Case Summary: Party City Chapter 11

Party City Holdco Inc. filed for Chapter 11 to execute a wind-down and asset sale following liquidity constraints, declining sales, and unsuccessful capital-raising efforts.

Business Description

Headquartered in Woodcliff Lake, NJ, Party City Holdco Inc. (“PC Holdco”), along with its Debtor and non-Debtor affiliates (collectively, “PCHI” or the “Company”), is a leading retailer and supplier of party goods and related products.

- The Company operates approximately 692 retail stores and 29 franchised stores across the United States, including Puerto Rico.

PCHI’s business is structured around two primary segments:

- Retail Operations: Encompasses the Company’s owned and franchised stores, as well as its e-commerce channels.

- Consumer Products: Focuses on the design, sourcing, and distribution of party-related goods to third-party wholesalers and retailers, including the Company’s retail stores.

- These operations span the United States and Asia, supplying products to customers in over 70 countries worldwide.

In FY2023, the Company generated $1.8 billion in operating revenues.

- ~85% of total revenues were derived from retail operations, with the remaining ~15% attributable to its consumer products segment.

As of the Petition Date, the Company reported $1-$10 billion in assets and liabilities.

Corporate History

PCHI emerged from a Chapter 11 reorganization in October 2023, transitioning from a publicly traded to a privately held company.

- Over 97% of the Company’s equity is held by four Second Lien Noteholders, who also own over 99% of the Second Lien Notes.

Since emerging, the Company implemented various initiatives to modernize operations and improve profitability, including:

- Optimizing inventory management and right-sizing its workforce.

- Updating retail pricing methodologies.

- Exiting its historical manufacturing business to focus on retail and wholesale operations.

In September 2024, the Company sought additional capital to fund its business plan and address liquidity constraints.

- Efforts to raise capital from existing lenders, investors, and third-party strategic partners were unsuccessful.

As of the Petition Date, PCHI’s Board of Directors comprised three Independent Directors: Bob Hull, Neal Goldman, and Patrick Bartels.

- The Independent Directors guided the Company’s efforts to explore strategic alternatives, including capital raising initiatives, in an attempt to avoid liquidation.

- They also reviewed and authorized the Chapter 11 filings, facilitating the transition to a liquidation strategy.

Following a default under the ABL/FILO Facilities on December 10, 2024, the Company entered into a Forbearance Agreement with its lenders.

- This agreement mandated Chapter 11 filings by December 22, 2024, facilitating an efficient and value-maximizing asset sale as well as an orderly wind-down of operations.

Operations Overview

Retail and Product Offering

- PCHI’s retail operations generate revenue primarily through the sale of party supplies under the Amscan and Brava brand names.

- On average, the retail stores offer 15,000 stock-keeping units (“SKUs”) at any given time, while the e-commerce platform offers 40,000 SKUs.

- The Company designs and sources approximately 80% of its products in-house and partners with third-party suppliers for the remaining 20%.

Consumer Products and Manufacturing

- The consumer products segment offers nearly 400 ensembles of tableware, accessories, novelties, balloons, and decorations, sold through PCHI stores, franchisees, and other retailers.

- AmPro, a piñata manufacturing business in Mexico owned and operated by Trisar, Inc., one of PC Holdco’s indirect subsidiaries, is the only manufacturing operation retained by PCHI following the sale of its other manufacturing businesses in 2023-2024.

- PCHI plans to market its equity interest in AmPro as part of the Chapter 11 process.

Sourcing and Vendor Relationships

- The Company maintained relationships with third-party vendors, primarily in Asia, managed through PCHI Asia Limited, a non-Debtor subsidiary based in Hong Kong.

- With the transition to a wind-down strategy, PCHI intends to liquidate PCHI Asia Limited through proceedings in Hong Kong.

Distribution and Logistics

- The Company operates a centralized distribution facility in Chester, New York, which facilitates direct shipments to retailers and distributors worldwide.

- Additionally, PCHI utilizes an electronic order entry and information systems platform to streamline its global distribution.

