Case Summary: PrimaLend Chapter 11

PrimaLend filed for Chapter 11 amid macro headwinds and rising delinquencies that led to over-advances on its credit facilities, and is pursuing a court-supervised sale process supported by DIP financing from existing senior lenders.

Business Description

Headquartered in Plano, TX, PrimaLend Capital Partners, LP ("PCP"), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "PrimaLend" or the "Company"), operates as a specialized asset-based lender serving the subprime auto finance sector. Founded in 2007, PrimaLend provides financing to "buy-here, pay-here" (BHPH) used-car dealerships and related finance companies that cater to credit-challenged consumers, positioning itself as a flexible funding partner where traditional banks typically decline.

- PrimaLend’s "Dealer-Borrower" clients are independent auto dealers and third-party investors in retail installment sales contracts (RISCs) requiring capital to purchase inventory and finance vehicle sales.

The Company offers comprehensive financing solutions through three primary business lines, delivered via its PCP, Good Floor Loans, LLC ("GFL"), and PrimaLend Real Estate, LLC ("PRE") entities:

- PrimaLend Capital Partners (PCP): Extends first-lien revolving lines of credit (RLOCs) and subordinate loans secured by dealers' portfolios of auto finance receivables (RISCs).

- Good Floor Loans, LLC (GFL): Provides inventory floorplan lines of credit, enabling dealers to purchase used-car inventory.

- PrimaLend Real Estate, LLC (PRE): Offers real estate-backed loans to dealers or their affiliates/principals, utilizing dealership real property as collateral.

This integrated approach allows a synchronized funding cycle where a dealer can finance inventory through GFL, and upon sale, leverage PCP against the customer’s RISC to repay the floorplan. Many of PrimaLend’s over 100 dealer clients utilize multiple credit lines concurrently.

PrimaLend differentiates itself as one of the largest national direct lenders to the BHPH sector through its "end-to-end" financing products, including servicing support and real estate cash-out loans. The Company leverages a proprietary technology platform integrated in real-time with dealers’ management systems (DMS) for granular collateral and cashflow insights, facilitating faster funding decisions and early risk detection. Backed by a seasoned leadership team, PrimaLend had grown to operate in 12 states (with approximately two-thirds of its business concentrated in Texas). As of the Petition Date, its consolidated loan portfolio totaled approximately $280 million.

PrimaLend Capital Partners, LP and certain affiliates filed for Chapter 11 protection on October 22, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Northern District of Texas, reporting $100 million to $500 million in both assets and liabilities.

