Case Summary: Rite Aid Chapter 11

Rite Aid has filed for Chapter 11 bankruptcy for the second time in under two years after a failed turnaround and renewed liquidity pressures, with plans to sell assets or wind down operations.

Business Description

Headquartered in Philadelphia, PA, New Rite Aid, LLC (formerly Rite Aid Corporation), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Rite Aid" or the "Company"), is a national retail pharmacy chain with a 60-year operational history. The Company's business model centers on the symbiotic relationship between its in-store pharmacies, which drive foot traffic, and its "front-end" retail operations, which benefit from this traffic to generate high-margin sales. Prescription drug sales have historically comprised approximately 70% of revenue within Rite Aid’s Retail Pharmacy Segment, with front-end merchandise generating the remaining 30%.

- The pharmacy operations focus on prescription fulfillment, immunizations, medication therapy management, health screenings, and pharmacist consultations.

- The front-end retail operations offer over-the-counter medications, health and beauty products, personal care items, convenience goods, and seasonal merchandise.

As of the Petition Date, Rite Aid operated 1,277 stores across 15 states and employed approximately 24,500 individuals.

- The Company also owns regional subsidiaries, notably Bartell Drugs in Washington, which continue to operate under their local branding.

Following its emergence from a prior Chapter 11 restructuring in August 2024, Rite Aid became a privately held company, with former creditors becoming its new equity owners; all existing common shares were canceled in the 2024 reorganization. As of the Petition Date, JPMorgan Chase and Sixth Street held approximately 18.3% and 16.5% of the equity, respectively.

New Rite Aid, LLC and its affiliates filed for Chapter 11 protection on May 5, 2025 (the "Petition Date"), in the U.S. Bankruptcy Court for the District of New Jersey, reporting $1 billion to $10 billion in both assets and liabilities.

⁽¹⁾ For a complete list of Debtor entities, see corporate structure chart.

Corporate History

Rite Aid's origins trace back to 1962, when Alex Grass opened the "Thrif D Discount Center" in Scranton, PA. The Company expanded rapidly, incorporating pharmacy services and officially rebranding as Rite Aid Corporation in 1968, the same year it launched its IPO. By 1981, Rite Aid was the third-largest U.S. retail drugstore chain, achieving $1 billion in annual sales by 1983.

Aggressive Expansion and Subsequent Challenges

- Throughout the 1980s and 1990s, Rite Aid pursued an aggressive growth-by-acquisition strategy, acquiring chains such as Gray Drug Stores, Harco Drugs, K&B, Perry Drug Stores, and Thrifty PayLess. By 1996, its store count neared 4,000, establishing a coast-to-coast presence.

- In 1999, diversification efforts included a partnership with GNC and an investment in Drugstore.com. That same year, Rite Aid entered the pharmacy benefits management (PBM) sector by acquiring PCS Health Systems.

- The late 1990s were marked by a significant accounting scandal, leading to the restatement of several years' earnings and convictions of former senior executives, including then-CEO Martin Grass. The Company admitted to overstating profits by up to $1.6 billion, necessitating debt restructuring and store divestitures to avert insolvency. Mary Sammons assumed the CEO role in 2003, guiding the Company toward stabilization.

Major Transactions and Strategic Shifts

- In 2007, Rite Aid acquired the Brooks and Eckerd drugstore chains for approximately $3.4 billion, increasing its store count to around 5,000. However, integration challenges and the debt incurred contributed to ongoing financial pressures.

- The Company re-entered the PBM space with the $2 billion acquisition of EnvisionRx (later Elixir) in 2015.

- A proposed merger with Walgreens Boots Alliance, announced in 2015, was abandoned in 2017 due to antitrust concerns. Instead, Walgreens acquired 1,932 Rite Aid stores and three distribution centers for approximately $4.4 billion.

- A subsequent merger agreement with grocery chain Albertsons in 2018, valued at approximately $24 billion, was also called off due to Rite Aid shareholder opposition.

