Case Summary: Pinstripes Chapter 11

Pinstripes has filed for Chapter 11 bankruptcy amid liquidity pressures from declining sales and costly expansion, with support from a restructuring support agreement with its lenders for an expedited $16.6 million stalking horse sale.

Business Description

Headquartered in Northbrook, IL, Pinstripes Holding, Inc., along with its Debtor⁽¹⁾ affiliates (“Pinstripes” or the “Company”), is a best-in-class “eatertainment” brand that integrates upscale dining with bowling and bocce. Each venue features a full-service Italian-American bistro and bar alongside gaming amenities and flexible event spaces, positioning itself as a sophisticated, family-friendly leisure destination.

- The Company’s operating philosophy emphasizes its culinary offerings, with management describing the concept as “a restaurant with bowling and bocce – not the other way around.”

Pinstripes’ revenue is primarily driven by food and beverage sales, which historically account for approximately 80% of total revenue, with gaming fees contributing the remaining 20%. For the fiscal year ended April 27, 2025 (unaudited), total revenue was approximately $129 million, with average unit volumes of roughly $7.4 million per location.

Pinstripes Holding, Inc. and its affiliates filed for Chapter 11 protection on September 8, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $100 million to $500 million in both assets and liabilities.

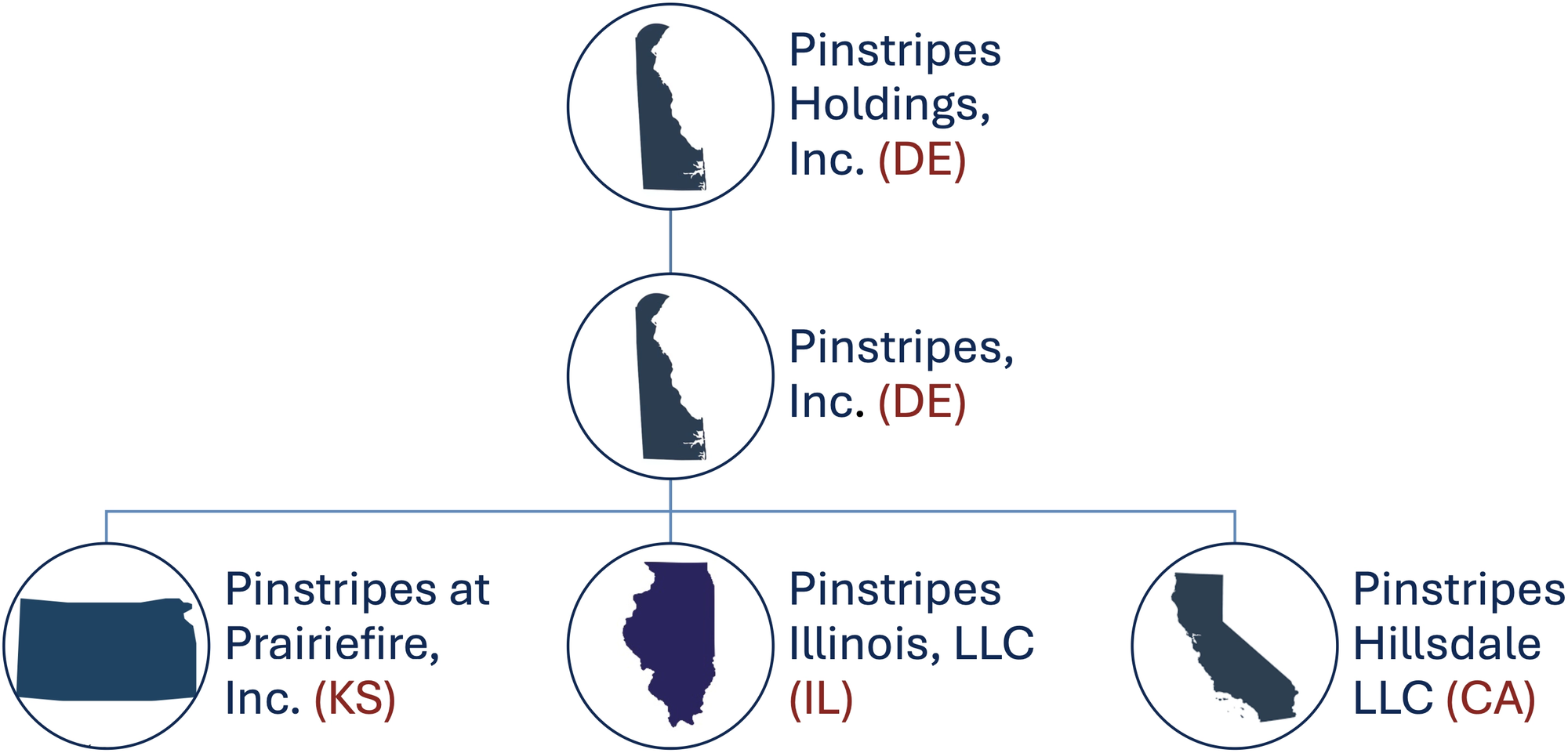

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Pinstripes was founded in 2007 by Dale Schwartz, who opened the flagship location in Northbrook, IL, to combine classic social games with a high-quality bistro and event venue. Over the next several years, the Company expanded to a peak of eighteen locations across 10 states and Washington, D.C.

- As of the Petition Date, Pinstripes continues to operate eight of those locations.

SPAC Merger and Public Listing

- In June 2023, Pinstripes announced a merger with Banyan Acquisition Corp., a special purpose acquisition company (SPAC), in a transaction that valued the Company at an enterprise value of $520 million.

- The merger closed on Dec. 29, 2023, and Pinstripes Holding, Inc. began trading on the New York Stock Exchange under the ticker “PNST” on Jan. 2, 2024.

- The "De-SPAC" transaction provided over $70 million in gross proceeds to fund an aggressive expansion strategy, including a $50 million senior secured term loan from Oaktree Capital Management.

