Case Summary: Office Properties Income Trust Chapter 11

Office Properties Income Trust filed for Chapter 11 bankruptcy amid office-market headwinds and an overleveraged balance sheet, seeking to cut about $1.1 billion of debt through a prearranged restructuring backed by $125 million in DIP financing.

Business Description

Headquartered in Newton, MA, Office Properties Income Trust ("OPI"), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, the "Company"), is a publicly traded real estate investment trust (REIT) that owns a portfolio of 124 office and mixed-use properties across 29 states and Washington, D.C., totaling approximately 17.2 million rentable square feet.

- The Company primarily targets high-quality office buildings in central business district, urban infill, and select suburban markets, prioritizing locations with strong economic fundamentals and high barriers to entry.

- Historically, the Company focused on leasing to investment-grade and government tenants under long-term agreements.

As of June 30, 2025, the Company’s tenant roster included approximately 220 distinct tenants with a weighted average remaining lease term of roughly 6.8 years.

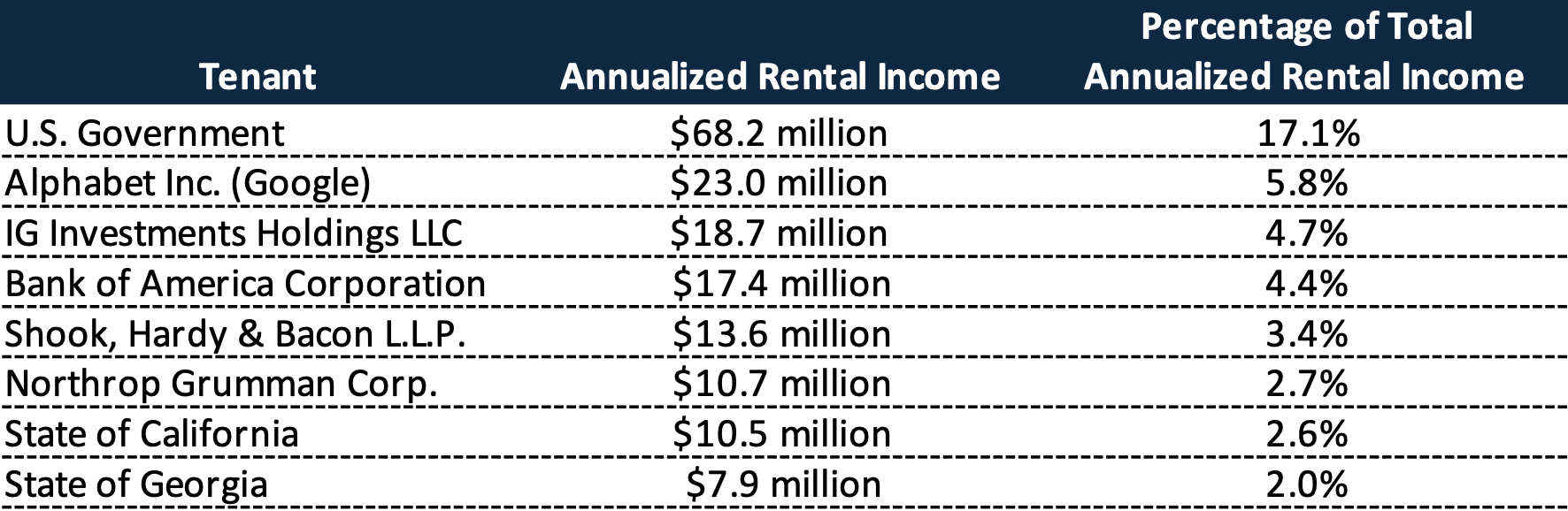

- The U.S. Government represents the Company’s single largest tenant, contributing around 17.1% of annualized rental income as of June 30, 2025.

- Other significant tenants, each contributing between 2% and 6% of annual rent, include blue-chip corporations such as Alphabet (Google), Bank of America, law firm Shook Hardy & Bacon, and defense contractor Northrop Grumman.

- Collectively, government entities account for approximately one-quarter of OPI’s rent base, with approximately 60% of total revenues derived from investment-grade rated tenants.

OPI is externally managed by The RMR Group LLC (Nasdaq: RMR), which provides all necessary personnel and corporate services, including asset management, leasing, property management, accounting, and compliance, under comprehensive business and property management agreements.

