Case Summary: Lutheran Home Chapter 11

Lutheran Home has filed for Chapter 11 bankruptcy to address liquidity challenges driven by declining occupancy, rising costs, and reimbursement shortfalls, aiming to restructure debt and preserve operations.

Business Description

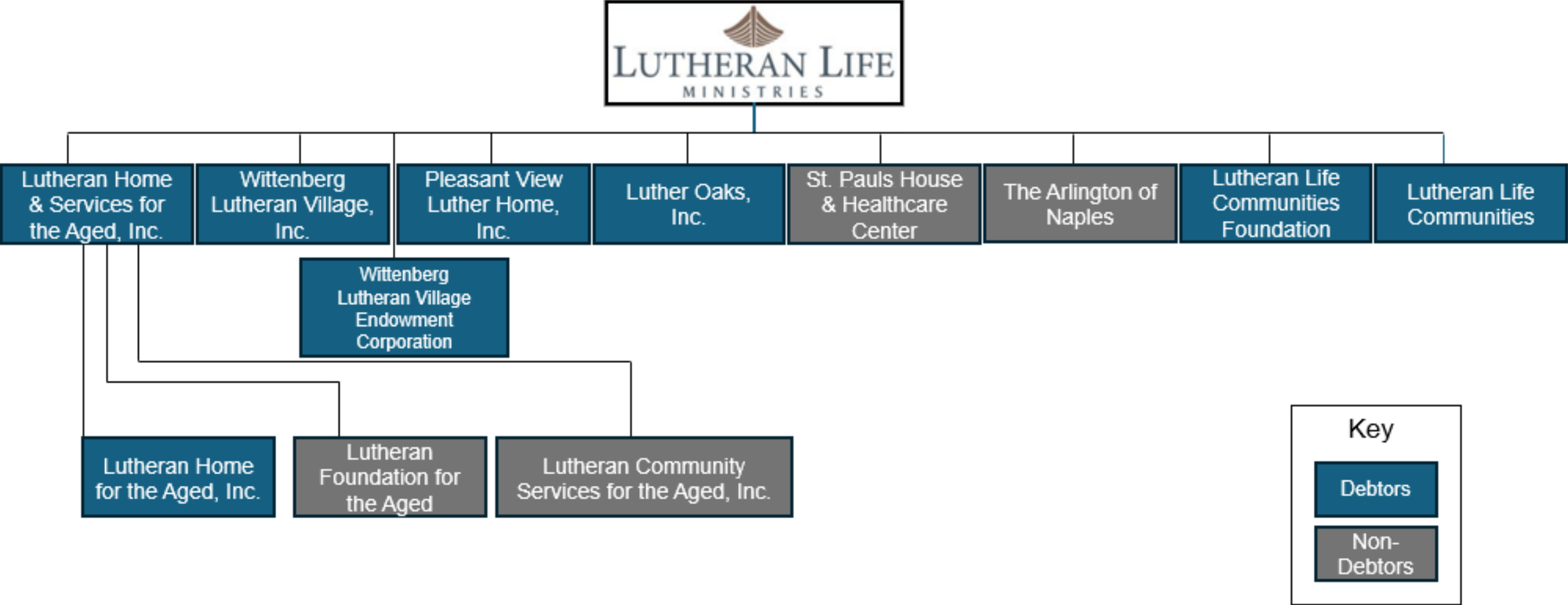

Headquartered in Arlington Heights, IL, Lutheran Life Communities ("LLC"), along with its Debtor affiliates⁽¹⁾ (collectively, the "Debtors"), are Illinois and Indiana non-profit corporations that own and operate four senior care facilities known as Lutheran Home, Luther Oaks, Pleasant View, and Wittenberg Village (collectively, the "Communities"). These Communities are part of the Lutheran Life Ministries system (the "LLM System"), providing a range of senior living options.

- Continuing Care Retirement Communities ("CCRCs"): Luther Oaks, Pleasant View, and Wittenberg Village operate as CCRCs, offering a continuum of care from independent living to skilled nursing, allowing residents to age in place with varying levels of support.