Post-IPO Challenges and Delisting

- Shortly after its public debut, Pinstripes’ financial performance deteriorated amid macroeconomic headwinds and rising operational costs.

- On March 5, 2025, approximately 14 months after its listing, the NYSE suspended trading of the Company’s stock and issued a delisting notice due to its low market capitalization and share price. The Company did not appeal the decision.

Corporate Organizational Structure

Operations Overview

Pinstripes operates large-format destination venues, typically ranging from 26,000 to 38,000 square feet of interior space, often supplemented by expansive outdoor patios with additional dining, bocce courts, and fire pits. The interior layout is designed to accommodate both public dining and private events concurrently, featuring 11–20 bowling lanes, 6–12 bocce courts, a full bistro, a bar, and multiple private event rooms.

Store-Level Economics

- In the fiscal year ended April 27, 2025, companywide revenue totaled approximately $129 million, with each location averaging about $7.4 million in annual sales.

- Operations are subject to seasonality, with peak business occurring during the winter holidays and summer months.

- The large-scale, full-service model carries substantial operating costs. In the quarter ending October 2024, store-level labor costs reached 39% of revenue, pressuring profitability as customer traffic softened.

- In response to declining performance in 2024, management initiated significant cost-cutting measures, including a plan to remove $10 million in annual venue-level expenses and $4 million in corporate overhead.

Workforce and Management

- As of the Petition Date, the Company employed approximately 863 individuals, including 134 salaried and 729 hourly employees, with an additional 915 employees terminated following recent restaurant closures. None of the employees are unionized.

- The Company cultivated a strong hospitality culture, with senior leadership recruited from prominent restaurant groups such as The Cheesecake Factory and Hillstone Restaurant Group.

Technology and Innovation

- Since 2020, Pinstripes has invested in a new technology ecosystem, implementing cloud-based platforms for point-of-sale, reservations, inventory control, and labor scheduling to drive operational efficiency.

- The Company also enhanced the guest experience with in-venue technology, including projection-mapping visuals on bowling lanes and creative game variations like Angry Birds Bowling.

