Case Summary: Mallard Cove Senior Living Chapter 11

Mallard Cove Senior Living has filed for Chapter 11 bankruptcy, citing financial pressures from loan maturities, foreclosure actions, and alleged mismanagement under new operators that materially reduced asset value.

Business Description

Headquartered in Sharonville, OH, Mallard Cove Senior Development, LLC ("Mallard Cove" or the "Debtor") owns and operates Mallard Cove Senior Living (the "Facility"), a senior living facility acquired on July 1, 2008. The Facility is licensed to provide assisted living and memory care services on a private pay basis, excluding Medicare, Medicaid, or other government reimbursements.

The Facility offers 125 studio, one-bedroom, and two-bedroom apartments, along with 34 memory care studio units, providing a continuum of care that includes independent living, assisted living, and memory care services.

- Residents receive support with daily activities such as medication management and personal hygiene.

- Apartment rent includes amenities like food, laundry, housekeeping, transportation, and assisted living services.

As of the Petition Date, the Debtor’s workforce comprised 110 hourly employees and seven salaried employees.

Mallard Cove filed for Chapter 11 protection on Jan. 28 in the U.S. Bankruptcy Court for the Western District of Pennsylvania. As of the Petition Date, the Debtor reported $1 million to $10 million in assets and $10 million to $50 million in liabilities.

Corporate History

Founded as a single-member LLC in Missouri, the Debtor acquired Mallard Cove Senior Living in 2008, establishing its presence in Sharonville, OH.

- The Debtor is organized under the laws of the State of Missouri and operates as a member-managed entity.

- Jonathan R. Levey, the sole member and manager of the Debtor, oversees the operations.

The Facility is licensed for private pay assisted living and memory care, distinguishing it from government-reimbursed services.

Operations Overview

Continuum of Care

The Facility provides a range of care services tailored to residents' needs, including independent living, assisted living, and memory care for those with Alzheimer's or dementia.

Amenities

- First-class amenities include a fitness center, patio garden, outdoor common areas, walking paths, computer room, library, cafe, game room, billiards lounge, beauty salon, theater, and arts and crafts center.

Staffing and Services

- Trained staff offer occupational, speech, and physical therapy, medication management, housekeeping, laundry, and grocery shopping services.

- A full-time activities team organizes social, educational, and entertainment events, with scheduled transportation for outings.