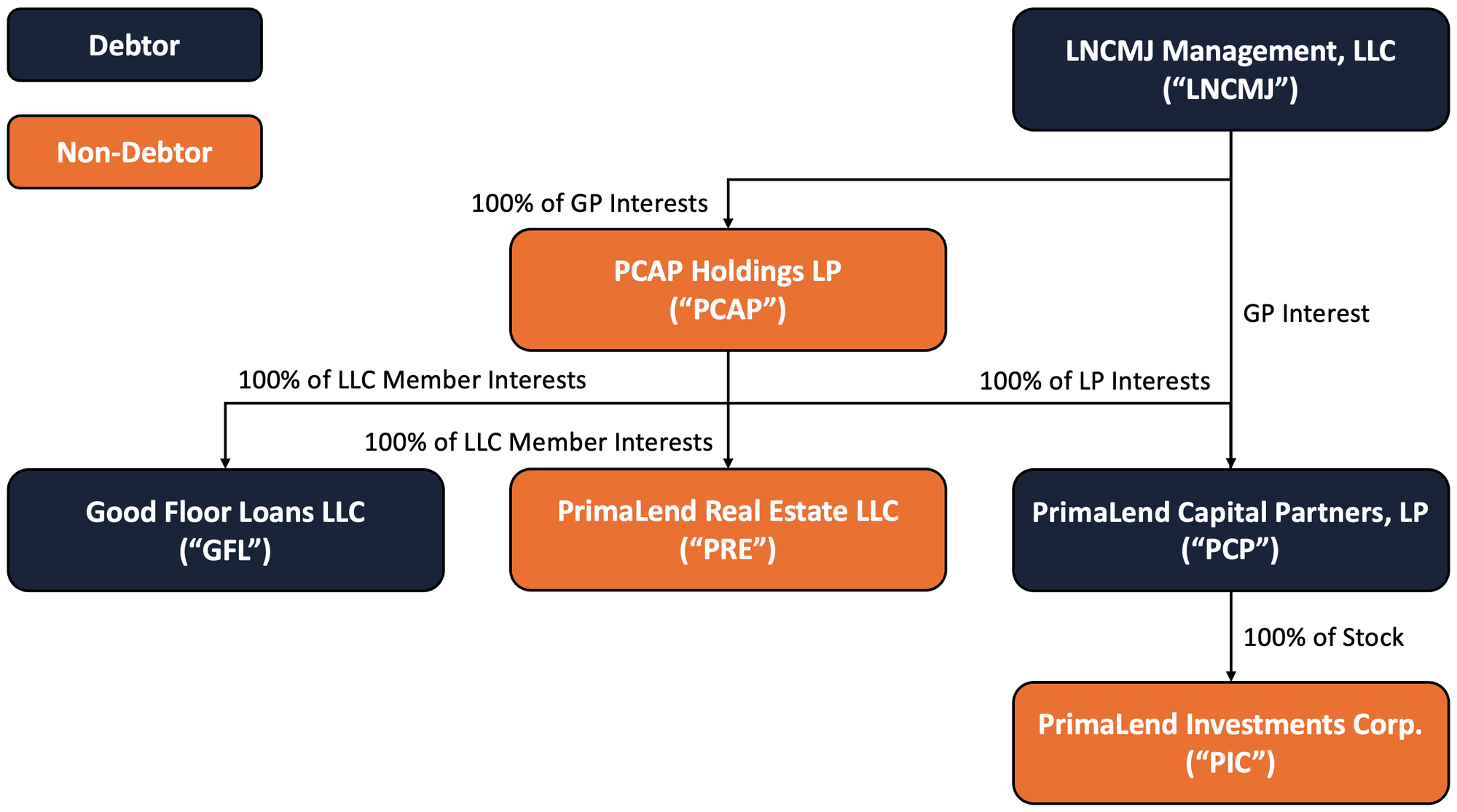

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

PrimaLend was established in 2007 in Dallas as PrimaLend Capital Group, Inc. ("PCG"), initially securing a $2.5 million credit facility to begin financing dealer loans. In 2010, the Company reorganized its primary lending operations into PrimaLend Capital Partners, LP (PCP), a limited partnership led by Founder and CEO Mark A. Jensen.

Expansion of Business Units

Responding to its dealer clients' evolving needs, PrimaLend strategically diversified its product offerings:

- In 2019, it launched Good Floor Loans, LLC (GFL) as a dedicated floorplan lender to finance dealers’ vehicle inventory purchases.

- Between 2020 and 2023, amidst a boom in used-car prices, PrimaLend introduced its third business unit, PrimaLend Real Estate, LLC (PRE), to offer real estate-backed loans to dealers and their affiliates.

