Case Summary: Omega Therapeutics Chapter 11

Omega Therapeutics has filed for Chapter 11 bankruptcy, citing liquidity issues and a loan dispute, with plans for an asset sale.

Business Description

Headquartered in Cambridge, MA, Omega Therapeutics, Inc. ("Omega" or the "Debtor") is a development-stage biotechnology company pioneering programmable epigenetic mRNA medicines using its OMEGA Epigenomic Programming platform.

Like many early-stage biotechs, Omega has required substantial upfront investment and has operated at a loss, funding its growth through equity offerings, debt financings, and strategic collaborations.

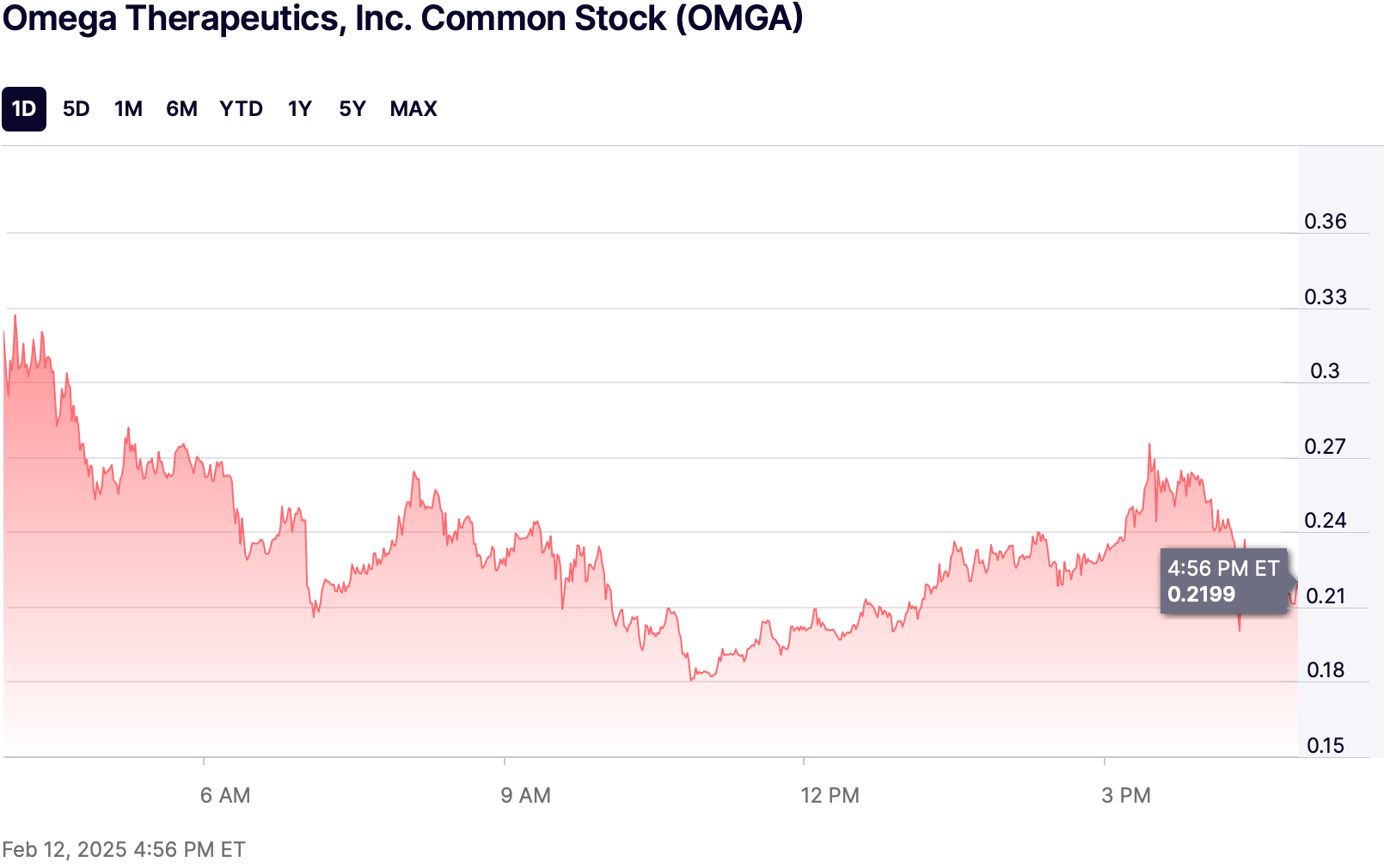

Omega is publicly traded on Nasdaq under the ticker “OMGA.”

- On January 29, 2025, Nasdaq notified the Debtor of non-compliance with the $1.00 minimum bid price, placing it at risk of delisting.

For the LTM ended September 30, 2024, the Debtor reported $8.1 million in revenue, up from $2.8 million a year prior, with net losses improving to ($73.1 million) from ($108.0 million).

Omega filed for Chapter 11 protection on Feb. 10 in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtor reported $137.5 million in assets and $140.4 million in liabilities.

Corporate History

Omega was established in 2017 by Flagship Pioneering ("Flagship"), a venture creation firm specializing in founding and incubating biotechnology companies, following breakthrough research in epigenetics.

Initially funded through venture capital, the Debtor secured additional liquidity in 2018 via a $20 million loan facility from Pacific Western Bank (later Banc of California), which was fully repaid in January 2025 following a cash sweep.

Omega went public in August 2021, raising $128.1 million in net proceeds through an IPO at $17.00 per share.

- In February 2023, it raised an additional $40 million via a registered direct offering at $5.78 per share.

