Case Summary: Mosaic Chapter 11

Mosaic has filed for Chapter 11 bankruptcy amid elevated interest rates, uncertainty surrounding federal clean energy policy, and failed refinancing efforts, supported by a $45 million DIP from existing lenders to maintain operations and explore a dual-track reorganization or asset sale.

Business Description

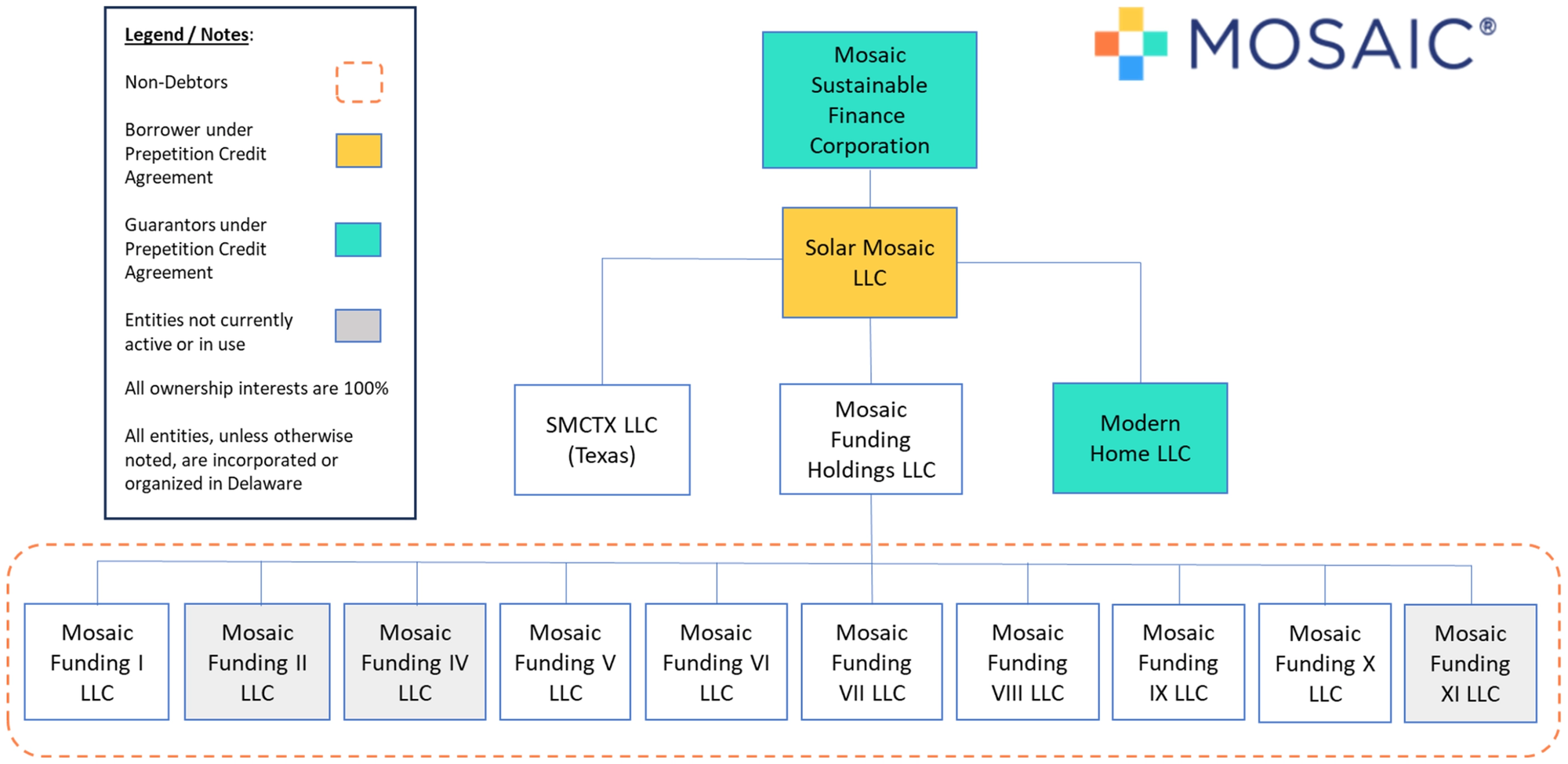

Headquartered in Oakland, CA, Mosaisc Sustainable Finance Corporation ("MSFC"), along with its Debtor affiliates⁽¹⁾ (collectively, "Mosaic” or the "Company"), is a fintech company specializing in the origination and servicing of consumer loans for residential solar energy systems and sustainable home improvements.

