Case Summary: Publishers Clearing House Chapter 11

Publishers Clearing House has filed for Chapter 11 bankruptcy amid mounting legal settlements, rising operational costs, and a stalled digital transition, supported by $5.5 million in DIP financing to maintain operations and explore a going-concern sale.

Business Description

Headquartered in Jericho, NY, Publishers Clearing House LLC ("PCH" or the "Company"), is a digital entertainment and media company primarily known for its free-to-play games and sweepstakes offering chances to win cash and prizes. Originally founded as a mail-order magazine subscription service, PCH has transitioned its business model to focus on generating revenue through digital advertising displayed across its network of websites and mobile applications.

- Key digital properties include PCH.com, PCH Search & Win, PCH Lotto, PCH Games, and PCH FrontPage, which attract millions of users engaging with sweepstakes entries, trivia, and casual games.

- The Company leverages its sweepstakes model to collect first-party user data (with figures previously reported at over 170 million opt-in users), enabling targeted advertising campaigns for brands through its media division (branded as "PCH/Media").

Following strategic shifts, PCH announced in 2025 its complete exit from the legacy mail-order merchandise and magazine subscription businesses to operate as a pure digital advertising business centered on free-to-play entertainment. The iconic "Prize Patrol," known for surprising winners with oversized checks, remains a core element of its brand identity and marketing.

As of the Petition Date, following the full wind-down of its commerce division at the close of 2024, the Company’s ongoing operations are projected to generate annual gross revenue of approximately $38 million.

- In FY 2024, during the final phase of the commerce division’s closure, PCH reported revenue of approximately $181.9 million (including magazine and merchandise), down nearly 46% from $336.8 million in FY 2023.

PCH filed for Chapter 11 protection on April 9, 2025, in the U.S. Bankruptcy Court for the Southern District of New York. As of the Petition Date, the Company reported $1 million to $10 million in assets and $50 million to $100 million in liabilities.

Corporate History

PCH was founded in 1953 by Harold and LuEsther T. Mertz and their daughter Joyce as a partnership operating from their Long Island home. Initially, the business focused on offering magazine subscriptions from multiple publishers through a single direct mail campaign, described by Harold Mertz as a "car pool for publishers."

- The Company was reformed as a New York limited partnership in 1957 and later converted to a New York limited liability company in 2002.

Introduction of Sweepstakes and Prize Patrol

- In 1967, PCH introduced its highly successful direct mail sweepstakes, allowing entry regardless of purchase and quickly becoming a Company hallmark alongside magazine offers. PCH became one of the largest mailers in the U.S. during the 1960s-1990s.

- The iconic PCH "Prize Patrol" was established in 1989, featuring employees surprising winners at their homes with oversized checks. These filmed events became central to PCH's advertising and achieved significant cultural recognition.

Diversification and Digital Transition

- Facing challenges in the magazine industry, PCH diversified in the early 1990s by adding merchandise (books, collectibles, home goods) to its direct mail offerings, which initially sustained growth.

- Beginning in the late 1990s, PCH expanded into digital marketing via pch.com, acquiring several digital businesses to bolster its online presence:

- Blingo (search, 2006, later PCH Search & Win)

- Funtank (online gaming, 2010)

- Liquid Wireless (mobile marketing, 2012)

- Topix (quiz content, 2019)

- Wide Open Media (digital publishing, 2020)

- These digital efforts, combined with its ongoing e-commerce business, propelled Company revenue towards the $1 billion mark around 2018.

Industry Leadership and Philanthropy

- Historically, PCH employees held leadership roles in direct marketing associations (e.g., DMA committees) and consumer protection groups (e.g., National Consumers League, Better Business Bureau involvement), contributing to industry standards and ethics.

- The founding Mertz family established a significant history of philanthropy, starting with The Mertz Foundation in 1959. Over the years, more than 40% of PCH profits have supported charitable causes, including the arts (Joyce Theater, Lincoln Center, Public Theater), environmental protection, civil rights, medical research (Mertz Retinal Research), and public television. PCH has also contributed over $1 million to St. Jude Children’s Research Hospital through its consumer-facing "Giveback" campaign.