- The Company’s Board of Trustees, comprised of a majority of independent members, oversees RMR’s performance and approves any related-party transactions involving RMR or its affiliates.

- As a REIT, OPI is structured to distribute the bulk of its taxable income as dividends to shareholders, thereby avoiding corporate income tax, provided it adheres to REIT qualification requirements.

- However, due to escalating financial distress, OPI's common dividend was significantly reduced and subsequently suspended.

Office Properties Income Trust and certain affiliates filed for Chapter 11 protection on October 30, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $3.5 billion in assets and $2.5 billion in liabilities.

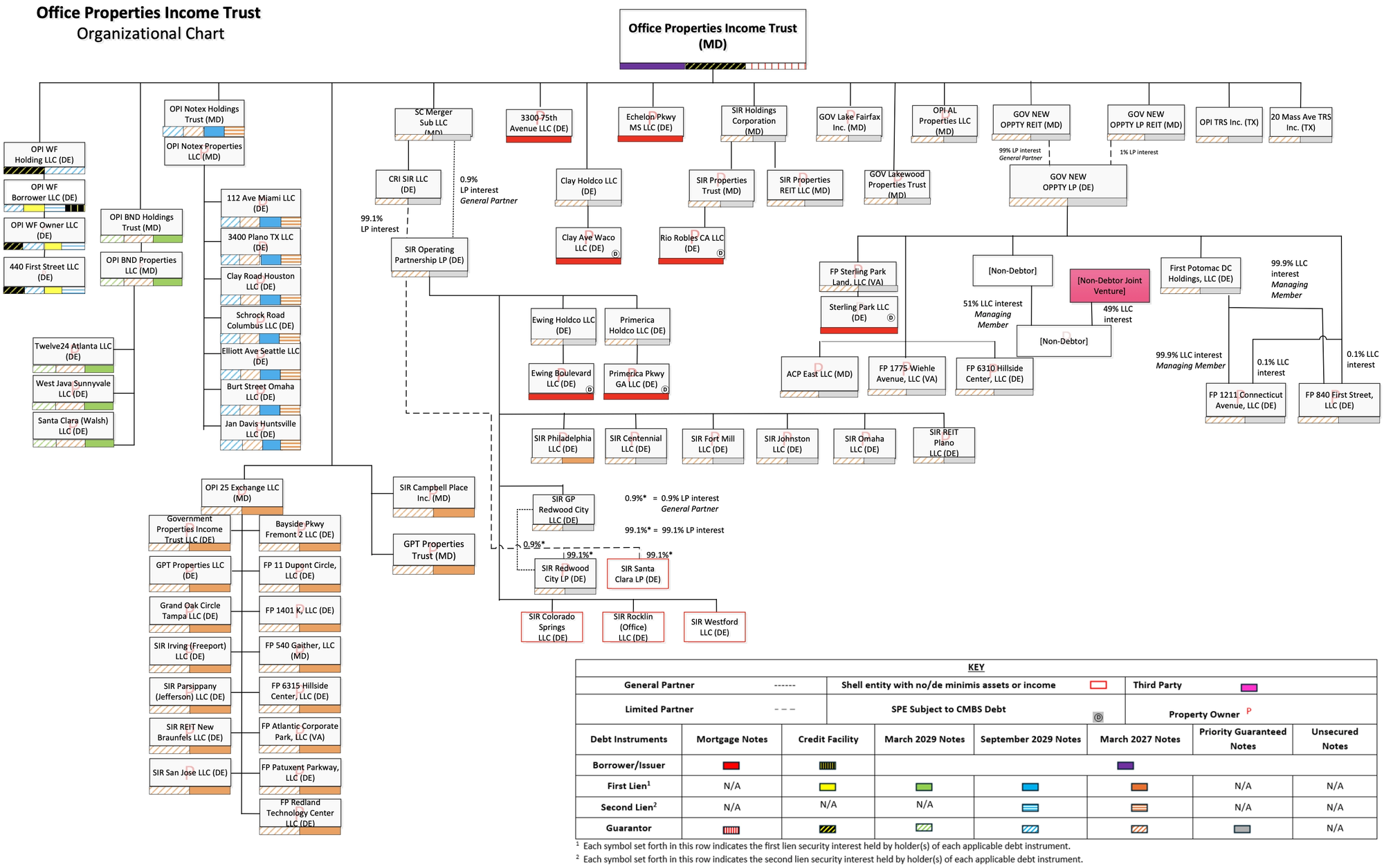

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

OPI was originally established in 2009 as Government Properties Income Trust, a spin-off from HRPT Properties Trust (later CommonWealth REIT). At its inception, the Company focused on acquiring and leasing office properties primarily to government tenants. CommonWealth REIT maintained a significant ownership stake until 2013, when it divested its shares in a public offering, making OPI an independent, publicly held REIT under RMR's external management.

Strategic Expansion and Rebranding

- July 2014 – Select Income REIT (SIR) Stake: OPI acquired a 35.9% ownership stake in Select Income REIT, an affiliated RMR-managed REIT.

- October 2017 – First Potomac Acquisition: OPI expanded its portfolio by acquiring First Potomac Realty Trust (FPO) in a merger valued at approximately $1.4 billion. This transaction added 72 properties, totaling about 6.5 million square feet, predominantly in the Washington, D.C., and Mid-Atlantic regions, and involved the assumption or repayment of approximately $650 million of FPO’s debt.

- December 2018 – Merger with Select Income REIT: OPI, then still known as Government Properties Income Trust, merged with Select Income REIT in a $2.4 billion stock and debt assumption transaction. This merger significantly expanded OPI's asset base by adding 99 office and industrial properties (approximately 16.5 million square feet) and diversified its tenant mix with major corporate clients. Following the SIR merger, the Company rebranded as Office Properties Income Trust, reflecting its broader strategy beyond government-tenanted buildings.

Portfolio Repositioning and Market Challenges

