Case Summary: Mondee Chapter 11

Mondee has filed for Chapter 11 bankruptcy amid declining revenue and high debt costs, with plans for a Section 363 sale backed by a $191M stalking horse bid.

Business Description

Headquartered in Austin, TX, Mondee Holdings, Inc. ("Mondee"), along with its Debtor and non-Debtor affiliates (collectively, the "Company"), operates as a travel technology company, providing personalized travel experiences to customers through an online transaction platform.

As a publicly traded company, Mondee's shares and warrants were previously listed on the NASDAQ Stock Market under the ticker symbols MOND and MONDW, respectively, until its common stock was delisted on December 6, 2024.

In FY 2023, the Company achieved $223.3 million in revenue, up from $159.5 million in FY 2022, while significantly reducing its net loss to $60.8 million from $90.2 million.

As of the Petition Date, the Debtors reported $100-$500 million in assets and liabilities.

Corporate History

Founded in 2011, the Company has undergone significant transformations through strategic acquisitions and expansions.

- The Company acquired several large businesses, including the largest air ticket consolidator companies in the United States and Canada, to establish itself as a successful marketplace for negotiated airfares.

- During the COVID-19 pandemic, the Company further expanded and diversified its services through acquisitions, entering new markets such as lodging, hotels, car rental, and cruise companies.

- In 2023, Mondee began incorporating artificial intelligence into its business to create user-friendly interfaces and seamless support processes.

SPAC Merger and Listing

- The Company's current corporate structure is the result of a "SPAC merger" involving a business combination contemplated by the Business Combination Agreement dated December 20, 2021, among ITHAX Acquisition Corp., Mondee Holdings II, Inc., and other entities.

- The Business Combination was completed on July 18, 2022, and the Company's common stock and warrants began trading on NASDAQ that same day.