Major Milestones

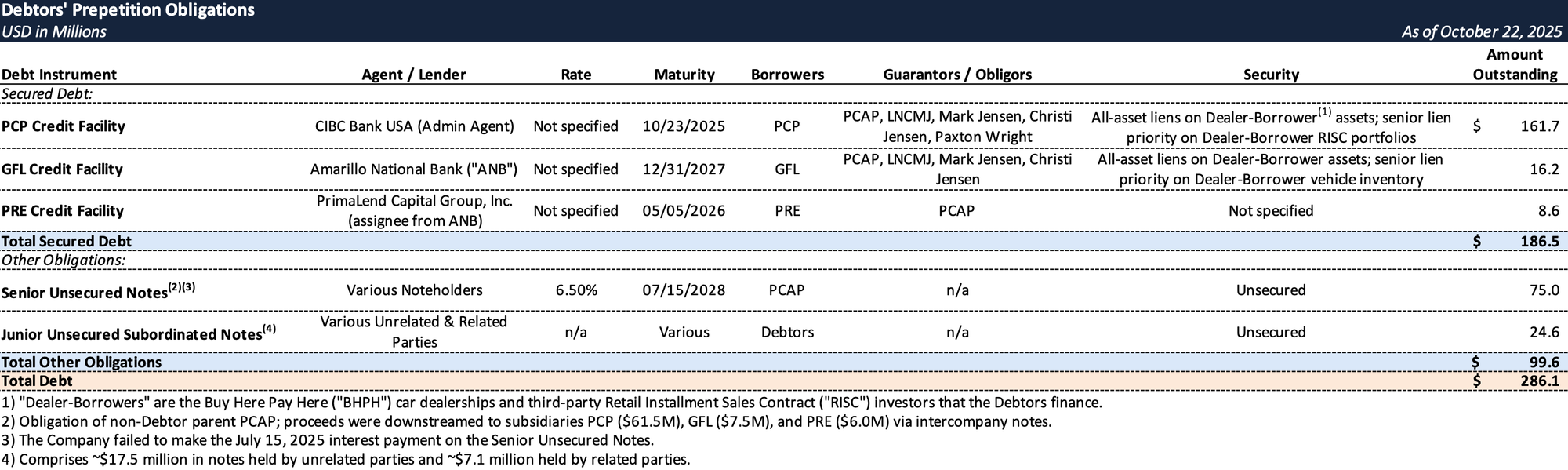

- In July 2021, PCAP issued $75 million of 6.50% senior unsecured notes due 2028, placed with institutional investors. The proceeds were downstreamed as intercompany loans to its subsidiaries—$61.5 million to PCP, $7.5 million to GFL, and $6.0 million to PRE—enabling rapid expansion of dealer lending capacity through 2022, albeit at the cost of higher leverage.

- A critical inflection point occurred on July 15, 2025, when PCAP, facing cash flow strain, defaulted on its quarterly interest payment due on the $75 million unsecured notes, signaling severe financial distress.

- On October 22, 2025, PCP, GFL, and LNCMJ filed voluntary Chapter 11 petitions. In the Company’s press release that day, CEO Mark Jensen said PrimaLend was ‘pursuing a sale process to maximize value of the business and strengthen our balance sheet.’ The Company also stated that it is not going out of business and would continue operating as usual.

Corporate Organizational Structure

- The economic interests in PCAP are held by 31 limited partners. The largest equity holder is the original corporate entity, PrimaLend Capital Group, Inc., with approximately a 36% LP interest.

- Ovation Alternative Income Master Fund LP is the second-largest holder at about 32%, with the remaining ~32% distributed among 29 other limited partners.

- LNCMJ, co-owned 50/50 by Mark Jensen and Christi Jensen, serves as the general partner for both PCAP and PCP, providing managerial oversight. Its Board of Managers, including an independent director (Matthew Kahn) since mid-2025, oversees major decisions for both Debtor and non-Debtor affiliates.

- PIC is a dormant subsidiary with no assets or operations.

Operations Overview

PrimaLend conducts its lending activities through a network of affiliated entities under common management, with shared services coordinated at the PCAP/LNCMJ level. While PCP and GFL are the primary operating lenders, non-Debtor affiliate PRE handles real estate-secured loans.

Loan Portfolio Composition

As of September 30, 2025, PrimaLend’s consolidated loan portfolio totaled approximately $280 million across its business lines:

- PCP Segment: ~$233.8 million outstanding, with approximately 90% in first-lien revolving lines of credit secured by dealers’ RISC receivables and ~10% (~$23.5 million) in subordinated term loans.

- GFL Segment: ~$24.6 million in inventory-secured floorplan loans, which are shorter-term and fluctuate with dealer purchases and sales.

- PRE Segment: ~$20.2 million in real estate loans, typically longer-term mortgages on dealership properties.

The portfolio is geographically concentrated, with roughly two-thirds of the loan value in Texas, but also extends across 11 other states.

Technology and Systems

PrimaLend leverages a custom-built monitoring and loan servicing platform that integrates tightly with dealer management systems (DMS). This system provides real-time data feeds on inventory, sales, and customer payments, enabling:

- Automated borrowing base adjustments (e.g., immediate removal of defaulted loans from collateral).

- Faster underwriting for new advances and early warning on credit risks.

Management and Governance

Mark A. Jensen, PrimaLend’s founder, serves as President and Chief Executive Officer, supported by a small executive team with over 60 years of collective experience in subprime auto finance. Governance was significantly enhanced in mid-2025:

- In July 2025, LNCMJ Management’s operating agreement was amended to establish a formal Board of Managers, including an independent member, Matthew Kahn.

- A Special Committee was formed, empowered to review potential conflicts of interest and investigate claims against related parties.

- In October 2025, Tanya Meerovich of FTI Consulting was appointed Chief Restructuring Officer to oversee Chapter 11 preparations.

Prepetition Obligations

Events Leading to Bankruptcy

PrimaLend’s financial distress emerged from severe headwinds in the subprime auto lending market, beginning in 2022, which profoundly affected its financial performance and liquidity.

Macroeconomic and Industry Headwinds

- The temporary boost from the COVID-19 pandemic (2020–2021)—driven by record-high used car prices and government stimulus—reversed by late 2021.

