Case Summary: Lugano Diamonds Chapter 11

Lugano Diamonds filed for Chapter 11 to pursue an asset sale after uncovering an alleged fraud scheme by its former CEO that led to material restatements and loan defaults, with the process anchored by a de facto stalking horse agency agreement and supported by $12 million in DIP financing.

Business Description

Headquartered in Newport Beach, CA, Lugano Diamonds & Jewelry Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Lugano" or the "Company"), is a vertically integrated luxury jewelry house specializing in the design, manufacture, and sale of high-end, one-of-a-kind pieces for a high-net-worth clientele.

- The Company’s artisans create unique jewelry often centered around rare gemstones, ranging in price from under $1,000 to seven-figure valuations.

- Lugano distinguishes itself through a high-touch, relationship-driven sales model, eschewing traditional mass retail in favor of private salon showings, bespoke service, and long-term client engagement.

Lugano operates a network of intimate retail salons located in affluent markets, including Newport Beach, Aspen, Palm Beach, Ocala, Houston, and Chicago. The Company complements its brick-and-mortar presence with a "traveling boutique" Equestrian Division that sponsors elite horse shows and hosts pop-up showrooms at private residences and charity galas.

- Lugano Privé: In 2023, the Company launched an exclusive members-only social club adjacent to its flagship salon. Focused on cultural programming and philanthropy rather than retail sales, the club serves as a vehicle to deepen brand loyalty among top-tier clients.

Prior to the discovery of financial irregularities, Lugano reported unaudited 2024 revenue of approximately $470 million and operating income of $180 million; however, the Company has since acknowledged these figures were materially overstated due to an alleged fraudulent scheme involving former management.

Lugano Diamonds & Jewelry Inc. and certain affiliates filed for Chapter 11 protection on November 16, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $100 million to $500 million in assets and $500 million to $1 billion in liabilities.

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Lugano was established in 2004 in Newport Beach by Mordechai "Moti" Ferder and his wife, Idit Ferder. Initially operating as an appointment-only jeweler, the brand built its reputation on exclusivity and a marketing strategy heavily tied to philanthropic and equestrian events.

Strategic Acquisition and Expansion

- In September 2021, Compass Diversified ("CODI"), a publicly traded private equity firm, acquired a majority stake (approximately 60%) in Lugano for an enterprise value of $256 million. Moti Ferder retained the remaining equity and continued as CEO.

- Post-acquisition, Lugano utilized loans from CODI to fund an aggressive expansion plan, growing from four boutiques to a peak of nine locations by mid-2025, including an international outpost in London.

Leadership Transition

- In early 2024, professional management was brought in to bolster infrastructure, including Joshua Gaynor as President and Christoph Pachler as CFO.

- The Company’s trajectory shifted abruptly in May 2025 following an internal investigation into financial irregularities. Consequently, Moti Ferder resigned from all roles, and control transitioned to a new interim leadership team appointed by the Board and CODI.

Corporate Organizational Structure

Operations Overview

Lugano employs a vertically integrated production model, managing design and gemstone sourcing in-house at its Newport Beach facility while partnering with third-party ateliers for manufacturing. The Company utilizes an opportunistic global supply chain to acquire rare stones and finished jewelry, maintaining substantial inventory with a cost basis estimated between $148 million and $175 million as of the Petition Date.

Sales Channels

- Retail Salons: The core of Lugano’s revenue is generated through its appointment-based salons in luxury destinations.

- Equestrian Division: Established in 2008, this division targets high-net-worth patrons at major equestrian circuits, primarily in the U.S. Southeast, serving as both a sponsorship vehicle and mobile sales platform.

- Wholesale: While not a primary focus, the Company engages in occasional wholesale transactions of loose diamonds.

Client Engagement Strategy

Lugano’s business model relies heavily on blending commerce with philanthropy. By sponsoring arts, education, and healthcare initiatives, the Company cultivates relationships with clients in their social spheres. This strategy is reinforced by Lugano Privé, which offers non-commercial, experience-based engagement to solidify the brand's standing within its community.

Prepetition Obligations

The Debtors’ funded debt consists of a single senior secured facility provided by majority equity owner CODI. Under the September 2021 Credit Agreement, Lugano Diamonds & Jewelry Inc. and Lugano Buyer, Inc. serve as borrowers, with obligations guaranteed by the remaining Debtors and secured by liens on substantially all personal property.

- As of the Petition Date, outstanding principal included approximately $466.7 million in term loans, $211.7 million in revolving loans, and $2.63 million in letters of credit. The facility matures on Sept. 3, 2027.

- Following 23 amendments to increase commitments and fund expansion, the Debtors entered into a forbearance agreement with CODI on Aug. 29, 2025. In connection with that forbearance, the parties stipulated to a total payable amount of approximately $701.3 million (inclusive of accrued interest and fees) and executed a twenty-third amendment to provide $2.2 million in incremental pre-filing liquidity.

Top Unsecured Claims

Events Leading to Bankruptcy

Discovery of Fraud and Financial Restatement

- In April 2025, CODI launched an investigation into irregularities regarding Lugano’s financing, accounting, and inventory practices. This probe revealed an alleged scheme orchestrated by former CEO Moti Ferder, involving off-book “investment contracts” or joint-investment arrangements with high-net-worth individuals.