- Mosaic's platform connects homeowners with a network of solar installers and home improvement contractors, offering point-of-sale financing solutions.

- Loan products typically consist of fixed-rate installment loans with 10 to 25-year terms, enabling customers to adopt solar and other upgrades with minimal or no upfront cost. The Company pioneered industry-first products, including 20- and 25-year solar loans, battery-only loans, and promotional structures such as no payments for 18 months.

Operating as a lending marketplace, Mosaic originates loans either through its subsidiary, Solar Mosaic LLC ("Solar Mosaic"), or via bank and credit union partners. These loans are subsequently funded by institutional investors or sold into securitization pools. Mosaic generally does not retain loans on its balance sheet long-term, deriving revenue primarily from origination fees, dealer fees charged to contractors, and loan servicing fees.

- The Company's servicing platform manages customer billing and payments for the ultimate loan owners.

- Since its founding in 2010, Mosaic has facilitated over $15 billion in loans, assisting more than 500,000 households in financing clean-energy home improvements as of 2025.

- Beyond solar panels, Mosaic expanded its financing to include home battery storage, energy-efficient appliances (e.g., heat pumps), smart thermostats, HVAC systems, and EV charger installations.

Mosaic’s nationwide platform leverages a sophisticated technology stack, including an online contractor portal and APIs that integrate with installer sales tools, facilitating instant credit decisions and electronic document signatures. Homeowners are provided with an online portal for loan account management. This technology-driven approach, combined with extensive installer partnerships, positioned Mosaic as a leading U.S. residential solar financing provider, alongside peers such as GoodLeap and Sunlight Financial.

Mosaic Sustainable Finance Corp. and its affiliates filed for Chapter 11 protection on June 6, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in both assets and liabilities.

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Mosaic was founded in 2010 by Billy Parish and Daniel Rosen as Solar Mosaic. Initially, the Company operated as a crowdfunding platform, enabling retail investors to fund community-scale solar projects with contributions as small as $25.

- Early projects included privately investor-funded rooftop solar plants and zero-interest financing for community organizations. By 2013, its online platform offered investors a set annual return on solar projects, with initial offerings reportedly selling out rapidly.

- In 2014, Mosaic pivoted its business model to focus on originating residential solar loans directly to homeowners, partnering with installers and securing capital from institutional investors rather than crowdfunders. The pivot positioned Mosaic as the first to integrate solar lending with a fully digital financing platform, enabling the Company to seize early momentum in the fast-growing solar loan market.

Growth and Expansion

- In 2016, Mosaic secured significant financing to scale its operations, including $200 million in warehouse credit facilities from Germany’s DZ Bank and NY Green Bank, $220 million in Series C equity from private equity firm Warburg Pincus, and a $250 million warehouse facility with Deutsche Bank.

- From 2017 to 2019, the Company significantly expanded its loan originations and product offerings (including longer tenors and financing for non-solar clean energy upgrades).

- Between 2020 and 2022, Mosaic experienced substantial growth, doubling its annual loan volume in 2022 and announcing over $9 billion in cumulative funded loans by late 2022.

- In mid-2022, a Series D funding round co-led by Affinity Partners (Jared Kushner’s firm) and J. Safra Sarasin raised over $200 million, valuing Mosaic at over $1 billion.

- The Company noted that the extension of the Investment Tax Credit (ITC) through the Inflation Reduction Act in 2022 provided a significant tailwind for its business.

Leadership Changes

- Founder Billy Parish led Mosaic for approximately 13 years. In August 2023, Patrick Moore, then President and COO (since 2017), assumed the role of CEO, while Parish transitioned to Executive Chair. Daniel Budington, formerly of Santander Bank, became the new CFO.

