Case Summary: Norcold Chapter 11

Norcold has filed for Chapter 11 bankruptcy amid legacy product-liability burdens and broader industry headwinds, backed by a $13 million DIP to pursue a stalking-horse sale to Dave Carter & Associates.

Business Description

Norcold LLC ("Norcold" or the "Company") is a long-standing supplier of specialty refrigeration products, primarily serving the recreational vehicle (RV) and marine markets. Founded in 1959, the Company established itself as an industry leader with its gas-absorption refrigerators, which utilize a heat source like propane to power the cooling cycle, making them ideal for off-grid applications.

- Norcold’s product line includes a broad range of refrigerators and freezers designed for mobile use, which have been installed in millions of RVs, boats, and heavy-duty trucks.

- While historically focused on its core propane-powered absorption units, the Company has also introduced DC compressor refrigerators to adapt to evolving industry technology.

- The Company serves both original equipment manufacturers (OEMs) for installation in new vehicles and the aftermarket through a network of distributors, dealers, and retailers for replacement units and parts.

As of its Chapter 11 filing, Norcold has transitioned from a domestic manufacturer to a distribution-focused business. It now sources its inventory from third-party manufacturers and affiliates, leveraging its established brand and customer base to sell RV and marine refrigerators and parts.

Norcold LLC filed for Chapter 11 protection on November 3, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $10 million to $50 million in assets and $100 million to $500 million in liabilities.

Corporate History

Norcold was founded in 1959 as a family-owned business in California. Amid rapid growth driven by the post-war recreational camping boom, the Company relocated its operations in 1964 to Sidney, Ohio, a hub for RV manufacturing. In 1963, Norcold was acquired by Stolle Corporation, an Alcoa-owned company. Under this ownership, Norcold expanded its capabilities, notably by building its own state-of-the-art cooling unit factory in Gettysburg, Ohio, in 1989, thereby ensuring control over a critical supply component and strengthening its market position.

