Case Summary: PinSeekers Chapter 11

PinSeekers has filed for Chapter 11 bankruptcy due to liquidity constraints and governance disputes, aiming to restructure debt and stabilize operations under new management.

Business Description

Headquartered in DeForest, WI, PinSeekers DeForest Operations LLC ("PDO" or the "Debtor") operates a year-round hybrid-golf entertainment facility located at 6909 River Road (the “PDO Facility”).

- The PDO Facility features a diverse portfolio of recreational offerings, including all weather luxury Toptracer golf suites, mini golf, mini bowling, traditional golf suites, and multi-sport simulators, catering to a broad customer base.

- Additionally, the PDO Facility features a restaurant and bar, as well as event spaces capable of accommodating up to 100 guests, making it suitable for various gatherings and special occasions.

As of the Petition Date, PDO employed approximately 75 full-time and part-time staff members.

PDO filed for Chapter 11 protection on Feb. 18 in the U.S. Bankruptcy Court for the Western District of Wisconsin. As of the Petition Date, the Debtor reported $1 million to $10 million in assets and $10 million to $50 million in liabilities.

Corporate History

The PDO Facility is leased from PinSeekers DeForest, LLC (“Landlord”), which entered a Development Agreement with the Village of DeForest on July 15, 2021, requiring minimum improvements by July 1, 2023. At execution, Landlord principals William and Ryan Ranguette were in investment discussions with the Iowa Group regarding PDO’s development.

- The Iowa Group formed Golf DeForest RE, LLC (“Golf DeForest”) to invest in the Landlord and PDO. In February 2022, through Golf DeForest, they acquired an 80% equity stake in the Landlord and a 25% stake in PDO.

- Post-transaction, PDO ownership was 65% 3RS Holding, 25% Golf DeForest, and 10% Palm Ventures, while the Landlord was 80% Golf DeForest and 20% 3RS Holding.

- William and Ryan Ranguette are also members of 3RS Holding.

On February 23, 2022, PDO signed a 20-year lease with two 10-year renewal options and a five-year Facility Management Agreement (“FMA”) with St. Somewhere, Inc., extendable for another five years.

- PDO began membership sales in November 2022 and launched operations in October 2023.

- St. Somewhere, owned by William Ranguette, managed operations until the FMA’s termination on February 8, 2025.

The termination aligned with the Iowa Group exercising its option to acquire 3RS Holding’s interests, increasing Golf DeForest’s stake in PDO to 90%.

Operations Overview

PDO is a year-round golf and entertainment venue, combining high-tech golf with diverse leisure experiences.

Core Offerings

- Golf & Entertainment Complex – Located at 6909 River Road, featuring all-weather Toptracer golf suites for all skill levels.

- Mini Golf & Putting Course – Synthetic putting course for recreational and competitive play.

- Mini Bowling – Duckpin-style bowling designed for families and group outings.

- Multi-Sport Simulators – High-definition simulators featuring 13+ interactive sports and games, including zombie dodgeball.

- Restaurant & Bar – On-site food and beverage service to enhance guest experience.

Customer Engagement & Loyalty Programs

PDO employs a multi-faceted customer acquisition and retention strategy aimed at driving recurring revenue and increasing customer lifetime value.

- Gift Card Program – Approximately 7,150 gift cards remain unredeemed, with an outstanding balance of $428,000 (as of the Petition Date).

- Membership Program – Tiered plans for individuals, families, and corporate clients, offering exclusive perks such as daily golf suite rentals and event discounts. As of the Petition Date, the program includes:

- 54 individual members

- 46 corporate members

- 29 family memberships

- All-Access Pass – Prepaid punch-card system for multi-visit access to golf suites, simulators, bowling, and putting courses.

- Promotions & Discounts – Targeted offers for corporate events, youth programs, field trips, and golf lessons to drive retention and brand loyalty.

