLC

Restructuring Advisor / CRO:

- Breakpoint Partners LLC (Jeffrey S. Stein)

Public Relations Agent:

- ThroughCo Communications, LLC

Claims Agent:

Equity Security Holders:

- Linqto, Inc. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.