- Skilled Nursing and Assisted Living: Lutheran Home provides assisted living options, including skilled nursing and memory care, catering to residents with higher care needs.

As of January 31, 2025, the Communities serve over 825 senior residents, including spouses, offering housing, meals, security, and engaging programs to foster independence and community involvement. Rooted in a faith-based mission, the LLM System aims to address the spiritual, social, emotional, intellectual, and physical needs of aging individuals, promoting vibrant living across generations.

Lutheran Home filed for Chapter 11 protection on Feb. 4 in the U.S. Bankruptcy Court for the Northern District of Illinois. As of the Petition Date, the Debtors reported $100 million to $500 million in both assets and liabilities.

⁽¹⁾ Lutheran Home and Services for the Aged, Inc. ("LHSA"); Luther Oaks, Inc ("Luther Oaks"); Lutheran Home for the Aged, Inc. (“LHA”); Pleasant View Luther Home, Inc. (“Pleasant View”); Wittenberg Lutheran Village, Inc. (“Wittenberg”); Wittenberg Lutheran Village Endowment Corporation (“Wittenberg Endowment”); Lutheran Life Communities Foundation (“Foundation”).

Corporate History

The Communities trace their legacy back over 130 years, founded on a faith-based mission while embracing diversity. Each Community has distinct origins:

- Lutheran Home: Established in 1892 by a Lutheran pastor in Arlington Heights, IL, it offers a home-like environment for older adults.

- Wittenberg Village: Founded in 2000 in Crown Point, IN, it features 33 assisted living units, 52 villas, and 57 apartments on a 40-acre campus.

- Luther Oaks: Opened in 2007 in Bloomington, IL, with 90 independent living apartments, 57 assisted living suites, and 18 skilled nursing beds.

- Pleasant View: Established in 2005 in Illinois, offering 90 skilled nursing beds, 41 assisted living units, and 34 villas.

LLC (fka Verispring), established in 2007, provides management services, while Lutheran Life Communities Foundation, since 1992, supports care costs and spiritual programs. The mission emphasizes enriching resident experiences and community engagement.

Organizational Structure

Operations Overview

The Debtors operate a network of senior care facilities offering a continuum of care. Their operations are structured around residency agreements, management services, and regulatory compliance.

Residency Agreements

- The Communities utilize residency agreements outlining terms for occupancy, including entrance fees and monthly service fees, with four refund plans:

- Traditional Amortization: Refunds decrease by 2% monthly with a 5% administrative fee.

- 50% Refundable: Amortizes over 22.5 months with a 5% fee.

- 75% Refundable: Amortizes over 10 months with a 5% fee.

- 90% Refundable: Guarantees a minimum refund of 90%.

- Entrance fees vary by community:

- Luther Oaks: $99,083 - $348,950

- Pleasant View: $199,255 - $241,279

- Wittenberg Village: $87,329 - $332,305

- Monthly service fees range from $1,555 to $5,211, covering services like housekeeping, meals, and healthcare benefits.

Management Structure

- LLC manages the Debtors, employing key executives and providing oversight.

- Management fees in 2024 were 4-6% of operating revenue, capped at 8%, with 4% unsubordinated to bond obligations.

- Each community has an executive director for daily operations, supported by LLC.

Regulatory Compliance

- Regulated by state and federal agencies, including the Illinois Department of Public Health and Indiana State Department of Health.

- Participation in Medicare and Medicaid requires certification from the Center for Medicare & Medicaid Services.

- Compliance with the Illinois Life Care Facilities Act and Assisted Living and Shared Housing Act ensures high care standards.

Non-Debtor Affiliates

- The LLM System includes various affiliated non-Debtor entities that supplement senior living services with home care, intergenerational childcare, and other supportive programs, expanding the continuum of care for residents and families alike.