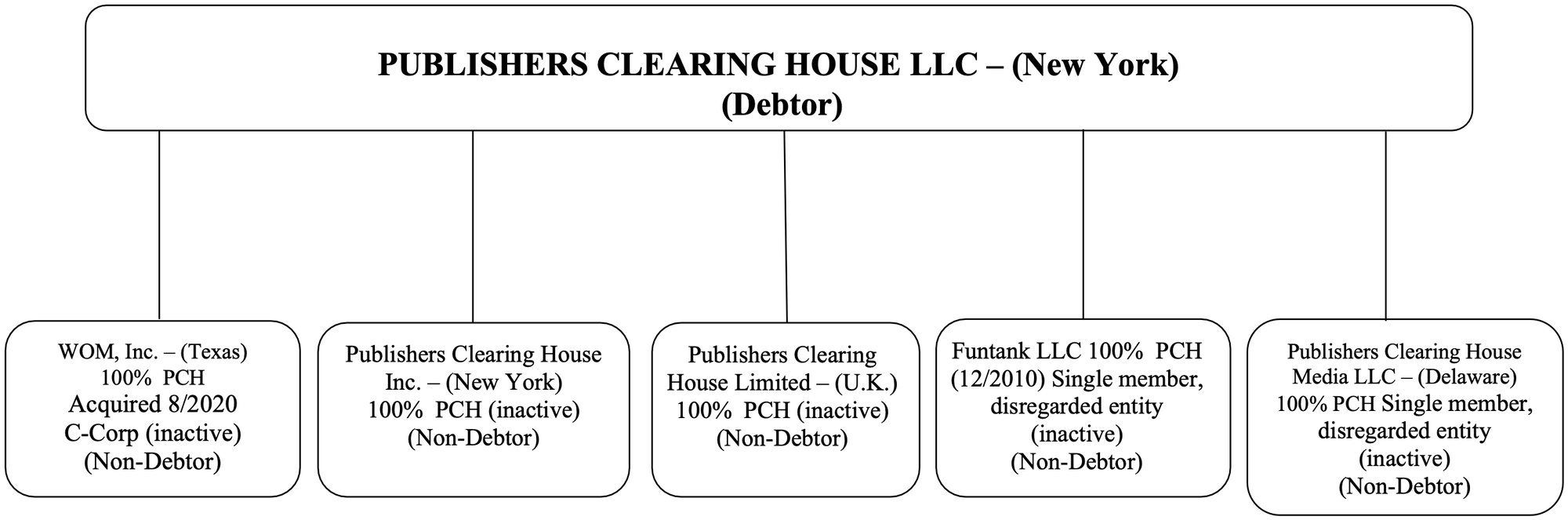

Organizational Structure

Ownership and Governance

- PCH remains privately held, essentially a family-owned company. Equity is held by individuals (Mertz family successors/beneficiaries) and charitable trusts/interests established by the founders (constituting almost 55% of equity).

- Shareholders play no role in management; no family members are employed by or hold executive power at PCH.

- Andrew "Andy" Goldberg currently serves as President, CEO, and Chairman, having overseen the recent digital transformation.

Operations Overview

Following the closure of its commerce division at the end of 2024, PCH's operations are now centered entirely on its digital publishing business. The Company manages a network of web and app-based entertainment properties featuring free-to-play games, quizzes, and other content integrated with its signature sweepstakes opportunities. Key properties include:

- PCH.com (main sweepstakes portal)

- PCH Search & Win (rewards for web searches)

- PCH Lotto (daily cash drawings)

- PCH Games/Slots/Casino (casual games rewarding tokens/entries)

- PCH Quiz and Trivia (skill-based entries)

- PCH FrontPage (news portal with integrated prize chances)

