Case Summary: Nikola Chapter 11

Nikola Corporation has filed for Chapter 11 bankruptcy due to liquidity struggles, high operational costs, and failed fundraising efforts, with plans to wind down operations.

Business Description

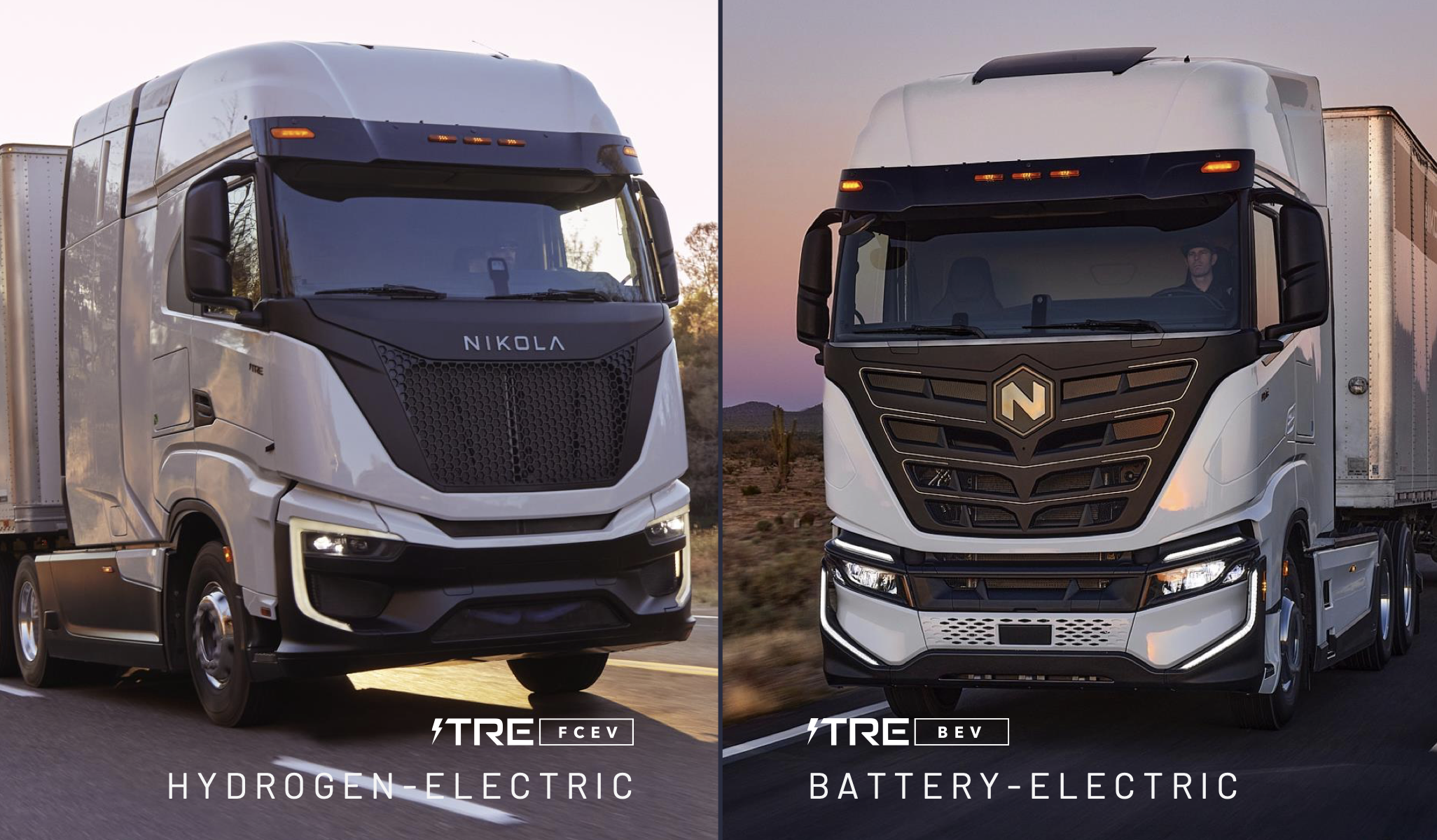

Headquartered in Phoenix, AZ, Nikola Corporation (“Nikola”), along with its Debtor⁽¹⁾ and non-Debtor affiliates, operates as an early-stage growth company specializing in the design and manufacture of heavy-duty commercial hydrogen-electric (“FCEV”) and battery-electric (“BEV”) trucks, as well as energy infrastructure solutions under the HYLA brand.

