Case Summary: Prospect Medical Holdings Chapter 11

Prospect Medical Holdings has filed for Chapter 11 bankruptcy, citing financial and operational challenges from the pandemic, rising costs, and regulatory issues.

Business Description

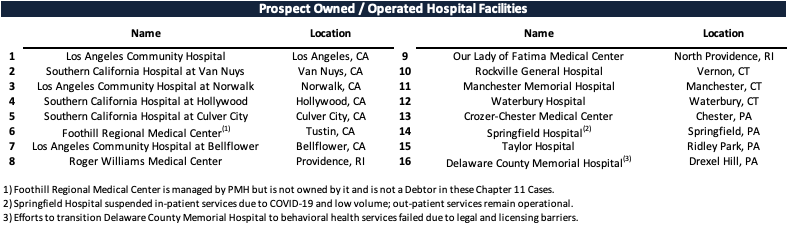

Headquartered in Los Angeles, CA, Prospect Medical Holdings, Inc. ("PMH"), along with its Debtor and their non-Debtor affiliates ("Prospect" or the "Company"), is a leading provider of healthcare services in California, Connecticut, Pennsylvania, and Rhode Island.

The Company currently owns and operates 16 acute and behavioral hospitals that offer a comprehensive range of services tailored to their specific communities.

- These hospitals provide partnerships with other area hospitals, physicians, and health plans.

As of the Petition Date, the Debtors reported assets and liabilities totaling $1-$10 billion.

Corporate History

Founded in the mid-to-late 1990s as Alta Hospital Systems, Prospect commenced operations as a community hospital operator in Los Angeles, delivering critical healthcare services to underserved populations.

- Today, the Company encompasses over 100 entities across multiple jurisdictions.

