Case Summary: Partners Pharmacy Chapter 11

Partners Pharmacy has filed for Chapter 11 bankruptcy to pursue a lender-led 363 sale after failed out-of-court efforts, supported by a $6.5 million DIP and a $51 million stalking horse credit bid from affiliate CS One.

Business Description

Partners Pharmacy Services, LLC, along with its Debtor affiliates⁽¹⁾ (collectively, "Partners Pharmacy" or the "Company"), is a long-term care (LTC) pharmacy provider that serves the medication management needs of residents in skilled nursing facilities, assisted living communities, and other institutional care settings. Operating a “closed-door” pharmacy model not open to the general public, the Company delivers comprehensive, integrated pharmacy solutions through a network of pharmacies located within or dedicated to specific healthcare facilities.

- At its peak, Partners Pharmacy was the third-largest LTC pharmacy company in the U.S., serving approximately 48,000 residents across 16 states and the District of Columbia from 13 pharmacy locations.

- Following a period of contraction, the Company currently serves roughly 17,000 residents in seven states.

Partners Pharmacy’s key offerings include specialized medication packaging, routine delivery services, infusion therapies, compounding services, and the integration of electronic medication administration record (eMAR) systems. Its largest clients include CareOne Management-affiliated facilities (serving approximately 8,000 residents) and various State of New Jersey healthcare facilities.

Partners Pharmacy Services, LLC and 13 affiliates filed for Chapter 11 protection on August 13, 2025 (the "Petition Date"), in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 million to $10 million in assets and $10 million to $50 million in liabilities.