- Nikola has emerged as a pioneer in zero-emissions transportation, introducing the first class 8 hydrogen fuel cell electric trucks to North America and establishing the HYLA hydrogen refueling highway, connecting Northern California to Southern California.

- With over 3.3 million miles driven by customers across FCEV and BEV platforms, and the HYLA network dispensing over 300 metric tons of hydrogen, Nikola has demonstrated its commitment to advancing clean technology.

- The Company’s integrated business model aimed to provide fleets and end-users with comprehensive solutions, including hydrogen refueling infrastructure and electric vehicle charging systems, to establish a competitive edge in the clean tech sector.

The Company operates through two primary business units:

- Truck: Commercializes FCEV and BEV Class 8 trucks tailored for short, medium, and long-haul trucking sectors.

- Energy: Develops hydrogen fueling infrastructure to support FCEV trucks, encompassing supply, distribution, and dispensing.

Augmenting its market presence is Nikola’s robust patent portfolio, comprising 46 U.S. utility patents, 51 foreign utility patents, 15 U.S. design patents, and 115 foreign design patents.

- The Company also has 65 pending patents covering mechanical systems, thermal, electrical, power management, hydrogen systems, diagnostics, and controls.

Nikola filed for Chapter 11 protection on Feb. 19 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors reported $878.1 million in assets and $469 million⁽²⁾ in liabilities.

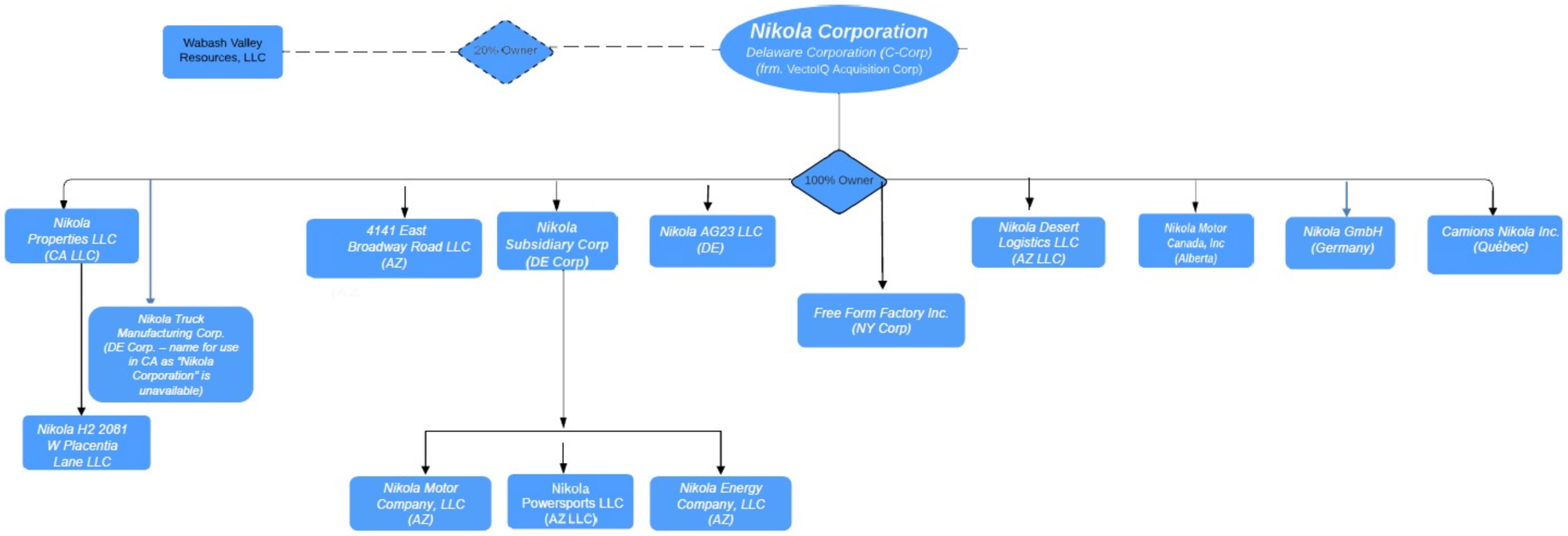

⁽¹⁾ Nikola Properties, LLC, Nikola Subsidiary Corporation, Nikola Motor Company LLC, Nikola Energy Company LLC, Nikola Powersports LLC, Free Form Factory Inc., Nikola H2 2081 W Placentia Lane LLC, 4141 E Broadway Road LLC, and Nikola Desert Logistics LLC.

