Filing Alert: Publishers Clearing House Chapter 11

Publishers Clearing House Files Chapter 11 in Southern District of New York

Update (April 10, 2025): Bondoro has published a full case summary for the Publishers Clearing House Chapter 11 filing.

Publishers Clearing House LLC, a New York-based sweepstakes and digital entertainment company known for its iconic “Prize Patrol” and ad-supported online gaming and media platforms, filed for Chapter 11 protection on Apr. 9 in the U.S. Bankruptcy Court for the Southern District of New York.

The filing follows mounting losses driven by the decline of its legacy direct mail and e-commerce businesses amid rising costs, shifting consumer behavior toward digital platforms, increased competition, and a costly 2018 FTC settlement. The company seeks to restructure its operations, shed legacy debts and leases, and potentially pursue a sale, supported by a proposed $5.5 million DIP receivables purchase facility from Prestige Capital Finance.

The company reports $1 million to $10 million in assets and $50 million to $100 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-10694.

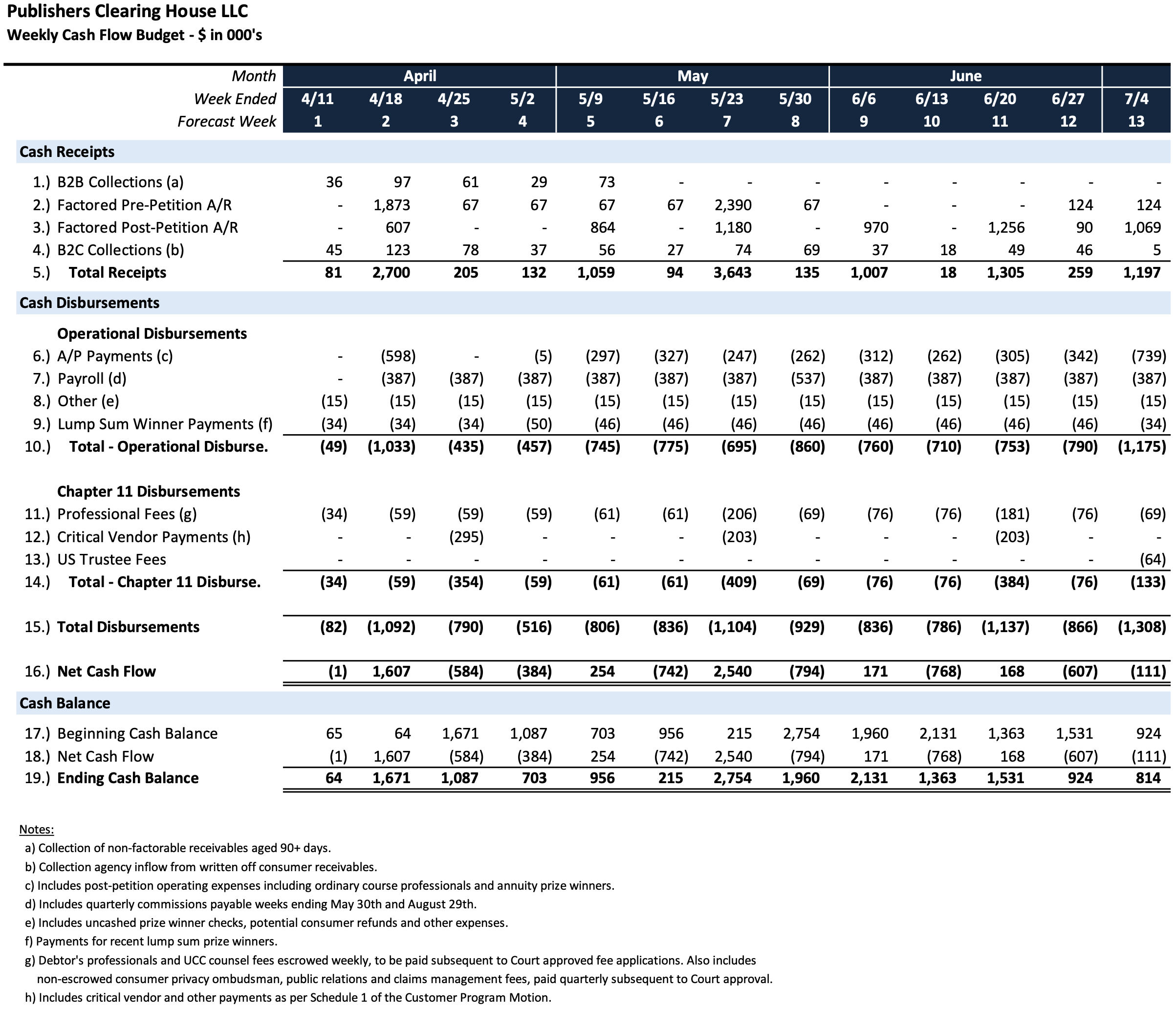

Initial Budget

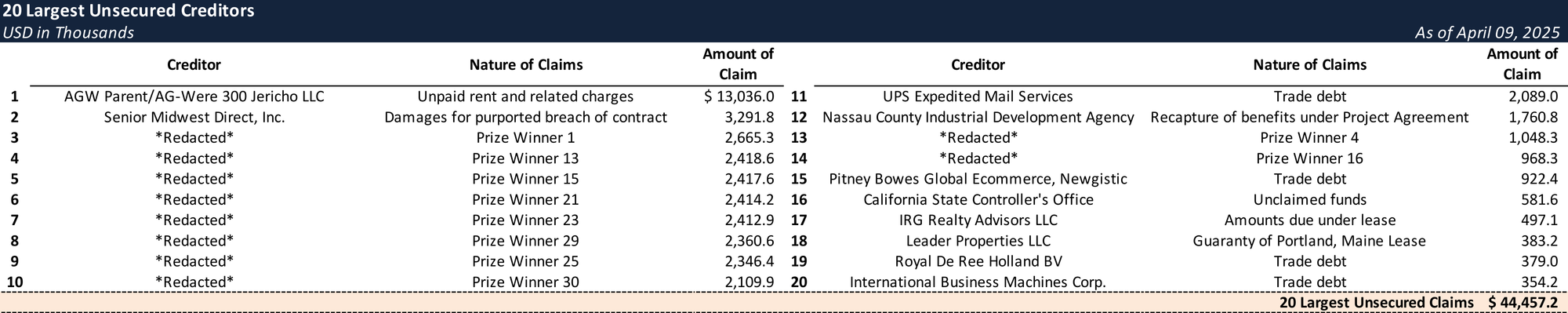

Top Unsecured Claims

Key Parties

Counsel:

- Tracy L. Klestadt

- Klestadt Winters Jureller Southard & Stevens, LLP

- Email: tklestadt@klestadt.com

Financial Advisors:

- Getzler Henrich & Associates LLC

Investment Banker:

- SSG Advisors, LLC

Signatories:

- William H. Henrich – Co-Chief Restructuring Officer

Claims Agent:

- Omni Agent Solutions, Inc.

Equity Security Holders:

- Elizabeth B. Gilmore – 16.1% Equity Interest

- Trust u/w Joyce M. Gilmore, F/B/O Mertz Gilmore Foundation – 10.6% Equity Interest

- LuEsther T. Mertz Legacy Trust for The New York Botanical Garden – 10% Equity Interest

- LuEsther T. Mertz Legacy Trust for The Public Theater – 10% Equity Interest

- Stephen Siller Tunnel to Towers Foundation – 10% Equity Interest

- First Mertz Trust – 8% Equity Interest

- Community Funds, Inc. – 6.8% Equity Interest

- Other Minority Holders – 28.5% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.