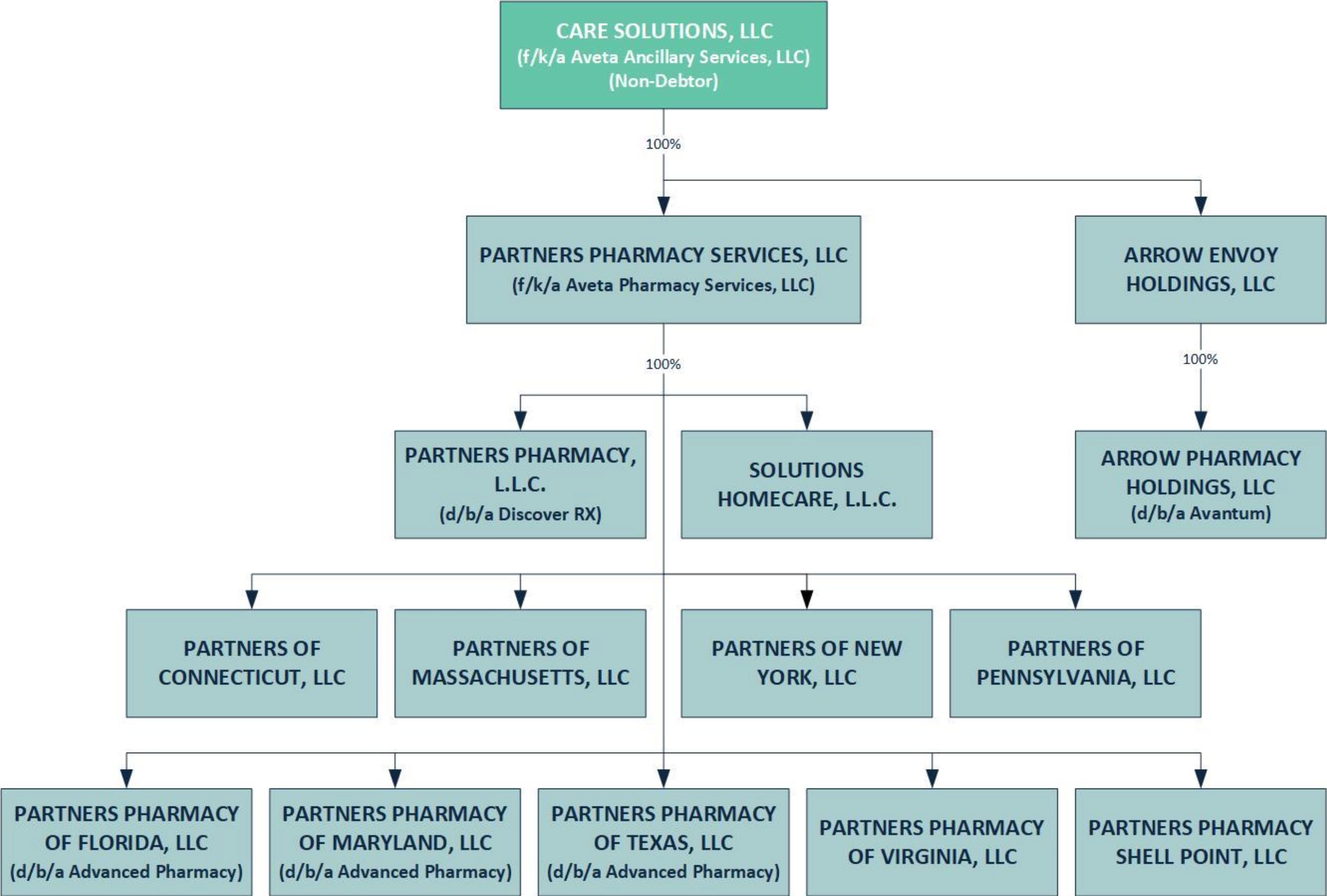

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Partners Pharmacy was founded in 1998 in New Jersey as Partners Healthcare, L.L.C. The Company originated as a family-owned business and continues to maintain strong ties to the family of Daniel E. Straus, a healthcare entrepreneur and founder of CareOne, a leading senior care operator in the Northeast.

- Through holding companies, Mr. Straus indirectly owns all equity in the Debtors, as well as CareOne and the Debtors’ pre-petition lender, CS One. This ownership structure created a close relationship in which CareOne-affiliated nursing facilities became the Company’s largest group of customers.

National Expansion and Financing

- Over the past two decades, Partners Pharmacy expanded its long-term care pharmacy services into a multi-state footprint through a mix of organic growth and targeted acquisitions. Notable milestones include:

- October 2015: Acquisition of Tech Pharmacy Services LLC (dba Advanced Pharmacy), a Houston-based provider of remote pharmacy services and automated dispensing technology.

- March 2018: Acquisition of the onsite pharmacy serving Presbyterian Village North, a continuing care retirement community in Dallas, further expanding Partners Pharmacy’s operations in Texas. After this deal, the Company reported serving 6,000+ residents across 50+ Texas communities from three pharmacy locations.

Pivotal New Jersey State Contract

- In 2014, Partners Pharmacy was awarded a contract to operate on-site pharmacies for New Jersey’s state-run facilities, including veterans’ homes and developmental centers.

- Fulfilling this contract required significant investment in the Company’s central pharmacy hub in Springfield, NJ. Notably, during the most recent rebid cycle, no other pharmacy companies submitted competing bids, underscoring the difficulty of replicating the Company's in-house capabilities at scale.

Corporate Organizational Structure

Operations Overview

Partners Pharmacy’s operational model is centered on providing specialized, high-touch pharmacy dispensing and medication management services tailored to the long-term care environment. Its services are deeply embedded in its clients’ daily care routines, making the Company a critical and not easily replaceable partner.

Service Model and Facilities

- The Company offers prescription fulfillment (often in specialized unit-dose or multi-dose packaging), routine medication delivery, infusion therapy, compounding services, and clinical support, including medication regimen reviews and staff training.

- Operations are run from a few regional, "closed-door" pharmacy hubs, with the largest facility located in Springfield Township, NJ, which supports the New Jersey state contract. Other active pharmacies are located in states including Connecticut, Massachusetts, and Texas.

- Many pharmacies are strategically located near or within client facilities to enable rapid delivery and on-site pharmacist access, increasing the stickiness of its service offerings.

Key Customers and Payors

- The Company’s business is concentrated with a few key customers:

- CareOne-Affiliated Facilities: The largest customer group, representing approximately 8,000 residents served.

- State of New Jersey: A cornerstone contract covering ten state-operated facilities.

- Beyond these anchor clients, Partners Pharmacy serves numerous independent skilled nursing and assisted living facilities. A significant portion of residents' medications are paid for by Medicare Part D and Medicaid, making the Company highly sensitive to public healthcare reimbursement policies.

Supply Chain and Key Creditors

- Partners Pharmacy sources approximately 95% of its pharmaceuticals from its primary supplier, Cardinal Health, under a 2019 Prime Vendor Agreement.

- As the Company’s financial condition deteriorated, its relationship with Cardinal Health became strained:

- By November 2022, Partners Pharmacy owed Cardinal Health approximately $29 million for unpaid invoices.

- In response, Cardinal tightened credit terms to cash-on-delivery (COD) for all new orders and began withholding monthly rebates to offset the outstanding balance, severely straining the Company's daily cash flow.

- As of the Petition Date, the outstanding balance to Cardinal was approximately $20.4 million, secured by a junior lien on substantially all of the Company's assets.