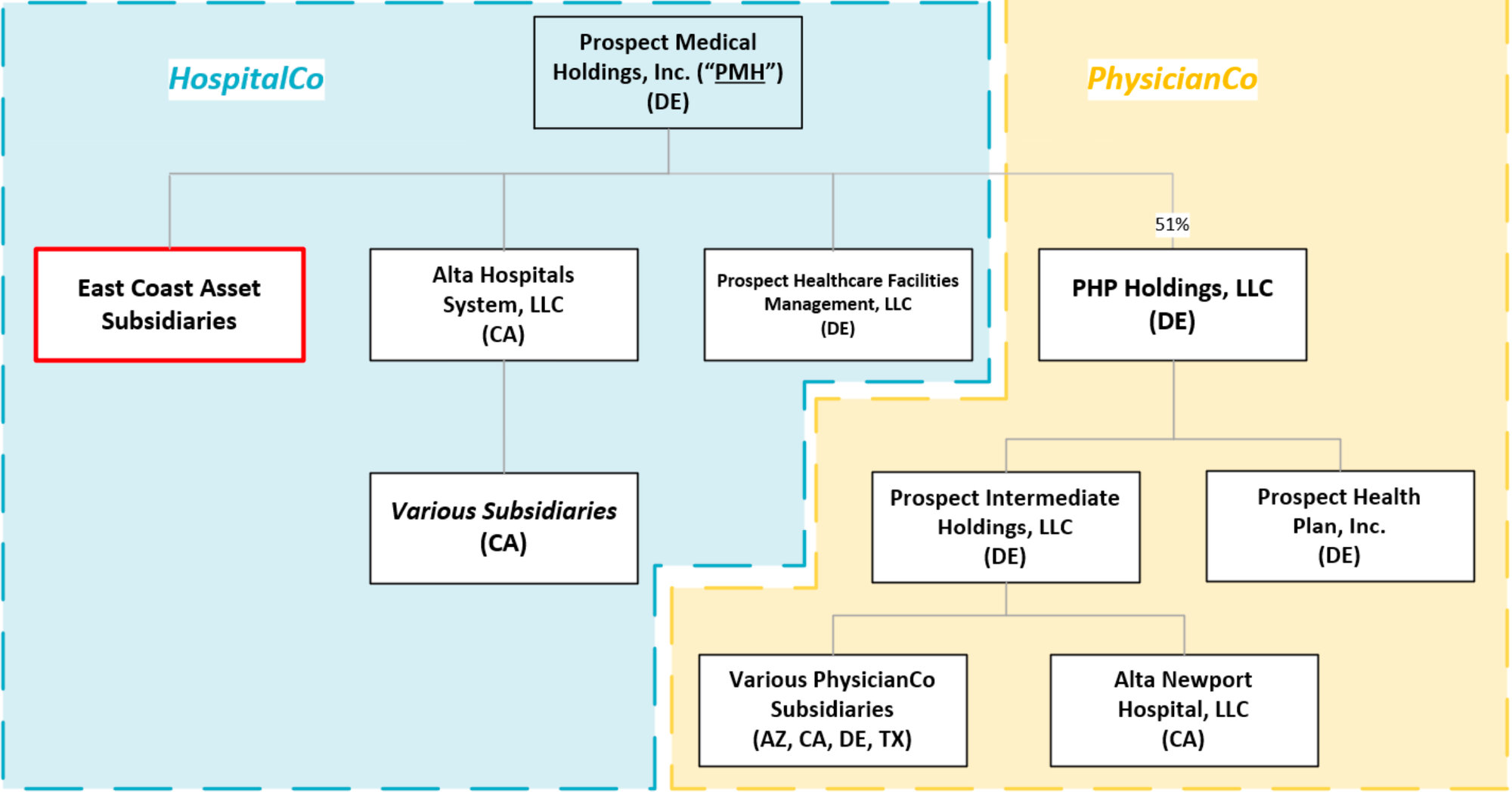

The organization operates through two primary divisions:

- HospitalCo: PMH and its hospital subsidiaries.

- PhysicianCo: PHP Holdings and its subsidiaries, which are non-Debtor entities in the Chapter 11 Cases.

PMH serves as the parent holding company of HospitalCo and owns a 51% majority stake in PHP Holdings, the parent company of PhysicianCo.

Prospect Healthcare Facilities Management, LLC, a wholly-owned subsidiary of PMH, manages PHP Holdings and other PhysicianCo entities, including Foothill Regional Medical Center.

Key Acquisitions and Expansion

- February 2012: Acquired Nix Health Care System, establishing operations in Texas.

- June 2014: Formed a joint venture in Rhode Island, acquiring majority ownership of CharterCARE and sharing governance with the CharterCARE Community Board.

- March 2016: Acquired East Orange General Hospital in New Jersey.

- July 2016: Expanded into Pennsylvania with the acquisition of Crozer-Keystone Health System.

- 2016: Extended operations in Connecticut with the acquisition of three acute care hospitals, including Eastern Connecticut Health Network and Waterbury Hospital.

Strategic Investments

- From 2014 to 2020, the Company invested approximately $420 million in capital expenditures across Rhode Island, Connecticut, Pennsylvania, California, Texas, and New Jersey.

Governance and Strategic Review

- October 4, 2024: PMH established a special committee and appointed Alan Carr and Elizabeth Abrams as independent directors to evaluate strategic alternatives and potential settlement terms.

- October 21, 2024: In preparation for a forbearance agreement with Medical Properties Trust, Inc. and its affiliates (collectively “MPT”), the special committee was disbanded, and Elizabeth Abrams was replaced by Jeremy Rosenthal.

- The reconstituted Special Committee, including Independent Managers and advisory members, was tasked with evaluating conflicts of interest and pursuing strategic opportunities.

Operations Overview

Prospect operates across three core segments: Hospitals, Medical Groups, and Independent Physician Associations, with each tailored to specific healthcare delivery needs and market demands.

Hospitals:

- Encompasses ownership and operation of 16 acute care and behavioral hospitals, providing comprehensive inpatient and outpatient services.

- Hospitals engage with local providers, including other hospitals, physicians, and health plans, to deliver community-focused healthcare.

- Facilities serve as safety-net hospitals in states like California, Connecticut, Rhode Island, and Pennsylvania, ensuring access regardless of patients’ financial status.

Medical Groups:

- Networks of independent physicians offering managed care services in collaboration with Health Maintenance Organizations ("HMOs").

- Designed to incentivize preventative care and reduce unnecessary procedures, enhancing efficiency and patient outcomes.

- Affiliation provides independent physicians with practice-building support, while HMOs gain streamlined contracting and outsourced administrative functions.

Independent Physician Associations:

- Focuses on managing physician services for HMO enrollees through a network of employed and affiliated independent physicians.

- Prospect Health Plan, Inc., a non-Debtor entity, operates under a limited Knox-Keene license in California to offer comprehensive health insurance plans.

- Participates in value-based payment models such as capitation and bundled payments, fostering operational and financial efficiencies.

Community Engagement and Impact

Prospect’s hospitals and healthcare programs emphasize community health and wellness, with a commitment to underserved populations.

California Initiatives:

- The Company's California hospitals are members of PEACH, contributing significantly to the state's charity care initiatives, providing $2.9 million in charity care in FY2023.

- PEACH hospitals contribute over $400 million annually in safety-net hospital charity care.