Corporate Organizational Structure

Operations Overview

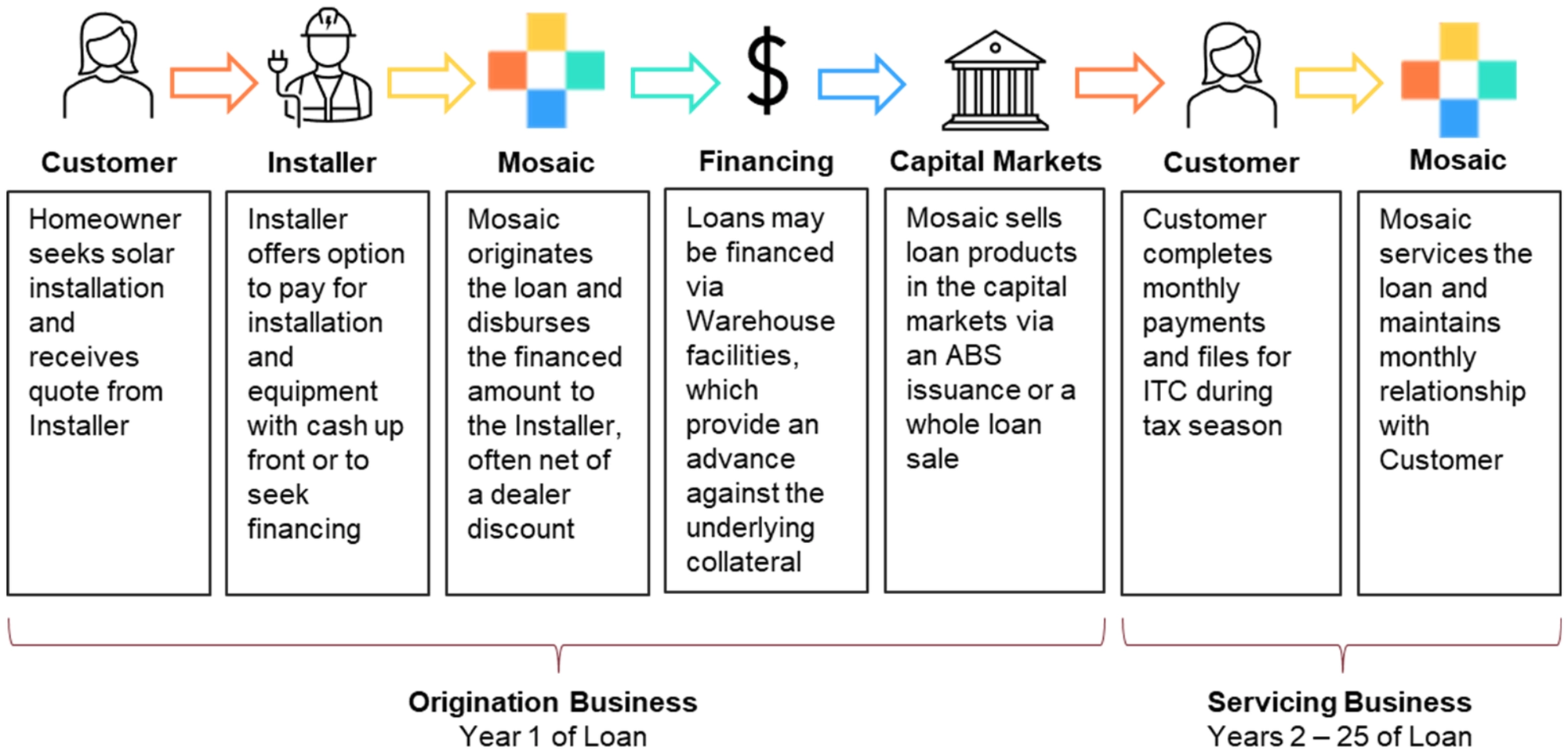

Mosaic’s operations are structured around two primary business segments: loan origination (the “Origination Business”) and loan servicing (the “Servicing Business”). The Company leveraged a national network of approximately 2,000 active vetted contractors (“Installers”) who offered Mosaic’s financing products to homeowners.