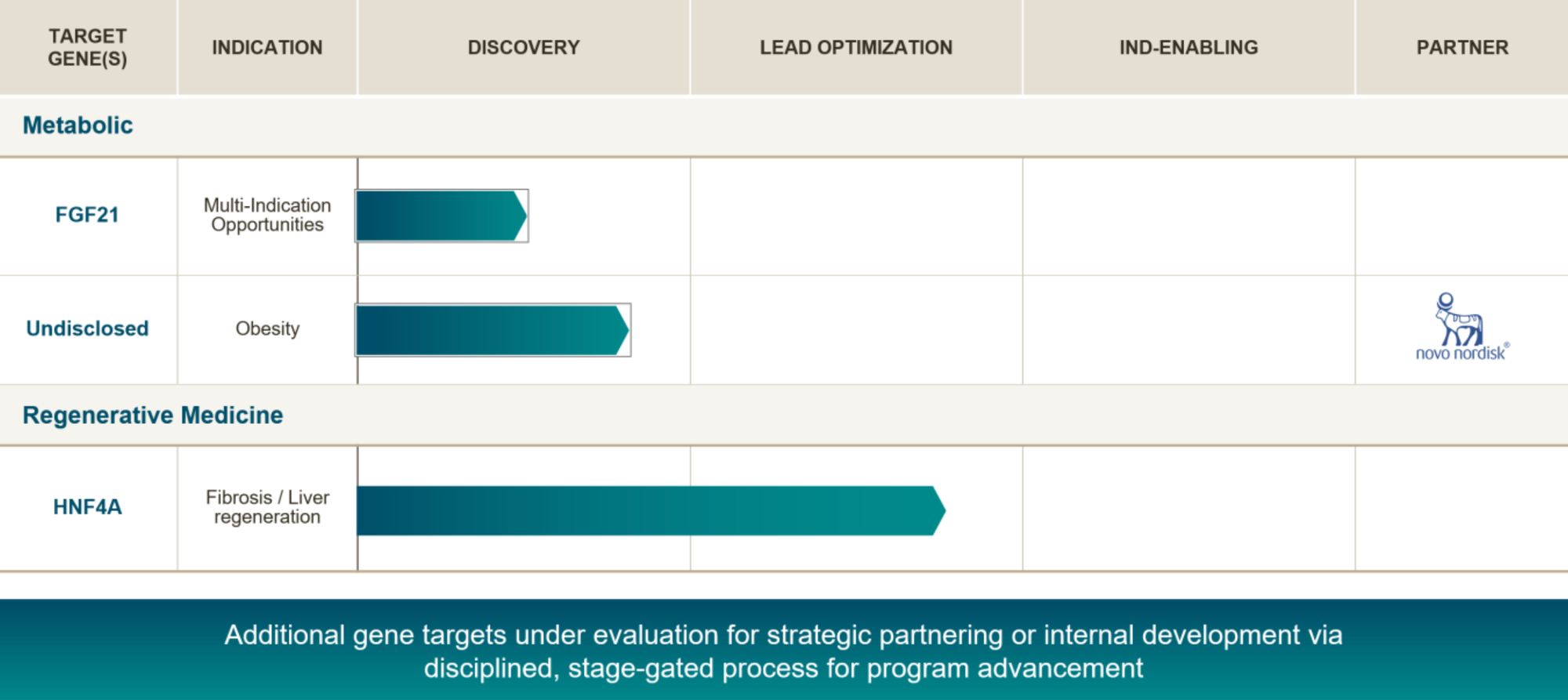

In December 2023, Omega entered a research collaboration with Novo Nordisk to develop cardiometabolic therapies, securing a $10 million upfront payment, up to $522 million in milestone payments, and ongoing royalties.

- Omega received $5.1 million of the upfront payment in January 2024 and expects $21.6 million in cost reimbursement through 2027.

Amid financial pressures, Omega initiated a strategic realignment in March 2024 to streamline operations and extend its cash runway.

As of February 12, 2025, Omega's stock trades at $0.22 per share.

