Case Summary: Merit Street Media Chapter 11

Merit Street Media has filed for Chapter 11 bankruptcy following partner disputes, mounting distribution liabilities, and failed capital raises, supported by $21 million in DIP financing to pursue a section 363 sale and continue litigation against key counterparties.

Business Description

Headquartered in Fort Worth, TX, Merit Street Media, Inc. ("Merit Street" or the "Company"), is a digital multicast television network and streaming service founded by television host Dr. Phil McGraw. Launched on April 2, 2024, the network, branded as Merit TV, provides 24/7 programming centered on “core American values” and family-oriented entertainment.

- Merit Street’s content includes news programs, talk shows, and true-crime series, anchored by the flagship nightly show, Dr. Phil Primetime.

- The network is carried nationwide on major cable and satellite providers like DirecTV and Dish Network, and is also available on more than 40 local broadcast stations as well as digital platforms, including its free Merit+ streaming app and various free ad-supported TV (FAST) services.

At its launch, Merit Street claimed a reach of over 65 million television homes, which it states later grew to over 90 million. As of the Petition Date, the Company employed approximately 66 full-time staff and 30 independent contractors.

Merit Street Media, Inc. filed for Chapter 11 protection on July 2, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Northern District of Texas, reporting between $100 million and $500 million in both assets and liabilities.

Corporate History

Merit Street was conceived in 2023 following Dr. Phil McGraw's decision to conclude his long-running syndicated talk show and establish a new television venture in Texas. The Company was formed as a joint venture between McGraw's production company, Peteski Productions, Inc. ("Peteski"), and Trinity Broadcasting Network of Texas, Inc. ("TBN"), a prominent Christian media broadcaster.

Joint Venture Agreement

- Ownership Structure: Under a binding letter of intent finalized in late 2023, TBN initially held a 70% controlling stake, with Peteski holding the remaining 30%.

- TBN’s Obligations: TBN committed to provide, at no cost to Merit Street, all necessary distribution and production services, including access to its national broadcast network, studio facilities, technical staff, and a license to its programming library.

- Peteski’s Obligations: Peteski agreed to produce and deliver original programming, principally a new Dr. Phil primetime show, over a 10-year term in exchange for an annual fee of approximately $50 million, to be paid by the joint venture.

Launch and Strategic Partnerships

- Merit Street officially debuted on April 2, 2024, with a lineup featuring Dr. Phil Primetime, Morning on Merit Street, The News on Merit Street, and Crime Stories with Nancy Grace. The network also licensed a library of existing content, including over 300 episodes of Steve Harvey’s talk show.

- In March 2024, veteran host Steve Harvey joined as a strategic partner, taking a minority equity stake through his company, Steve Harvey Global ("SHG"), and agreeing to develop new content for the network.

- In May 2024, Merit Street entered into a four-year media rights agreement with Professional Bull Riders, LLC ("PBR") to broadcast over 300 hours of rodeo programming annually. PBR later reported that its events drew 2.4 million unique viewers to the network.

Operational Disputes and Governance Changes

Despite a high-profile launch, significant disputes with TBN emerged almost immediately, which the Company alleges led to its financial distress.

- Distribution and Production Failures: Merit Street alleges TBN reneged on its commitment to provide free nationwide carriage, forcing the Company to incur approximately $96 million in distribution liabilities that TBN subsequently stopped paying. The Company also claims TBN provided "comically dysfunctional" production facilities and improperly caused Merit Street to sign a multi-million dollar lease for a studio campus that TBN was obligated to provide for free.

- Payment Defaults: The Company asserts TBN failed to establish a functional advertising sales team and, in July 2024, defaulted on a $5 million payment owed to Peteski, undermining the venture’s financial stability.

- PBR Contract Termination: The PBR partnership collapsed after Merit Street failed to pay rights fees, leading PBR to terminate the agreement in November 2024. PBR subsequently filed an arbitration demand for $3.5 million, which Merit Street is contesting with counterclaims of fraud and breach of contract.