- 2019–2021 – Capital Recycling and Pandemic Impact: After the SIR acquisition, OPI initiated a "capital recycling" program, selling non-core or underperforming assets to rebalance its portfolio toward higher-quality properties and reduce leverage. However, the COVID-19 pandemic in 2020 severely impacted the office sector, leading to extended remote-work arrangements, tenant downsizing, rising vacancies, and falling property values across OPI’s portfolio. By 2021, OPI faced a challenging leasing environment, particularly in its critical D.C. market.

- 2022 – Strategic Uncertainty and Governance: The lingering effects of the pandemic forced OPI to scale back growth plans, conserve capital, and pause acquisitions, prioritizing existing tenant renewals. The Board continued to maintain a majority of independent trustees, though some managing trustees, including Chairman Adam Portnoy, also held executive roles at RMR, highlighting potential conflicts.

Failed Merger and Financial Distress

- Early 2023 – Attempted Merger with DHC: In April 2023, OPI announced a proposed all-stock merger with Diversified Healthcare Trust (DHC), another financially challenged RMR-managed REIT. The merger faced opposition from DHC’s shareholders and was terminated in the second half of 2023, resulting in OPI incurring $31.8 million in transaction-related costs.

- 2023 – Dividend Cuts and Cash Preservation: Under significant cash flow pressure, OPI’s Board initiated measures to conserve liquidity. In April 2023, OPI cut the quarterly dividend from $0.55 to $0.25 per share. In January 2024, it was cut again to $0.01 per share. By July 2025, OPI fully suspended its $0.01 quarterly dividend to preserve cash, signaling ongoing financial stress and liquidity pressure.

- Mid-2025 – Restructuring Preparations: As financial challenges intensified, OPI implemented proactive governance measures. In June 2025, the Board appointed an additional independent trustee, Timothy Pohl, and established a Special Committee. This committee, along with new independent directors at key subsidiaries, was empowered to evaluate restructuring or recapitalization proposals and investigate potential claims or transactions involving the Company, including historical dealings with RMR, in anticipation of a potential debt restructuring or bankruptcy.

Corporate Organizational Structure

Operations Overview

As of the Petition Date, the Company's real estate portfolio comprised 124 properties (117 wholly owned by debtor entities) across 29 states and Washington, D.C., with approximately 17.2 million square feet of rentable space. These assets primarily consist of office buildings, supplemented by some mixed-use complexes, leased under a combination of gross, net, and modified gross agreements.

