Filing Alert: Mosaic Chapter 11

Mosaic Files Chapter 11 in Southern District of Texas

Mosaic Sustainable Finance Corporation ("Mosaic") and its debtor affiliates⁽¹⁾, an Oakland, CA-based fintech platform for U.S. residential solar and energy-efficient home improvements, filed for Chapter 11 protection on Jun. 6 in the U.S. Bankruptcy Court for the Southern District of Texas.

The company stated the filing was a strategic action to address its financial position amid macroeconomic challenges facing the residential solar industry, including high interest rates and recent legislation threatening residential solar tax credits, which have impacted the flow of capital. Through the Chapter 11 process, Mosaic intends to complete a restructuring and recapitalization supported by certain of its existing lenders, including Forbright Bank acting as Administrative Agent. Simultaneously, the company will conduct a comprehensive marketing process for its platform and other assets. Mosaic has secured $45 million in DIP financing from its existing lenders, including $15 million in new money, to fund ongoing operations and administrative expenses. The company plans to maintain its loan servicing platform in the ordinary course during the proceedings.

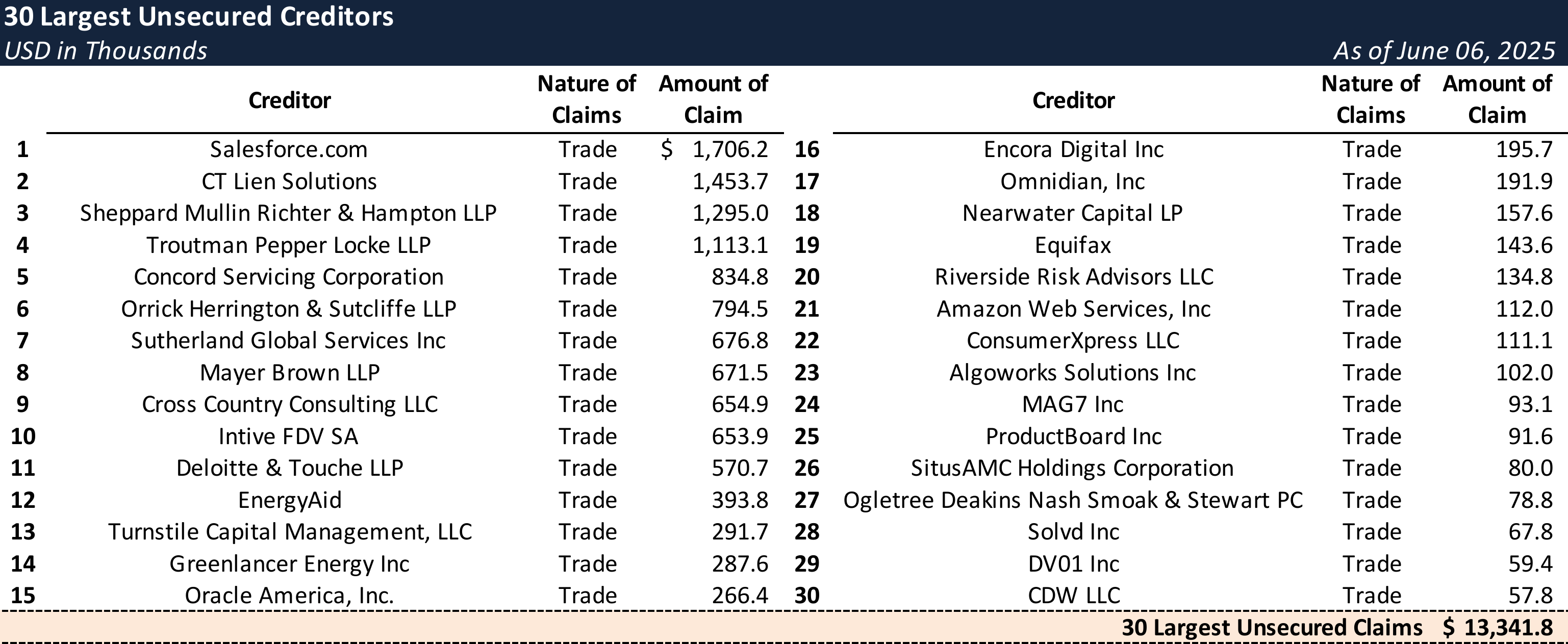

The company reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that no funds will be available for distribution to unsecured creditors after administrative expenses are paid. The case number is 25-90156.

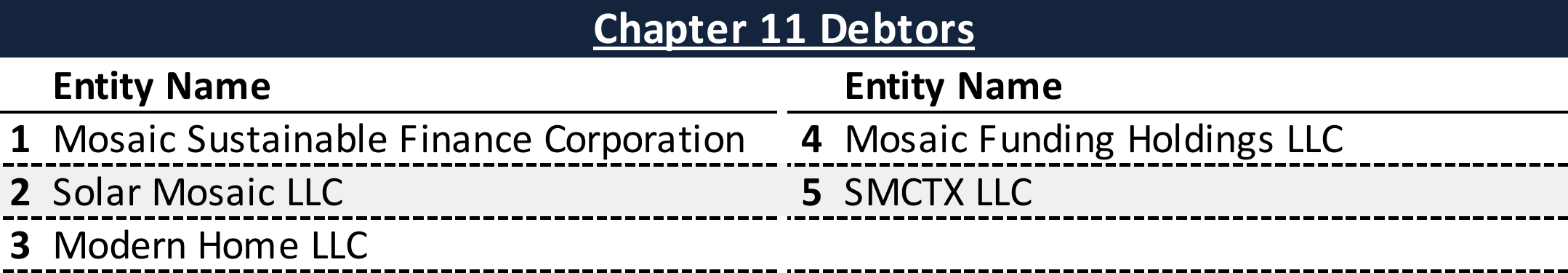

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

Top Unsecured Claims

Key Parties

Counsel:

- Charles Persons

- Paul Hastings LLP

- Email: [email protected]

Investment Banker:

- Jefferies Financial Group Inc.

Financial Advisor / CRO:

- Berkeley Research Group, LLC (Mark A. Renzi)

Claims Agent:

Equity Security Holders (10% or Greater Ownership):

- TWAB Trust 3 LLC – 13.1% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.