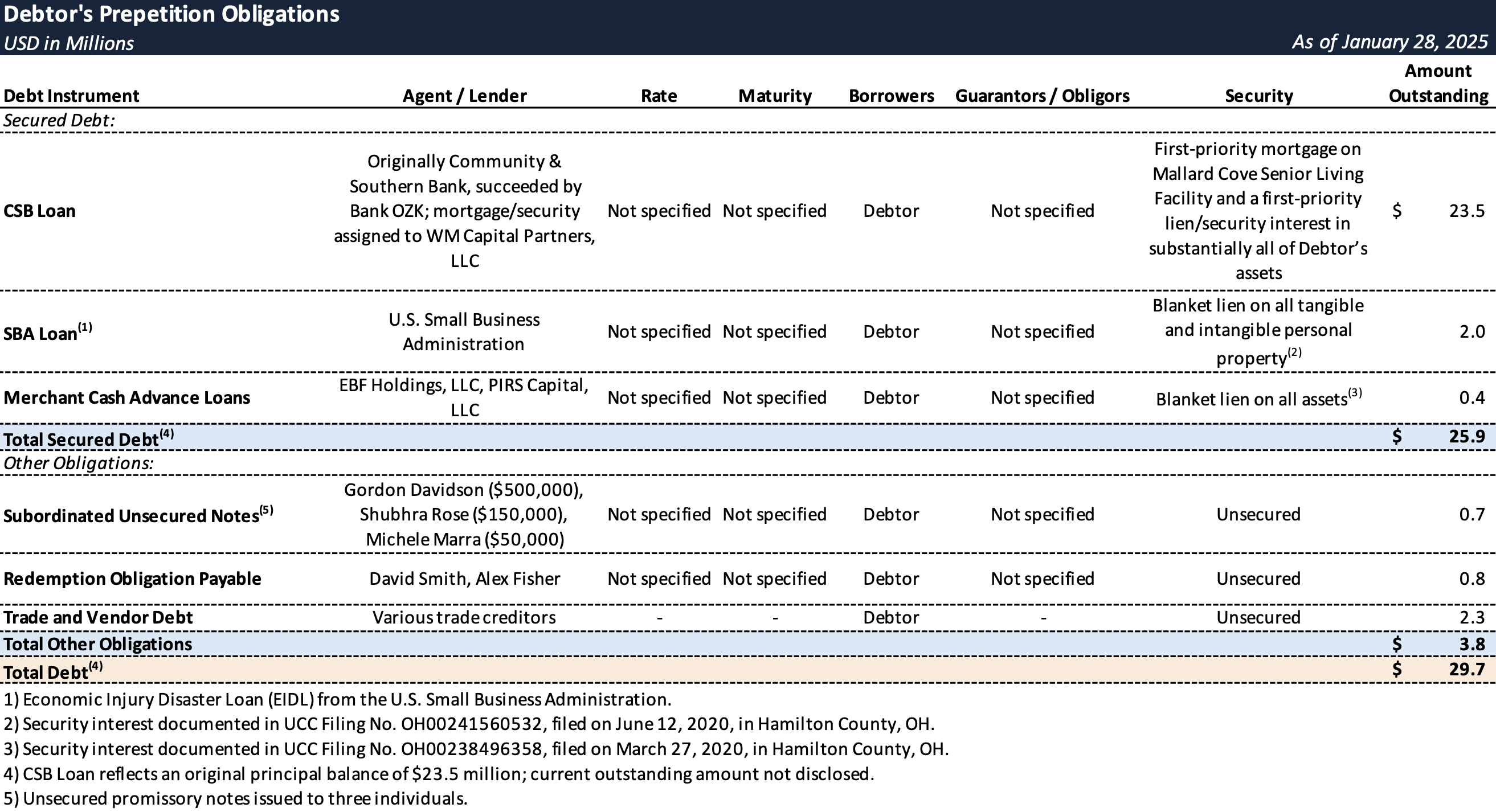

Prepetition Obligations

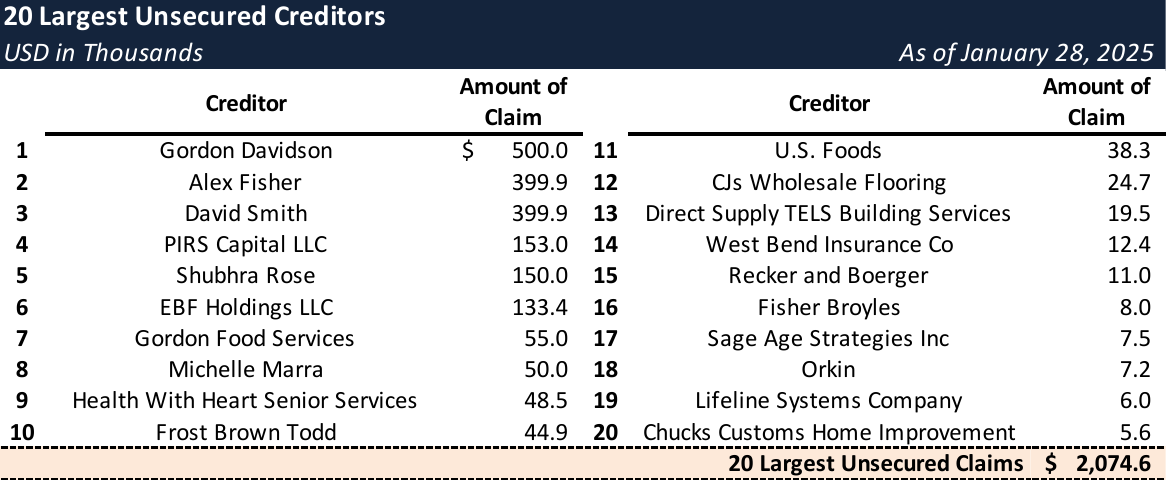

Top Unsecured Claims

Events Leading to Bankruptcy

Financial Difficulties and CSB Loan Maturity

- Beginning in 2018, Mallard Cove faced financial challenges tied to its operation of the Facility, exacerbated by macro issues affecting healthcare delivery in Ohio and changes in healthcare laws. These challenges intensified in 2020 due to the onset of the COVID-19 pandemic and the maturity of the Debtor’s primary secured debt facility, the CSB Loan, which is secured by substantially all of the Debtor’s assets.

- These combined events rendered the Debtor unable to fully meet its obligations, leading to a default under the CSB Loan.

- Despite these challenges, the Debtor maintained asset value, continued to operate the Facility effectively, and generated positive cash flow, albeit at a reduced level.

Loan Extensions with Bank OZK

- Following the CSB Loan’s maturity, Bank OZK granted two one-year extensions through 2022 in exchange for increased interest rates and fees.

- During negotiations for a third extension in 2022, Bank OZK demanded stringent terms and adopted a rigid negotiating stance.

- In connection with these negotiations, Bank OZK relied on a 2022 appraisal valuing Mallard Cove’s real estate assets at approximately $30 million.

- To avoid a maturity default, the Debtor accepted Bank OZK’s terms, paid an extension fee, and agreed to an interest rate of WSJ prime plus 1.5%. The Debtor continued making monthly mortgage payments until March 2023.

Assignment to WM and Failed Negotiations

- On June 30, 2023, Bank OZK assigned the mortgage securing the CSB Loan and related security agreements to WM Capital Partners 90, LLC (“WM”).

- Negotiations with WM quickly broke down due to WM’s unrealistic demands, which Mallard Cove deemed impossible to satisfy.