Turnaround Attempts and Path to Restructuring

- Heyward Donigan was appointed CEO in August 2019 and rolled out the “RxEvolution” strategy, a brand overhaul that included a new logo, revamped stores branded as “Stores of the Future,” and a shift toward positioning Rite Aid as a holistic health provider combining conventional pharmacy with alternative wellness offerings.

- In late 2020, Rite Aid acquired the Seattle-based Bartell Drugs chain (67 stores) for $95 million.

- Despite these efforts, Rite Aid continued to post significant net losses (e.g., $750 million in FY2023) and faced mounting pressure from over $3 billion in debt and escalating opioid-related litigation, including a March 2023 lawsuit from the U.S. Department of Justice. By late 2023, the Company was defending over 1,600 opioid lawsuits.

- CEO Heyward Donigan resigned in January 2023, replaced by interim CEO Elizabeth “Busy” Burr.

2023 Chapter 11 Case

- Unable to service its debt and facing mounting legal liabilities, Rite Aid filed for Chapter 11 protection on October 15, 2023. At the time, it operated over 2,100 stores. The restructuring aimed to deleverage, address opioid claims, and rationalize its store footprint.

- Rite Aid emerged on August 30, 2024, as New Rite Aid, LLC, a private entity with approximately $2 billion of debt eliminated and $2.5 billion in exit financing.

- During the bankruptcy, it sold or wound down roughly 800 underperforming stores and sold its Elixir PBM business to MedImpact for $575 million. Jeffrey S. Stein served as interim CEO through the bankruptcy, succeeded by former CFO Matt Schroeder upon emergence.

Operations Overview

As of the Petition Date, Rite Aid's operations consisted of approximately 1,277 retail stores and three distribution centers across 15 states. This footprint reflects significant consolidation from its 2023 Chapter 11 case, during which roughly 800 stores were closed or sold, including complete exits from markets like Michigan and most of Ohio.

- As part of the current Chapter 11 proceedings, the Company is pursuing a court-supervised sale of its remaining assets, including plans to close or sell all remaining stores and distribution centers.

Store Portfolio and Pharmacy Services

- Rite Aid's stores are concentrated in California, the Pacific Northwest (including the Bartell Drugs unit), the Northeast (Pennsylvania, New York, New Jersey, New England), and select Southeastern states.

- Pharmacy services are the core of the business, encompassing prescription dispensing, immunizations (flu, COVID-19), medication therapy management, health screenings, and pharmacist consultations. The Company participates in Medicare and Medicaid programs.

- Further store rationalization was underway at the time of the 2025 filing, with deals pending for prescription file transfers from 60 stores, plans to close 50 additional stores, and negotiations to sell approximately 275 stores in regional packages.

Supply Chain and Distribution

- Rite Aid relies heavily on third-party suppliers. McKesson Corporation has been its principal pharmaceutical supplier for approximately 20 years, providing about 99% of the dollar volume of its prescription drugs through daily deliveries, allowing for minimal in-store drug inventory. This critical relationship was highlighted when McKesson threatened to halt shipments in 2023 due to Rite Aid's financial distress, a situation resolved via settlement during the first bankruptcy.

- Front-end merchandise is sourced from numerous consumer goods suppliers and distributed through Rite Aid's three main distribution centers. These facilities faced operational pressures and widespread inventory outages due to vendors tightening credit terms amidst Rite Aid’s liquidity crisis.

Regulatory Framework

- Rite Aid operates in a heavily regulated environment, subject to federal, state, and local laws governing pharmacy operations, controlled substance dispensing (a key issue in the Department of Justice opioid litigation), healthcare program participation (Medicare/Medicaid), and patient data privacy (HIPAA).

E-commerce and Digital Operations

- Rite Aid invested in digital capabilities, including a relaunched website (RiteAid.com) and a mobile app for prescription management, rewards, and online shopping. It offers buy-online-pickup-in-store (BOPIS) options and same-day delivery through partnerships with third-party platforms like Instacart and DoorDash.