Workforce

- At its operational peak, Partners Pharmacy employed approximately 800 people. Following multiple rounds of workforce reductions amid declining business volume, the Company now employs about 284 staff, of whom approximately 239 are full-time.

- The workforce includes licensed pharmacists, pharmacy technicians, nurses, drivers, and administrative personnel responsible for billing, customer service, and IT support.

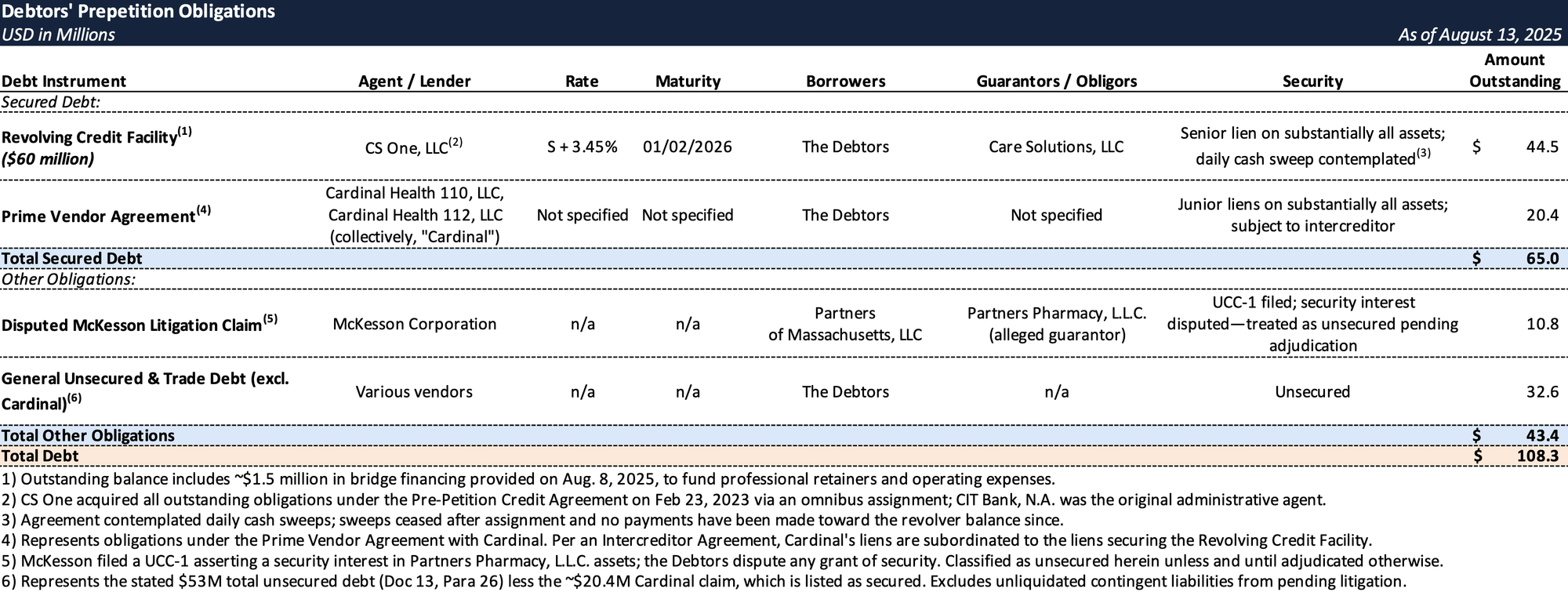

Prepetition Obligations

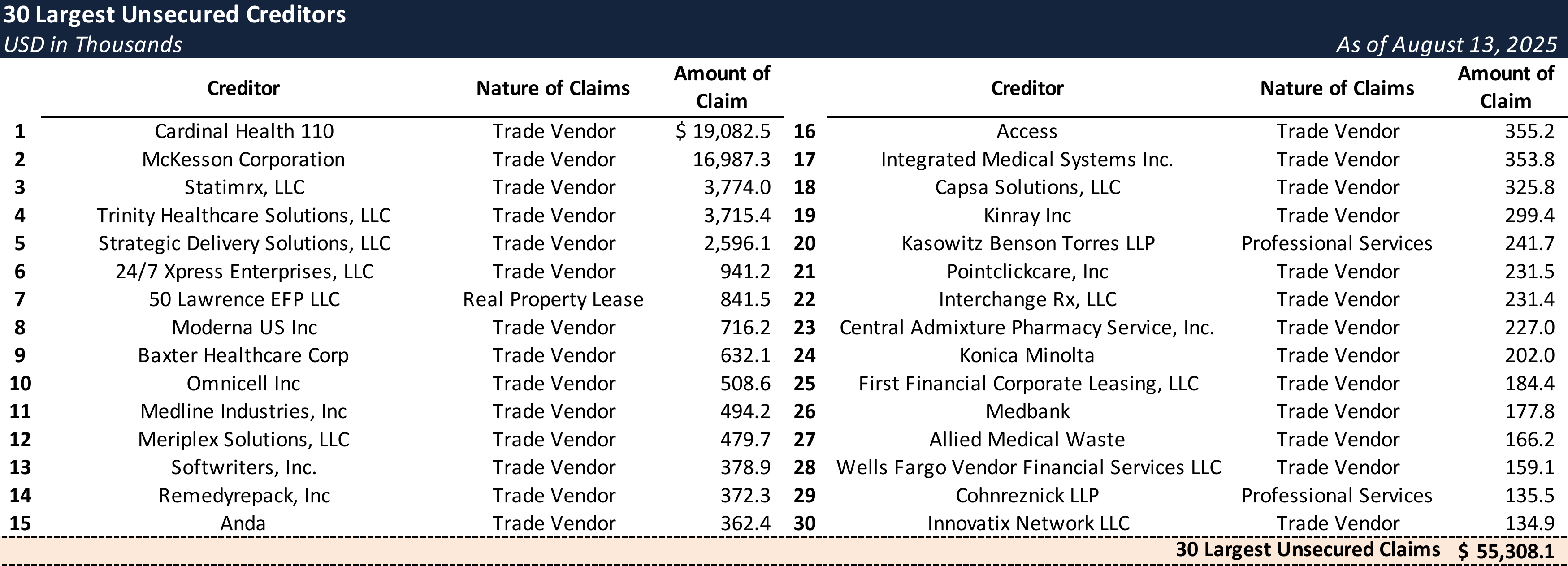

Top Unsecured Claims

Events Leading to Bankruptcy

Impact of COVID-19 and Industry Headwinds

- The COVID-19 pandemic severely impacted the long-term care sector, leading to lower patient occupancy at client facilities and a direct reduction in the Company's prescription revenue.

- Simultaneously, the Company faced a confluence of structural challenges:

- Inflationary Pressures: Rising labor costs for scarce healthcare workers, including pharmacists and technicians, compressed margins.

- Reimbursement Declines: The shift of seniors from traditional Medicare Part D to lower-reimbursing Medicare Advantage plans narrowed pharmacy networks and reduced payment rates.

- Customer Consolidation: The acquisition of independent LTC facilities by larger chains, which often use national pharmacy vendors, resulted in the loss of key contracts.

- These factors contributed to significant operating losses, with net losses of $10.4 million in 2022, $7.5 million in 2023, and $6.7 million in 2024.

Liquidity Crisis and Operational Downsizing

- Mounting losses led to a severe liquidity crisis in 2022. The Company breached financial covenants on its senior secured revolving credit facility, which was subsequently acquired from the lending syndicate by CS One, LLC, a Straus-affiliated entity, in February 2023.