- As a result, discussions with WM ceased, and no agreement was reached.

Receivership Action and Foreclosure

- On August 21, 2023, WM initiated the Receivership Action in the Court of Common Pleas of Hamilton County, OH, and filed a motion for the ex parte appointment of a receiver.

- The Ohio Court granted the motion and appointed Flanagan Consulting, L.L.C. as receiver for certain of the Debtor’s assets.

- On the same date, WM filed a foreclosure complaint against the Debtor.

- On November 26, 2024, the Ohio Court entered a foreclosure judgment in favor of WM, awarding $20.5 million.

- A foreclosure sale of the Facility was scheduled for January 29, 2025, with an opening bid of $6 million based on a 2025 appraisal valuing the real estate at $9 million.

Impact of Charter's Management

- Under the Receiver’s appointment, Charter Senior Living (“Charter”) took over management of the Facility in December 2023 at WM’s request.

- During Charter’s management, the Facility experienced a significant decline in value, as evidenced by the disparity between the 2022 appraisal ($30 million) and the 2025 appraisal ($9 million).

- Mallard Cove observed poor operational management under Charter, including decreased service quality, low employee morale, reduced revenue, and increased expenses.

Decision to File for Bankruptcy

- Mallard Cove determined that allowing the foreclosure process to proceed would result in the sale of its real estate at a fraction of its value, enabling WM to acquire the assets at a significantly discounted price.

- The Debtor concluded that its assets were worth substantially more than the 2025 appraisal indicated and could not allow further erosion of value at the hands of WM.

- To preserve and restore asset value for the benefit of all creditors, the Debtor filed for Chapter 11 bankruptcy protection on Jan. 28.

Subscribe for access to coverage of all Chapter 11 bankruptcy cases with liabilities exceeding $10 million.