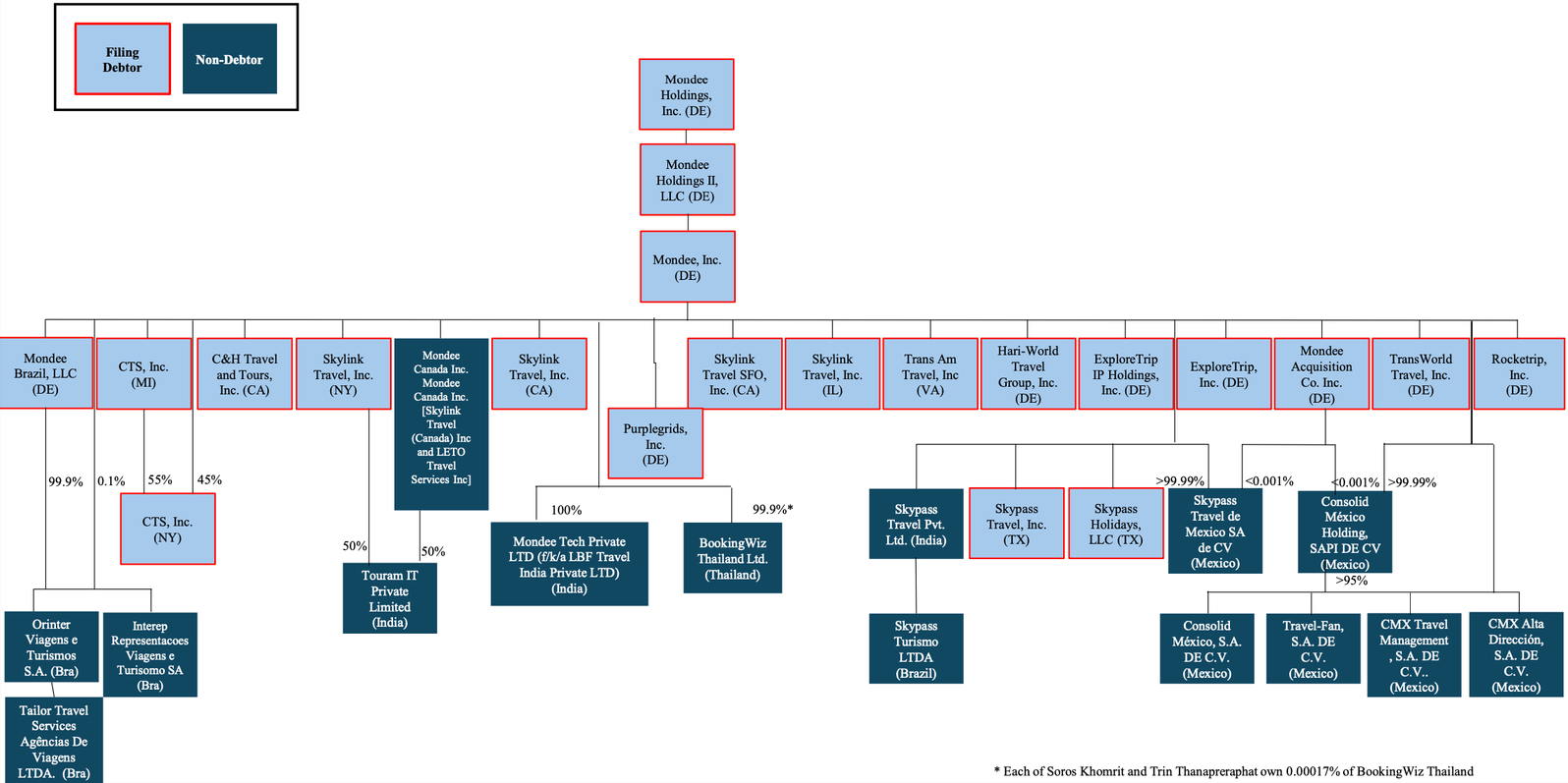

Organizational Structure

Operations Overview

Mondee's business is built around an AI Transaction Platform that supports over 50 million searches daily, utilizing artificial intelligence engines, large language models, and proprietary probabilistic learning models to deliver personalized consumer experiences.

The Mondee Marketplace facilitates the sale of unsold and empty airline seats, hotel rooms, cruise cabins, and other travel experiences, producing over 5 million airline transactions annually.

The Company has established a business-to-business-to-consumer distribution network with strong partnerships across the travel distribution chain, including a network of 65,000 travel experts, social media influencers, member organizations, and small to medium enterprises that access more than 125 million travelers.

Support Services and Global Presence

- Mondee offers 24/7 multi-lingual support service centers across various global locations, including the United States, Canada, Brazil, Mexico, India, and Thailand.

- This global support network enables the Company to provide seamless assistance to its customers and partners worldwide.

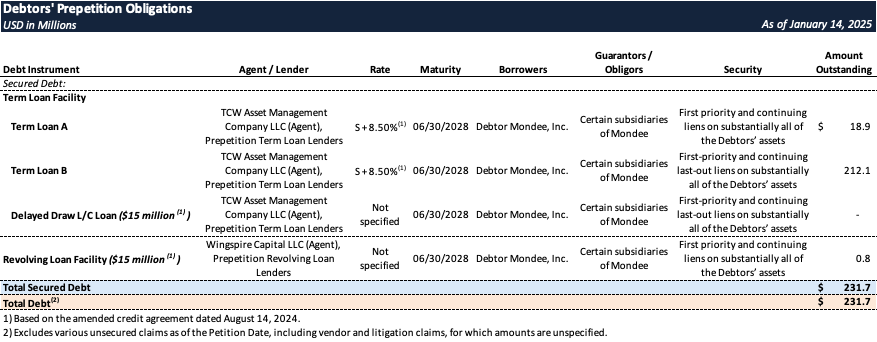

Prepetition Obligations

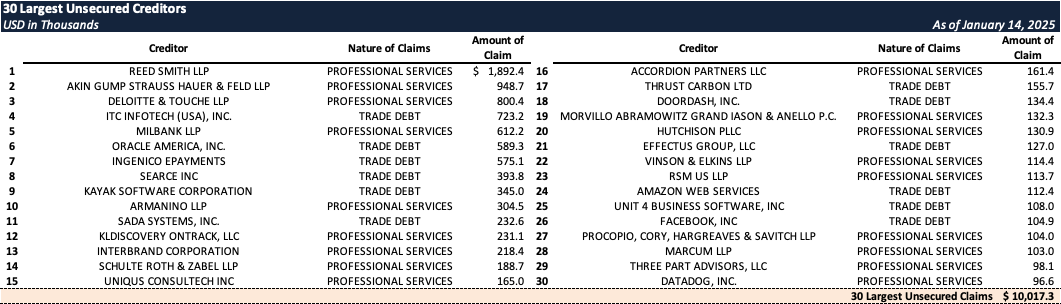

Top Unsecured Claims

Events Leading to Bankruptcy

Challenging Business Environment and Operational Decline

- Mondee has experienced significant operational decline and incurred negative cash flows from operating activities and substantial losses in recent years, relying heavily on debt and preferred equity financings to fund operations.

