Case Summary: Omnicare Chapter 11

Omnicare has filed for Chapter 11 bankruptcy following a $949 million legal judgment, supported by $110 million in DIP financing to pursue a dual-track sale or reorganization.

Business Description

Headquartered in Woonsocket, RI, Omnicare, LLC, along with its Debtor⁽¹⁾ affiliates (collectively, "Omnicare" or the "Company"), is a leading U.S. provider of pharmacy services to the long-term care ("LTC") industry. Operating a nationwide network of "closed-door" pharmacies, Omnicare delivers medications and specialized clinical services directly to skilled nursing centers, assisted living facilities, and independent living communities.

- The Company dispenses approximately 40 million prescriptions annually to over 800,000 patients residing in more than 4,000 LTC facilities across 46 states.

- In addition to medication dispensing, Omnicare provides a suite of high-touch services, including on-site medication administration, infusion therapy, compounding, and clinical consulting, all supported by proprietary technology platforms designed to ensure safety and regulatory compliance.

Omnicare’s technology-enabled model features its Automated Label Verification ("ALV") system for zero-error dispensing and the "Omniview" web portal, which integrates with electronic health records to help facility staff manage medication orders and patient profiles.

Omnicare, LLC and its affiliates filed for Chapter 11 protection on September 22, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Northern District of Texas, reporting $100 million to $500 million in assets and $1 billion to $10 billion in liabilities.

⁽¹⁾ For a complete list of Debtor entities, see the organizational structure chart.

Corporate History

Founded in 1981, Omnicare pioneered pharmacy services for the LTC sector, initially focusing on residents in skilled nursing facilities. Through decades of strategic acquisitions and service expansion, the Company grew into one of the largest pharmacy providers to LTC facilities in the United States.

Acquisition by CVS Health

- In 2015, CVS Health Corporation acquired Omnicare in a transaction valued at approximately $12.7 billion, including debt.

- Following the acquisition, Omnicare has operated as a separate business unit within CVS’s pharmacy division, maintaining its own operations and customer base while leveraging certain shared corporate resources, such as purchasing and cash management.

- Omnicare’s corporate headquarters is co-located with CVS in Woonsocket, Rhode Island.

Pre-Bankruptcy Governance

- In the period leading up to the Chapter 11 filing, CVS Health installed restructuring experts in Omnicare’s management, including co-Chief Restructuring Officers and an independent board manager, to guide the Company's turnaround efforts.

Equity Security Holders:

- CVS Cabot Holdings Inc. (49.86%)

- CVS Shaw Holdings Inc. (49.86%)

- Aetna, LLC (0.28%)

Operations Overview

Omnicare’s core operations revolve around its nationwide network of pharmacies, specialized repackaging capabilities, and a workforce of approximately 6,000 employees, including pharmacists, nurses, pharmacy technicians, and delivery drivers.

Pharmacy Network and Distribution Model

- As of the Petition Date, Omnicare managed 101 pharmacy locations across 44 states, the majority of which are "closed-door" facilities not open to the general public.

- The Company employs a "hub-and-spoke" model to optimize efficiency and ensure service continuity:

- Hub Pharmacies: 16 large-volume, highly automated centers, many operating 24/7, fill the majority of prescription orders.

- Spoke Pharmacies: Approximately 36 smaller locations handle STAT orders, first doses, and provide localized support.

- Other Locations: The network also includes 33 independent regional pharmacies and 16 on-site "open-door" retail pharmacies within senior living communities.

- This structure provides geographic flexibility and redundancy, allowing other locations to provide backup support during emergencies to prevent service disruptions for patients.

Specialized Facilities and Technology

- Omnicare operates a unique, FDA-registered pharmaceutical repackaging facility licensed in 41 states. This division repackages bulk medications into unit-dose cards and other specialized formats required for the LTC setting, adhering to cGMP quality standards.

- The Company utilizes proprietary technology to enhance accuracy and service levels:

- Automated Label Verification (ALV): A robotic system that uses barcode scanning and visual checks to audit each prescription, achieving a "zero-error" dispensing record in trials.

- Omniview Portal: A secure online platform that allows LTC facility staff to track medication orders, refills, and costs in real time and integrates with major electronic medical record (EMR) systems.

Prepetition Obligations

As of the Petition Date, Omnicare has no significant funded debt. The capital structure is primarily comprised of a large unsecured judgment and substantial trade-related obligations.

The Judgment

- The Company's most significant liability is an unsecured judgment of approximately $948.8 million entered against Omnicare in favor of the United States. This includes roughly $406.8 million in trebled damages under the False Claims Act and $542 million in statutory penalties.

- Parent company CVS Health is jointly and severally liable for $164.8 million of these penalties.

Trade & Intercompany Payables

- The Company’s core operational liabilities are estimated at approximately $33 million, comprised of:

- Direct Trade Debt: Roughly $5 million owed to various vendors and suppliers.

- CVS Reimbursement Obligations: Approximately $28 million owed to parent CVS for purchases made pursuant to vendor agreements.