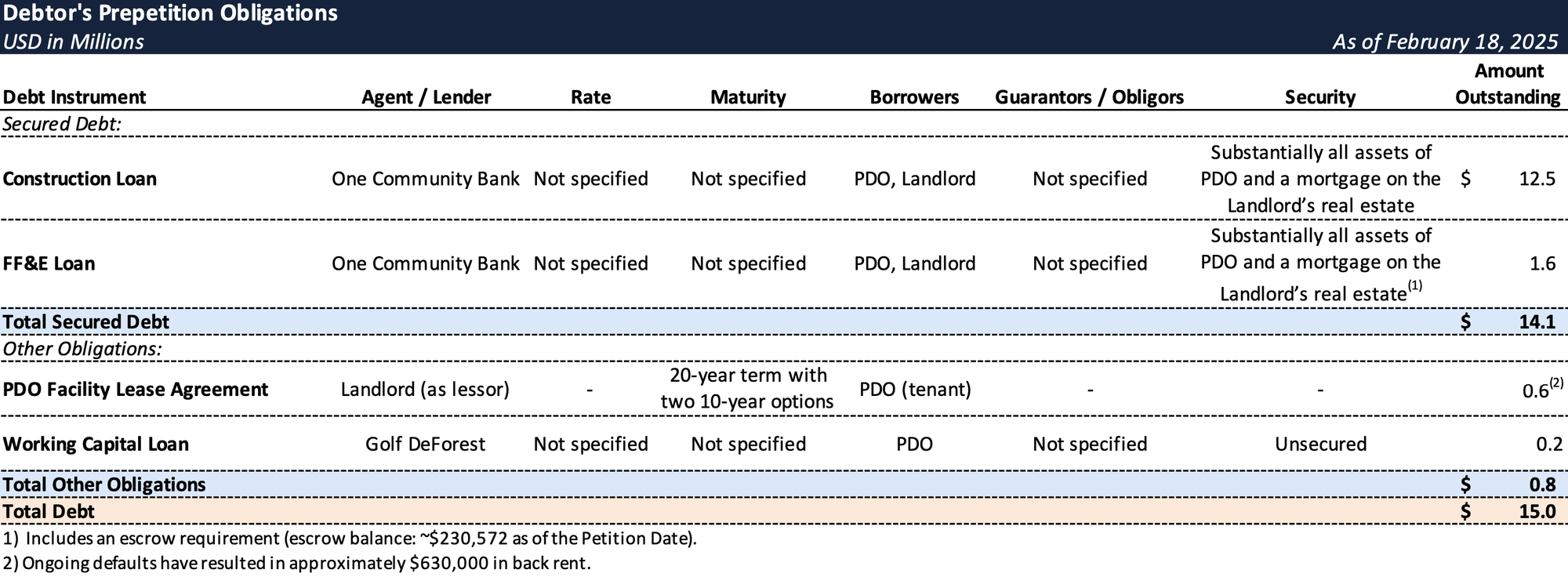

Prepetition Obligations

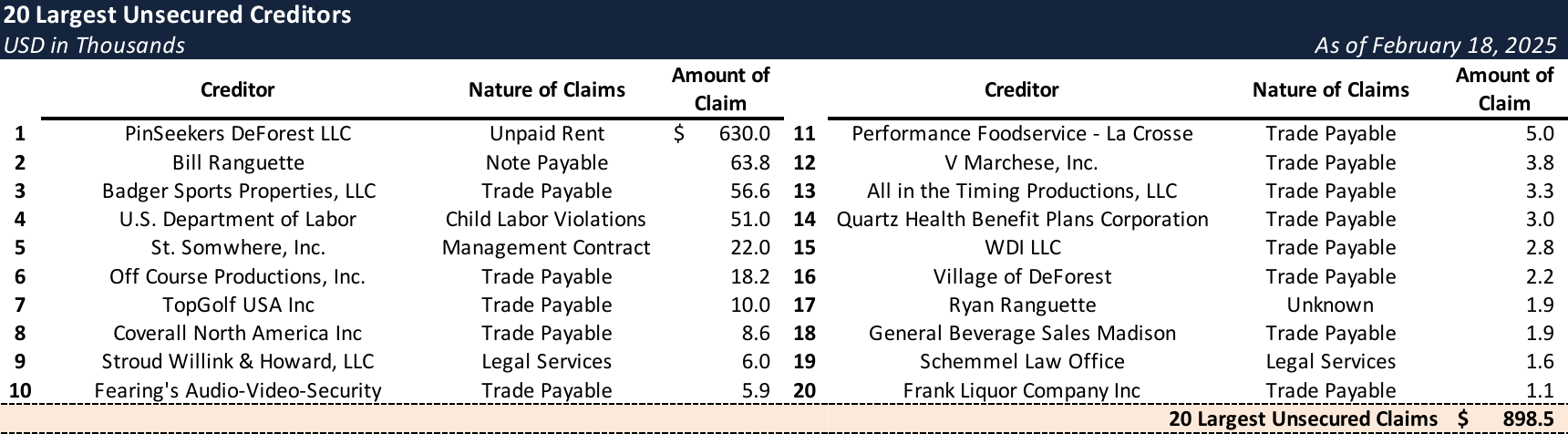

Top Unsecured Claims

Events Leading to Bankruptcy

Liquidity Shortfall and Rental Defaults

- PDO faced severe cash flow issues, leading to missed rent payments from May 2024 and a complete cessation by October 2024, accruing $630,000 in arrears by February 2025. Multiple default notices went unresolved.

Facility Management Agreement

- On February 23, 2022, PDO entered a five-year FMA (with a renewal option) with St. Somewhere, Inc., owned and controlled by William Ranguette.

- Financial terms included:

- $85,000 pre-opening fee.

- 5% of gross revenue as a management fee, capped at $300,000 in Year 1, with annual inflation adjustments.

Golf DeForest Takeover and Financial Unraveling

- On February 8, 2025, after PDO failed to cure a 180-day lease default, Golf DeForest exercised its $1.00 purchase option under PDO’s February 23, 2022, Operating Agreement, increasing its stake in PDO to 90%.

- Golf DeForest and Palm Ventures appointed Nicholas A. Andersen as Manager and immediately terminated the FMA, citing the lack of unanimous member approval required under the Operating Agreement.

- Before February 8, 2025, Ryan and William Ranguette allegedly restricted access to PDO’s financial records, bank accounts, and operational systems, with evidence of professionally wiped computers erasing key data.

- On February 10, 2025, the Iowa Group took full operational and financial control, gaining access to records and bank accounts.

- A financial review revealed:

- Overdue vendor payments and multiple overdraft fees.

- A $50,990 U.S. Department of Labor fine for 12 child labor law violations.

- Cash reserves of just $32,000 as of February 10, 2025.

Liquidity Support and Chapter 11 Filing

- On February 11, 2025, Golf DeForest extended a $200,000 loan for working capital.

- Despite this, liquidity remained insufficient, leading PDO to file for Chapter 11 bankruptcy on February 18, 2025, to restructure debt and stabilize operations.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.