Origination Business

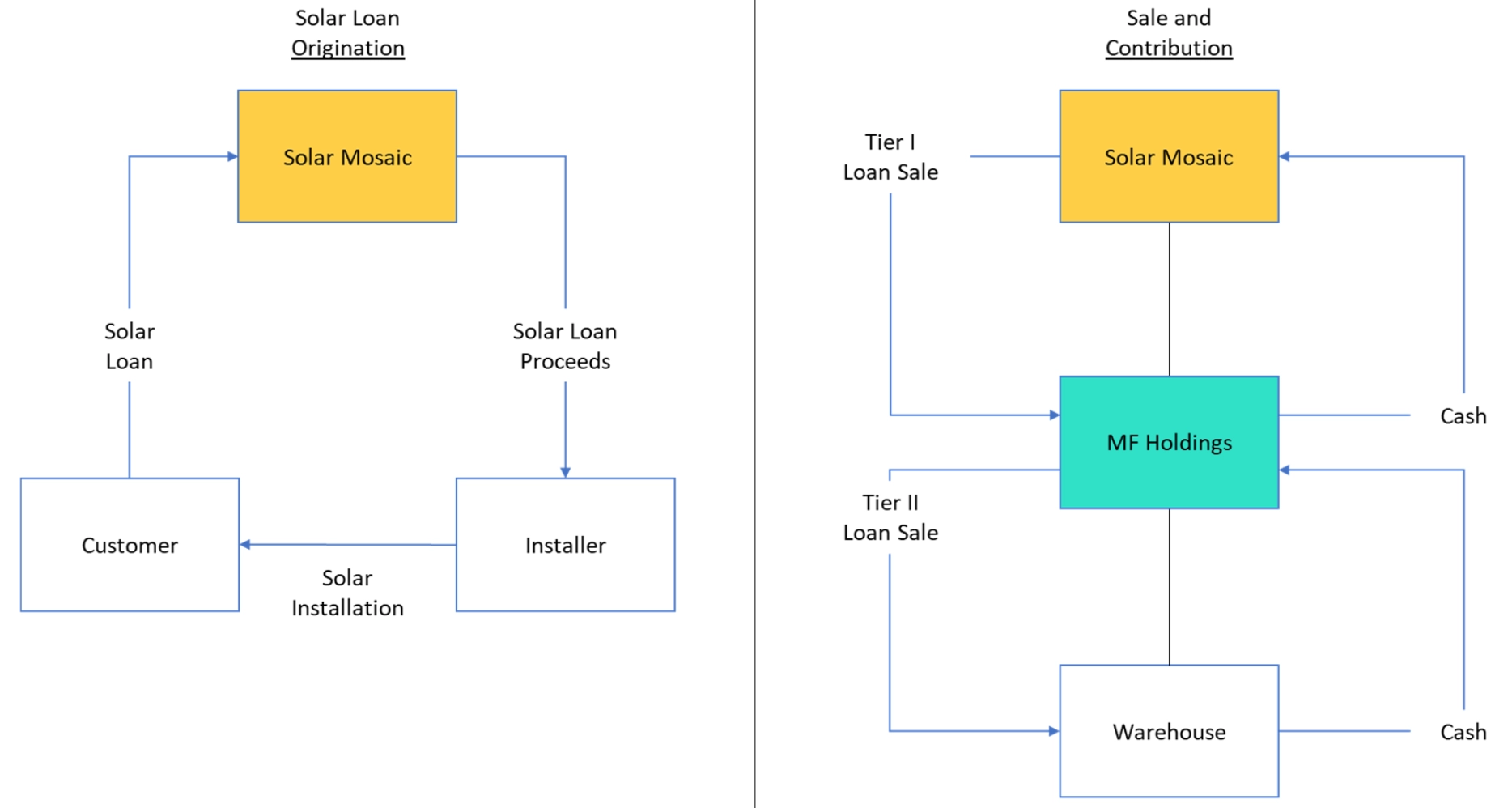

- Loans were typically originated by Solar Mosaic LLC, the Company’s primary operating subsidiary and a licensed lender, or by partner banks such as WebBank, which utilized Mosaic's platform.

- Installers used Mosaic’s point-of-sale fintech platform, featuring tools like a contractor portal, prequalification APIs, and the “SwiftLink” web-based credit application service, to facilitate instant financing proposals and loan documentation.

- Home improvement projects financed by Mosaic loans typically progressed through several stages over 90 to 180 days, from loan approval to permission to operate (PTO), with partial loan disbursements made at project milestones.