- The portfolio exhibits a significant concentration in the Washington, D.C. metropolitan area (including Northern Virginia and suburban Maryland), accounting for about 24.2% of annualized rental income.

- Other key markets by rental income include Virginia (~14.1%), California (~12.1%), Illinois (~10.9%), Georgia (~10.5%), and Texas (~9.4%).

Occupancy and Leasing Trends

- OPI has experienced a sustained decline in portfolio occupancy due to tenant downsizings and a challenging office demand environment.

- As of December 31, 2024, the total portfolio was 85.0% leased, down from 86.9% a year prior. By the Chapter 11 filing, portfolio-wide occupancy had fallen to roughly 77.5%, with the debtor-owned properties at 75.7% leased.

- In 2024, lease expirations significantly outpaced new leasing activity, with approximately 3.6 million square feet of leases expiring compared to only 2.04 million square feet of new or renewed leases.

- The Company projected that a majority of upcoming lease expirations, approximately 682,000 square feet in 2025 and 60,000 square feet in 2026, would not be renewed or would involve tenant downsizing.

Tenant Profile and Risks

- OPI's tenant base is characterized by large government and corporate entities with high credit quality.

- Approximately 60% of OPI’s total revenue comes from investment-grade rated tenants, historically providing stable cash flows.

- Government agencies (federal and state) contribute roughly a quarter of total rent, with the U.S. Government alone accounting for 17.1%.

- Other major tenants (≥2% of rent) include:

- Even among high-credit tenants, footprint consolidation has continued. Federal austerity and telework policies heighten risk for OPI’s largest tenant segment, and certain government leases include termination rights tied to annual appropriations. While OPI’s rent roll is diversified (~220 tenants mid-2025), the systemic downsizing trend weighs on the whole portfolio.

Asset Management, Expenses, and Liquidity

- OPI’s daily operations, including leasing, maintenance, and property improvements, are managed by RMR, as the Company has no in-house personnel.

- Property operating costs (e.g., real estate taxes, insurance, utilities) are generally governed by gross, modified gross, or net leases, many of which require tenant reimbursements. However, declining occupancy has increased unreimbursed operating carry costs (such as utilities at vacant space) and reduced recovery income, pressuring NOI.

- Consolidated NOI was approximately $304.7 million in 2024, down from $334.1 million in 2023 (–8.8%), primarily due to property sales and higher vacancy.

- Interest expense surged from $110.6 million to $163.7 million in 2024, reflecting higher weighted-average borrowing costs from 2024 debt issuances.

- The Company recorded $181.6 million of non-cash real estate impairment charges in 2024 to reduce 18 properties to estimated fair value (vs. $11.3 million in 2023), reflecting weaker office valuations.

- OPI sharply curtailed redevelopment spending, allocating $14.5 million in 2024 vs $137.6 million in 2023, and focused capex on recurring items (TI/commissions + building improvements: $119.0 million)

- In 2024, OPI sold 24 properties for $199.4 million and booked a $7.4 million net loss; proceeds repaid debt and increased liquidity.

- These dispositions, along with additional sales in 2025, reduced OPI’s property count from 152 at the start of 2024 to 124 by October 2025. While these sales modestly reduced debt, they also diminished rental income and NOI, further exacerbating the Company’s cash flow squeeze.

- Ultimately, by mid-2025, OPI was generating insufficient cash to cover its substantial debt service and capital needs, necessitating the drastic measures that followed.