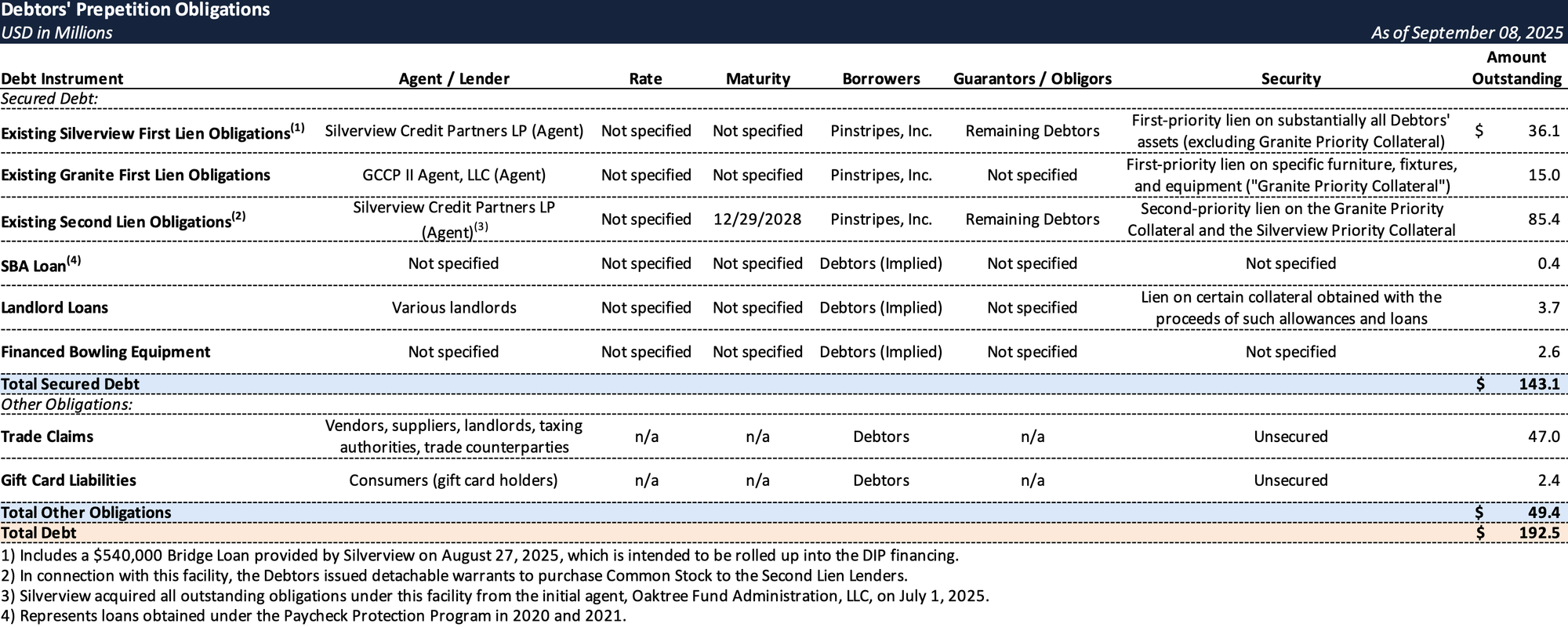

Prepetition Obligations

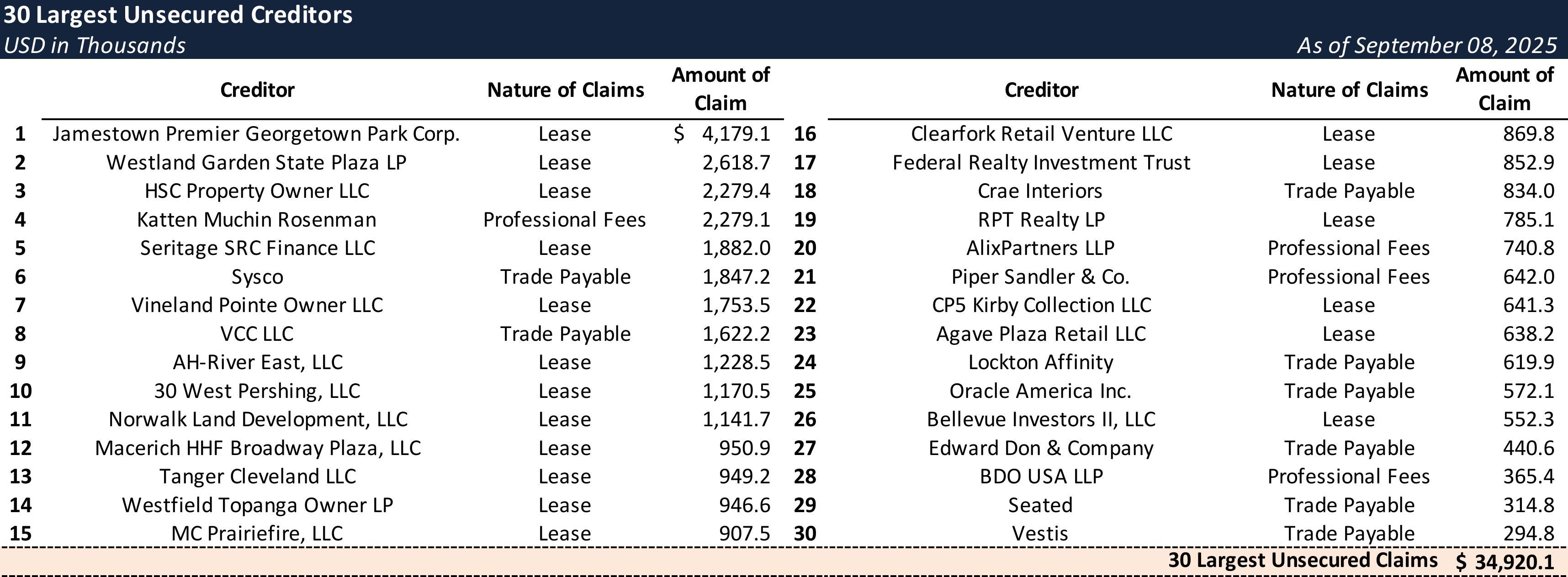

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Downturn and Expansion Pressures

- Pinstripes faced significant macroeconomic headwinds, including rising labor and food commodity costs, which eroded margins. Simultaneously, inflationary pressures led to a shift in consumer behavior, with cost-conscious customers reducing discretionary spending.

- This resulted in declining foot traffic and a 9.4% drop in same-store sales during the second quarter of fiscal 2024. The downturn coincided with an aggressive expansion phase, and the substantial costs associated with new store build-outs severely strained the Company's liquidity as systemwide revenues fell.

Debt Defaults and Forbearance

- The combination of declining revenue and heavy capital expenditures caused Pinstripes’ EBITDA to turn negative, leading to defaults on its debt covenants.

- On Jan. 7, 2025, the Company entered into forbearance agreements with its key secured lenders—Silverview Credit Partners (first lien), Oaktree Capital Management (second lien), and Granite Creek Capital (equipment)—to temporarily stave off foreclosure.

Strategic Alternatives Process

- On Jan. 13, 2025, the Board of Directors formed a Special Committee of independent directors to evaluate restructuring alternatives and engaged Piper Sandler & Co. as its investment banker.

- Piper Sandler conducted an expedited marketing process from January to February 2025, contacting over 80 potential strategic and financial partners. However, the process failed to produce any actionable third-party offers to purchase or recapitalize the business.

Failed Recapitalization and Debt Consolidation

- In March 2025, Pinstripes signed a non-binding letter of intent with Oaktree for a potential recapitalization, but the deal ultimately collapsed.