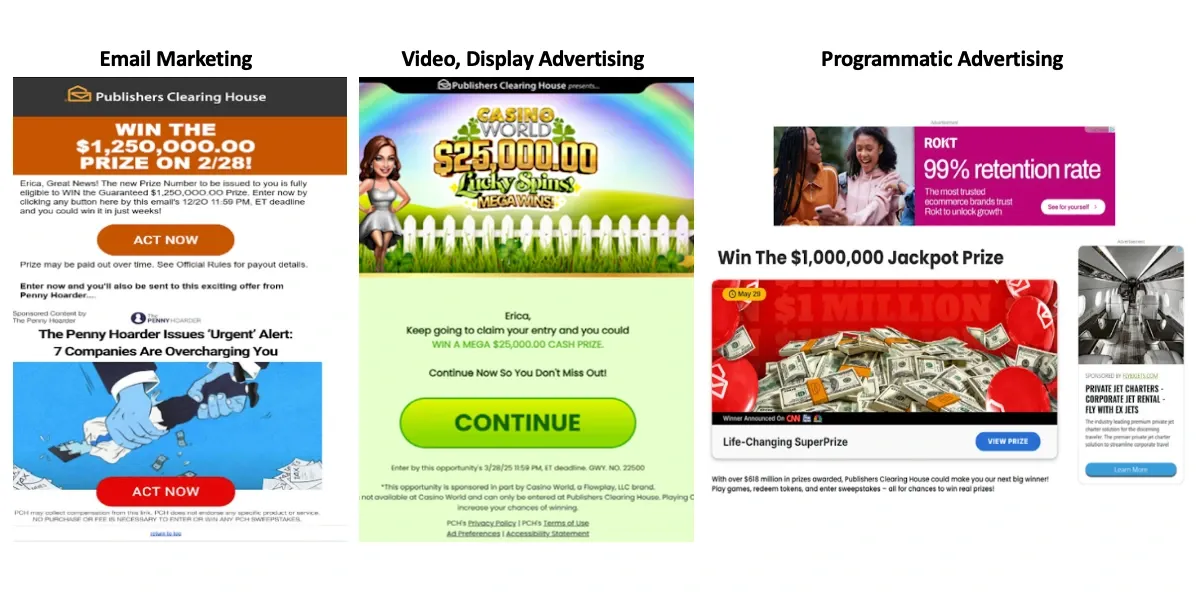

Revenue Model and Digital Advertising

- PCH generates revenue primarily through its PCH/Media division by selling digital advertising space to consumer brands and advertising agencies.

- The Company monetizes its large and engaged user base (approximately 36 million visitors in 2024) through various ad formats, including:

- Email marketing

- Video advertising

- Display advertising

- Programmatic advertising

- A key operational strength lies in PCH's use of its rich first-party data and analytics to optimize user engagement and offer advertisers highly targeted placements, enabling them to reach specific demographic or affinity groups effectively.

Workforce

- As of the filing date, PCH employs approximately 105 individuals.

- This represents a significant downsizing over the prior year, during which approximately 300 employees were terminated as the Company restructured and exited the commerce business.

Key Operational Assets

- PCH's current operations rely on its digital platforms (websites and apps), proprietary content, extensive customer database (first-party data), strong brand recognition associated with PCH and the Prize Patrol, and related intellectual property, including trademarks and domain names.

Prepetition Obligations

As of the Petition Date, PCH reported minimal prepetition secured debt, limited to specific computer equipment leases and certain personal property securing its premises lease. Aggregate unsecured liabilities total approximately $40 million, primarily owed to vendors, employees, and landlords.

- Significant liabilities also arise from customer prize obligations, including ~$1.8 million currently due for prepetition lump-sum awards and an estimated ~$26 million liability (present value, discounted at 11%) for long-term annuity prizes (~$1.9 million payable in 2025).

- Additionally, specific prepetition payables related to ongoing customer programs total approximately $0.7 million (comprising ~$175 thousand for advertiser/user acquisition, ~$80 thousand for marketing, and ~$446 thousand for critical program vendors). Minor liabilities exist for uncashed prepetition prize (~$167 thousand) and refund (~$145 thousand) checks.