- Inflation and Interest Rates: Accelerating inflation (peaking at 9.1% in June 2022) prompted the Federal Reserve's rapid interest rate hikes in 2022–2023. This drastically increased borrowing costs for BHPH dealers and their subprime customers.

- Rising Delinquencies: By the second half of 2022, subprime auto loan delinquency rates began a steep climb. As end-customers defaulted on RISCs, dealers lost cash flow, and delinquent accounts became ineligible collateral for their credit lines, creating a liquidity crisis that impacted PrimaLend.

- Declining Collateral Values: Post-pandemic, used-car values normalized downward in 2023, leading to weaker recoveries on repossessed vehicles and increasing PrimaLend's loan losses.

Liquidity Crises and Over-Advances

- Initial Over-Advance: By mid-2024, mounting dealer defaults eroded PrimaLend’s borrowing base, resulting in an over-advance on its main credit line with CIBC in August 2024.

- BVY2 Participations Sale: To cure this, PrimaLend sold over $34 million in loan participations to BVY Partners II, LLC ("BVY2"), a non-Debtor affiliate, in late 2024. This transaction temporarily injected liquidity and paid down the CIBC facility.

- Recurring Over-Advances: The relief was short-lived. Dealer performance did not rebound, and losses continued, leading to another over-advance in January 2025 on both the CIBC (PCP) and ANB (GFL) facilities.

- Deleveraging Transactions: In early 2025, PrimaLend implemented stopgap measures, including negotiating paydowns from distressed Dealer-Borrowers. These efforts modestly reduced senior secured exposure but failed to resolve the fundamental liquidity gap.

- Missed Interest Payment: By July 2025, PrimaLend operated hand-to-mouth, evidenced by its default on the $1.2 million quarterly interest payment due on its $75 million unsecured notes.

- Legal Judgment: A significant liability emerged from a lawsuit by a Texas dealer group (the Benit family), where PrimaLend faced claims for wrongful foreclosure. In August 2025, the Texas Fifth Court of Appeals affirmed a judgment of over $5 million (including attorneys' fees) against PrimaLend, further straining its financial position.

Prepetition Restructuring Efforts and Advisor Engagement

- Advisor Retention: In February 2025, lead lender CIBC issued formal default notices and demanded that PrimaLend retain a financial advisor. The Company subsequently engaged FTI Consulting as restructuring advisors and Spencer Fane LLP as legal counsel in early 2025.

- Governance Enhancements: In July 2025, LNCMJ amended its operating agreement to establish a formal Board of Managers, including an independent director, Matthew Kahn. A Special Committee was formed and engaged independent counsel, Katten Muchin Rosenman LLP, in August 2025, to conduct an "Independent Investigation" into all prepetition transactions involving insiders (e.g., the BVY2 participations deal) to assess potential estate claims.

- Refinancing and Sale Process: In July 2025, Houlihan Lokey was retained as investment banker to explore refinancing and sale options. A comprehensive marketing process engaged over 50 potential parties, yielding four preliminary indications of interest, with one emerging as a lead "Potential Purchaser".

BVY2 Consent Rights & Exchange Transaction

- BVY2 Consent Rights: The BVY2 participation agreements contained contractual consent rights, preventing PCP from unilaterally modifying key terms of certain RLOCs without BVY2’s approval. This presented a significant impediment to a potential restructuring or sale.

- Exchange Transaction: To address this, PrimaLend and its advisors negotiated an "Exchange Transaction" in principle with BVY2 pre-petition. BVY2 agreed to transfer its participation interests in 27 loans back to PCP, in exchange for PCP transferring 5 loans to BVY2, thereby freeing the majority of the portfolio from the restrictive BVY2 Consent Rights.

Sale and Marketing Process Developments

As of the Chapter 11 filing, PrimaLend’s sale/recapitalization efforts were ongoing. While no stalking-horse agreement was executed at filing, discussions with the lead Potential Purchaser were advancing, with the goal of securing a binding letter of intent. Another party re-engaged pre-filing, indicating it would submit an updated offer. The Chapter 11 process is intended to facilitate a formal auction or plan solicitation to maximize value through a going-concern sale.