- In a pivotal development in early 2025, Oaktree exited its position by selling its entire $85+ million second-lien debt facility to affiliates of Silverview at a steep discount.

- In April 2025, the Company engaged CR3 Partners, and James Katchadurian was appointed Chief Restructuring Officer (CRO).

Restructuring Support Agreement

- By late August 2025, Pinstripes and Silverview executed a Restructuring Support Agreement (RSA) outlining the terms of a pre-arranged Chapter 11 filing centered on an expedited asset sale. Key terms included:

- 363 Asset Sale: The Company agreed to pursue an expedited sale of substantially all of its assets under Section 363 of the Bankruptcy Code.

- Stalking Horse Bid: Silverview, through an acquisition vehicle, agreed to serve as the stalking horse bidder with a bid valued at approximately $16.6 million, consisting of a $15 million credit bid and $1.6 million in cash, plus the assumption of certain liabilities. The bid included no breakup fee.

- DIP Financing: Silverview committed to providing up to $3.8 million in debtor-in-possession (DIP) financing to fund the Chapter 11 cases, which included the roll-up of a $540,000 pre-petition bridge loan.

Chapter 11 Filing and Path Forward

- On Sept. 8, 2025, Pinstripes filed for Chapter 11 protection and immediately commenced the 363 sale process, seeking approval of Silverview's stalking horse bid and the associated bidding procedures.

- The stalking horse entity, SilverStrike, LLC, has the right to credit bid the debt controlled by Silverview. Filings also indicate that competing eatertainment brand Punch Bowl Social, Inc. may be involved in operating the purchased assets post-sale.

- The RSA imposes an accelerated timeline designed to complete the sale by late October 2025, preserving the going-concern value of the remaining eight locations and approximately 900 jobs ahead of the holiday season.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.