Case Summary: Remember Me Senior Care Chapter 11

Remember Me Senior Care has filed for Chapter 11 bankruptcy following the alleged unauthorized issuance of debt and misappropriation of funds by a former member.

Business Description

Headquartered in Cleveland, TN, Remember Me Senior Care, LLC (“Remember Me”), along with its Debtor affiliate⁽¹⁾ (collectively, the "Debtors"), operates a boutique assisted living and memory care community consisting of five secured-access residential homes functioning as a single neighborhood.

- The facility offers 60 units under a 70-bed license, relying on private pay (no federal funding), with monthly rates averaging $7,900 for single rooms and $11,850 for shared rooms.

- In 2024, the Debtors reported $5.9 million in revenue and had 82 employees as of the Petition Date.

The Debtors filed for Chapter 11 protection on Feb. 24 in the U.S. Bankruptcy Court for the Eastern District of Tennessee. As of the Petition Date, the Debtors reported $0 to $50,000 in assets and $10 million to $50 million in liabilities.

⁽¹⁾ Lighthouse Land Holdings, LLC

Corporate History

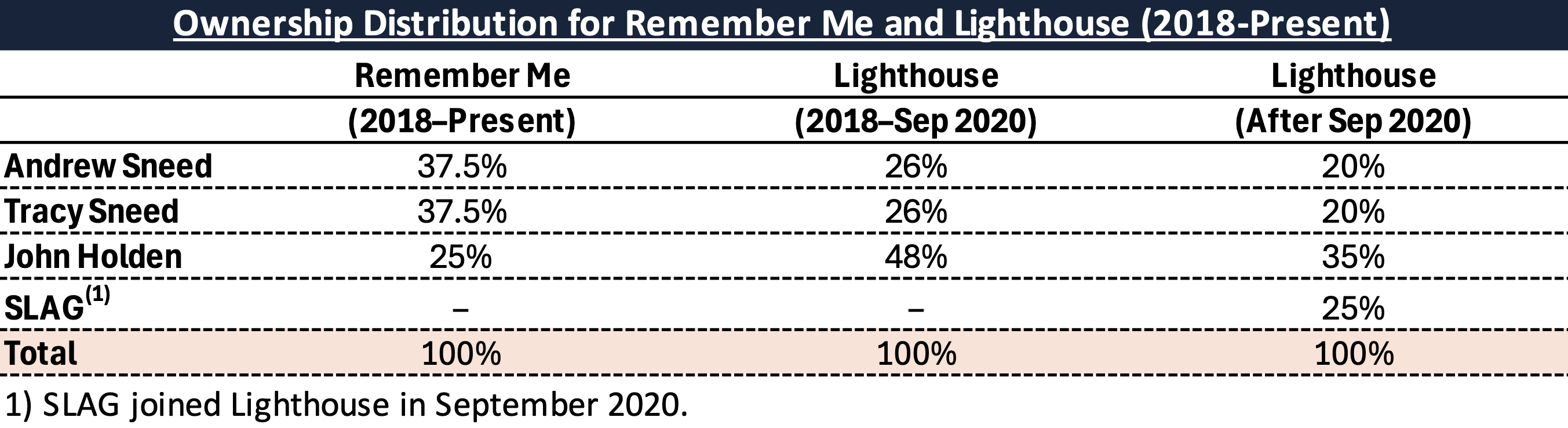

Remember Me and Lighthouse were formed in 2018 by Andrew Sneed, Tracy Sneed, and John Holden with the goal of providing personalized senior care in a small-home setting.

- In August 2018, Remember Me engaged Solinity Services, LLC for financial management and consulting, while Lighthouse operated independently.

- In September 2020, SLAG Investments, LLC (“SLAG”) joined Lighthouse, leading to a redistribution of membership interests. The table below outlines the original allocations and subsequent changes.

Leadership Changes

Former President Andrew Sneed was removed following allegations of unauthorized financial activities. By May 2024, he had fully relinquished his membership interests in both companies.

Operations Overview

The Debtors operate a secure, small-home community providing assisted living and memory care services. Each of the five residences features private and shared living spaces, courtyards, and kitchens, fostering a familiar neighborhood atmosphere for residents.

- Personalized Care: Staff provide 24/7 support with activities of daily living (ADLs), medication management, and specialized dementia programming.