- Behavioral health operations include 91 licensed beds and outpatient services for over 9,000 patients annually.

- Designated as Disproportionate Share Hospitals, these facilities are pivotal in meeting underserved community healthcare needs.

Pennsylvania Initiatives:

- Debtor Prospect Crozer, LLC provided nearly $80 million in charity care during the 2020–2021 reporting period.

- Continued development of wellness, education, and outreach programs to address diverse community needs in Delaware County and beyond.

- Focused efforts on improving healthcare access, supporting underserved groups, and promoting medical education.

- During the pandemic, nearly 100,000 vaccines were administered, alongside extensive safety and resource outreach efforts.

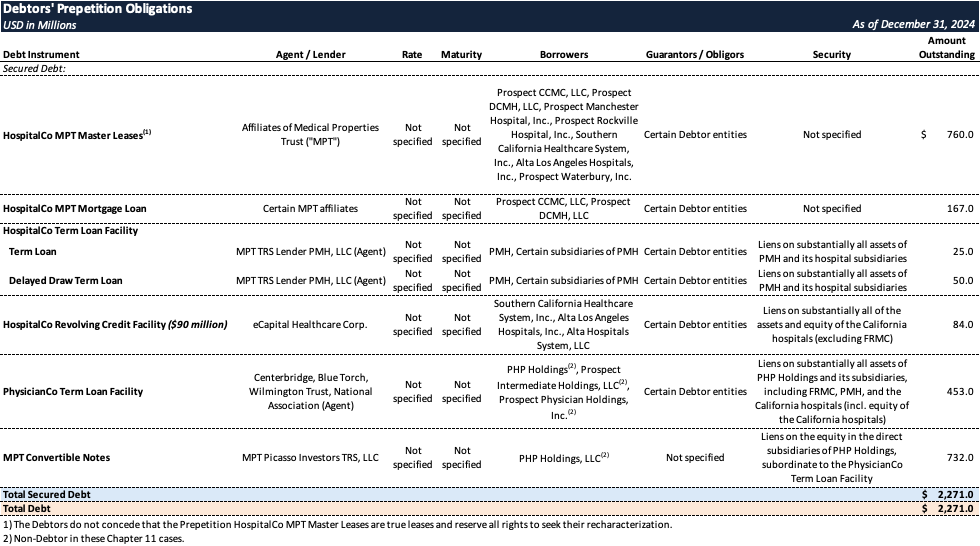

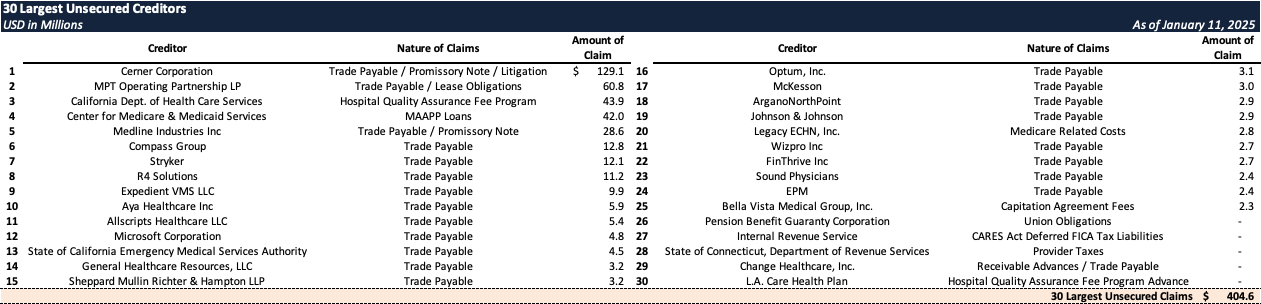

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Operational and Financial Challenges

- The Company expanded its operations through acquisitions of hospital systems in Texas, Rhode Island, New Jersey, Pennsylvania, and Connecticut from 2012 to 2016. While growth initially provided opportunities, the acquired hospitals introduced significant operational and financial complexities.

- The Company assumed three underfunded pension plans through acquisitions, with an aggregate underfunding liability of $312 million as of November 2024.

- Missed minimum contributions triggered statutory liens on 61 entities, compounding financial strain.

- COVID-19 Pandemic Impact:

- Disrupted normal operations, including postponed elective procedures and reduced patient volumes, leading to depressed revenue.

- Increased costs for labor, medical supplies, and specialized equipment needed for COVID-19 care.

- Despite partial recovery in outpatient visits, volumes remained below pre-pandemic levels, further straining financial performance.