DIP Financing and Cash Collateral Strategy

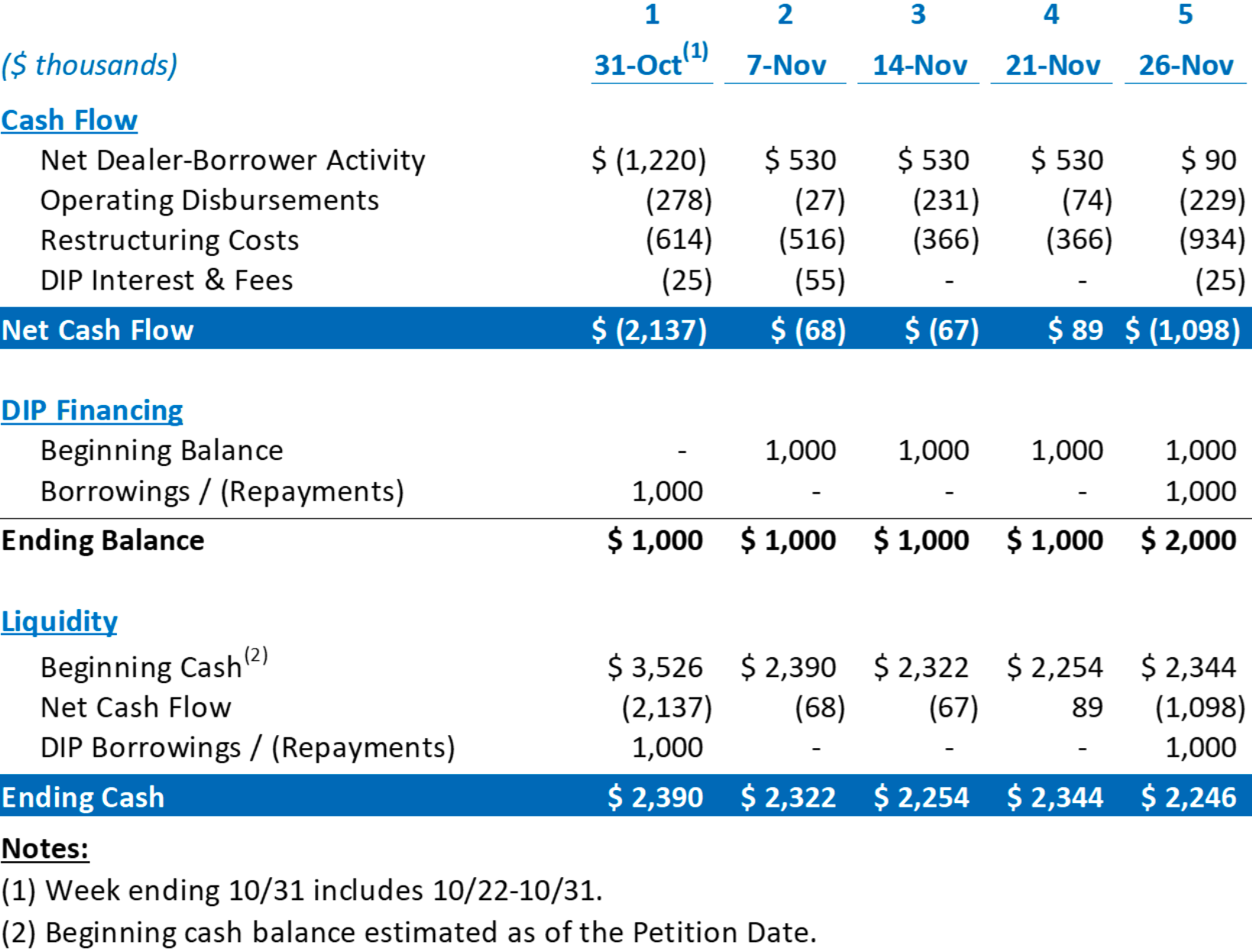

Upon filing, PrimaLend secured DIP financing commitments to ensure liquidity during the Chapter 11 case:

- PCP DIP Facility: Provided by the prepetition first-lien lender group (led by CIBC), this facility includes a $4 million new-money revolving credit line and a "roll-up" feature converting up to $12 million of prepetition PCP loans into postpetition DIP obligations (a 3:1 roll-up ratio). It carries priming liens and super-priority status, with LNCMJ and PCAP as guarantors.

- GFL Cash Collateral: For GFL, no separate DIP loan was obtained. Instead, GFL was authorized to use its cash collateral (generated from loan repayments and inventory sales) to fund ongoing lending to dealers under existing warehouse lines, with ANB receiving adequate protection.

The DIP financing and cash collateral orders allow PrimaLend to continue normal operations, including funding and servicing dealer loans, to preserve going-concern value. The Company emphasized that no dealer’s credit line would be cut or accelerated due to the filing, underscoring its commitment to maintaining relationships and business continuity. This strategic move aims to stabilize liquidity and provide a runway for the sale process under court supervision.

