Case Summary: Plastic Suppliers Chapter 11

Plastic Suppliers has filed for Chapter 11 amid sharp revenue declines, initiating a going concern sale with a $13 million stalking horse bid.

Business Description

Headquartered in Columbus, OH, Plastic Suppliers, Inc. (“PSI”), along with its Debtor subsidiaries Plastic Suppliers, Inc. and Sidaplax, Inc. (collectively, the “Debtors” or the “Company”), is a global leader in the production of innovative, environmentally friendly, thin-gauge, bio-based materials.

- The Company specializes in distinctive biopolymers such as Polylactic Acid and Polyhydroxyalkanoates while also manufacturing petrochemical-based films.

PSI delivers highly engineered, application-specific solutions to diverse industries including consumer packaged goods and industrial markets, serving a broad customer base across the Americas, EMEA, and Asia.

For FY2024 (ended October 31), the Company reported $17.5 million in revenue and an unaudited pre-tax loss of $8.7 million, reflecting a sharp decline from FY2023’s $53.6 million in revenue and $1.2 million pre-tax loss.

- For November 2024 (FY2025’s first month), PSI posted $924,529 in revenue and a net pre-tax loss of $869,764.

As of the Petition Date, the Debtors reported $10-$50 million in assets and liabilities.

Corporate History

Founded in 1959 as Plasticorp in New Jersey, PSI adopted its current name in 1988.

The Company operates from offices and manufacturing facilities at 2400-2450 Marilyn Lane, Columbus, OH, which also houses its books and records.

As of October 31, 2024, PSI’s ownership is distributed among 73 shareholders:

- 58% held by 29 Tatem family members and associated trusts.

- 16.7% held by the Employee Stock Ownership Plan (“ESOP”).

- 25.3% held by directors, employees, former employees, and individual shareholders.

PSI owns two subsidiaries—Specialty Films Inc. and Sidaplax Inc.—which collectively hold a 50% stake in Belgium-based partnership Sidaplax V.O.F.

Operations Overview

PSI focuses on markets such as food and beverage packaging, architectural products, medical equipment, personal care, office supplies, and industrial applications.

The Company’s compostable and recyclable products are used in applications including:

- Food packaging, mailers, shrink sleeves, and window packaging.

- Envelopes, filters, adhesive labels, and barrier sealants.

- Thermoforming films and laminates.

PSI employs approximately 56 full-time and 2 part-time employees, with a semi-monthly salaried payroll of $207,000 and weekly hourly payroll of $35,000.

- Employee benefits include health insurance, 401(k) matching, and expense reimbursements.

Banking and Insurance

- PSI previously maintained three bank accounts for collections, disbursements, and ESOP distributions, and its employees utilize corporate American Express cards for business expenses.

- The Company carries comprehensive insurance coverage, including general liability, property, auto, cyber, and management liability policies, as well as credit insurance for international operations.

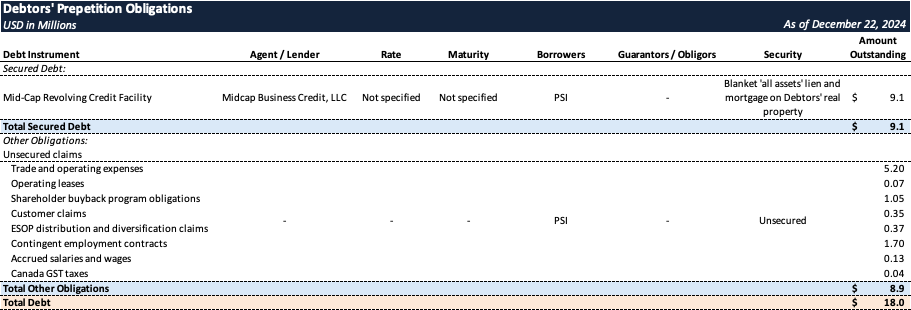

Prepetition Obligations

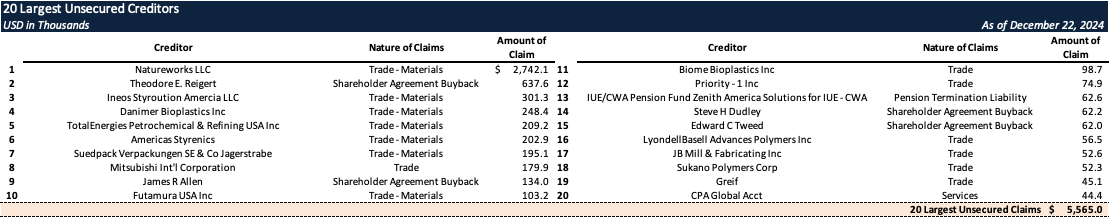

Top Unsecured Claims

Events Leading to Bankruptcy

Financial Challenges

- PSI’s financial struggles stem from a combination of factors:

- Sanctions Impact: U.S. and EU sanctions significantly restricted exports to key markets.

- COVID-19 Disruption: The pandemic weakened sales channels and demand.

- Strategic Transition: Shifting from fossil-fuel to bio-based films presented implementation challenges.

Key Agreements and Market Evolution

- In 2014, PSI secured an exclusive supply agreement for its patented Earthfirst film with a major consumer brand. By FY2020, consolidated revenues peaked at $78 million, driven by shipments of 31 million pounds annually.

- This accounted for ~71% of the Company’s total consolidated revenue.

- Declining demand for first-generation products, combined with the customer’s shift to alternate suppliers, impacted growth beginning in FY2021.

- European and U.S. sanctions in FY2022-2023 compounded the impact, driving a 92% global product revenue decline from peak levels by FY2024.

Strategic Opportunities

- Despite setbacks, PSI is actively developing bio-resin compostable solutions with a robust pipeline valued at approximately $95 million, including:

- $17 million in commercial development projects.

- $11 million in lamination division growth opportunities.

- Initiatives include compostable snack bags, overwraps, lidding films, and industrial applications, many of which are targeted for commercialization by 2025. However, liquidity constraints have hindered progress.

Path Forward: Going Concern Sale

- To address financial challenges and maximize stakeholder value, PSI has decided to pursue a going concern sale of its business.

- As part of this process, PSI has entered into a Stalking Horse Agreement with API Industries, Inc. (the “Stalking Horse Purchaser”) for the acquisition of substantially all of the Company’s assets for $13 million in cash, along with the assumption of certain liabilities.

- Additionally, the Stalking Horse Purchaser has provided a $1.3 million deposit.

- This agreement, negotiated at arm’s length with counsel representation on both sides, establishes a baseline offer for the Chapter 11 sale process.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.