- All-Inclusive Pricing: Private-pay fees cover housing, meals, personal care, housekeeping, laundry, and other standard assisted living services.

- Medical Partnerships: The Debtors collaborate with hospice providers and physician services to ensure comprehensive medical oversight, supporting residents with cognitive impairments.

Key Assets

The Debtors' asset portfolio includes five residential care homes, a central management office, and related infrastructure, with a total estimated value of approximately $20 million.

- As of the Petition Date, the Debtors had approximately $115,000 in cash.

Prepetition Obligations

The Debtors’ capital structure primarily supported the $16 million development of their assisted living community.

- A $13 million construction loan from Andrew Johnson Bank funded most of the project. The loan’s terms, including interest rate and maturity, have not been disclosed.

- Approximately $10.9 million in debentures remain outstanding.

- These debentures were allegedly issued unilaterally and without proper authorization by former executive Andrew Sneed.

- Investigations suggest that the proceeds were never deposited into company accounts and remain unaccounted for.

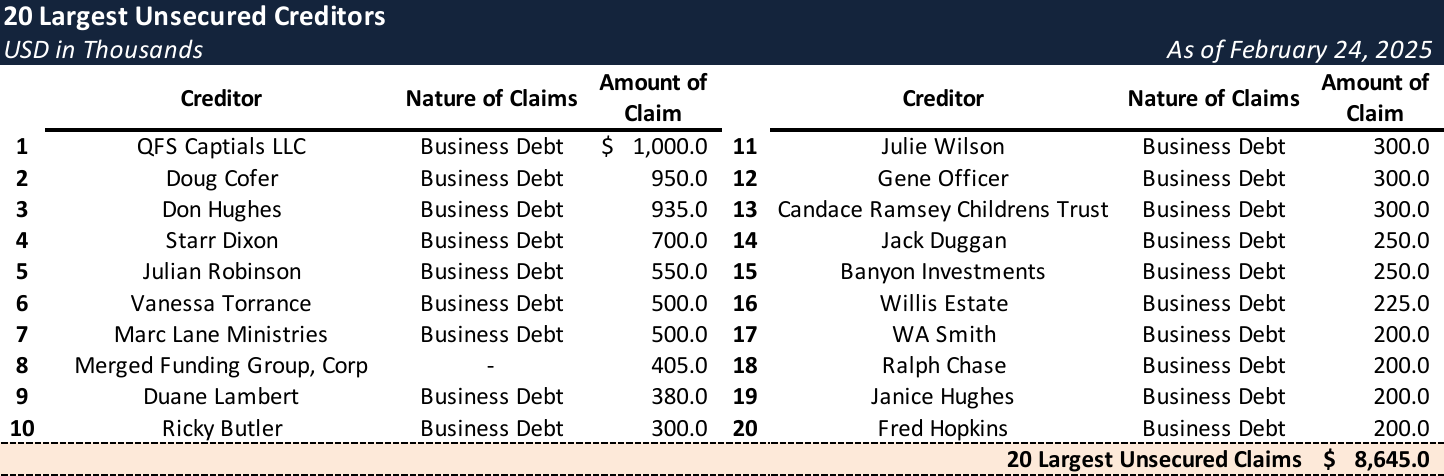

Top Unsecured Claims

Events Leading to Bankruptcy

Alleged Misconduct

- The necessity for this Chapter 11 filing stems primarily from alleged misconduct by former executive Andrew C. Sneed, whose unauthorized financial transactions severely impacted the Company's financial stability.

- Issues surfaced in April 2024 when a payment to Solinity Services was returned due to insufficient funds, triggering further investigation into financial irregularities.

- Subsequent investigations revealed substantial unauthorized payments made by Andrew Sneed to himself and his personal travel business, Aceco Travel, utilizing Company funds.

- Internal reviews identified unauthorized debentures totaling approximately $10.9 million. These debentures were executed without the knowledge or consent of other company executives.

- Funds obtained through these unauthorized debentures remain unaccounted for and were not deposited into the Company's bank accounts.

Financial Reporting Irregularities

- Significant discrepancies were identified in financial documentation submitted to Andrew Johnson Bank, reflecting inconsistencies between reports submitted by Andrew Sneed and other executives. Discrepancies included inaccuracies in tax returns and financial statements.