⁽²⁾ Excludes certain contingent and unliquidated litigation claims.

Corporate History

Nikola Corporation, a Delaware corporation, originated as VectoIQ Acquisition Corp. ("VectoIQ"), which was incorporated in January 2018. On June 3, 2020, VectoIQ completed a business combination with Nikola's corporate predecessor, Legacy Nikola, resulting in:

- A merger of VectoIQ’s wholly-owned subsidiary with Legacy Nikola, with Legacy Nikola surviving as the accounting predecessor and becoming Nikola Corporation.

- Legacy Nikola subsequently became a wholly-owned subsidiary of Nikola.

Nikola Corporation is publicly traded on Nasdaq under the symbol “NKLA”, though it is set to be delisted. As of February 24, 2025, the Company had 84.47 million shares outstanding, with the stock last trading at $0.26 per share.

- On February 19, 2025, Nasdaq issued a delisting notice for Nikola due to its Chapter 11 bankruptcy filing and concerns over public interest, equity holder impact, and continued listing compliance.

- Trading in NKLA shares is scheduled to be suspended at market open on February 26, 2025.

Corporate Structure (As of December 12, 2024)

Nikola holds a 100% direct or indirect stake in all Debtor entities, three non-Debtor foreign subsidiaries (Nikola GmbH, Nikola Motor Canada Inc., and Camions Nikola Inc.), and a bankruptcy-remote entity (Nikola AG23 LLC). It also owns a 20% stake in Wabash Valley Resources, LLC.

Operations Overview

Nikola initiated commercial production of BEV trucks in Q1 2022 and FCEV trucks in Q3 2023, both at its state-of-the-art manufacturing facility in Coolidge, AZ.

- Truck Range: BEV trucks offer an estimated range of up to 330 miles, while FCEVs extend up to 500 miles.

- Manufacturing Capacity: The facility currently supports up to 2,400 units annually with existing tooling.

As of the Petition Date, Nikola held an inventory of 259 trucks at its Coolidge facility (103 FCEVs and 156 BEVs), with an additional 87 trucks (79 FCEVs and 8 BEVs) at various dealer locations, though some were non-sellable due to ongoing recalls.

Recall Impact

In late 2023, Nikola faced a voluntary recall of BEV trucks requiring battery pack replacements. As of the petition date, retrofits were ongoing, with an estimated $44 million in realized losses and a projected total recall impact of approximately $56 million.

- These proceedings will delay the completion of retrofits, originally expected by late 2024.

Hydrogen Fueling Network

Nikola's HYLA brand encompasses energy solutions for procuring, distributing, and dispensing hydrogen to fuel its FCEV trucks.

HYLA operates eight hydrogen fueling locations in California, Arizona, Illinois, Colorado, and Canada. These sites support up to 120 FCEV trucks daily.

Supply Chain and Dealership Network

Nikola sources components globally, with a reliance on single-source suppliers for critical parts such as hydrogen fuel cells and batteries.

The Company collaborates with 11 dealers across 22 locations in 14 U.S. states and Canada, targeting national, medium, and small truck fleets.

Incentive Programs

Nikola leverages green policy incentives, with $350 million available in U.S. and Canadian tax incentive funding for over 1,862 trucks by 2025. This aligns with the Company’s strategy to assist fleets in securing financial support for vehicle purchases.

Recent Performance

In 2024, Nikola produced 282 FCEVs and shipped 200 units, alongside limited BEV production due to recall impacts. The Company generated $62 million in revenue from truck sales and $7 million from services.

- The Debtors decided to halt further manufacturing to conserve cash ahead of asset sale preparations.

Workforce

As of the Petition Date, Nikola employed 878 individuals, comprising full-time salaried and hourly workers. Employees play a crucial role in operational continuity and maximizing asset value during these proceedings.