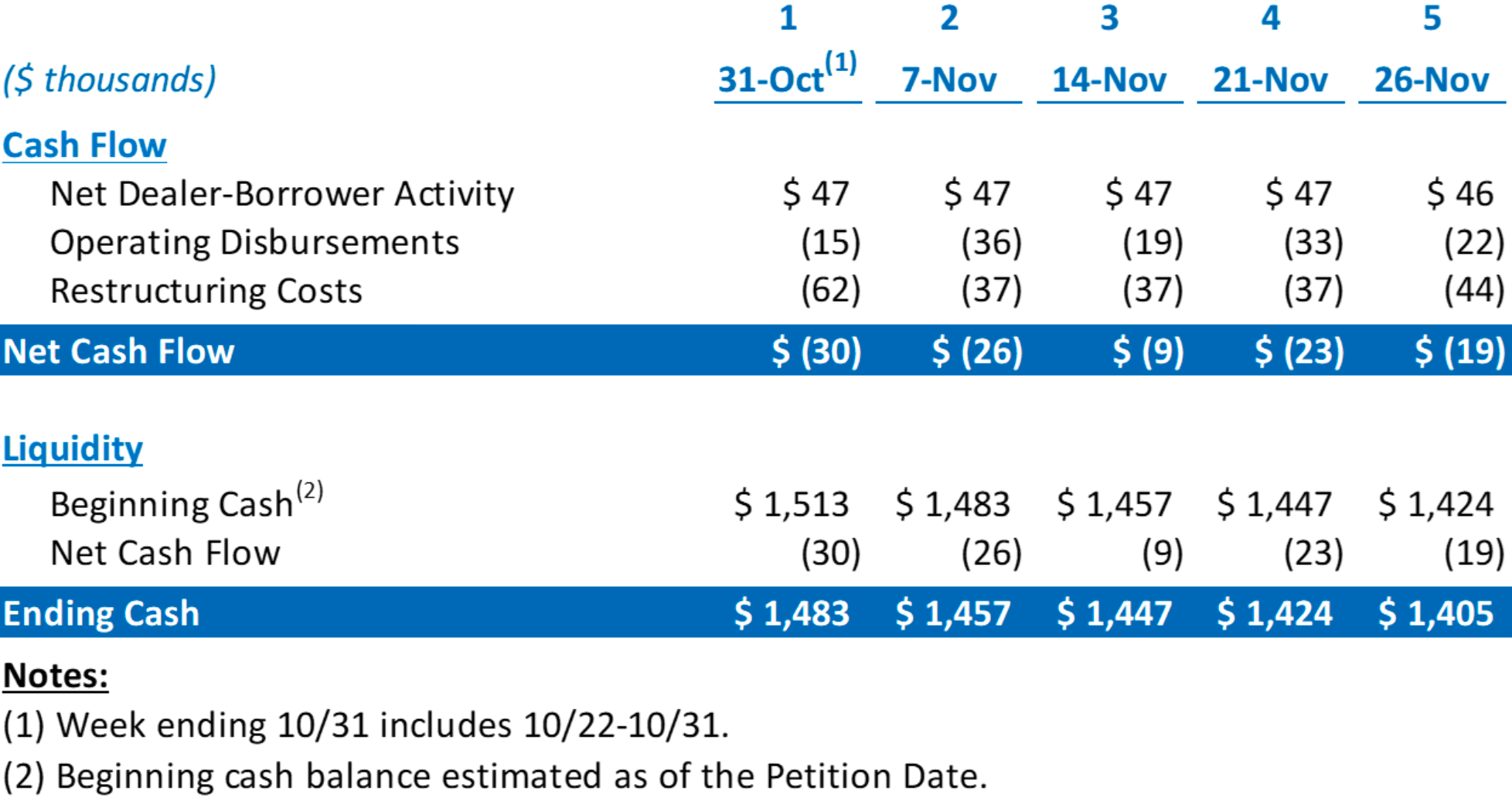

PrimaLend Capital Partners - DIP Budget

Good Floor Loans - Cash Collateral Budget

Key Parties

- Spencer Fane LLP (general bankruptcy counsel); FTI Consulting, Inc. (financial advisor / CRO, Tanya Meerovich); Houlihan Lokey, Inc. (investment banker); Willkie Farr & Gallagher LLP (legal counsel); Mark Jensen (president); Stretto, Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.