- Andrew’s issuance of debentures vastly exceeded approved limits, leaving the Debtors over-leveraged and unable to service their debt. Additionally, no clear accounting existed for the funds raised, and repeated requests for financial disclosures were denied, preventing a full assessment of their financial health.

Initiation of Chapter 11 Bankruptcy Proceedings

- Given the magnitude of the alleged fraudulent activities and resulting insolvency, the Debtors have filed for Chapter 11 bankruptcy protection on February 24, 2024, aiming to reorganize operations and satisfy legitimate financial obligations effectively.

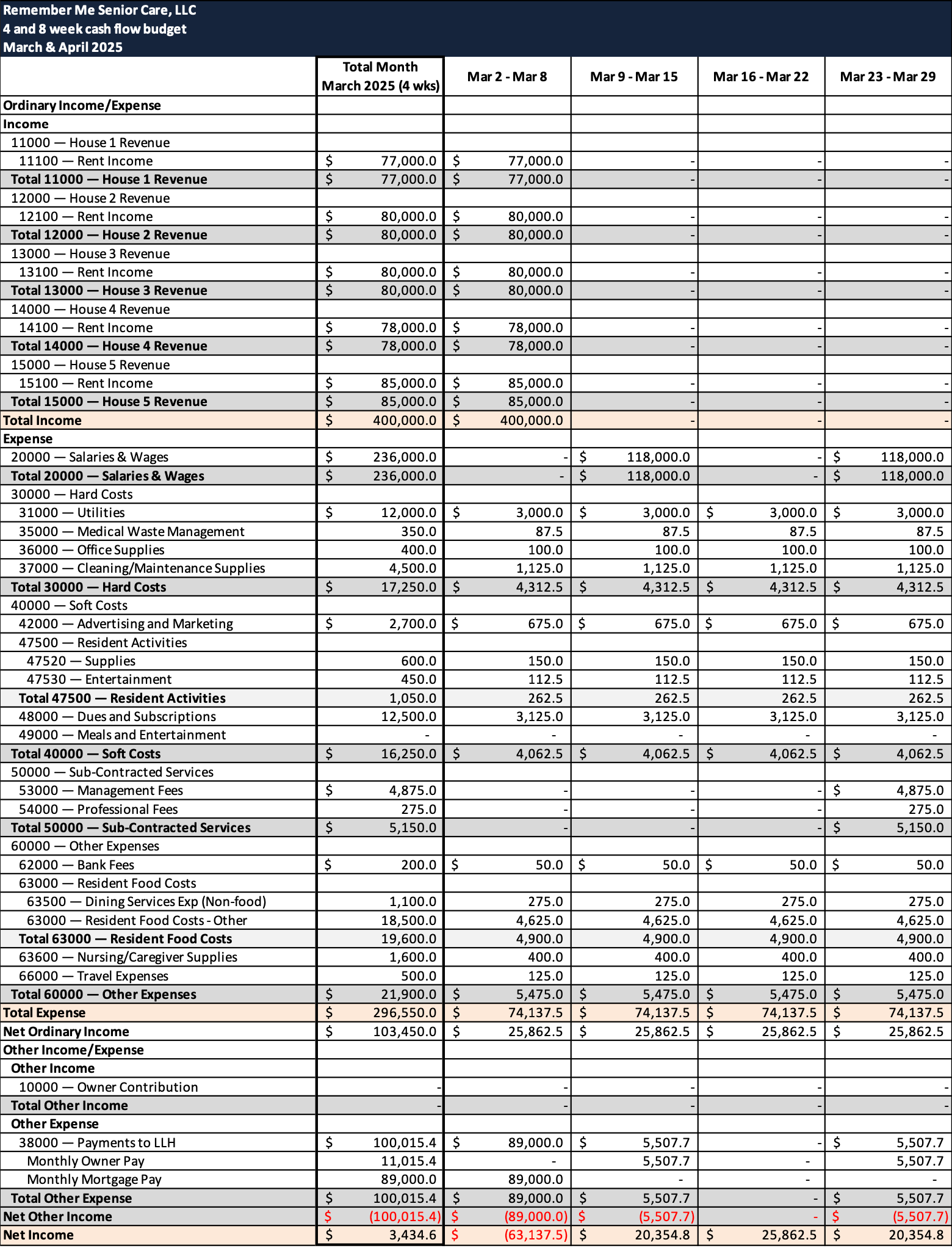

Initial Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.