Acquisition by Thetford and Monomoy

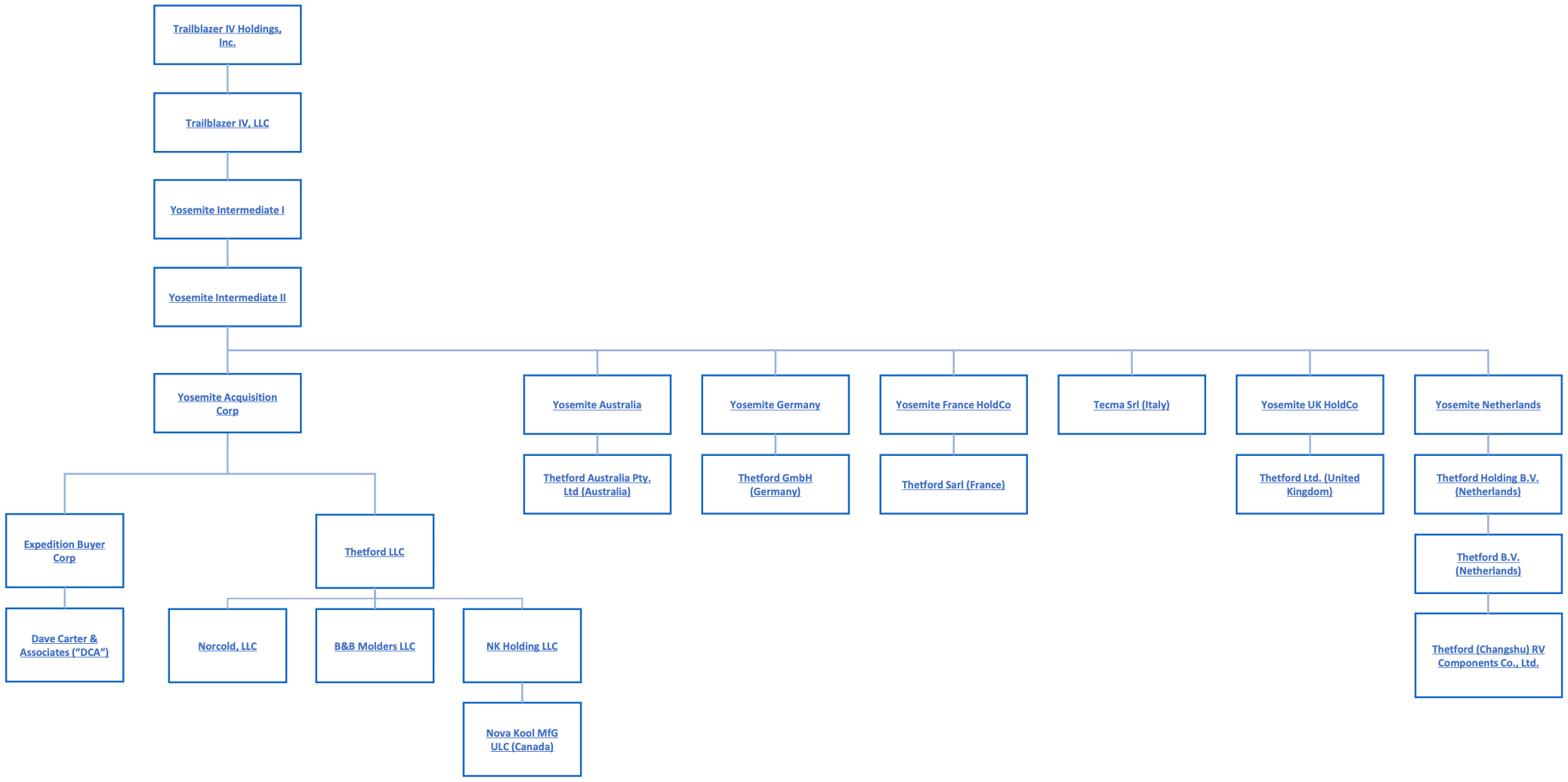

- A pivotal change occurred in 1997 when Thetford Corporation, a leading manufacturer of RV sanitation products, acquired Norcold to expand into the refrigeration segment. The acquisition integrated Norcold into a global RV supply enterprise, expanding its international reach.

- Thetford, and by extension Norcold, was owned by The Dyson-Kissner-Moran Corporation (DKM) for several decades until late 2021, when private equity firm Monomoy Capital Partners acquired Thetford, with DKM retaining a minority interest.

- Following the transaction, Norcold LLC became an indirectly wholly-owned subsidiary of Thetford LLC, which in turn is controlled by Monomoy Capital Partners and its affiliates.

Corporate Organizational Structure

Operations Overview

For most of its history, Norcold operated as a vertically integrated manufacturer with a significant footprint in Ohio. However, facing steep revenue declines, the Company executed a major operational restructuring in 2022, transforming its business model from manufacturing to distribution.

Shift to a Distribution Model

- In 2022, Norcold shuttered its U.S. manufacturing plants in Sidney and Gettysburg, Ohio, ceasing all domestic production and resulting in the layoff of approximately 500 employees.

- The Company now operates as a "buy-and-sell" distribution business with no direct employees.

- Production of its legacy gas-absorption refrigerators was transferred to a non-debtor European affiliate, Thetford B.V.

- Its growing line of DC compressor refrigerators is sourced from third-party manufacturers in China.

Products, Customers, and Shared Services

- Norcold’s product portfolio includes gas-absorption and compressor-driven refrigerators, freezers, ice makers, and replacement parts for the RV, marine, and long-haul truck markets.

- The Company sells to RV manufacturers as an OEM supplier and serves the aftermarket through parts distributors and dealerships, leveraging Thetford's global sales and distribution network.

- Day-to-day functions, including IT, logistics, sales administration, and engineering, are provided by its parent, Thetford, through shared service arrangements. As of the Petition Date, Norcold owed approximately $1.9 million to non-debtor affiliates for these internal supply and service agreements.