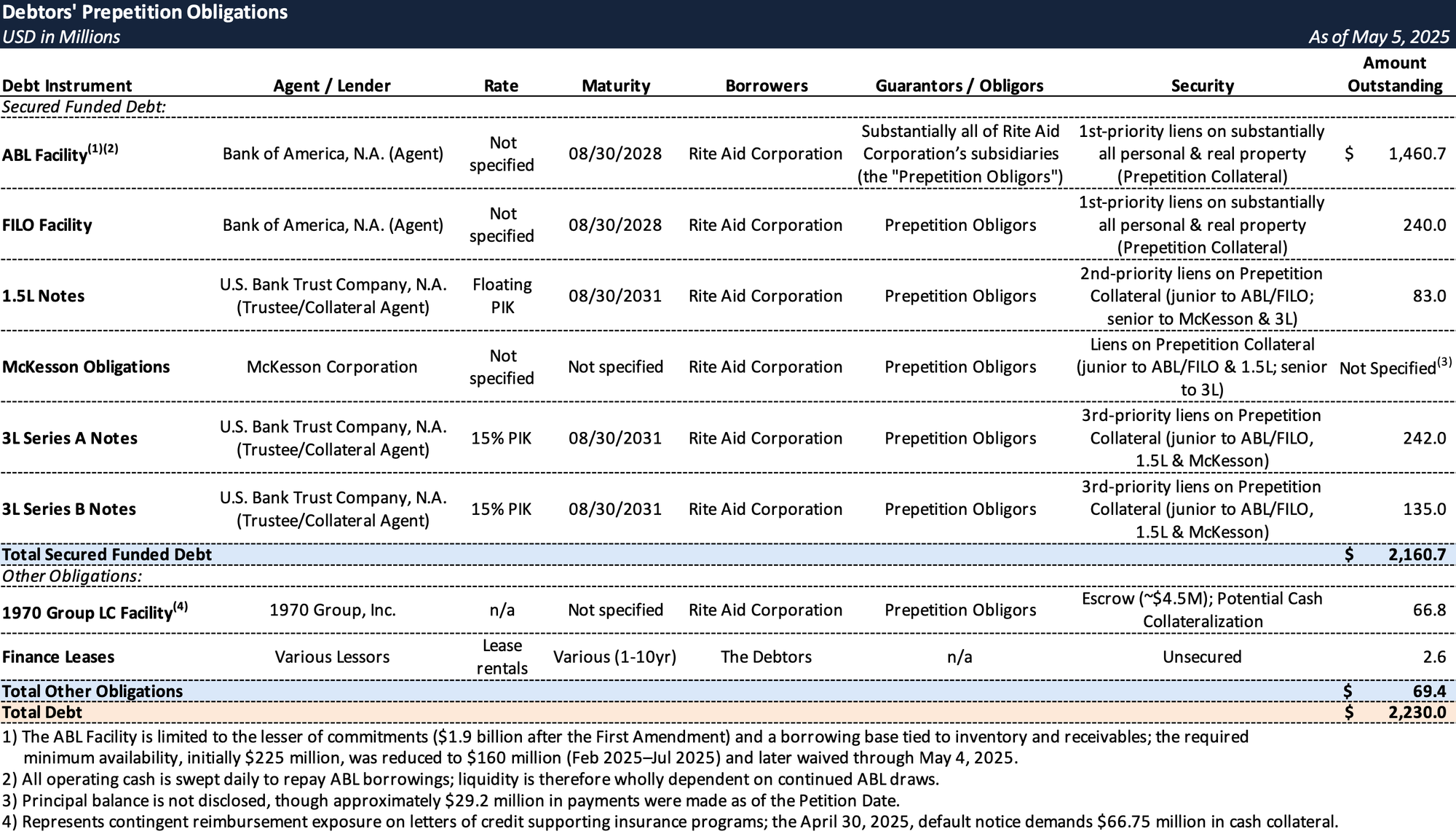

Prepetition Obligations

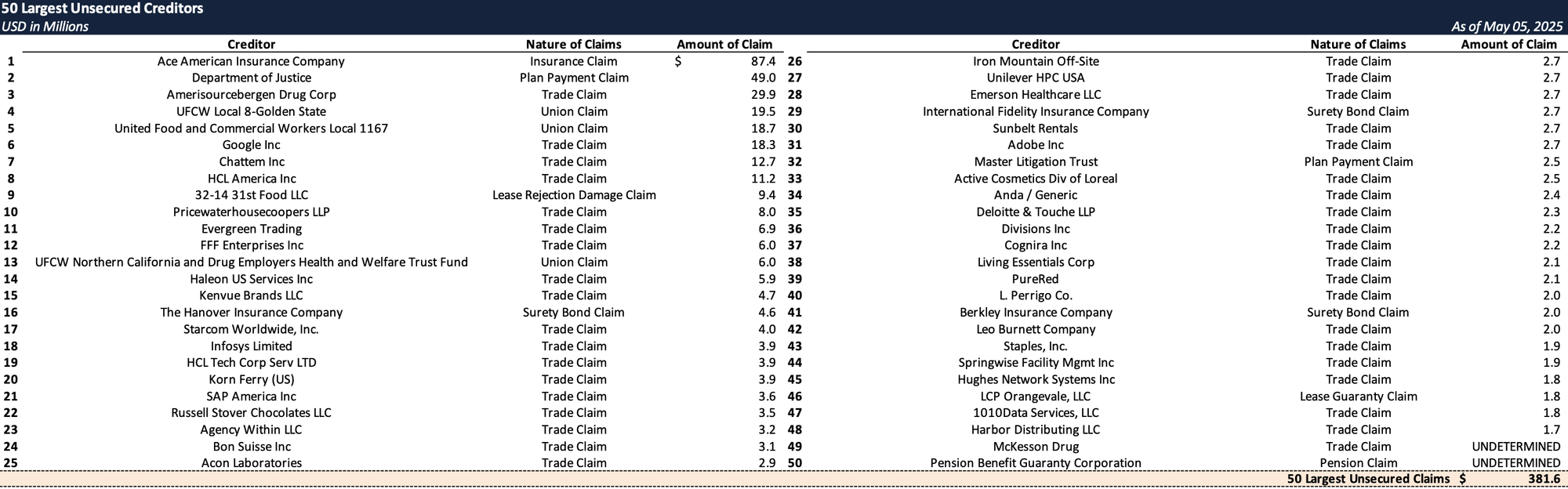

Top Unsecured Claims

Events Leading to Bankruptcy

Factors Culminating in the October 2023 Chapter 11 Filing

- Overwhelming Debt Burden and Sub-Optimal Retail Footprint:

- Decades of debt-fueled acquisitions left Rite Aid with over $4 billion in funded debt obligations by 2023 and annual interest expenses exceeding $200 million, which limited the Company’s ability to execute turnaround initiatives and make critical in-store investments.

- The Company was further burdened by unprofitable stores and costly, non-terminable leases, resulting in $80 million in annual “dead rent” even after store closures.

- Intense Competition and Declining Profitability:

- Rite Aid faced persistent pressure from larger pharmacy chains (CVS, Walgreens), mass-market retailers with pharmacies (Walmart, Target), and online pharmacies.

- Profitability was further pressured by elevated labor costs, reduced demand for front-end merchandise and COVID-19 vaccines, and declining reimbursement rates from third-party payors.

- The Company reported substantial net losses, including $749.9 million in FY2023.

- Escalating Opioid Litigation:

- By early 2023, Rite Aid faced over 1,600 opioid-related suits. In March, the DOJ filed a civil complaint alleging the Company violated the Controlled Substances Act by filling unlawful opioid prescriptions from 2014–2019 despite clear red flags.

The 2023 Chapter 11 Restructuring and Brief Emergence

- On October 15, 2023, Rite Aid filed for Chapter 11 protection in New Jersey, securing $3.45 billion in DIP financing.

- The restructuring involved a debt-for-equity swap, a $2 billion reduction in funded debt, the sale of the Elixir PBM business to MedImpact for $575 million, and settlements with certain opioid claimants. Approximately 800 underperforming stores were closed.