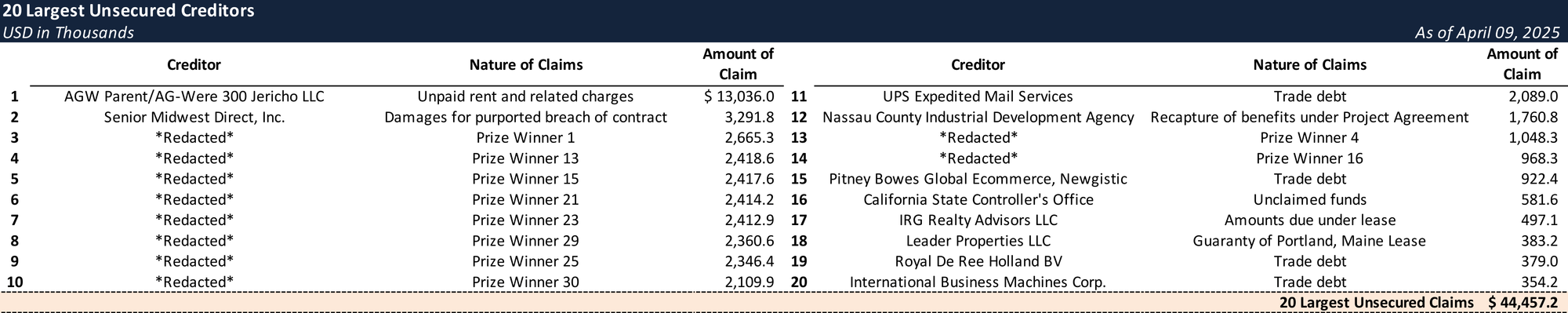

Top Unsecured Claims

Events Leading to Bankruptcy

Legal and Regulatory Challenges

- The Company faced prolonged regulatory scrutiny regarding its sweepstakes marketing practices, dating back to the late 1990s. State Attorneys General and Congress raised concerns that consumers might mistakenly believe purchasing products improved their odds of winning.

- This scrutiny resulted in multiple costly settlements over the years:

- Settlements totaling $52 million with various states initiated around 2000 ($18 million with 24 states, $34 million with 23 others shortly after).

- An additional $3.5 million settlement in 2010 involving 32 states and the District of Columbia, expanding previous terms.

- More recently, the Federal Trade Commission (FTC) revisited these issues in 2018, alleging unclear "no purchase necessary" disclosures and the use of manipulative online "dark patterns."

- Despite PCH's defense citing that 99% of entries were non-purchase, the potential for protracted litigation and injunctive actions led the Company to settle for $18.5 million.

- This settlement occurred when PCH was already grappling with significant operational and financial headwinds, adding to the Company's financial strain and distracting from core business issues.

Operational and Market Headwinds

- PCH encountered escalating operational costs related to product sourcing, shipping, and particularly postal rates, which rose significantly even as efforts by the direct marketing industry to negotiate volume discounts with the Postal Service failed.

- The Company faced intensifying competition from large, well-funded e-commerce retailers like Amazon and Walmart, which offered broader product selections, free shipping and returns, and faster delivery, challenging PCH's traditional model.

- The effectiveness of PCH's primary customer acquisition channels diminished significantly:

- Direct Mail Marketing: Rising costs and the closure of other direct mail marketers led to a shrinking pool of available new mailing lists, hindering new customer acquisition.

- Television Advertising: Increased costs for TV spots combined with audience fragmentation across numerous channels and streaming platforms reduced the reach and cost-effectiveness of this formerly key channel.

- The COVID-19 pandemic exacerbated existing pressures, introducing inventory challenges, supply chain disruptions, and delayed shipments, while accelerating the consumer shift towards value-driven online retailers.

Digital Transformation Challenges

- As traditional channels weakened, PCH focused on leveraging its first-party customer data for digital revenue, but encountered significant obstacles:

- Industry-wide declines in programmatic advertising rates limited revenue potential.

- Google's delays in phasing out third-party cookies slowed the anticipated rise in value for PCH's first-party data.

- The ability to monetize its data assets with third parties progressed slower than expected.

- These digital transition efforts were further complicated by the concurrent FTC litigation.

- Ultimately, the financial burden of legacy business debts combined with the challenges and costs of transitioning to a digital-centric model created an unsustainable operating environment, leading directly to the Chapter 11 filing.

Chapter 11 Filing and Path Forward

- The Chapter 11 filing is intended as a strategic tool to restructure the balance sheet, shed burdensome legacy debts and leases associated with the defunct commerce business, and allow PCH to emerge as a streamlined digital media entity.