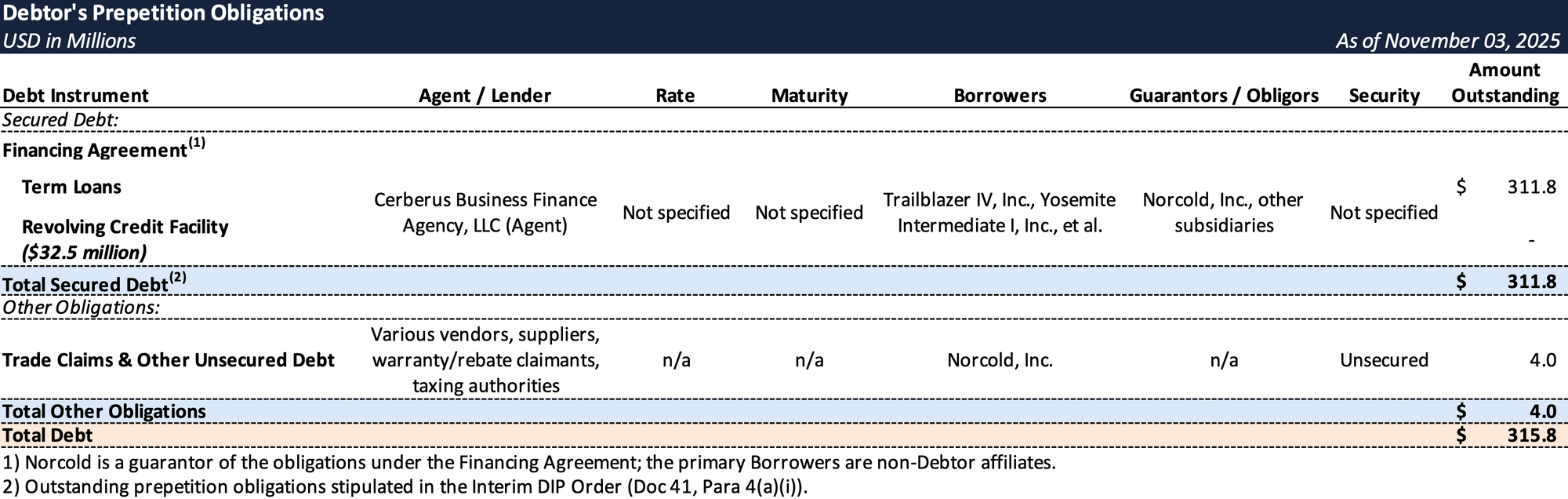

Prepetition Obligations

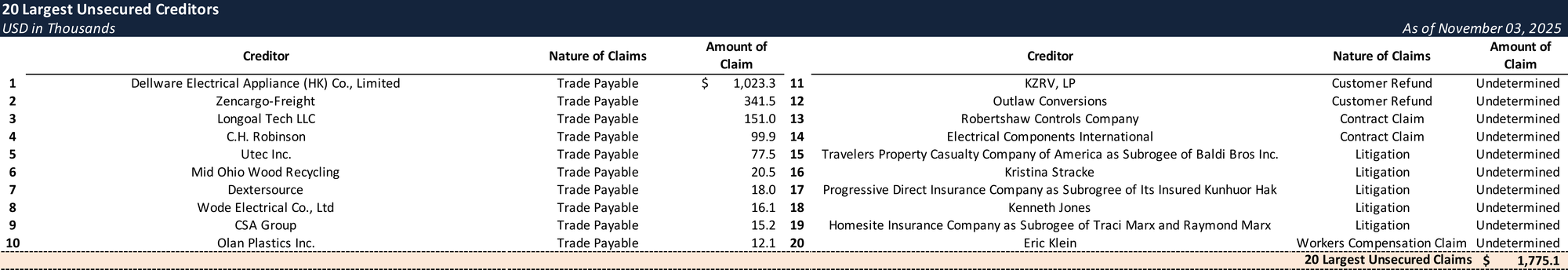

Top Unsecured Claims

Events Leading to Bankruptcy

Norcold’s path to Chapter 11 was driven by the combined weight of massive legacy product liabilities, a disruptive technological shift in its core market, and the resulting collapse of its revenue and profitability.

Legacy Product Liabilities and Litigation

- Beginning in 2010, the Company faced a severe product safety crisis related to a defect in its popular 1200-series gas-absorption refrigerators, which posed a potential fire hazard due to leaking flammable gas.

- The issue triggered a widespread product recall and a wave of litigation that has burdened the Company for over a decade.

- In 2016, Norcold settled a class-action lawsuit for approximately $36 million on an uninsured basis.