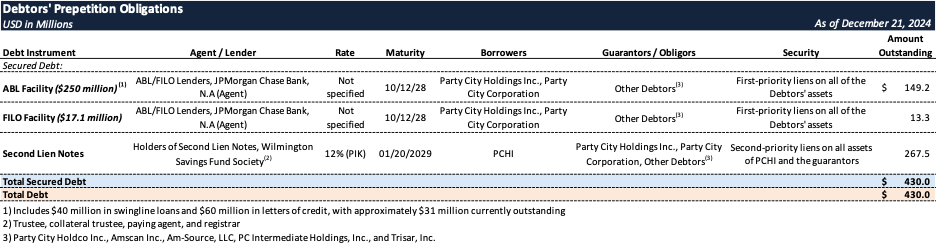

Prepetition Capital Structure

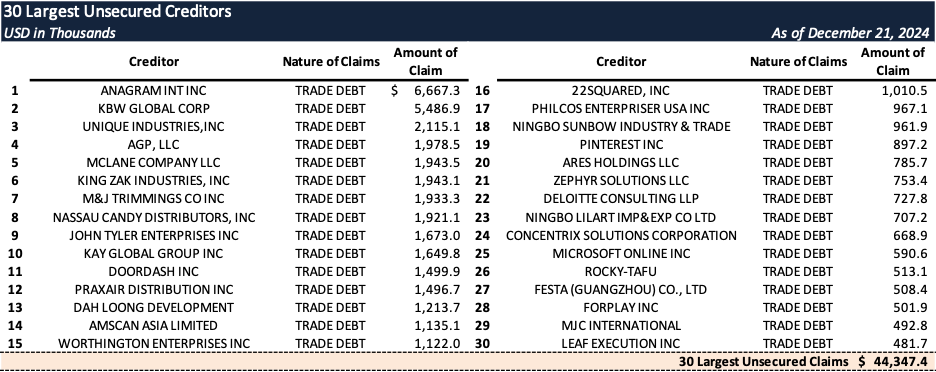

Top Unsecured Claims

Events Leading to Bankruptcy

Transformation Efforts Post-2023 Chapter 11 Cases

- Following its emergence from Chapter 11 reorganization in October 2023, PCHI pursued initiatives aimed at transforming the company into a modern, efficient, and profitable retail enterprise. Key initiatives included:

- Inventory Optimization: Implemented a strategy to reduce excess and outdated inventory, targeting a reduction from $450 million to $300 million through discounted sales. This lowered margins and reduced the borrowing base tied to inventory levels, limiting available liquidity.

- Business Refocus: Exited manufacturing operations to concentrate on retail and wholesale lines.

- Balloon Business Separation: Finalized the separation of its balloon business, “Anagram,” through a December 2023 Omnibus Commercial Arrangement, governing the commercial relationship post-separation.

- Wholesale Partnership Realignment: Ended unprofitable wholesale partnerships to focus on supplying independent party goods retailers and key accounts like Canadian Tire, a major Canadian retail conglomerate to which PCHI sold its Canadian business in 2019.

- Store Closures: Closed 27 additional underperforming stores post-emergence, building on the 48 closures during the Prior Cases, aligning the retail portfolio with long-term business goals.

Financial and Operational Decline

- Sales Decline:

- Comparative store sales dropped 9.5% YoY from July 2023 to July 2024, while the consumer products division’s sales fell 24.8% in the same period.

- Purchases from key partner Canadian Tire also declined sharply, further straining revenues.

- Workforce Reductions:

- The Company undertook significant layoffs in January and September 2024, impacting 280 corporate employees, and planned similar measures for retail operations to enhance efficiency.

Liquidity Challenges

- In September 2024, PCHI retained Hilco Valuation Services to reappraise inventory and strengthen borrowing capacity under ABL/FILO Facilities.

- Hilco’s preliminary November 2024 report significantly reduced the net orderly liquidation value (“NOLV”) of key assets, further eroding the borrowing base.

- PCHI disputed the findings, negotiated adjustments, and secured an NOLV increase; however, the overall impact on liquidity remained significant.

- On November 18, 2024, the ABL Agent imposed a $50 million discretionary reserve, further deepening the liquidity trough.

- Combined with failed capital-raising efforts, this reserve exacerbated PCHI’s liquidity crisis, leading to defaults under ABL/FILO Facilities by December 10, 2024, and triggering lender remedies.

- Despite seeking funding from ABL/FILO Lenders, Second Lien Noteholders (PCHI’s majority owners), and third-party investors, all efforts were unsuccessful.

Chapter 11 Filing

- On December 17, 2024, PCHI and its lenders entered into a Forbearance Agreement requiring adherence to milestones, such as retaining a liquidation consultant and commencing Chapter 11 proceedings by December 22, 2024.

- The Company selected Gordon Brothers for store closures and A&G Real Estate Partners to monetize leases.

- On December 21, 2024, PC Holdco, along with its Debtor affiliates, filed for Chapter 11 bankruptcy protection in the Southern District of Texas.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.