- Inflation and Cost Pressures:

- Rising labor costs, including a reliance on expensive contract staff, exacerbated operational expenses.

- Inflation-driven increases in medical supply and drug costs outpaced reimbursement rates, particularly for Medicare and Medicaid patients.

Liquidity Challenges and Financial Obligations

- Declining Liquidity:

- As of September 30, 2024, outstanding liabilities under the CARES Act reached $33 million, including accrued penalties and interest.

- Efforts to secure bridge financing were unsuccessful, leaving the Company without adequate liquidity to meet ongoing obligations.

- 401(k) Savings Plan:

- The Company’s 401(k) Savings Plan is underfunded by nearly $48 million, constituting an ERISA violation.

- This underfunding could result in severe tax consequences for both the Company and plan participants if the plan is disqualified by the IRS.

- Unions:

- The Company employs about 5,500 union employees across various facilities.

- As of the Petition Date, $1.4 million in withheld dues remained to be remitted to the relevant unions.

Litigation and Regulatory Challenges

- Pennsylvania Litigation:

- The Pennsylvania Attorney General filed suit against the Company in October 2024, alleging mismanagement and seeking the appointment of a receiver for Crozer Health.

- The lawsuit cited failures to meet purchase agreement obligations, including pension funding and maintaining essential service lines.

- Connecticut Litigation:

- Yale New Haven Health Services Corporation filed a lawsuit in May 2024 to terminate its agreement to acquire Connecticut hospitals, further delaying the Company’s divestiture plans and compounding operational losses.

- Rhode Island Regulatory Concerns:

- On January 13, 2025, the Rhode Island Department of Health and the Attorney General submitted filings alleging mismanagement and urging a prompt transition of the hospitals to more responsible ownership.

- Roger Williams Medical Center and Our Lady of Fatima Hospital handle over 50,000 annual ER visits and provide ~20% of Rhode Island’s behavioral health beds, serving uninsured and underinsured populations.

- The Attorney General highlighted a 2018 payout of $457 million in shareholder dividends, which reduced cash on hand to precarious levels.

- Daily revenue "sweeps" from the hospitals to corporate accounts exacerbated local financial pressures.

- Unapproved reductions in pediatric and primary-care services left Medicaid- and Medicare-dependent patients with fewer options.

- On January 13, 2025, the Rhode Island Department of Health and the Attorney General submitted filings alleging mismanagement and urging a prompt transition of the hospitals to more responsible ownership.

- Other Litigation: Claims span multiple jurisdictions and involve business disputes, employment matters, and patient care allegations, including negligence and wrongful death.

- Civil Investigative Demands:

- Department of Justice: Allegations of False Claims Act violations for submitting inaccurate codes to increase Medicare Advantage and Medi-Cal payments.

- Connecticut Department of Consumer Protection: Investigations into data breaches and unfair funding practices under the Connecticut Unfair Trade Practices Act.

- U.S. Senate Investigation and Report:

- On January 7, 2025, the Senate Budget Committee released a report criticizing the Company’s majority owner, Leonard Green & Partners, for allegedly prioritizing shareholder returns over patient care, exacerbating facility closures and financial distress.

Strategic Transactions and Sale Processes

- From 2019 to 2022, the Company initiated the sale of its Texas and East Coast hospital assets to reduce financial burden:

- Texas hospital operations were wound down after failing to secure a buyer, while other divestitures faced significant regulatory and legal hurdles.

- The Rhode Island sale remains delayed due to regulatory requirements, while the Connecticut sale has been obstructed by litigation.

- In November 2023, Morgan Stanley was retained to market PhysicianCo assets, culminating in a $745 million purchase agreement with Astrana Health, expected to close in Q2 2025.

Prepetition Restructuring Efforts

- 2023 Liability Management Transaction:

- A $375 million capital infusion from Centerbridge and Blue Torch, allowing repayment of $200 million in ABL obligations.

- Establishment of PHP Holdings as the parent entity for non-debtor assets, streamlining corporate structure.

- Operational Turnaround Initiatives:

- Implemented cost-cutting measures and service line optimization, particularly in California hospitals, which achieved financial stability despite broader challenges.

- Efforts to stabilize East Coast hospitals were less successful due to demographic shifts, lingering pandemic effects, and regulatory constraints.

DIP Financing and Chapter 11 Filing

- DIP Facility: In the weeks leading to the Chapter 11 filing, JMB Capital committed $100 million in DIP financing to:

- Support day-to-day operations and ensure uninterrupted patient care.

- Facilitate asset sales under section 363 of the Bankruptcy Code, including pending transactions in Rhode Island and with Astrana Health.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.