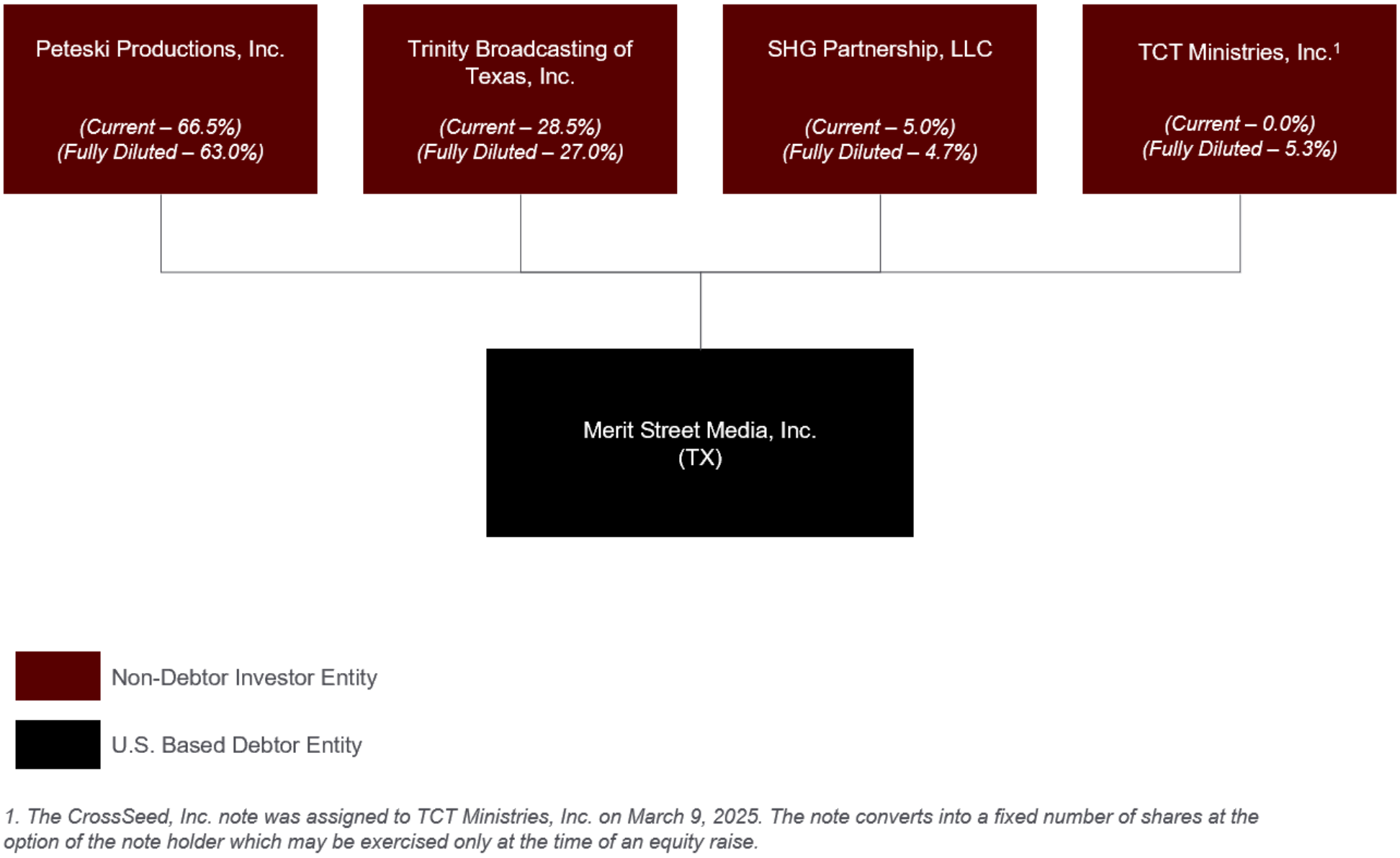

- Shift in Control: As TBN’s support waned, Peteski provided over $32 million in emergency loans to sustain operations. This led to a shift in the ownership structure, with Peteski’s stake increasing to 66.5%, TBN’s falling to 28.5%, and SHG holding 5.0%.

- Management and Board Changes: In April 2025, former Tennis Channel executive Ken Solomon was appointed President and CEO. In June 2025, the board appointed an independent director to lead a special committee tasked with evaluating strategic alternatives.

Corporate Organizational Structure

Operations Overview

Merit Street’s business model is centered on producing and distributing television content through its free, ad-supported network and streaming platforms. Revenue is primarily generated from advertising and sponsorships, leveraging the brand recognition of Dr. Phil and other personalities to attract a national audience.

Key Assets and Facilities

- Merit Street operates from a five-acre production and broadcasting campus in the Dallas–Fort Worth area, which includes soundstages, control rooms, and offices.

- The Company’s assets include broadcasting and IT equipment, the “MeritTV+” streaming application, customer data, and a content library. Intangible assets also include distribution rights for its original shows and licensing rights to TBN’s programming archive.