- The Company has faced over 10,500 product liability claims, and since 2010 it has paid approximately $84 million in related settlements, including $75 million for recall-related claims and $9 million for non-recall claims.

- High deductibles on its insurance policies, including a $5 million per-occurrence retention for recalled products, left Norcold to bear much of the financial impact directly.

Market Disruption and Revenue Collapse

- While grappling with litigation costs, Norcold’s core market underwent a fundamental technological shift. Beginning around 2018 and accelerating during the COVID-19 pandemic, RV manufacturers began favoring DC compressor refrigerators over Norcold’s traditional gas-absorption units.

- Norcold was ill-positioned to capitalize on the pandemic-driven RV sales boom, as its attempts to pivot to DC compressor models were insufficient to counter the rapid decline in demand for its legacy products.

- The shift eroded Norcold's market share and led to a catastrophic decline in sales. Annual net revenue plummeted from approximately $153 million in 2021 to a projected total of less than $28 million for 2025.

Operational Restructuring and Chapter 11 Filing

- In response to its financial distress, Norcold closed its U.S. manufacturing operations in 2022 to aggressively cut costs.

- After engaging restructuring advisors, management concluded that a Chapter 11 filing and a court-supervised sale process was the most viable path to preserve value.

- The Company entered Chapter 11 with a pre-arranged restructuring framework centered on a 363 sale of its assets.

- Dave Carter & Associates (DCA), a large RV parts distributor recently acquired by Thetford, has agreed to act as the stalking horse bidder.

- DCA is also providing a $13 million new-money DIP financing facility to fund Norcold’s operations through the sale process.

- The proposed Chapter 11 plan contemplates selling Norcold’s operating assets to DCA or a higher bidder and establishing a liquidating trust to distribute the remaining proceeds to creditors.

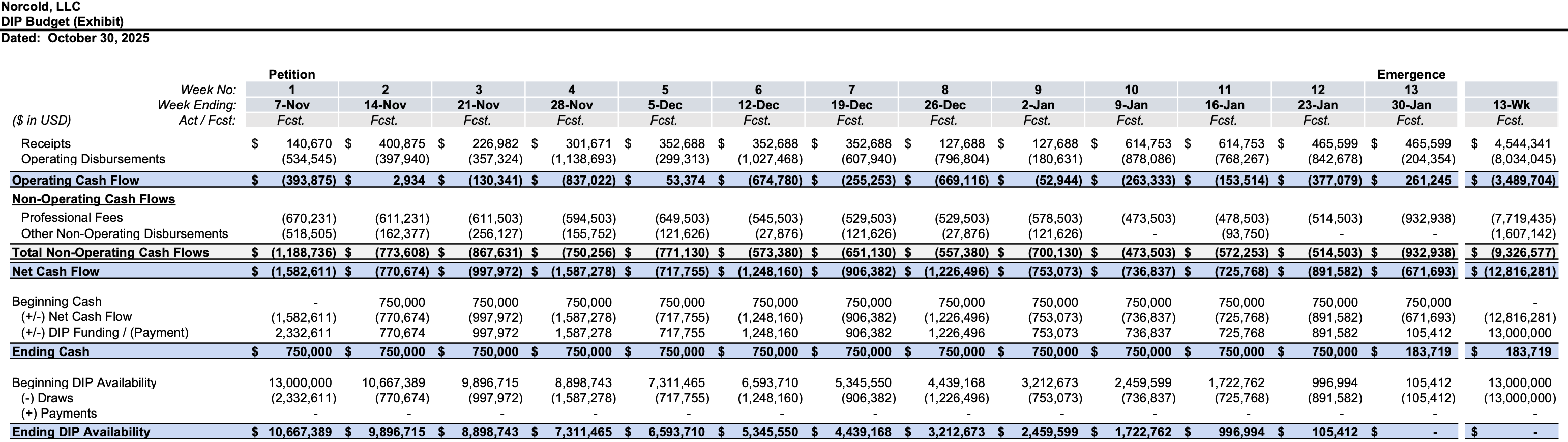

Initial DIP Budget

Key Parties

- Young Conaway Stargatt & Taylor, LLP (counsel); Alvarez & Marsal North America, LLC (financial advisor / CRO, Richard Wu); Hilco Corporate Finance, LLC (investment banker); Stretto, Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.