Filing Alert: Lugano Diamonds Chapter 11

Lugano Diamonds & Jewelry Files Chapter 11 in District of Delaware

Update (Nov. 17, 2025): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Lugano Diamonds & Jewelry Inc.

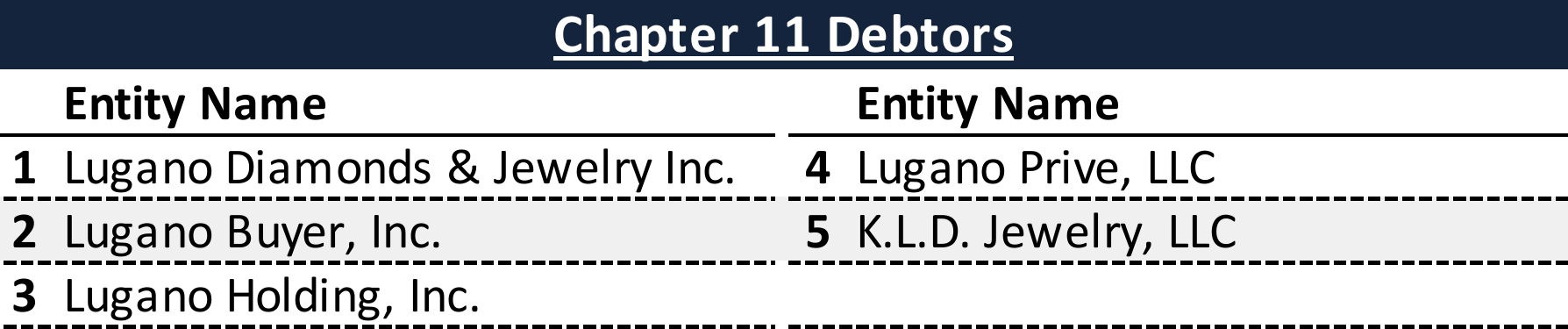

Lugano Diamonds & Jewelry Inc. (dba Lugano) and its debtor affiliates⁽¹⁾, a Newport Beach, CA-based designer, manufacturer and retailer of high-end jewelry, filed for Chapter 11 protection on Nov. 16 in the U.S. Bankruptcy Court for the District of Delaware.

The filing was precipitated by an internal investigation, disclosed in a May 7, 2025 Form 8-K, into the company's financing, accounting, and inventory practices, which led to the resignation of founder and CEO Mordechai "Moti" Ferder. The debtors allege Ferder engaged in a scheme involving "Investment Contracts" that created potential liabilities but were disguised as sales, leading to overstated revenues and operating income. In response to the alleged fraud, the company's sole prepetition lender and majority equity owner, Compass Diversified Holdings LLC (CODI), issued a notice of default in June 2025 on approximately $680 million in term and revolving loan obligations.

The debtors now seek to run a sale process through Chapter 11, having entered into a stalking horse agency agreement with Enhanced Retail Funding, LLC. The process will be funded by consensual use of cash collateral and a $12 million new-money priming DIP facility from CODI, which includes a $2.2 million roll-up of post-default advances.

Lugano Diamonds & Jewelry Inc. reports $100 million to $500 million in assets and $500 million to $1 billion in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-12055.

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Counsel:

- Edmon L. Morton

Young Conaway Stargatt & Taylor, LLP

Email: [email protected]

General Bankruptcy Counsel:

- Keller Benvenutti Kim LLP

Financial Advisor / CRO:

- GlassRatner Advisory & Capital Group, LLC (J. Michael Issa)

Investment Banker:

- Armory Securities, LLC

President:

- Joshua Gaynor

Chief Financial Officer:

- Christoph Pachler

Signatories:

- J. Michael Issa – Authorized Signatory

Claims Agent:

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.