Case Summary: RBX, Humper Equipment Chapter 11

RBX, Inc. and Humper Equipment LLC filed for Chapter 11 bankruptcy due to vehicle performance issues and repossessions, aiming to stabilize operations and reorganize.

Business Description

RBX, Inc. (“RBX”) is a family-owned truckload carrier headquartered in Strafford, MO.

- RBX operates a fleet of over 200 power units and 53-foot dry van trailers, providing freight transportation services across 24 states in the Midwest and Southeast.

Humper Equipment LLC (“Humper”, and collectively with RBX, the "Debtors"), a related entity, is a Missouri-based limited liability company specializing in vehicle leasing.

- Many of the trucks operated by RBX are owned and leased through Humper.

A significant portion of the vehicles leased by Humper and operated by RBX are manufactured and financed by PACCAR, a global manufacturer of commercial trucks.

As of the Petition Date, the Debtors reported assets totaling $0-$50 thousand and liabilities totaling $10-$50 million.

Corporate History

RBX was founded in 1983 by Randall Walker as a truckload carrier and has since expanded its operations to service contracts with numerous national and regional clients.

Humper was established to complement RBX’s operations by managing the acquisition and leasing of vehicles required for the fleet.

Operations Overview

Service Area and Terminals

RBX operates primarily in the Midwest and Southeast, serving 24 states with a focus on major cities such as Chicago, Dallas, and Atlanta.

The Debtors maintain terminals in Strafford, MO, and Macon, GA, with the latter specializing in same-day delivery within a 250-mile radius.

Fleet Composition

The fleet consists of over 200 power units and 53-foot dry van trailers, many of which are leased through Humper.

Vehicles are predominantly sourced from PACCAR, known for their Kenworth and Peterbilt brands.

Safety and Compliance

RBX emphasizes safety and reliability, maintaining a 96-98% on-time service rate.

The company is Hazmat certified and adheres to industry safety standards.

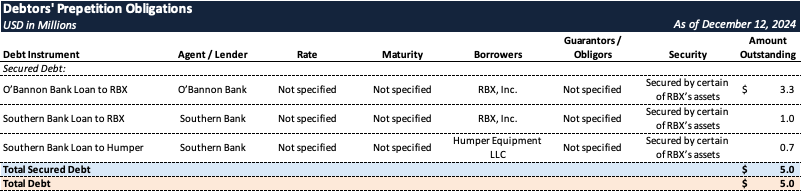

Prepetition Capital Structure

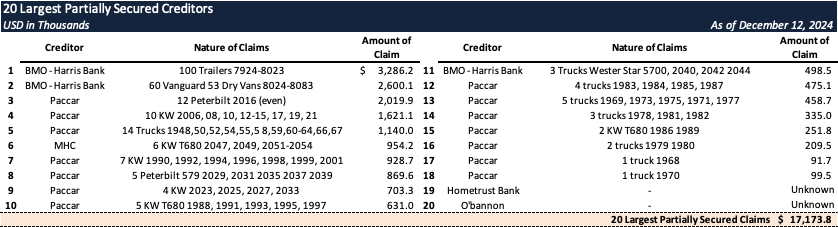

Top Unsecured Claims

Events Leading to Bankruptcy

Performance Issues with PACCAR Vehicles

Prior to the bankruptcy filing, the Debtors encountered significant challenges stemming from the performance of PACCAR-manufactured vehicles in RBX’s fleet.

- These issues led to substantial downtime and increased maintenance costs, which RBX attributed to design flaws in PACCAR trucks and PACCAR’s failure to address these defects.

- The resulting performance challenges substantially increased RBX’s cost of business and required significant efforts to minimize disruptions to customers.

Financial Impact

Due to these challenges, the Debtors were unable to fulfill their financing obligations to PACCAR in full and sought to renegotiate the terms of their financing agreements to account for the operational disruptions caused by the PACCAR vehicles.

Repossessions by PACCAR

Following the unresolved disputes, PACCAR initiated repossession of the Debtors’ vehicles, exacerbating operational challenges.

The repossession of critical assets prompted the Debtors to file for Chapter 11 bankruptcy protection to halt further repossessions and seek the return of repossessed vehicles.

Strategic Objectives in Bankruptcy

Through the Chapter 11 process, the Debtors aim to:

- Stabilize operations by addressing the vehicle performance issues.

- Resolve the dispute with PACCAR to secure the fleet necessary for continued operations.

- Develop a reorganization plan that maximizes value for creditors and ensures the long-term viability of the business.

Enjoyed this summary? Stay informed on new Chapter 11 filings over $10 million in liabilities—subscribe to Bondoro for free and get insights delivered directly to your inbox.

Plus, explore our full archive for all past summaries.