Content and Programming

- The network’s 24/7 programming strategy blends original productions with acquired content to appeal to a "heartland" audience seeking family-friendly entertainment and "unbiased" news.

- Original content, including Dr. Phil Primetime, daily news shows, and true-crime series, is supplemented by licensed reruns of shows from hosts like Steve Harvey and reality series such as Bear Grylls: The Island.

Distribution Model

- Securing widespread "carriage" on broadcast, cable, and satellite systems is critical to Merit Street’s ad-supported model. The network launched with significant over-the-air coverage through TBN-affiliated stations and negotiated carriage on major providers like DirecTV and Dish Network.

- Merit Street also pursued distribution on FAST platforms, including an exclusive deal with Samsung TV Plus, to reach cord-cutting audiences.

- A central element of the Company’s financial distress stems from the breakdown of its distribution model. Under the joint venture, TBN was obligated to cover all distribution costs. The Company alleges TBN’s failure to fulfill this commitment forced Merit Street to assume unsustainable carriage liabilities.

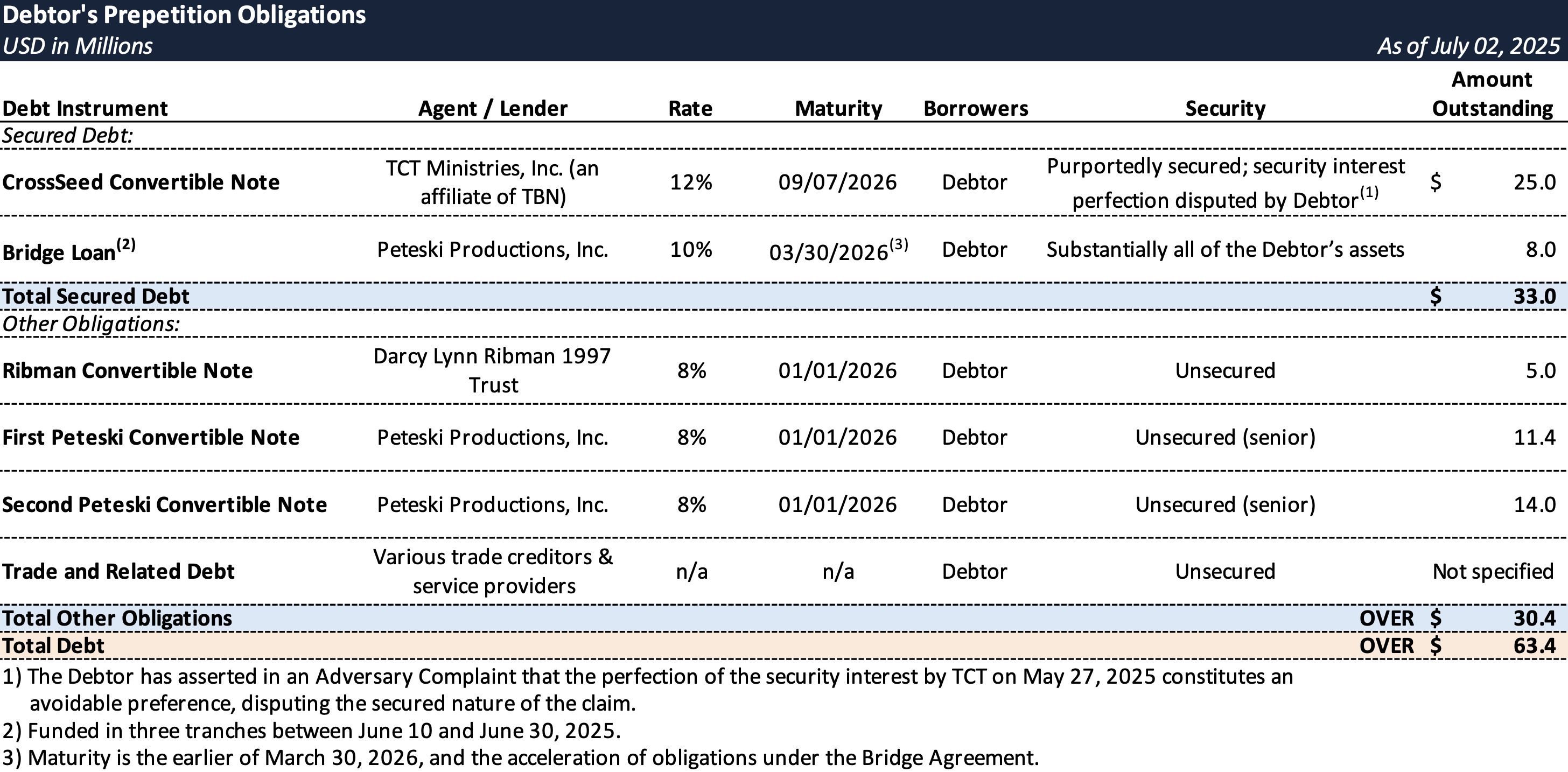

Prepetition Obligations

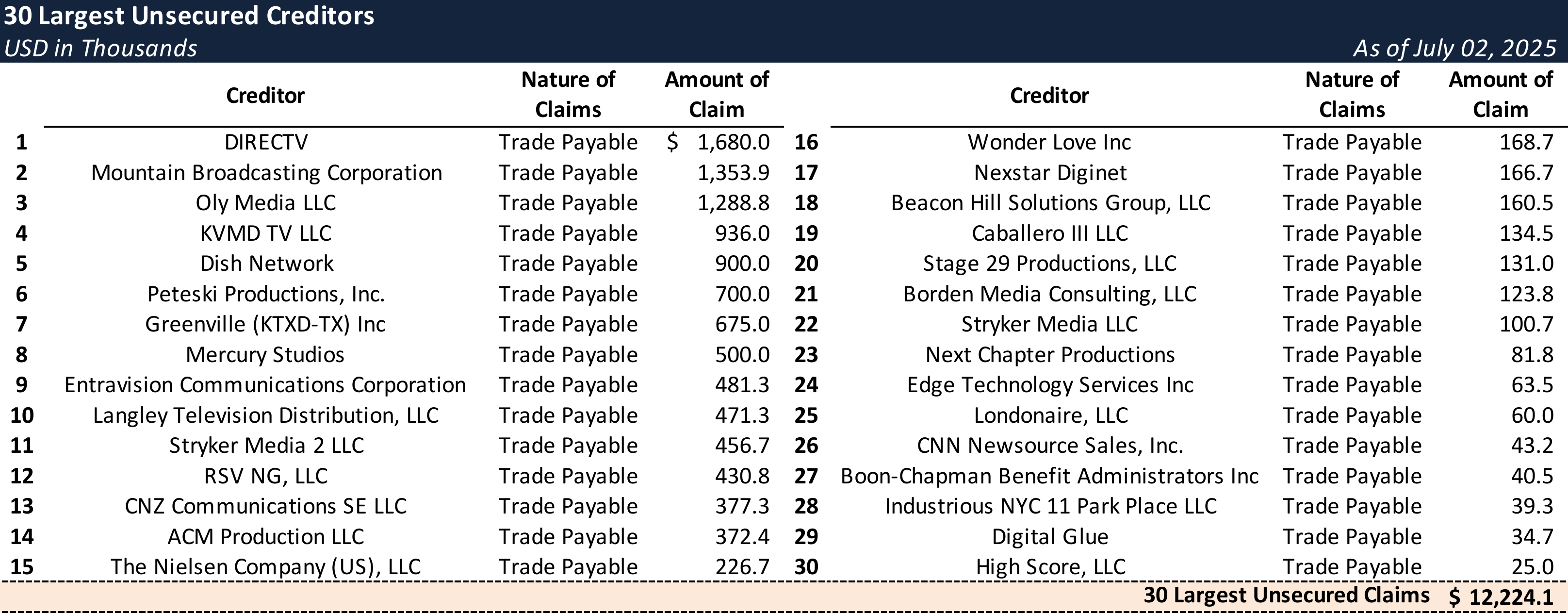

Top Unsecured Claims

Events Leading to Bankruptcy

Disputes with Joint Venture Partner (TBN) and Operational Failures

The Company attributes its rapid decline primarily to what it describes as significant breaches of contract and fiduciary duty by TBN, which began almost immediately after the venture's formation. On the Petition Date, Merit Street initiated litigation against TBN, accusing its partner of undermining the network.

Failure to Provide Free Carriage: The Company alleges TBN failed to fulfill its core obligation to provide nationwide carriage at no cost. Instead, TBN allegedly caused Merit Street to assume approximately $96 million in distribution liabilities and then ceased making payments, leading to breach notices and the loss of carriage, resulting in "millions of households" losing access.

- Defective Production Support and Improper Cost-Shifting: TBN allegedly provided defective production facilities with non-functional equipment, while simultaneously causing Merit Street to sign a multi-million-dollar lease for the very studio it was obligated to provide for free.

- Failure to Monetize and Missed Payments: The Company contends TBN never established a promised advertising sales team to monetize its content. This was compounded by TBN’s direct payment defaults, beginning with a missed $5.0 million payment to Peteski in July 2024.