- Despite generating revenue from travel commissions and incentive payments, the Company's business prospects declined substantially in the months leading up to the bankruptcy filing due to its inability to stabilize operations.

- The Company made large acquisitions in 2019 and 2020, partly funded by a $150 million term loan from Prepetition Lenders, which did not yield anticipated results due to the COVID-19 pandemic and subsequent global downturn in the travel business.

- The pandemic severely impacted Mondee's liquidity, prompting the Company to opt for PIK interest on Prepetition Loans, which raised its leverage ratio beyond initial expectations and further strained financial stability.

- The Company pursued De-SPAC and PIPE transactions to reduce leverage and raise new capital, but fell short of its target, diverting attention from core business operations and increasing operating expenses.

- Rather than raising common equity, it relied on higher-cost secured debt and preferred stock, resulting in insufficient access to working capital.

- Mondee's business suffered in an increasingly competitive market, including the loss of sales employees to competitors, making it difficult to capture volume-based contract incentives and further increasing liquidity needs.

- Additionally, the Company was impacted by variable interest rates on its debt and increasing global inflation, causing interest payments to rise over 5% and substantially increasing the cost of debt.

Strategic Alternatives Review

- In October 2023, the Company retained an investment banker to explore refinancing options, but despite outreach to at least 35 potential counterparties, Mondee did not receive sufficient interest for a refinancing transaction.

- To address ongoing economic and operational challenges, the Company implemented cost-cutting measures, including pay cuts, a hiring freeze, workforce reduction, and reduced disbursements and expenses, but revenue remained insufficient to cover ongoing cash requirements.

- Ultimately, Mondee retained Restructuring Advisors to explore strategic alternatives and appointed a Restructuring Committee to oversee key matters, including a potential sale process.

- In the weeks leading up to the bankruptcy filing, the Company and its advisors explored multiple potential transactions, conducted liquidity analyses, and considered restructuring alternatives before concluding that a sale process was the most viable path to preserve and maximize asset value.

- The Company contacted multiple potential strategic partners and financial buyers, developed a long-term business plan, and worked with interested parties to consider purchase opportunities, but was unable to reach mutually acceptable terms for a consensual sale or transaction out-of-court.

Efforts to Negotiate a Comprehensive Restructuring

- Prior to commencing the Chapter 11 cases, Mondee reached an agreement with primary stakeholders on a series of transactions, including a Stalking Horse Term Sheet with Prepetition Lenders and DIP lenders, which will serve as the blueprint for the Chapter 11 cases.

- The Stalking Horse Term Sheet contemplates a credit bid for a total purchase price of $191 million, consisting of outstanding obligations under the DIP Facility and a portion of outstanding Prepetition Loans, with the Prepetition Lenders assuming certain liabilities and leaving behind cash to conclude the Chapter 11 cases.

- The Company proposes to sell all claims and causes of action, including derivative claims, against the Prepetition Lenders and current or former officers and directors, with the sale process to be conducted pursuant to section 363 of the Bankruptcy Code.

- The Company filed a motion seeking approval of sale procedures, including the appointment of a Stalking Horse Bidder, and intends to file a combined Chapter 11 plan and disclosure statement to facilitate the wind-down of the Company's estates and realization of maximum value for stakeholders.

Amendments to Prepetition Facilities and Proposed DIP Financing

- In the weeks leading up to the Petition Date, Mondee entered into multiple amendments to the Prepetition Financing Agreement, providing temporary forbearance from default-related rights and remedies, as well as bridge financing to explore strategic options and negotiate a path forward.

- The Prepetition Lenders agreed to provide a DIP Facility in the amount of $110 million and access to prepetition cash collateral to fund the Company's business operations and administrative expenses during the Chapter 11 cases.

- The Company seeks approval of the DIP Facility and use of Cash Collateral, subject to adequate protection for the Prepetition Lenders, to facilitate a smooth landing into the Chapter 11 cases and a value-maximizing sale process.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Otherwise, you can also explore our full archive for all past summaries.