- The Company does not intend to originate new loans during the Chapter 11 cases but plans to facilitate funding for partially funded loans.

Loan Funding and Sales

- Originated loans were funded through various channels, including partner institutions (e.g., Truist Bank, Digital Federal Credit Union, Connexus Credit Union), whole loan sales to “Whole Loan Purchasers,” and transfers to special purpose entity “warehouses” (non-Debtor subsidiaries of Debtor Mosaic Funding Holdings LLC).

- Mosaic also engaged in securitization, bundling pools of solar loans into asset-backed securities (ABS) marketed as “Mosaic Solar Loan Trust.” While generally performing adequately, some subordinate tranches of its securitizations experienced downgrades in mid 2024.

- The Company had a marketing, loan sale, and servicing partnership with WebBank, whereby WebBank originated certain loans, retained them, and Mosaic serviced them, with Mosaic having an obligation to repurchase these loans under certain conditions.

- Mosaic incurred obligations to repurchase loans from financing partners if specific conditions were met, such as a failure to meet eligibility criteria or achieve PTO within a specified timeframe.

Servicing Business

- Mosaic’s platform services the loans it originates or markets, managing billing, payment collection, and customer support.

- As of the Petition Date, Mosaic was actively servicing over $8 billion in loans, distributed as follows:

- $3.8 billion in ABS Vehicles

- $2.3 billion with Whole Loan Purchasers

- $1.4 billion in Warehouses

- $300 million with Connexus Credit Union

- $32 million with WebBank

- The Company intends to continue operating the Servicing Business in the ordinary course during the Chapter 11 cases.

Partially-Funded Loans

- As of the Petition Date, approximately $130 million in loan commitments originated by the Company remained unfunded.

- Prepetition, disbursements to Installers were made by Solar Mosaic, with the loan subsequently sold through Sale and Contribution Agreements to Mosaic Funding Holdings LLC and then to the applicable Warehouse, which pledged the loan as collateral to its revolving lenders and reimbursed Mosaic.

- Postpetition, the Company seeks to reject these Sale and Contribution Agreements and negotiate amendments to Warehouse facilities, allowing Solar Mosaic to act as an agent for Warehouse lenders to complete these fundings, earning a fee for facilitating the process. The remaining funding is expected to come from Warehouse financial institutions, not the Debtors' estates.

Workforce

- All of the Company’s approximately 153 employees (149 full-time, 4 part-time) are employed by Solar Mosaic LLC. The workforce is predominantly remote.

- Mosaic also utilized a significant outsourced and contractor workforce across twelve countries for operations, sales, technology, and accounting functions.