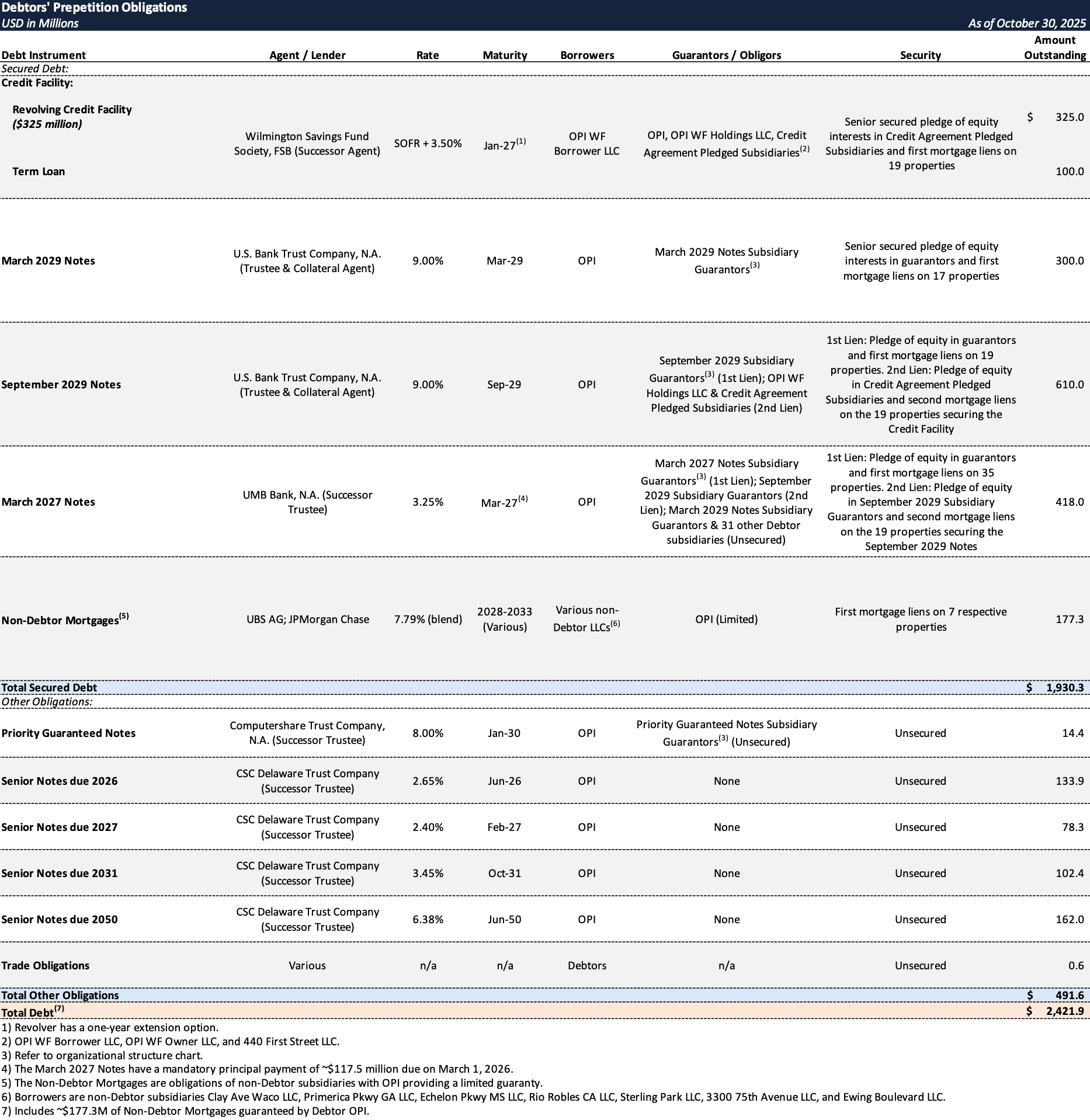

Prepetition Obligations

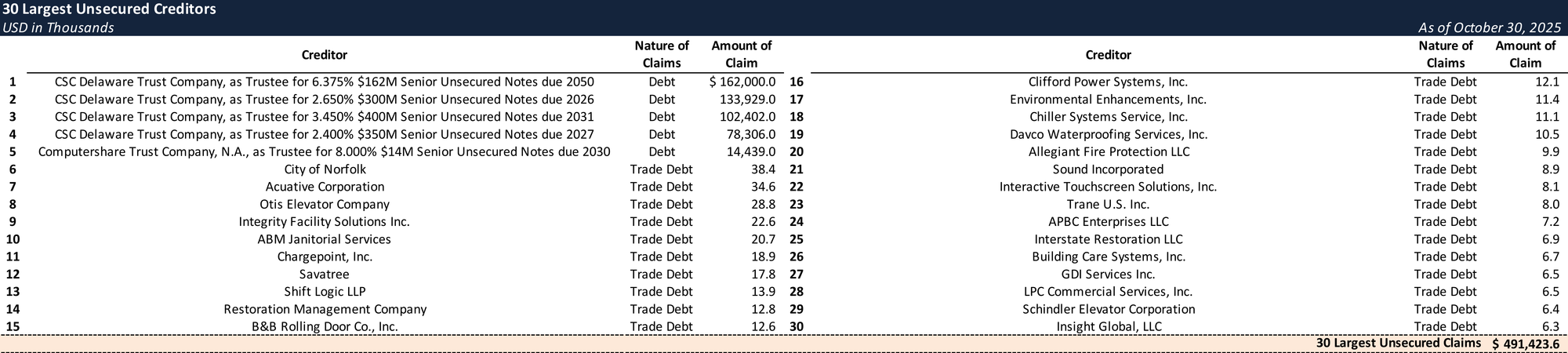

Top Unsecured Claims

Events Leading to Bankruptcy

OPI’s Chapter 11 filing on October 30, 2025, represented the culmination of a prolonged struggle against severe secular industry headwinds in the office real estate sector and an unsustainably over-levered balance sheet.

Office Market Deterioration and Operational Decline

- The widespread shift toward remote work and corporate office footprint rationalization since 2020 profoundly impacted demand for OPI’s properties. By 2023, the Company faced rising vacancies, falling market rents, and escalating costs associated with re-leasing space.

- Government tenants, influenced by budget constraints and telework policies, began reducing their occupied space, a trend mirrored by private-sector tenants as leases expired.

- Simultaneously, surging interest rates in 2022–2023 significantly inflated OPI’s borrowing costs at a time when its EBITDA was shrinking.

- This combination created a severe liquidity crunch, with OPI paying over $160 million in annual interest by 2024 while net cash from operations continued to deteriorate.

- In its SEC filings for 2024 and the first half of 2025, OPI explicitly warned of "substantial doubt about [its] ability to continue as a going concern" without a refinancing or restructuring solution.

Unsustainable Capital Structure and Looming Maturities

- As of the Petition Date, OPI’s capital structure was heavily levered and consisted of a complex mix of secured and unsecured debt, totaling approximately $2.24 billion at the Debtor entities (plus $177 million of non-recourse mortgage debt at non-Debtor joint venture properties).

- By the time of filing, OPI faced approximately $1.1 billion of maturities over the following 24 months, including:

- The secured 2027 Notes (approximately $418 million outstanding);

- The unsecured 2026 Notes (approximately $133.9 million outstanding);

- The unsecured 2027 Notes (approximately $78.3 million outstanding); and