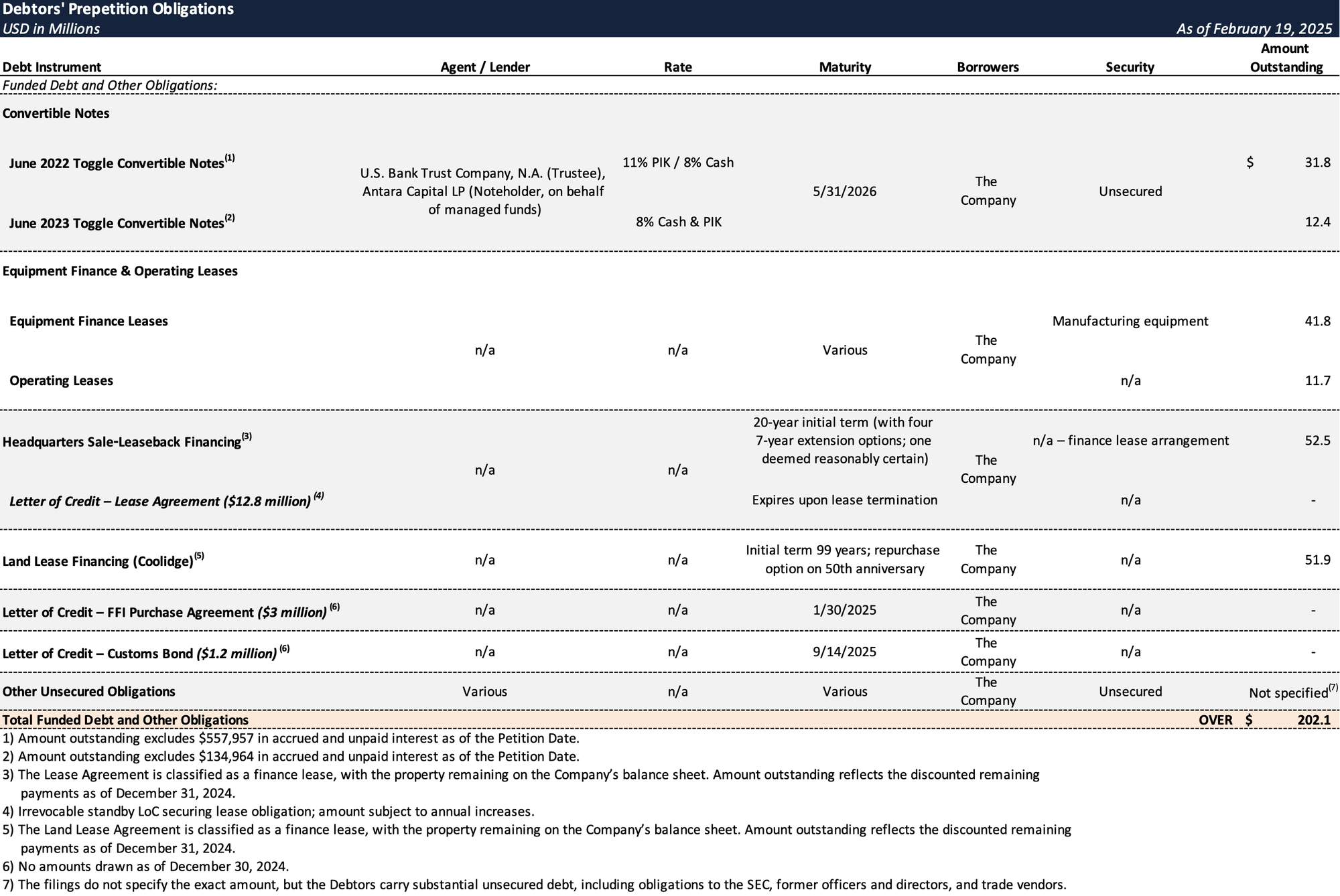

Prepetition Obligations

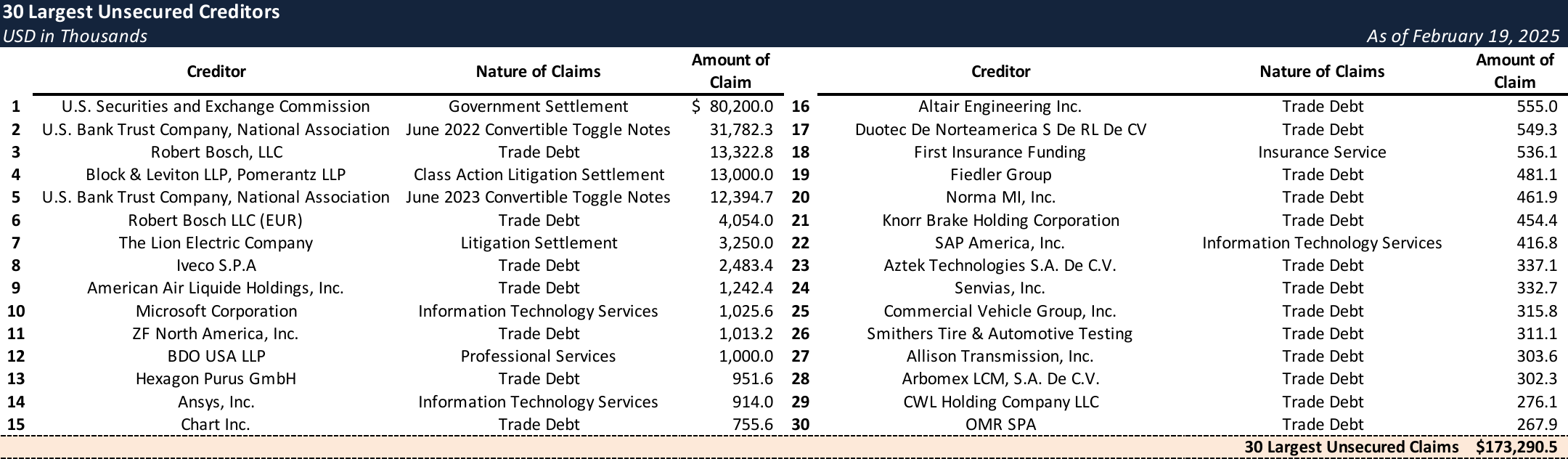

Top Unsecured Claims

Events Leading to Bankruptcy

Challenges in Hydrogen Fuel Cell Market

- Nikola operates in the early-stage hydrogen fuel cell vehicle and infrastructure markets, which present significant operational challenges:

- Production shortages have persisted due to supply chain disruptions related to new technology adoption.

- The lack of hydrogen infrastructure or supply for end users has hindered truck sales, requiring significant investment to build out necessary infrastructure.

- The Company’s business plans require substantial capital investment to address these challenges and scale operations effectively.

Litigation Challenges and Settlement Obligations

- The Company faces significant litigation-related costs, which have drained cash reserves:

- Nikola is obligated to make a substantial payment to the SEC under a December 21, 2021 settlement agreement. The terms include:

- A $125 million civil penalty, with the first installment of $25 million paid in December 2021.

- Remaining installments were originally due semiannually through 2023 but were later modified under an alternative payment plan agreed upon in July 2022.

- As of September 30, 2024, the Company reflects a remaining liability of ~$80 million in accrued expenses and other current liabilities.

- Nikola is obligated to make a substantial payment to the SEC under a December 21, 2021 settlement agreement. The terms include:

Liquidity Pressures and Failed Fundraising Efforts

- Nikola has faced severe liquidity challenges, exacerbated by its status as an early-stage, capital-intensive business:

- Net losses for the year ended December 31, 2023, and the nine months ended September 30, 2023, and 2024, were $966.3 million, $812.7 million, and $481.2 million, respectively.

- The Company has an accumulated deficit of approximately $3.6 billion from the inception of Nikola Corporation through September 30, 2024.

- Despite efforts to secure funding, the Company has been unable to raise sufficient capital to fund operations going forward.

Prepetition Restructuring Initiatives

- In an attempt to address its operational and liquidity challenges, the Company engaged in various restructuring efforts:

- Since summer 2024, Nikola raised $80 million in convertible debt financing and an additional $65 million in common equity to support its restructuring activities.

- The Company worked with advisors to explore strategic and financial transactions, though these efforts did not yield sufficient results to resolve its liquidity crisis.