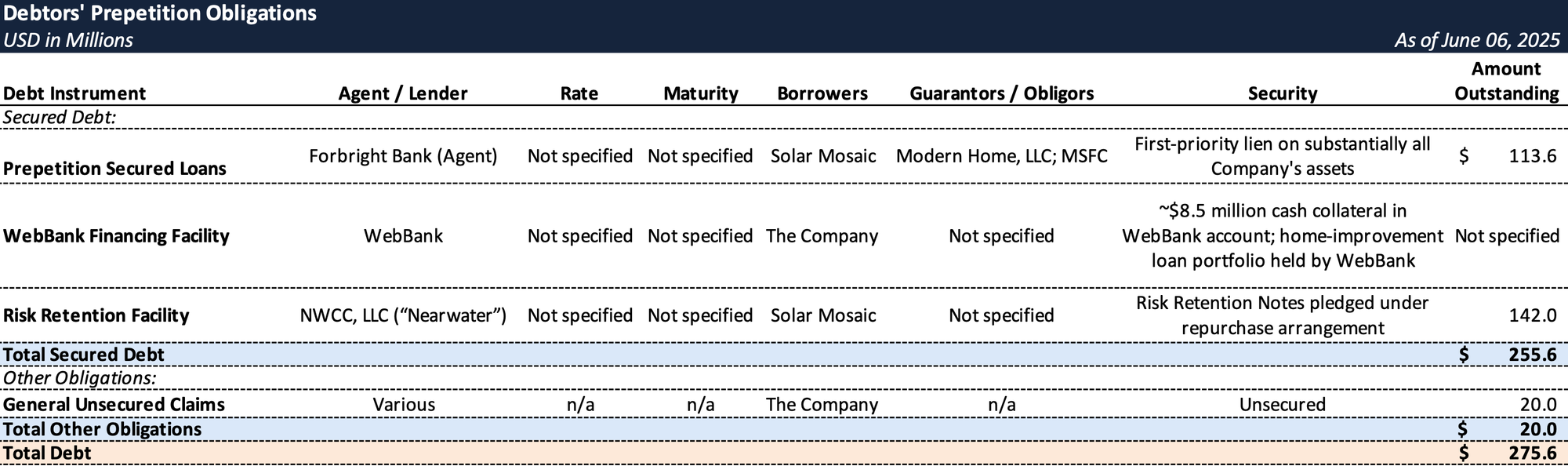

Prepetition Obligations

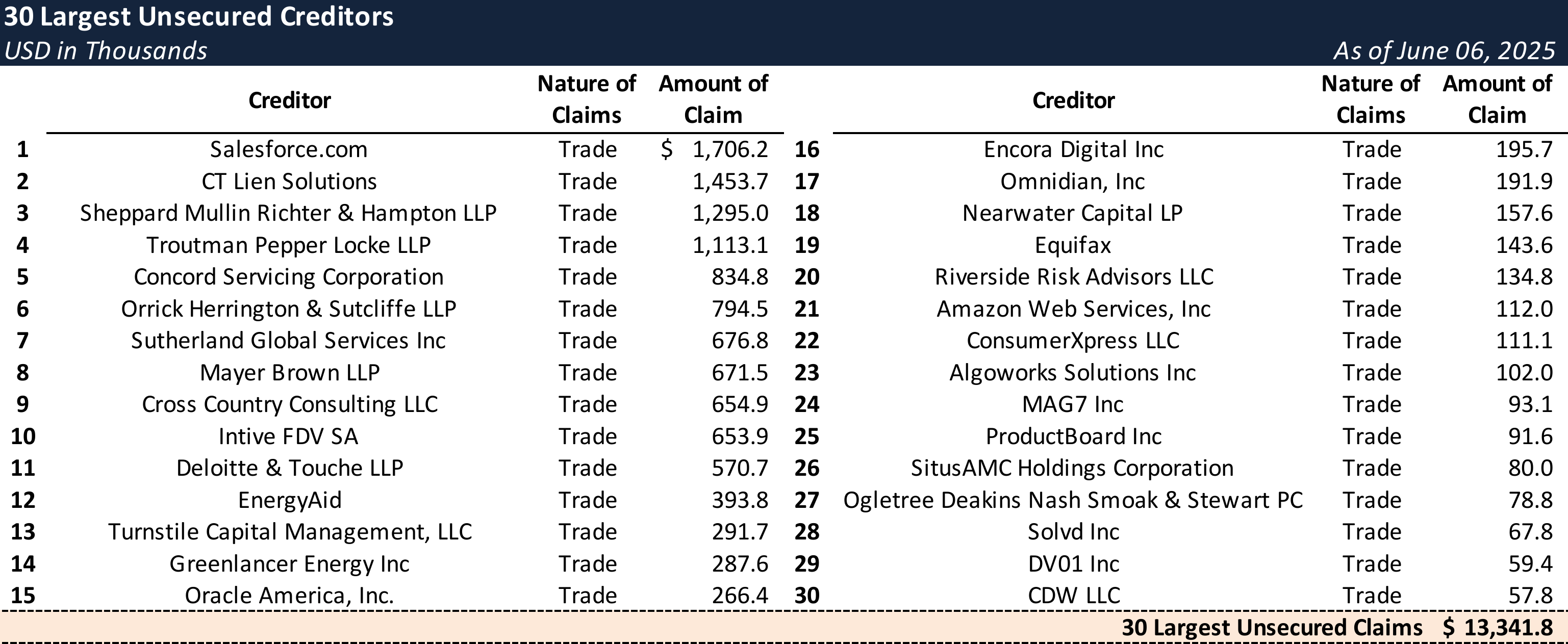

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic and Industry Challenges

- Rising Interest Rates: The sharp increase in interest rates during 2022–2023 significantly increased financing costs, slowing loan origination and diminishing consumer demand for solar projects.