- The fully drawn $425 million secured credit facility maturing in 2027.

- Liquidity was constrained, with only ~$29 million in cash on hand at the Petition Date and no available revolver capacity.

Prepetition Liability Management and Restructuring Efforts

- Throughout 2024, OPI executed a series of out-of-court transactions that exchanged nearer-term unsecured notes for new secured notes. These deals extended maturities and captured discount but also added secured debt and increased the Company’s interest burden.

- With its stock price collapsed and access to capital markets constrained, OPI retained Moelis & Company, Latham & Watkins LLP, and AlixPartners in early 2025 to explore strategic alternatives and prepare for a comprehensive restructuring.

- In summer 2025, the Company initiated negotiations with ad hoc groups representing its secured and unsecured noteholders, as well as its credit facility lenders.

Restructuring Support Agreement (RSA)

- On October 30, 2025, OPI entered into a Restructuring Support Agreement with holders of approximately 80% of its September 2029 Notes. Key terms include:

- Debt Equitization and Exit Debt: The September 2029 Notes will convert into reorganized equity valued at $98 million, and supporting holders will receive up to $420 million of secured exit notes.

- Other Creditors: The 2027 secured notes will be satisfied through a combination of collateral, cash, or take-back debt. Remaining unsecured claims, including unsecured deficiency claims, will receive reorganized equity and rights to participate in the equity rights offerings. Existing equity will be canceled.

- RMR Management Agreement: The plan includes a new five-year management agreement with RMR, with revised business management fees and a performance-based management incentive equity program.

Chapter 11 Filing and DIP Financing

- With the RSA in place, OPI and certain affiliated debtors filed voluntary Chapter 11 petitions in the U.S. Bankruptcy Court for the Southern District of Texas on October 30, 2025.