- The crisis was exacerbated when primary supplier Cardinal Health shifted the Company to cash-on-delivery (COD) terms in late 2022 after unpaid invoices reached $29 million. This change required approximately $500,000 in daily cash outflows, which the Company could not sustain.

- In response, management executed a drastic downsizing strategy between late 2022 and early 2025, closing six pharmacy locations and exiting markets in Maryland, Texas, Virginia, Connecticut, Pennsylvania, and Florida. Despite these measures, which reduced daily purchasing needs and overhead, the Company’s cash flow remained negative.

Failed Out-of-Court Sale Processes

- After retaining restructuring advisor Gibbins Advisors in December 2023, the Company pursued a sale as a going concern, leading to two unsuccessful deal processes:

- PharMerica: After months of negotiations for an asset purchase, PharMerica, a major competitor, abruptly terminated discussions in April 2025, delivering a significant setback.

- Specialty RX (SRX): In May 2025, the Company executed a binding term sheet with SRX, which included a $5 million deposit that Partners Pharmacy used for operating expenses. However, a definitive agreement was never reached, and SRX terminated the term sheet on August 5, 2025, leaving the Company without a buyer.

Chapter 11 Filing and Stalking Horse Sale Plan

- Facing limited options and depleted liquidity, the Company filed for Chapter 11 protection on August 13, 2025, to pursue a court-supervised §363 asset sale.

- The restructuring effort is being supported by prepetition lender and owner-affiliate CS One, LLC, under a loan-to-own strategy.

- CS One has provided $6.5 million in DIP financing to fund operations and sustain patient care throughout the sale process.

