Filing Alert: ModivCare Chapter 11

ModivCare Files Chapter 11 in Southern District of Texas

ModivCare Inc. and its debtor affiliates⁽¹⁾, a Denver, CO-based provider of supportive care solutions, filed for Chapter 11 protection on Aug. 20 in the U.S. Bankruptcy Court for the Southern District of Texas.

The prearranged filing is backed by a restructuring support agreement with holders of ~90% of first-lien debt and ~70% of second-lien notes, targeting a ~$1.1 billion deleveraging (to ~$300 million). The deal includes a backstopped $100 million DIP (to roll into an exit term loan), an up to $250 million exit revolver, and an equity rights offering for unsecured noteholders and other general unsecured creditors, with milestones for a swift confirmation.

The company reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-90309.

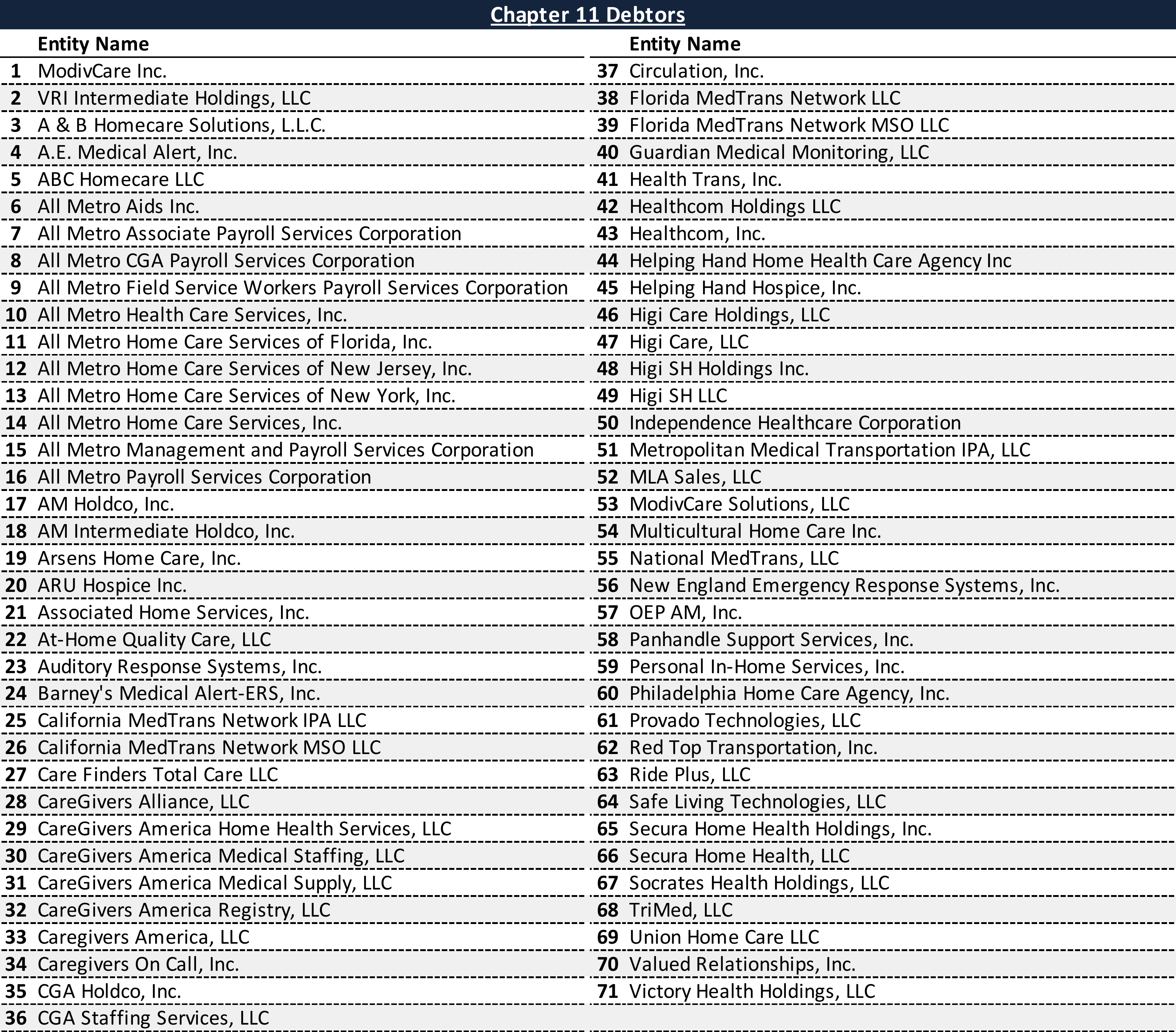