Mounting Liquidity Pressures and Failed Capital Raise

- By early 2025, the combined effect of TBN’s alleged withdrawal of support and the loss of the PBR contract plunged Merit Street into an acute liquidity crisis.

- To prevent a shutdown, Peteski provided a series of emergency loans totaling approximately $32.4 million through the Petition Date.

- An effort to raise third-party equity capital between February and May 2025 failed, as potential investors were deterred by the ongoing operational turmoil and unresolved disputes with TBN and PBR.

Cost-Cutting Measures and Turnaround Efforts

- In response to its financial crunch, Merit Street implemented aggressive cost-cutting measures, including multiple reductions in force.

- Between January and June 2025, the Company implemented a series of reductions in force (RIFs), resulting in the termination of approximately 71 employees.

- In June 2025, the flagship show, Dr. Phil Primetime, was placed on a "summer hiatus" to conserve cash.

- In June 2025, the board engaged restructuring advisors, including Sidley Austin LLP as legal counsel and Portage Point Partners as financial advisor and investment banker, to evaluate strategic alternatives.

Chapter 11 Filing and DIP Financing

- With no out-of-court solution available, Merit Street’s board determined a Chapter 11 filing was necessary to centralize its disputes and provide a structured forum to sell the business or its assets.

- In late June 2025, Peteski provided an emergency bridge loan of approximately $8.0 million to fund the transition into bankruptcy.

- Upon filing, the Company secured a commitment for a $21.4 million DIP financing facility from Peteski, consisting of $13.4 million in new money and a roll-up of the prepetition bridge loan.

- On July 3, 2025, the court approved the Company’s interim DIP order, authorizing an initial $4.1 million draw to fund postpetition operations.

- Merit Street has commenced an expedited dual-track restructuring process under which it will pursue a section 363 sale of substantially all of its assets — including its 1.5-year video library, intellectual property, contract rights, and litigation claims against TBN and PBR. Concurrently, the Company intends to continue prosecuting the litigation claims to maximize potential recoveries for stakeholders.

- Initial bids are due by September 4, 2025, with an auction scheduled for September 8, 2025, and a targeted closing by September 30, 2025.

Key Parties

- Sidley Austin LLP (counsel); Portage Point Partners, LLC (restructuring advisor & investment banker); Epiq Systems, Inc. (claims agent).

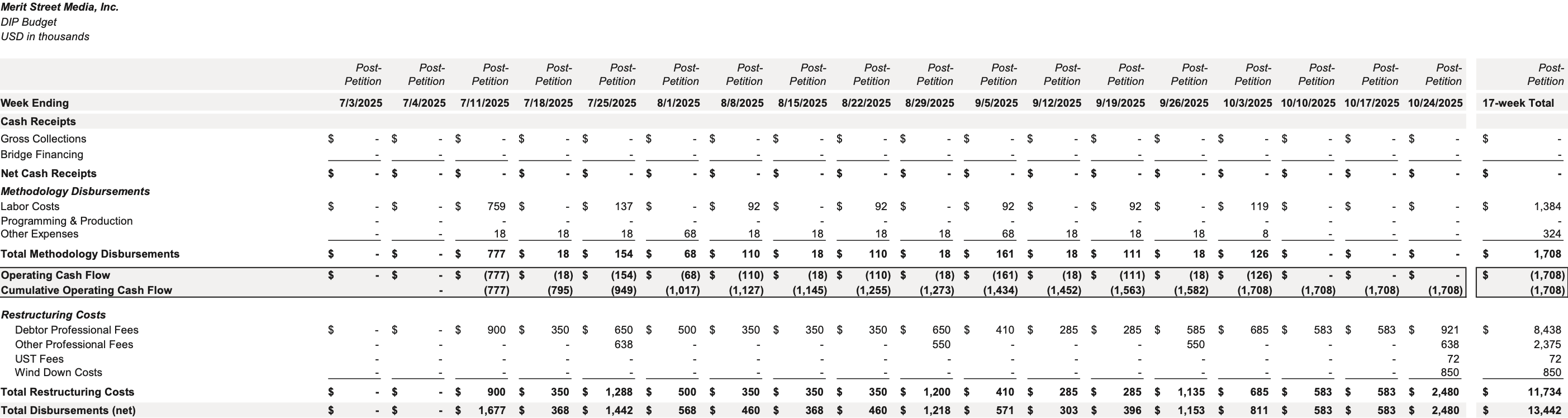

Approved DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.