Operations Overview

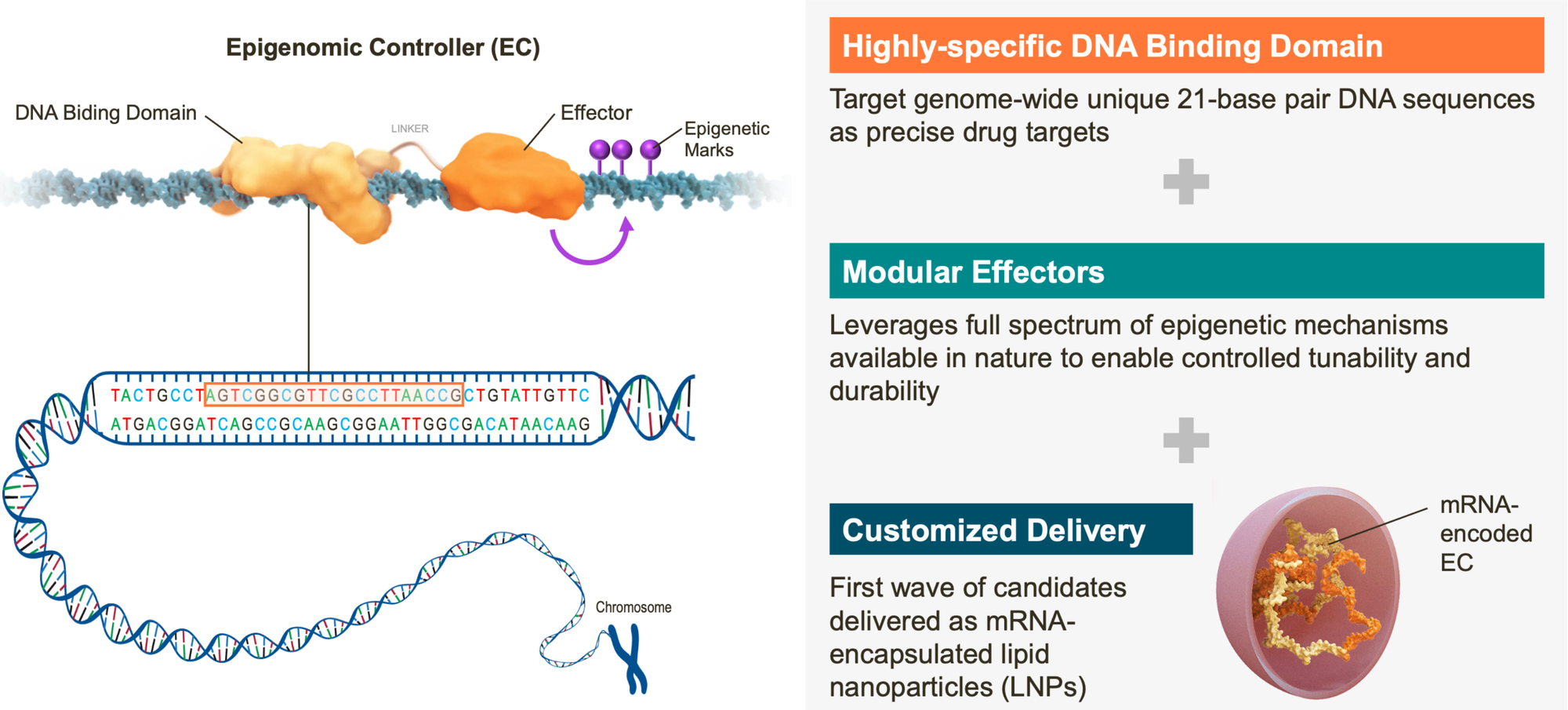

Omega is developing a new class of programmable epigenomic mRNA medicines through its OMEGA platform, designed to restore aberrant gene expression without altering native DNA sequences. By leveraging epigenetic control mechanisms, Omega aims to deliver precision therapeutics for complex diseases.

Key Platform Features

- Epigenomic Modulation: Harnesses Insulated Genomic Domains (IGDs) to control gene expression pre-transcriptionally.

- Programmable Therapeutics: Designs epigenomic controllers (ECs) for tunable, durable gene expression regulation.

- mRNA-Driven Approach: Utilizes mRNA-based therapies to target the root cause of diseases without permanent genetic modification.

Pipeline and Applications

Omega’s pipeline targets diseases driven by dysregulated gene expression, with applications in:

- Regenerative Medicine: Enhancing tissue repair and cellular function restoration.

- Multigenic Diseases: Addressing oncology, immunology, and cardiometabolic disorders.

- Strategic Collaborations: Includes a research partnership with Novo Nordisk to advance cardiometabolic therapies.