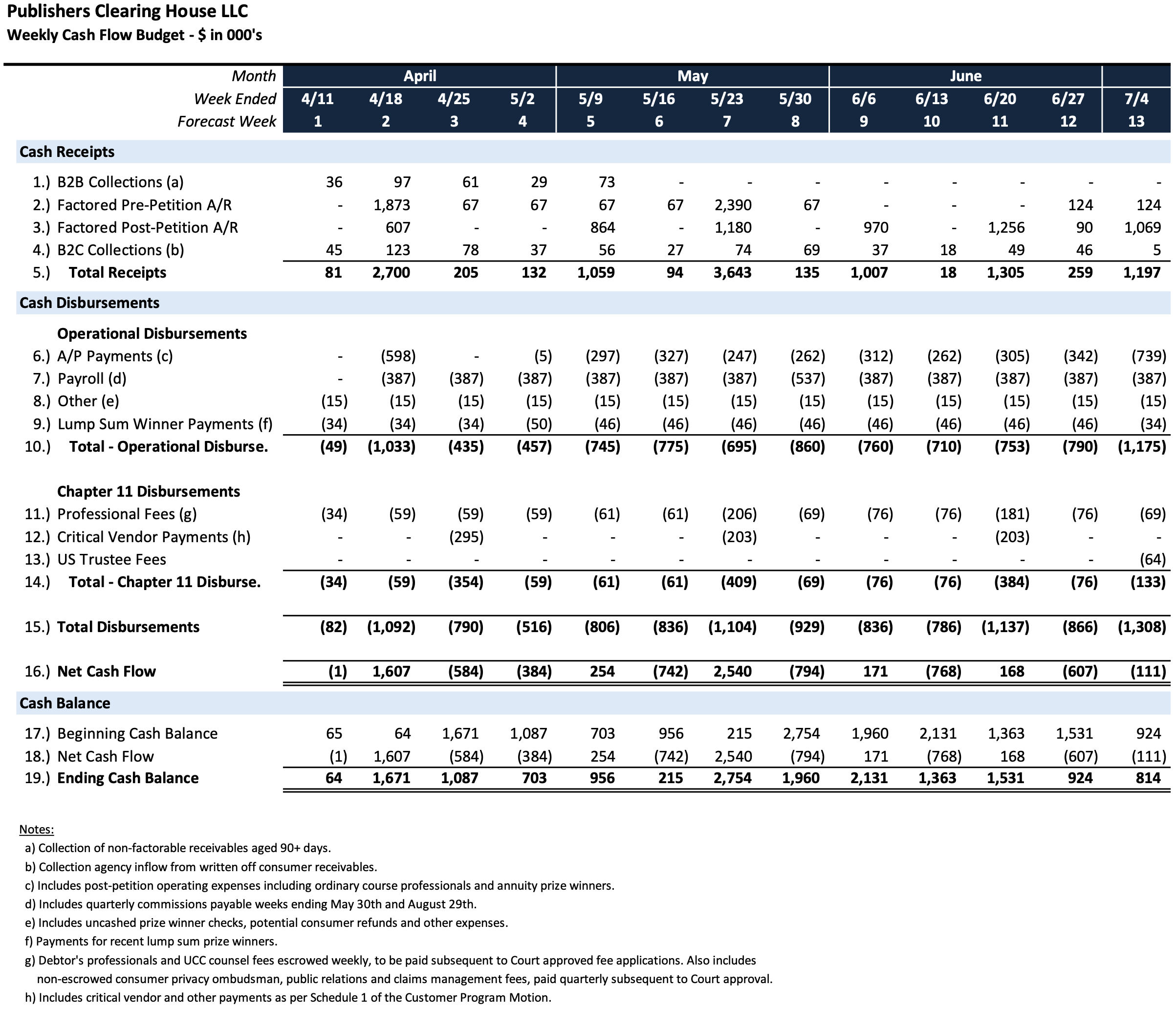

- To fund operations during the Chapter 11 case, PCH has sought court approval for a $5.5 million senior secured post-petition receivables purchase facility ($2.5 million available on an interim basis) provided by Prestige Capital Finance LLC.

- The DIP funds are critical for payroll, prize payments, maintaining digital platforms, customer acquisition, and other operating expenses.

- The Company aims to maximize value through restructuring and potentially exploring a sale of substantially all assets as a going concern, free and clear of legacy liabilities. SSG Capital Advisors has been retained as investment banker.

- PCH intends to seek the appointment of a consumer privacy ombudsman to oversee the protection of personally identifiable information during any potential asset sale, consistent with its Privacy Policy and applicable law.

- PCH emphasizes that operations, including prize awards and the Prize Patrol, will continue "business-as-usual" during the restructuring process, supported by the DIP financing.

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.