Bankruptcy Path Forward

- Faced with insufficient cash to fund operations and no viable funding prospects, Nikola concluded that filing for Chapter 11 was necessary:

- The Company seeks to maximize value for creditors through an orderly sale process of its assets.

- Upon filing, the Company had approximately $47 million in cash on hand to support limited operations, implement the postpetition sale process, and exit Chapter 11 through a plan process.

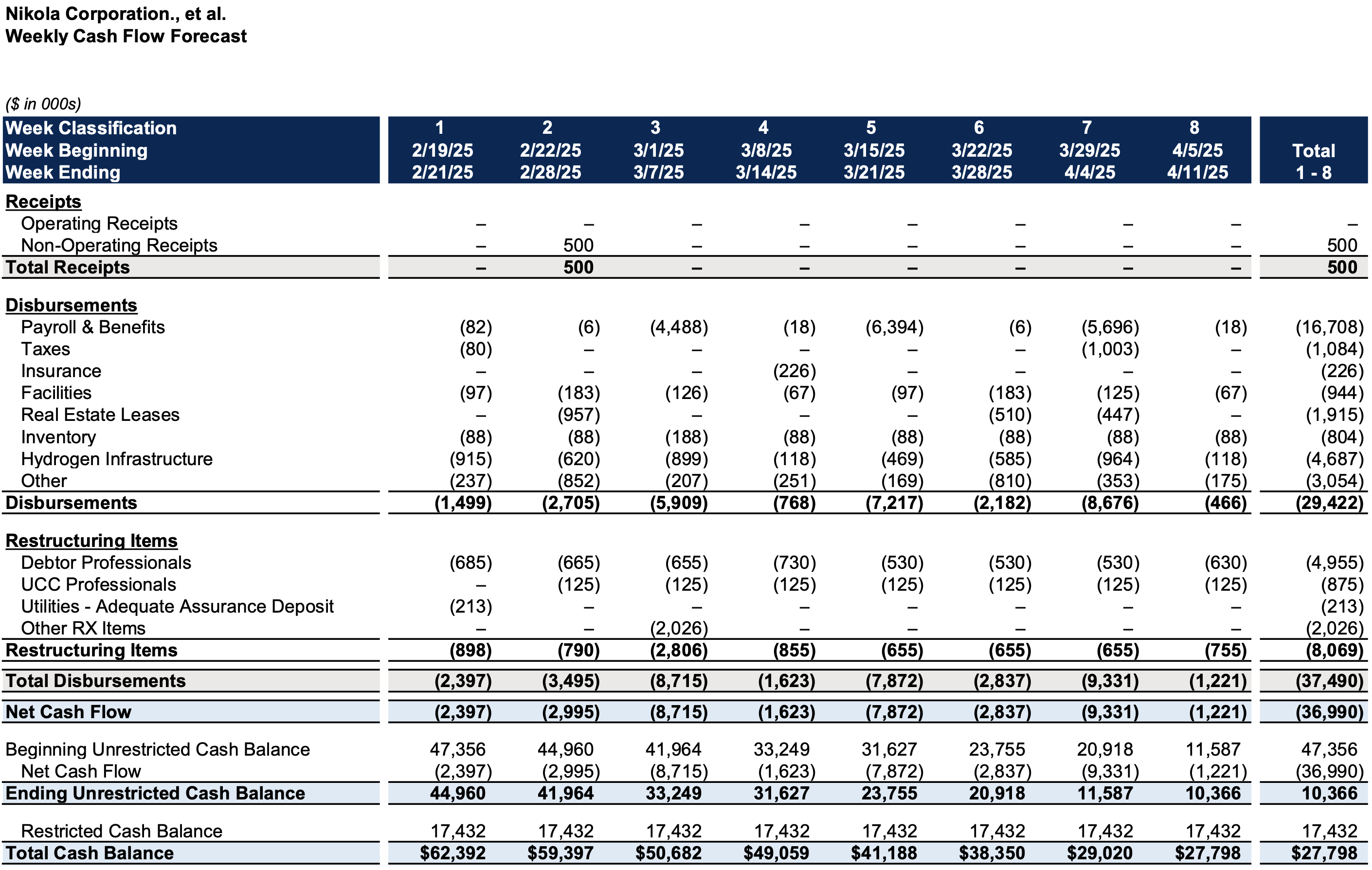

Initial Cash Flow Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.