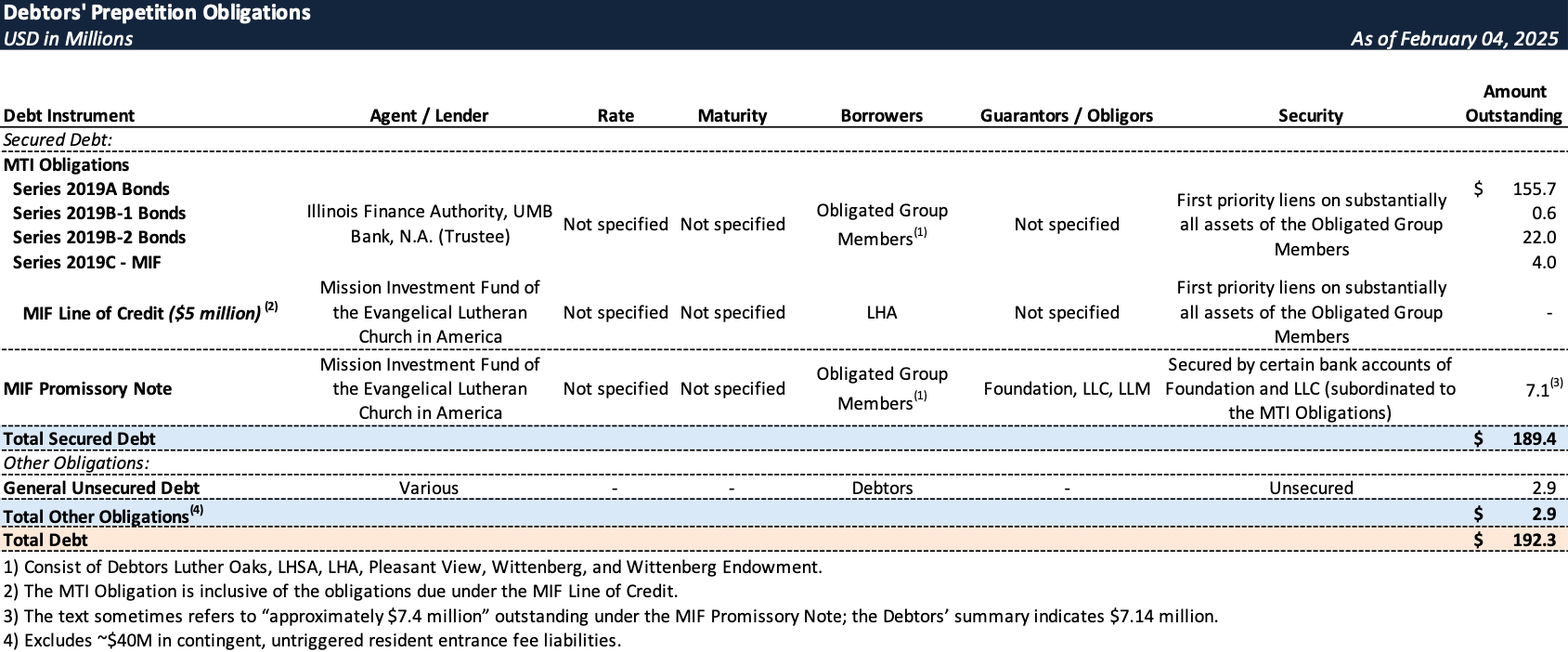

Prepetition Obligations

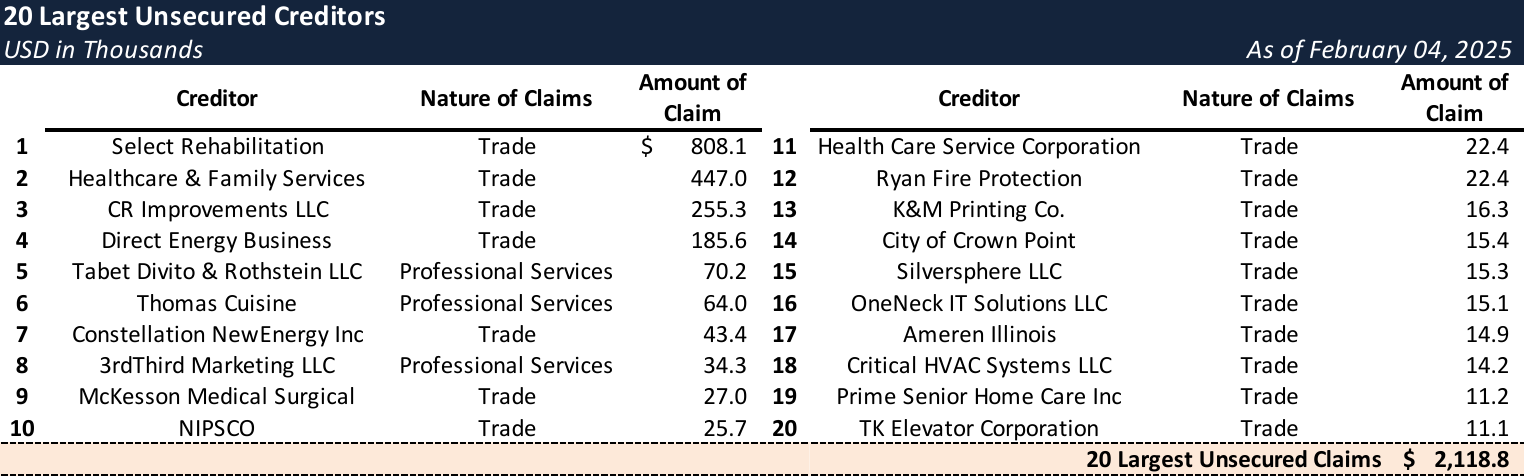

Top Unsecured Claims

Events Leading to Bankruptcy

Adverse Market Conditions

- The Debtors, reliant on revenue from existing and new residents, faced significant challenges due to the COVID-19 pandemic, which severely impacted its ability to service debt and maintain operations.

- Occupancy declined during the pre-vaccination phase due to admission restrictions and consumer fear of long-term care settings.

- Structural industry changes post-COVID-19 included rapid wage inflation, staffing shortages necessitating costly agency labor, and higher operational expenses.

- Medicare and Medicaid reimbursement rates failed to keep pace with inflation, while patient acuity levels shifted to more complex, less profitable cases.

- Average length of stay decreased, requiring more admissions to sustain occupancy, and new protocols added expenses.

- Government funding provided temporary relief but was insufficient to address combined revenue losses and expense increases.

- Occupancy recovery was slow, with pricing incentives reducing revenues and operating income below pre-COVID projections.

Default Under Prepetition Secured Debt

- The Debtors experienced a Debt Service Coverage Ratio (DSCR) default in Q3 2023, prompting forbearance discussions with ONB and deferral of payments under the MIF Note Documents.

- MIF declared a default on June 20, 2024, without accelerating obligations, and the Debtors deferred payments under Prepetition Bond Documents starting August 1, 2024.

- On October 25, 2024, the Master Trustee accelerated MTI Obligations, drawing the Debt Service Reserve Fund, and later applied funds to interest payments, leaving a balance of $13.1 million.