- Policy Uncertainty: While the Inflation Reduction Act of 2022 extended the 30% federal Investment Tax Credit (ITC) for residential solar through 2032, subsequent political shifts created significant uncertainty. In early 2025, legislation advanced by the U.S. House of Representatives threatened to roll back or eliminate these solar tax credits, unsettling investors and impacting Mosaic's ability to secure new funding.

- Residential Solar Bankruptcies: The Chapter 11 filings of residential solar companies Sunlight Financial (Case No. 23-11794), SunPower Corp. (Case No. 24-11649), Lumio Holdings (Case No. 24-11916), and Sunnova Energy International (Case No. 25-90160) underscored sector-wide strain as rising rates suppressed loan demand.

- Regulatory Scrutiny: In March 2024, Solar Mosaic, along with GoodLeap, Sunlight Financial, and Dividend Solar Finance, was named in a civil suit by Minnesota Attorney General Keith Ellison (Case No. 27-CV-24-3558), alleging deceptive loan practices tied to the nondisclosure of dealer fees rolled into thousands of residential solar loans originated since 2017. The complaint cites violations of state consumer protection and lending laws.

Prepetition Restructuring Efforts and Liquidity Crisis

- In response to mounting liquidity stress, Mosaic engaged advisors, including a Chief Restructuring Officer from BRG and investment bankers from Jefferies, in 2024 to explore recapitalization or sale options.

- The Company initiated a prepetition marketing process to solicit new financing or strategic investments. Rockefeller Capital Management was engaged in August 2024, contacting approximately seven parties, which resulted in no more than two indications of interest and ultimately a failed equity investment.

- Jefferies was retained in 2024 and re-engaged on May 29, 2025. Its initial marketing process to refinance the maturing Prepetition Credit Agreement involved outreach to 22 parties but yielded no acceptable offers. A subsequent re-engagement focused on incremental financing, a potential asset sale, or restructuring, involving contact with 21 parties (6 strategic, 15 financial), of which 7 executed NDAs. However, no party submitted an indication of interest or was willing to provide DIP financing or act as a stalking horse bidder as of the Petition Date.

Chapter 11 Filing and Path Forward

- Mosaic Sustainable Finance Corp. and four affiliates filed for Chapter 11 protection on June 6, 2025, in the Southern District of Texas.

- Mosaic entered Chapter 11 with a two-pronged restructuring strategy supported by key stakeholders, aiming to conclude the cases within approximately 13 weeks.