- The investigation indicated that funds from these unauthorized investments were falsely recorded as revenue, leading to a gross overstatement of the Company’s financial performance. Following these revelations, Ferder resigned in May 2025, and the Company determined its prior financial statements were unreliable.

- The fallout precipitated numerous lawsuits from affected counterparties and a civil suit by Lugano against Ferder for fraud, concealment, and breach of fiduciary duty.

Governance Reforms and Operational Rightsizing

- In response to the crisis, Lugano overhauled its governance structure, appointing independent directors and forming a Special Committee to investigate the fraud and evaluate strategic alternatives.

- To preserve value, the Company implemented emergency cost-cutting measures, including a reduction in force and the closure of underperforming boutiques in London, Greenwich, and Washington, D.C.

Liquidity Crisis and Forbearance

- Following CODI’s investigation and notice of default under its credit facility, Lugano’s obligations to CODI had grown to approximately $701 million (including accrued interest and fees).

- In August 2025, the Debtors entered into a Forbearance Agreement with CODI. In exchange for a temporary halt on remedies, Lugano agreed to strict sale milestones and stipulated to the validity and priority of CODI’s liens.

- Despite these measures, the Company faced a severe liquidity crunch, necessitating additional bridge financing of up to $4 million under the existing CODI facility in October 2025 (of which approximately $2.2 million had been drawn as of the Petition Date) to fund operations through the sale process.

Prepetition Sale Process and DIP Financing

- The Company engaged Armory Securities to conduct a comprehensive marketing process, contacting over 100 potential buyers. While multiple letters of intent were received, the Debtors determined that a court-supervised sale was necessary to maximize value for stakeholders.

- Prior to the filing, Lugano entered into an Agency Agreement with Enhanced Retail Funding LLC ("ERF"). Subject to higher and better offers, ERF will act as the Debtors’ exclusive agent, providing a guaranteed recovery floor for inventory and establishing a baseline transaction structure for the Company’s remaining assets.

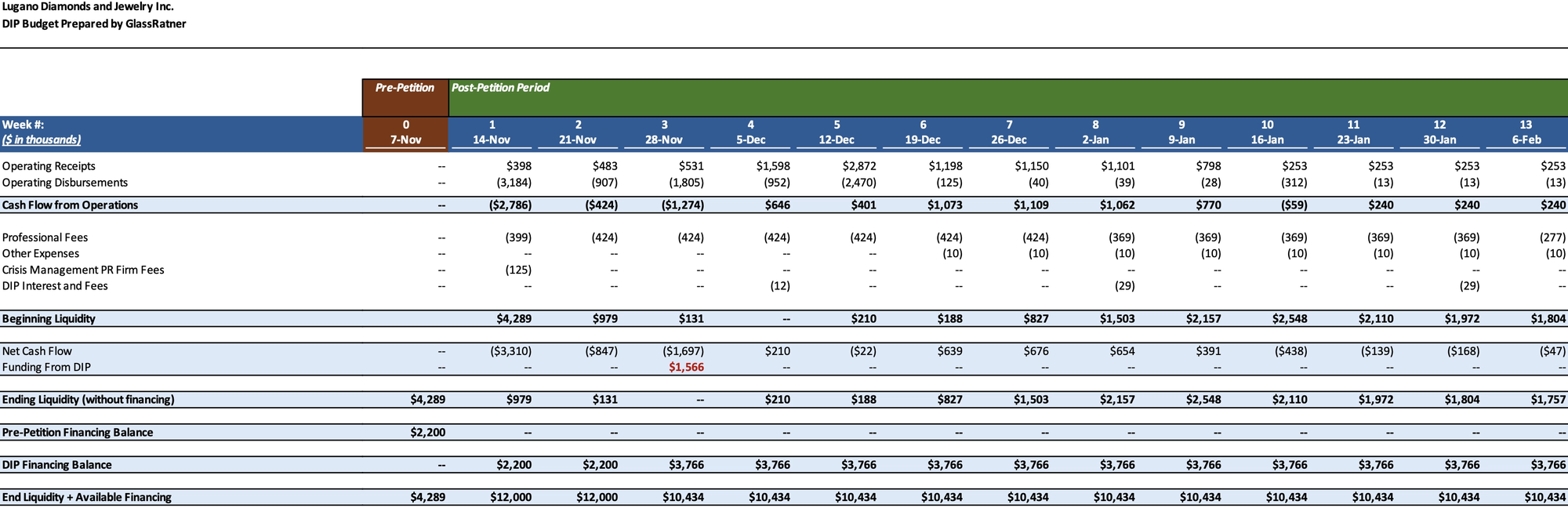

- To fund the Chapter 11 process and bridge to a sale, Lugano obtained a $12 million DIP facility from CODI. This financing, negotiated after third-party lenders declined to lend on a junior basis, includes a rollup of certain prepetition obligations and, together with CODI’s cash collateral, is critical to maintaining operations through the holiday season.

Initial DIP Budget

Key Parties

- Keller Benvenutti Kim LLP (general bankruptcy counsel); Young Conaway Stargatt & Taylor, LLP (local counsel); GlassRatner Advisory & Capital Group, LLC (financial advisor / CRO, J. Michael Issa); Armory Securities, LLC (investment banker); Omni Agent Solutions, Inc. (claims agent)

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.