- Rite Aid emerged from bankruptcy on August 30, 2024, as "New Rite Aid, LLC," a private company, with new CEO Matt Schroeder and $2.5 billion in exit financing, touting a "fresh start."

Post-Emergence Failures Leading to the May 2025 "Chapter 22" Filing

The "fresh start" proved short-lived, as a confluence of unforeseen challenges derailed the post-emergence business plan, leading to a second bankruptcy filing less than nine months later.

- Acute Liquidity Shortfall and Broken Assurances:

- Rite Aid's recovery plan heavily relied on vendors returning to normal trade credit terms and securing new letter of credit (LC) facilities. These assumptions proved overly optimistic.

- The Company expected approximately $126 million in additional liquidity from normalized vendor terms by February 2025 but realized only about $46 million, as many vendors refused to loosen restrictive terms or retained previously posted deposits (approximately 40% of deposits were not returned).

- Of an anticipated $166 million in new LC facilities, Rite Aid secured only one replacement facility for $66.75 million in November 2024, which was described as "too little and too late" to adequately restock for the critical holiday and flu season.

- Inventory Crisis and Operational Vicious Cycle:

- The severe liquidity constraints prevented Rite Aid from replenishing critically low front-end inventory. In-stock rates, which were 89% pre-2023, fell from 57% at emergence to 55% by February 2025.

- Low in-stock levels were detrimental to the high-margin front-end business, which relies on impulse purchases from customers visiting for prescriptions. This was particularly damaging during the critical September-December seasonal period (vaccine season, holidays).

- Declining inventory levels also reduced the Company's borrowing base under its ABL Facility, further diminishing available liquidity and impeding efforts to acquire more inventory. This created a vicious cycle: tightening liquidity led to empty shelves, which in turn further constrained liquidity and vendor terms.

- Compounding these issues, Rite Aid faced a structural market shift as its customer demographic (including low- and fixed-income consumers) significantly reduced purchases of front-end items from brick-and-mortar convenience stores post-emergence, viewing Rite Aid as a higher-cost provider.

- The Company generated negative adjusted EBITDA from November 2024 onward, diverging from the $453 million projected for March 2024 through February 2025 in the disclosure statement from its prior Chapter 11 case.

- Covenant Breach and Escalating Supplier Pressure:

- By February 2025, Rite Aid breached modified ABL availability covenants. A series of consents with ABL lenders ensued, mandating the development of a business rationalization plan and the initiation of a comprehensive sales process.

- Just days before the Petition Date, McKesson tightened credit terms, shortening Rite Aid’s payment window from 10 to 7 days and lowering the receivables cap from $270 million to $200 million, with a daily step-down to $175 million, citing deteriorating financials.

- Preemptive Actions and Governance Changes:

- In response to the escalating crisis, Rite Aid implemented cost-saving measures, including workforce reductions affecting approximately 2,119 employees, and continued to rationalize its store footprint.

- In March 2025, the HoldCo Board was reconstituted with independent directors experienced in restructuring, and a Special Committee was formed to oversee strategic alternatives. Marc Liebman of A&M was appointed Chief Transformation Officer.

- An extensive prepetition marketing process for some or all of the Company's assets was initiated in March 2025, yielding seven indications of interest by late April but no comprehensive out-of-court solution.

The 2025 Chapter 11 Filing and Stated Objectives

- On May 5, 2025, New Rite Aid, LLC and its affiliates filed for Chapter 11 protection in the District of New Jersey (Case No. 25-14861). The filing aims to facilitate an orderly wind-down and sale of the Company’s remaining assets.

- Rite Aid secured commitments for $1.94 billion in new DIP financing from existing lenders, comprising a $1.7 billion revolving ABL facility and a $240 million "first-in-last-out" (FILO) term loan. This financing, largely a roll-up of prepetition debt, is intended to fund operations through the sale process.

- The Company is pursuing an expedited sale of substantially all assets under Section 363.

- An auction for core pharmacy assets (prescription files, pharmacy inventory) was scheduled for May 14, 2025, with a sale hearing to approve winning bids by May 21, 2025.