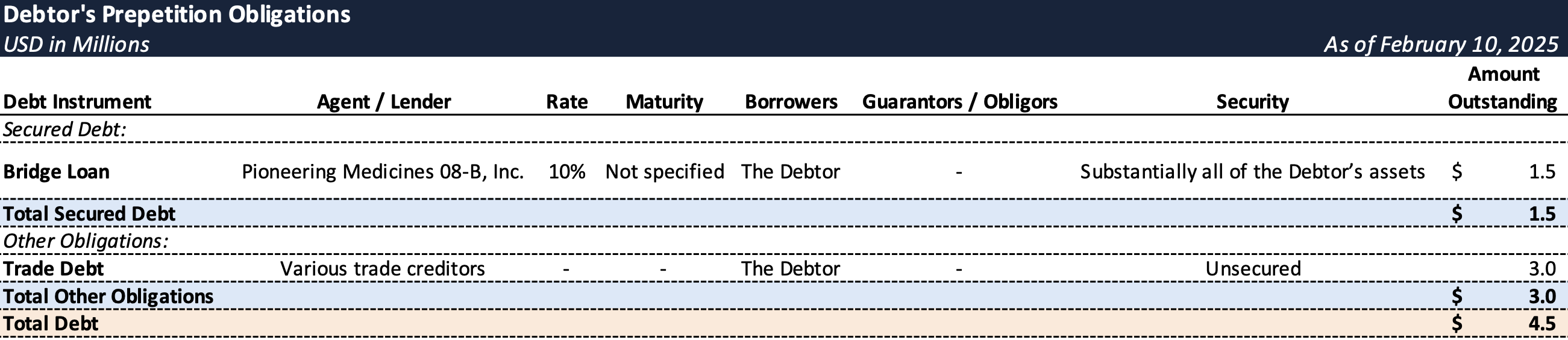

Prepetition Obligations

In addition to the bridge loan described above, the Debtor's operating lease liabilities totaled $112.5 million as of September 30, 2024, comprising $11.9 million in current liabilities and $100.6 million in long-term liabilities, primarily tied to its 140 First Street lease.

- This lease features structured rent escalations and shared space arrangements with Flagship affiliates.

- As of the Petition Date, the outstanding lease obligation amount is not specified, but the Debtor had no unpaid prepetition non-residential real property lease obligations.