- CS One is also serving as stalking horse bidder with an estimated $51 million credit bid, comprised of prepetition claims and DIP financing. The offer carries no breakup fee, expense reimbursement, or other bidder protections.

- The Debtors intend to conduct an expedited auction in early October 2025. The Chapter 11 process is designed to preserve the enterprise as a going concern and ensure continuity of care for roughly 17,000 residents.

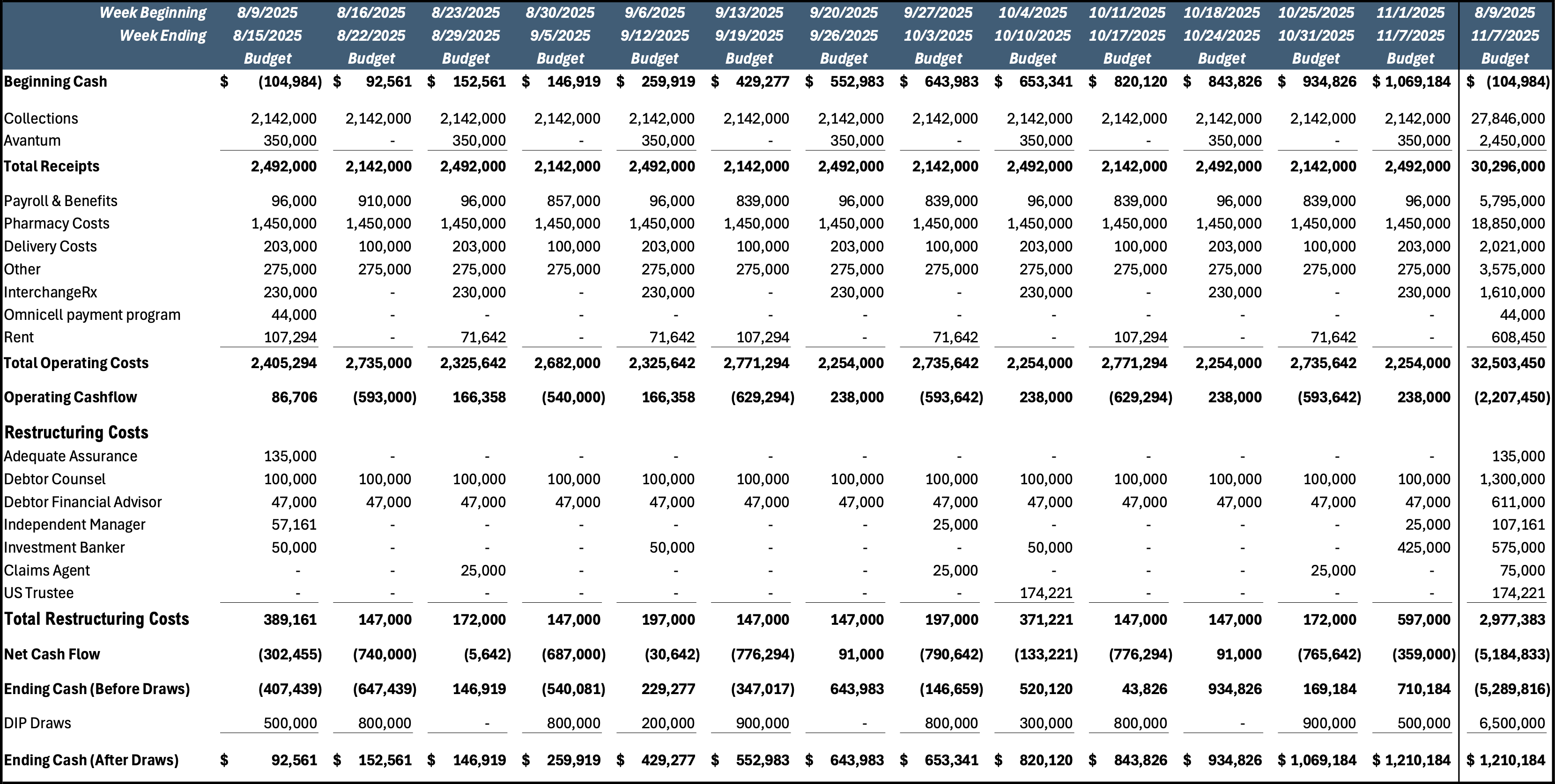

Initial DIP Budget

Key Parties

- Pillsbury Winthrop Shaw Pittman LLP (counsel); SSG Capital Advisors, LLC (investment banker); Gibbins Advisors, LLC (financial advisor / CRO, Ronald M. Winters); Kroll Restructuring Administration LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.