- A second auction for remaining assets (real estate, Thrifty Ice Cream business, IP) is anticipated around June 20, 2025.

- The process prioritizes minimizing disruption to pharmacy-care customers and preserving jobs where possible through sales to new operators.

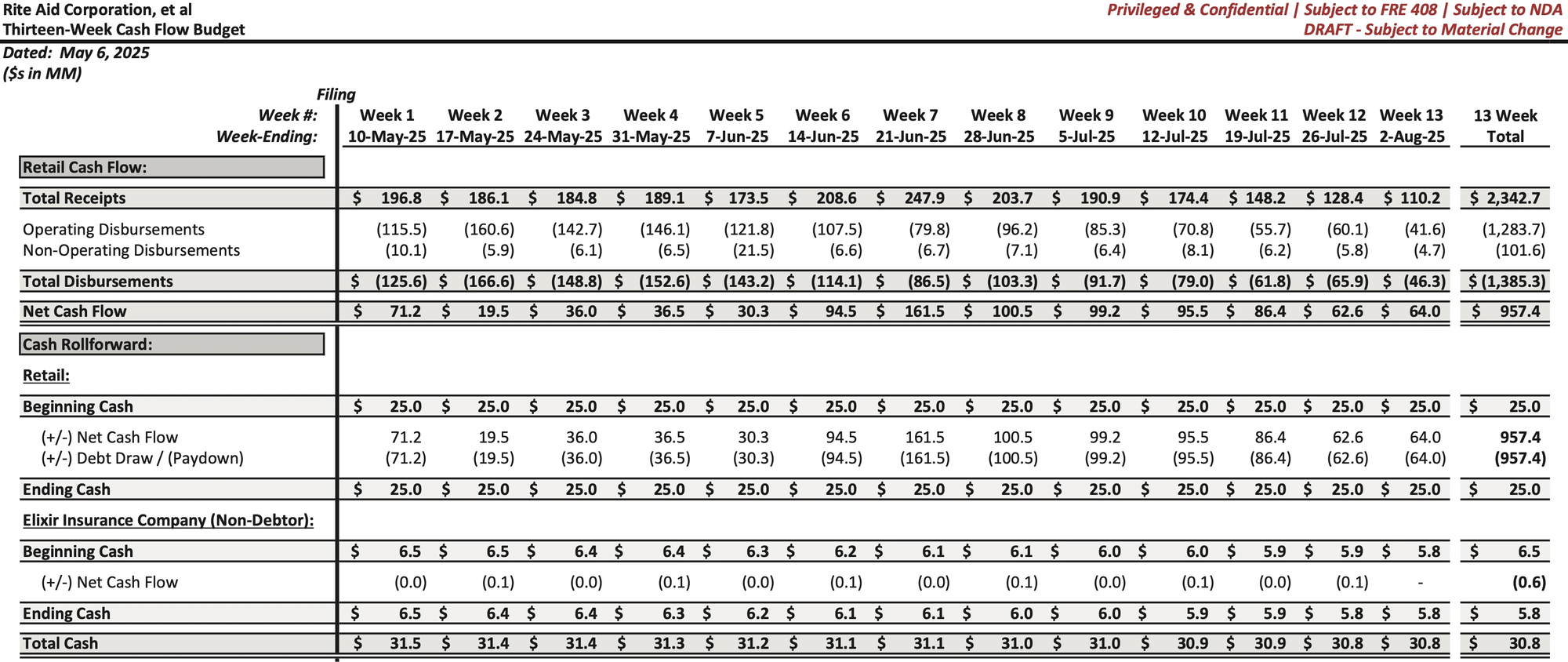

Initial Budget

Retained Professionals

- Bankruptcy Co-Counsel: Cole Schotz P.C., Paul, Weiss, Rifkind, Wharton & Garrison LLP

- Investment Banker: Guggenheim Securities, LLC

- Financial Advisor: Alvarez & Marsal North America, LLC

- Real Estate Advisor: A&G Realty Partners, LLC

- Claims Agent: Kroll Restructuring Administration LLC

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.