- The Company obtained commitments for $125 million in new-money DIP financing from members of the supporting noteholder group to fund operations and administrative costs throughout the Chapter 11 cases.

- OPI intends to continue operating as usual during the restructuring process, with minimal disruption to tenants and vendors, while pursuing a swift emergence from bankruptcy.

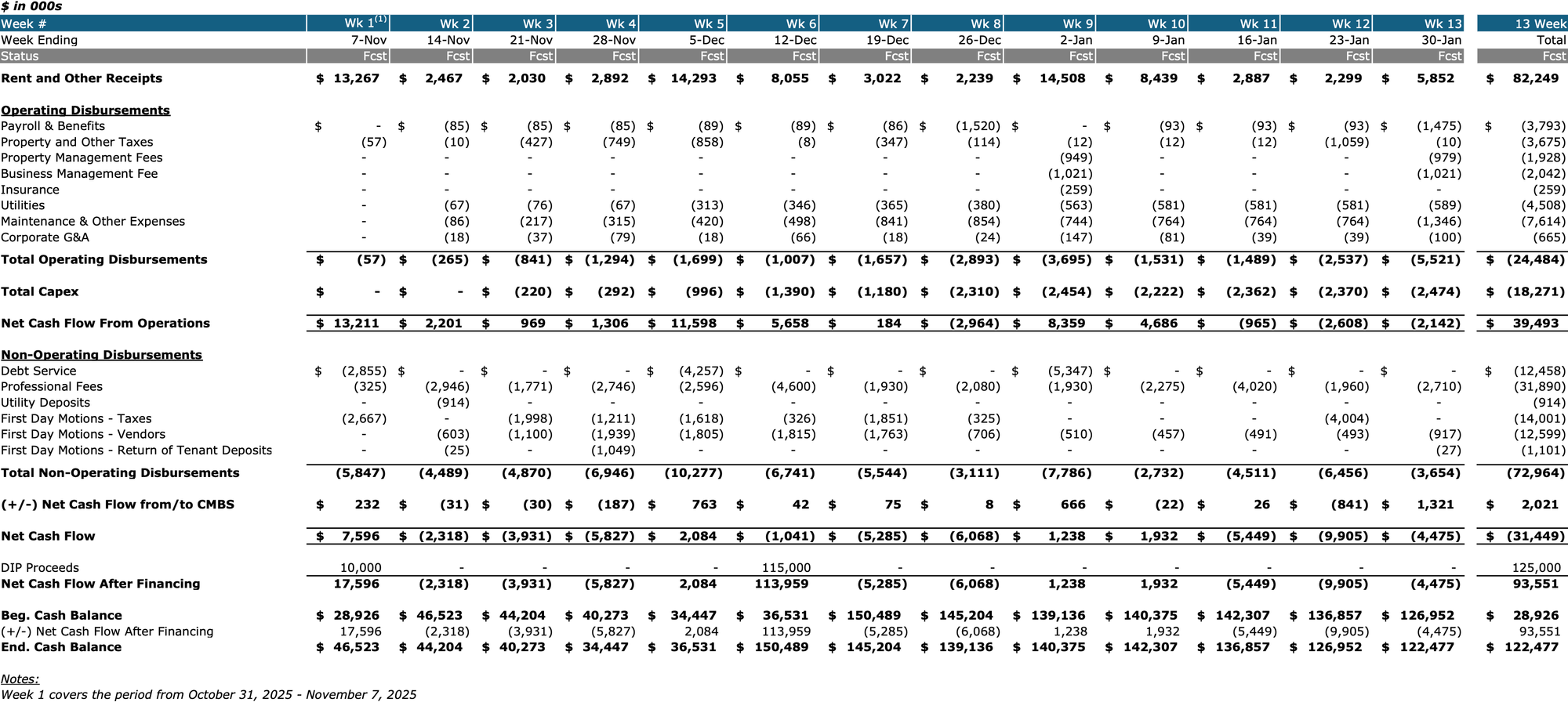

Initial DIP Budget

Key Parties

- Hunton Andrews Kurth LLP (counsel); Latham & Watkins LLP (bankruptcy co-counsel); Moelis & Company (investment banker); AlixPartners LLP (financial advisor / CRO, John R. Castellano); Kroll Restructuring Administration LLC (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.