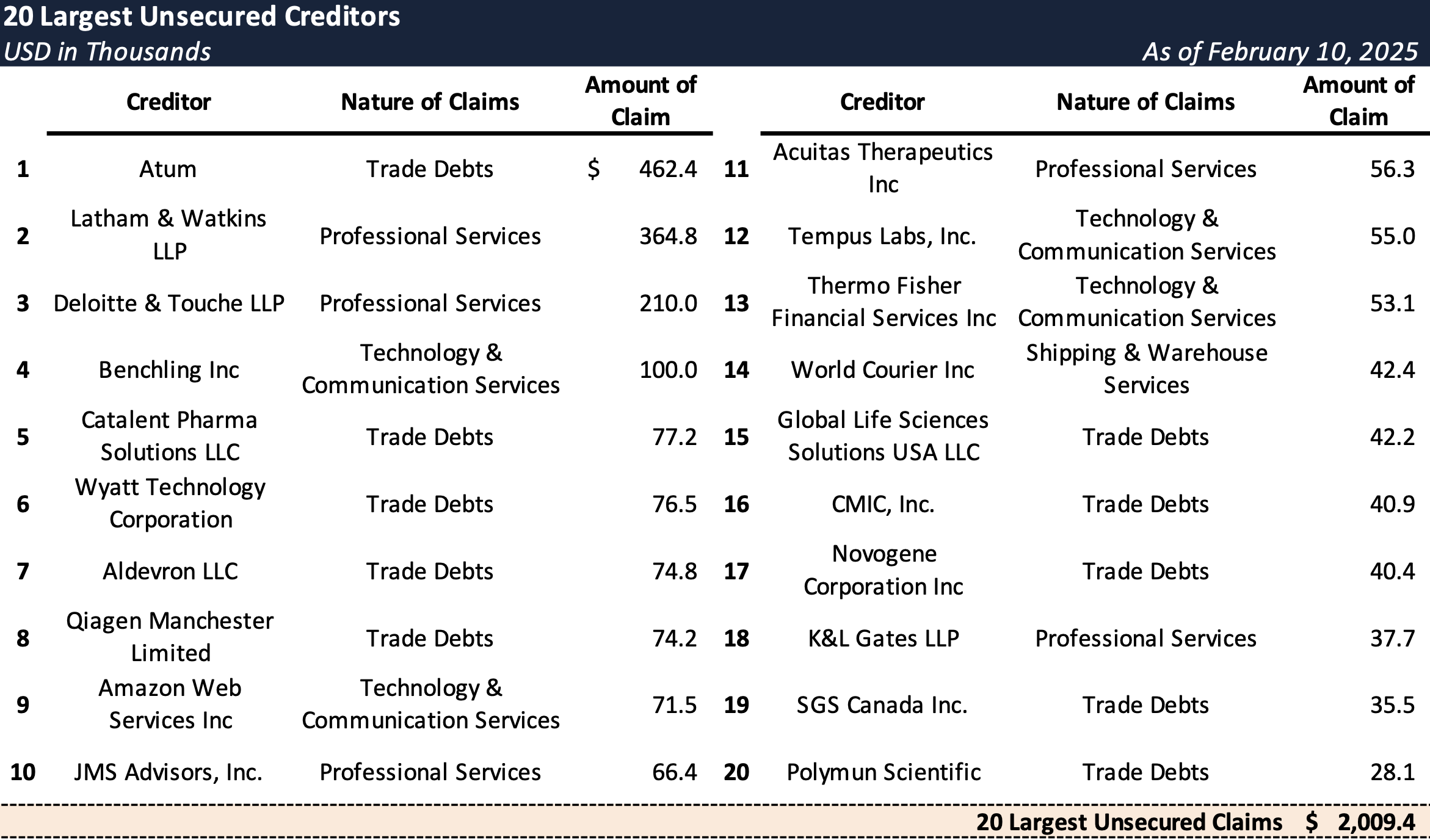

Top Unsecured Claims

Events Leading to Bankruptcy

Financial and Operational Challenges

- Omega faced significant financial and operational challenges, primarily due to the high-risk nature of pharmaceutical and biotechnology product development, which requires substantial upfront capital expenditures and carries a high risk of product failure.

- The Debtor incurred considerable R&D costs, including license fees, milestone payments, and clinical trial expenses, leading to net losses of $97.4 million and $102.7 million in 2023 and 2022, respectively.

- Omega's financial situation was further strained by its reliance on equity financing, with no assurance of securing sufficient funding to continue operations.

- This uncertainty was publicly disclosed during its IPO, highlighting substantial doubts about its ability to continue as a going concern.

- In 2024, the Debtor implemented cost-cutting measures, reducing its headcount by 35% and focusing on prioritized preclinical programs, which extended its cash runway into the first quarter of 2025. However, these efforts were insufficient to address the underlying financial distress.

Loan Agreement and Cash Sweep

- The Debtor entered into a Loan and Security Agreement with Banc of California in 2018, which was amended in 2023 to extend the maturity date and include a Minimum Cash Covenant requiring the Debtor to maintain at least $5 million in unrestricted cash.

- Despite projections of covenant compliance through April 2025, the Debtor claims Banc of California improperly seized $14.7 million via a Cash Sweep on January 13, 2025.