- Real Estate Obligations

The Company is party to over 100 real estate leases, which together represent annual rent obligations exceeding $19 million.

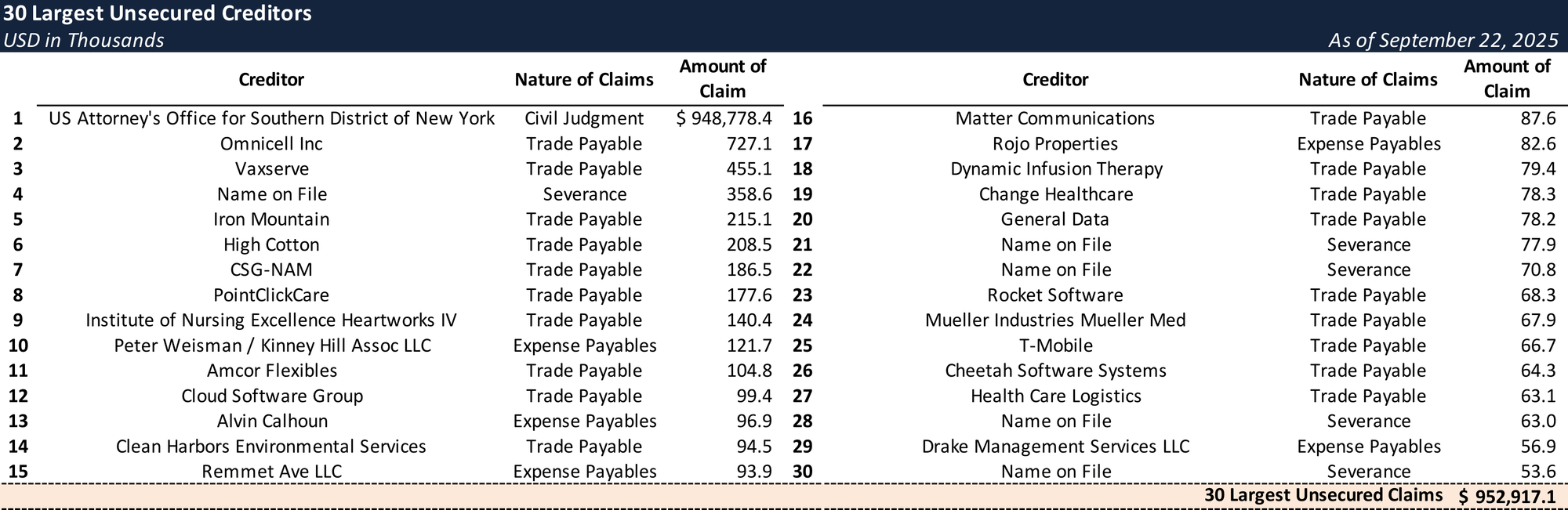

Top Unsecured Claims

Events Leading to Bankruptcy

Omnicare’s path to Chapter 11 was driven by a confluence of systemic industry challenges, significant customer disruptions, and a massive, unmanageable legal judgment.

Industry Headwinds and Financial Pressures

- COVID-19 Pandemic: The pandemic severely impacted the LTC industry, leading to higher patient mortality and a shift toward home care, which significantly reduced occupied beds in facilities and, consequently, Omnicare's prescription volumes.

- Macroeconomic Factors: High inflation and a tight labor market increased operating costs, particularly wages for pharmacists and drivers, while creating staffing challenges.

- Reimbursement Pressures: Changes in Medicare policy, including the shift to Medicare Advantage (Part C) managed care plans and new drug pricing controls under the Inflation Reduction Act, squeezed pharmacy margins and added payment complexity.

Customer Bankruptcies and Revenue Loss

- The financial distress in the skilled nursing sector resulted in the Chapter 11 filings of several of Omnicare’s largest customers, including Genesis Healthcare, Petersen Health, and LaVie Care Centers, between March 2024 and July 2025.

- The failure of these key clients led to a significant loss of ongoing revenue and left Omnicare with over $50 million in bad debt as an unsecured creditor in their respective bankruptcy cases.

False Claims Act Judgment

- The immediate catalyst for the bankruptcy filing was a nearly $949 million judgment entered against Omnicare in August 2025 in a False Claims Act ("FCA") lawsuit.

- A federal jury found Omnicare liable for submitting over 3.3 million improper prescription claims to government healthcare programs between 2010 and 2018, resulting in $135.6 million in overpayments.

- The final judgment included trebled damages (approximately $406.8 million) and $542 million in statutory penalties.

- While Omnicare and CVS Health (found jointly liable for a portion of the penalty) filed appeals, Omnicare was unable to post the required bond. The imminent threat of government enforcement actions to collect on the judgment necessitated the Chapter 11 filing to preserve operations and ensure continuity of patient care.

Pre-Petition Initiatives and Restructuring Strategy

- In response to ongoing challenges, Omnicare initiated a turnaround plan prior to filing, which included closing approximately 40% of its underperforming pharmacies since 2023, streamlining delivery logistics, and reviewing administrative functions.

- The Chapter 11 case is intended to provide a "breathing room" to address the FCA judgment and other liabilities while executing a value-maximizing restructuring.

