Filing Alert: Nine Energy Service Chapter 11

Nine Energy Service Files Chapter 11 in Southern District of Texas

Update (Feb. 2, 2026): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Nine Energy Service, Inc.

Nine Energy Service, Inc. and its debtor affiliates⁽¹⁾, a Houston, TX-based onshore oilfield services business that specializes in oil and gas resource extraction and development, filed for Chapter 11 protection on Feb. 1 in the U.S. Bankruptcy Court for the Southern District of Texas.

The company attributes the filing to an overleveraged capital structure, persistent pricing declines in the oil and gas industry, and reduced drilling activity, which constrained liquidity and hindered its ability to compete or pursue strategic consolidation.

The prepackaged filing aims to implement a comprehensive balance sheet restructuring pursuant to a Restructuring Support Agreement (RSA) with an ad hoc group holding over 70% of the company's senior secured notes and its prepetition ABL lenders. The plan contemplates the equitization of approximately $319.5 million in senior secured notes, leaving general unsecured creditors unimpaired. To fund the case and operations, the debtors have secured a $125 million senior secured superpriority asset-based DIP facility from their prepetition ABL lenders, which includes a roll-up of approximately $68.5 million in prepetition ABL obligations.

Nine Energy Service, Inc. reports $340.7 million in assets and $436.6 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 26-90295.

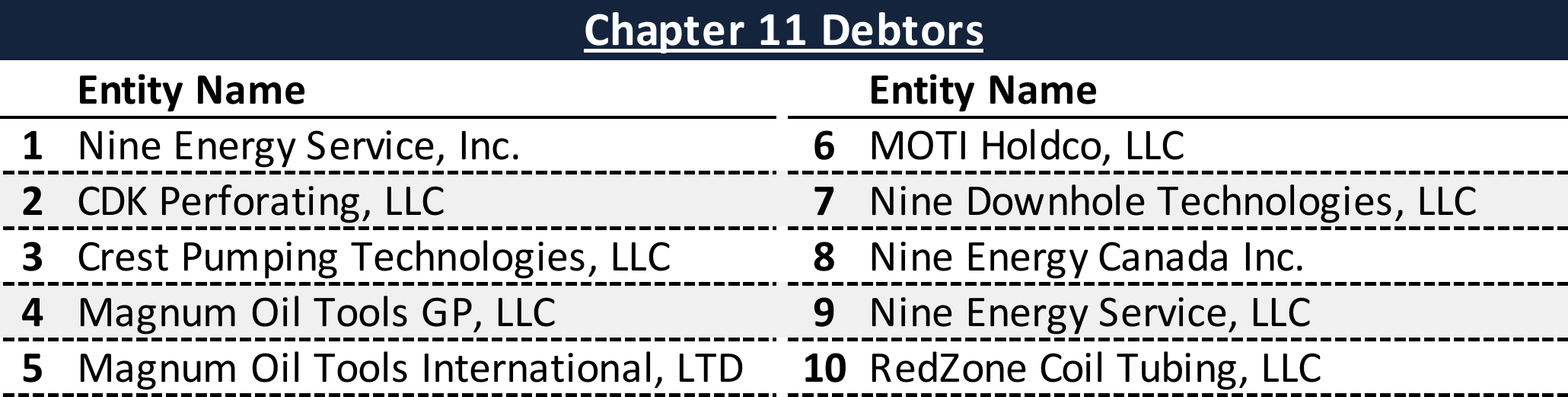

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

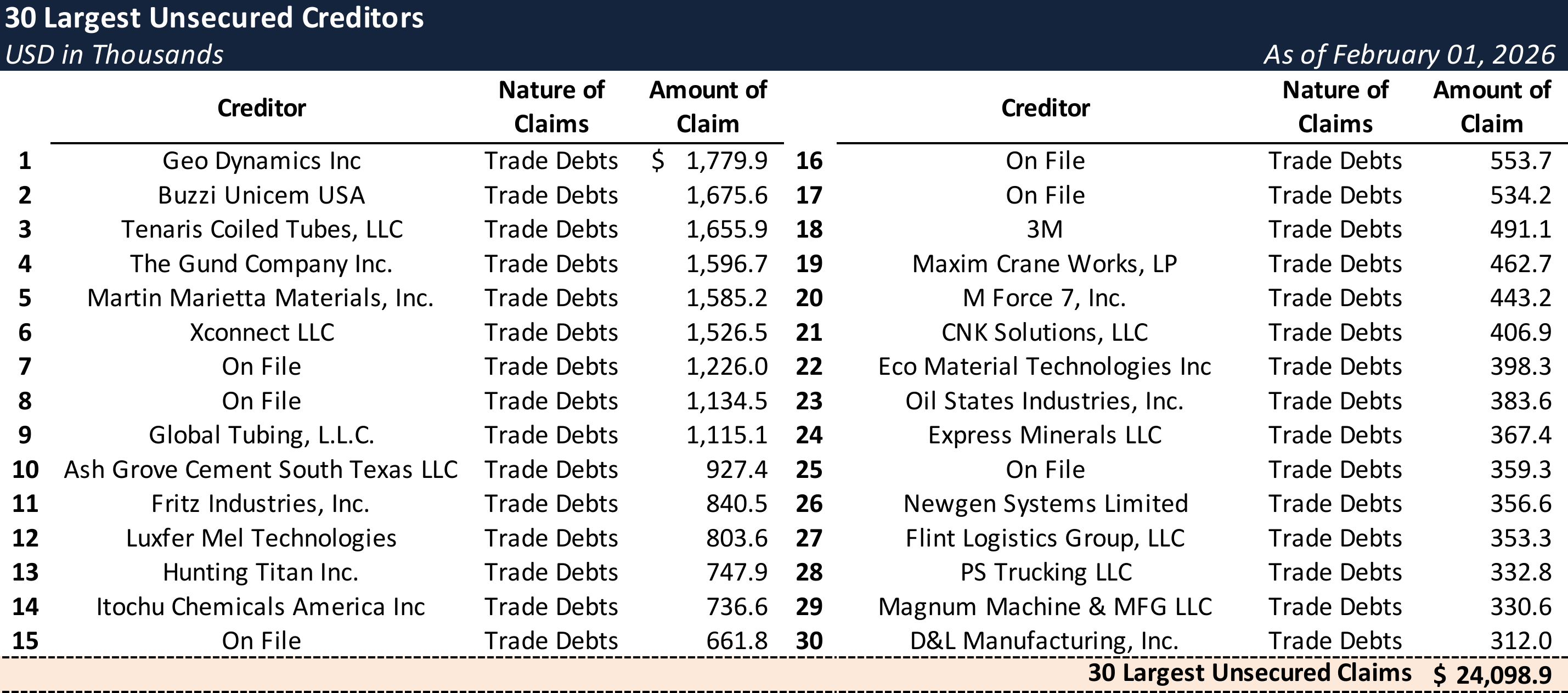

Top Unsecured Claims

Key Parties

Counsel:

- John J. Kane

Kane Russell Coleman Logan PC

Email: [email protected]

Co-counsel:

- Kirkland & Ellis LLP

- Kirkland & Ellis International LLP

Financial Advisor:

- FTI Consulting, Inc.

Investment Banker:

- Moelis & Company LLC

Tax Advisor:

- KPMG LLP

Signatories:

- Guy Sirkes – Executive Vice President and Chief Financial Officer

Claims Agent:

Equity Security Holders:

- Tontine Asset Management, LLC – 9.64% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.