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

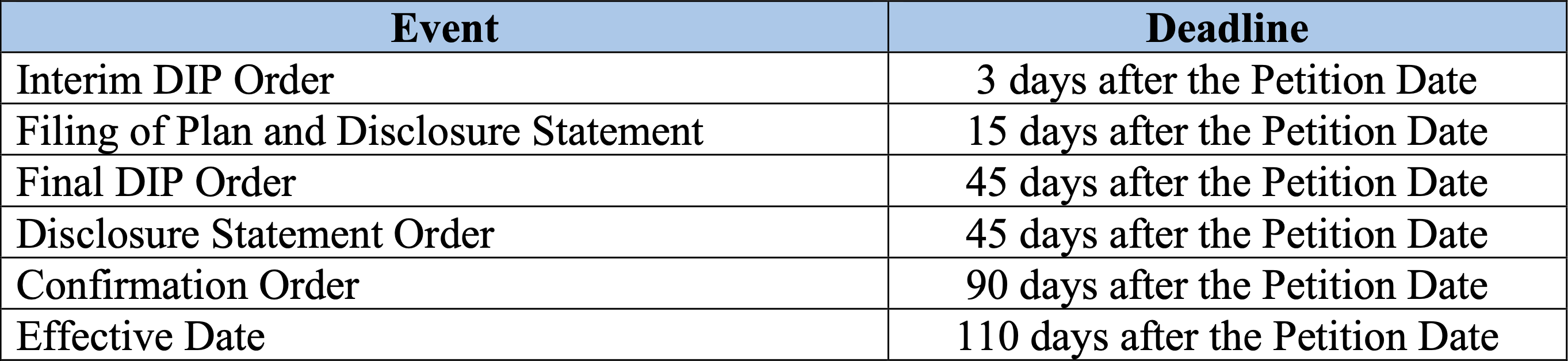

RSA Case Milestones

Chapter 11 Debtors

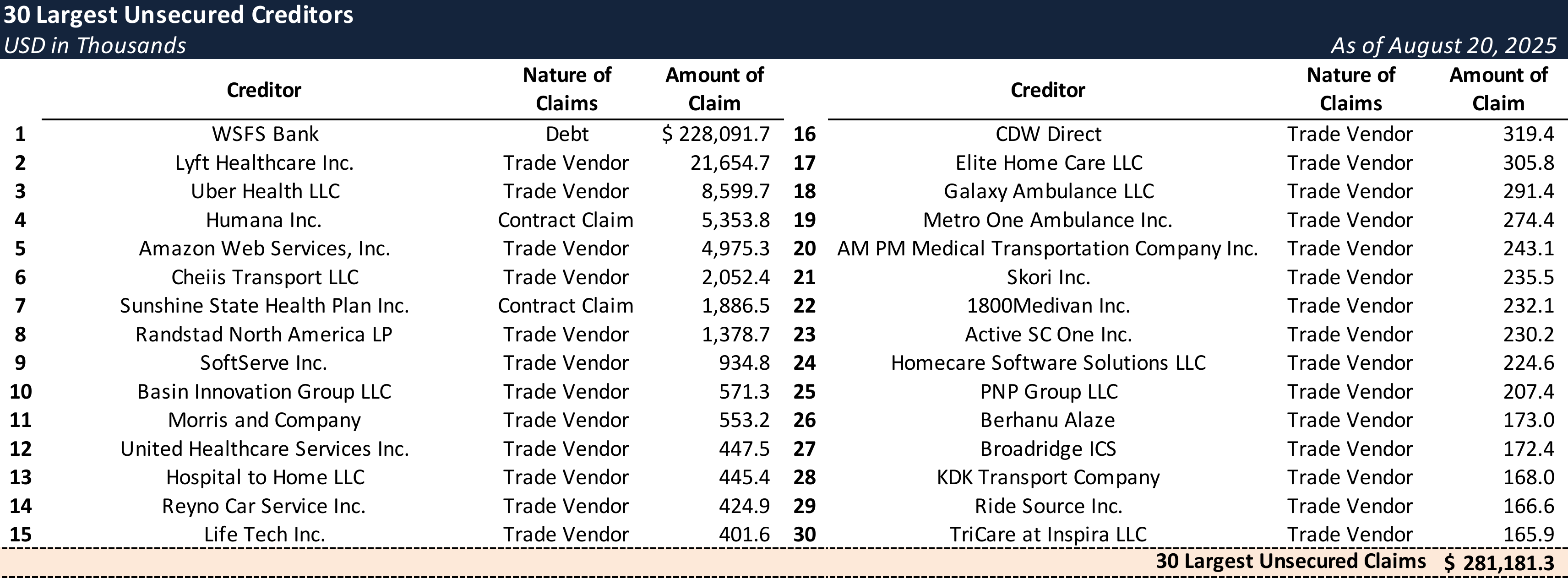

Top Unsecured Claims

Key Parties

Co-Counsel:

- Timothy A. (Tad) Davidson II

- Hunton Andrews Kurth LLP

- Email: [email protected]

Co-Counsel:

- Latham & Watkins LLP

Financial Advisor / Chief Transformation Officer:

- FTI Consulting, Inc. (Chad J. Shandler)

Investment Banker:

- Moelis & Company LLC

Claims Agent:

Equity Security Holders:

- Coliseum Capital Management LLC – 31.4% Equity Interest

- AI Catalyst Fund, LP – 14.9% Equity Interest

- Neuberger Berman Investment Advisors LLC – 10.3% Equity Interest

- Scepter Holdings, Inc. – 8.5% Equity Interest

- Other Minority Holders – 34.9% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.