- The Cash Sweep severely impacted the Debtor's liquidity, leaving it unable to operate without emergency funding. Omega sought bridge financing from various sources, including discussions with Flagship, which offered financing contingent on filing for Chapter 11 protection.

Restructuring Initiatives

- In fall 2024, Omega engaged a financial advisor to explore strategic options, including acquisitions, mergers, and licensing agreements. This process yielded a non-binding proposal from Mirai Bio, an affiliate of Flagship, to acquire the Debtor's rights under a Collaboration Agreement and license its platform technology in exchange for assuming $8 million of debt.

- The Special Committee, formed to evaluate the Mirai Proposal, found that potential buyers were deterred by the Debtor's debt and lease obligations.

- Negotiations continued, but the Cash Sweep disrupted progress, prompting the Debtor to seek alternative solutions.

Path Forward

- Facing limited options, the Debtor's Restructuring Committee determined that a Chapter 11 filing was the most viable solution. Omega entered into a Restructuring Support Agreement with PM08-B, a Flagship affiliate, for a $1.5 million prepetition loan and a post-petition DIP facility to facilitate a 363 sale process.

- The sale process aims to maximize asset value through a stalking horse bid by PM08-B, with provisions for higher offers.

- The Debtor views this approach as the best option to address its financial challenges and secure stakeholder value.

- Concurrent with the sale process, Omega reduced its workforce and implemented cost-cutting measures to preserve asset value and maintain operations during restructuring.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.