- DIP Financing: The Company has obtained a commitment for a $110 million DIP facility from JMB Capital Partners to fund operations and ensure uninterrupted service to its LTC facility clients (full DIP financing terms available on Bondoro Insights).

- Proposed Path Forward: Omnicare intends to pursue a dual-track process, evaluating a standalone reorganization while simultaneously running a marketing and sale process under Section 363 of the Bankruptcy Code. The Company has engaged Houlihan Lokey to manage the sale process, with DIP milestones requiring a stalking horse bidder by January 31, 2026, suggesting a targeted sale timeline in early 2026.

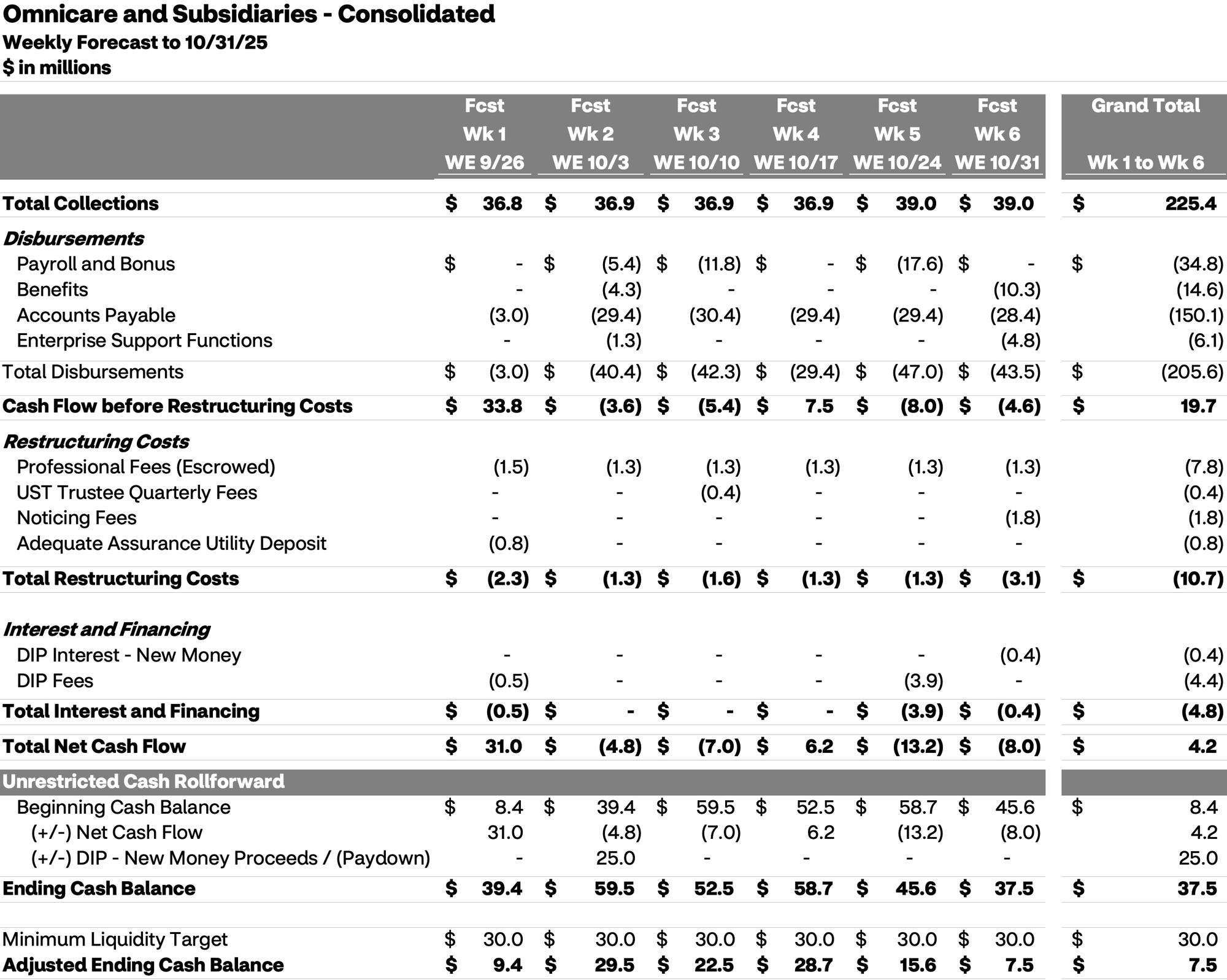

Initial DIP Budget

Key Parties

- Haynes and Boone, LLP (local bankruptcy counsel); Jenner & Block LLP (general bankruptcy counsel); Alvarez & Marsal North America, LLC (financial advisor / CRO, Matthew Frank); Houlihan Lokey Capital, Inc. (investment banker); Stretto, Inc. (claims agent).

Update (September 26, 2025): Bondoro Insights is now available for free in beta, with expanded coverage of DIP terms, RSAs, bidding procedures, and APAs, as well as continuously updated live dockets.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries. Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.