- ONB terminated SWAP Agreements on December 26, 2024, and set off $1.7 million against obligations on December 31, 2024.

Efforts to Address Liquidity Concerns

- The Debtors engaged consultants FTI Consulting and Continuum Development Services in January 2023 to address financial distress, implementing cost-saving measures:

- Centralized and outsourced billing, reducing staff and costs.

- Closed Wittenberg's skilled nursing facility, eliminating a $2.2 million net operating income loss.

- Created an in-house legal position, saving $1.65 million annually.

- Stopped hiring temp agency staff, yielding labor savings.

- An escrow structure for entrance fees was introduced in May 2024 to protect residents, with $8.5 million held as of the Petition Date.

- Option Deposits were refundable until residency became permanent, ensuring residents' funds were secure.

- Despite these efforts, the Debtors faced continued financial challenges, leading to discussions with the Senior Lender Group for restructuring, which were unsuccessful.

Indiana Cease and Desist Order

- The Debtors failed to file audited financials, leading to an Emergency Order from the State of Indiana on September 13, 2024, barring new contracts.

- The order was stayed until March 31, 2025.

Illinois Action and Chapter 11 Filing

- The Master Indenture Trustee filed a complaint on January 30, 2025, seeking a receiver, prompting the Debtors to file Chapter 11 on February 4, 2025.

- The Debtors aimed to ensure uninterrupted resident services and maximize stakeholder value through restructuring.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.