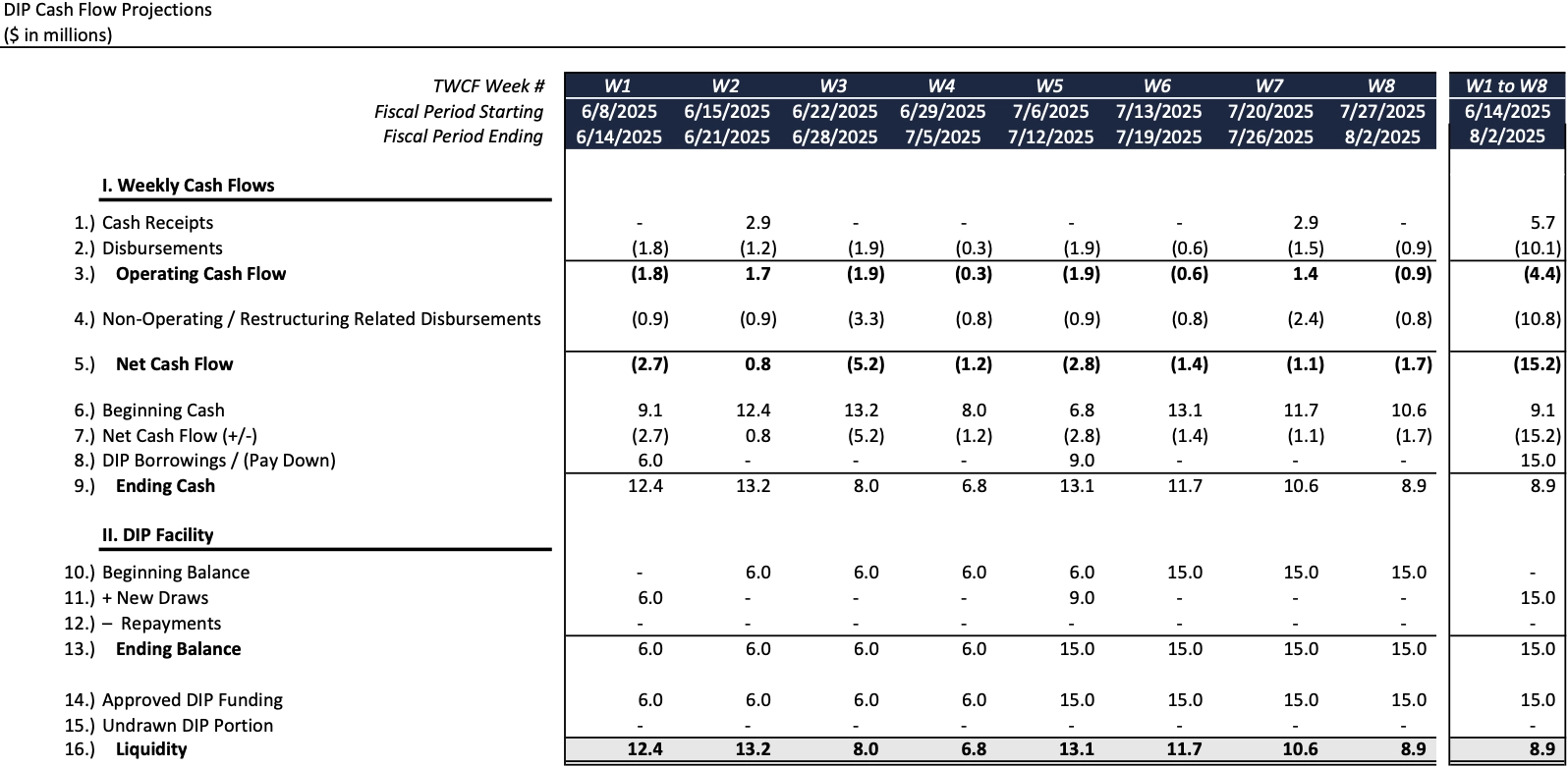

- DIP Financing: The Company secured a $45 million DIP financing facility from its existing prepetition lenders (the "DIP Lenders," with Forbright Bank as agent), including $15 million in new money, to fund operations, pay critical expenses, and facilitate the completion of partially funded installations.

- Dual-Track Process:

- The Company will continue a prepetition marketing process for its assets, intending to pursue an auction and sale under section 363 of the Bankruptcy Code if actionable bids are received that maximize value.

- Concurrently, certain prepetition lenders (the "Plan Sponsors") have agreed to support a Chapter 11 plan of reorganization (the "Plan") based on a negotiated Plan Term Sheet. This Plan contemplates the conversion of DIP Lender claims and prepetition lender claims into equity interests in the reorganized Company (a "Plan Equitization Transaction").

- Under the Plan Term Sheet:

- DIP Claims would receive 100% of Reorganized Preferred Equity in a Plan Equitization Transaction, or payment in full in cash from a Sale Transaction.

- Prepetition Secured Loan Claims would receive 80% to 100% of Reorganized Common Equity (subject to dilution from a potential Management Incentive Plan) in a Plan Equitization Transaction, or payment in full in cash from a Sale Transaction. Treatment is subject to an Agreement Among Lenders (AAL) dated March 27, 2024.

- General Unsecured Claims are projected to receive a pro rata share of a GUC Recovery Pool (if an equitization occurs) or a share of any net proceeds available after satisfying senior claims (if a sale occurs).

- Existing equity interests are expected to be cancelled with no recovery.

- The Company plans to continue its Servicing Business in the ordinary course while seeking to reject burdensome contracts and leases. While not originating new loans, Mosaic aims to preserve the optionality for a purchaser of the Origination Business to restart operations.

Key Parties

Counsel: Paul Hastings LLP

Investment Banker: Jefferies Financial Group Inc.

Financial Advisor / CRO: Berkeley Research Group, LLC (Mark A. Renzi)

Claims Agent: Kroll Restructuring Administration LLC

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.