Filing Alert: Rite Aid Chapter 11

Rite Aid Files Chapter 11 in District of New Jersey

New Rite Aid, LLC and its debtor affiliates⁽¹⁾ (collectively, “Rite Aid,” the “Company,” or the “Debtors”), a Pennsylvania-based pharmacy and drug store chain, filed for Chapter 11 protection on May 5 in the U.S. Bankruptcy Court for the District of New Jersey.

The filing marks Rite Aid’s second Chapter 11 in less than two years, following its emergence from the “2023 Cases” on Aug. 30, 2024. The Company states its post-emergence business plan was derailed by unforeseen challenges, including front-end vendors refusing to return to normalized trade terms and retaining deposits, significantly impacting expected liquidity (realizing only $46 million of an anticipated $126 million by Feb. 2025). This was compounded by delays and reductions in securing replacement letter of credit facilities (obtaining only $66.8 million of a planned $166 million, and not until Nov. 2024), leading to low inventory, declining sales, and a strained ABL facility.

The Debtors intend to pursue a sale of their business and assets, including prescription files, and have secured up to $1.94 billion in DIP financing from prepetition ABL lenders, comprising a $1.7 billion ABL revolver and a $240 million FILO term loan, to fund the process.

New Rite Aid, LLC reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-14861.

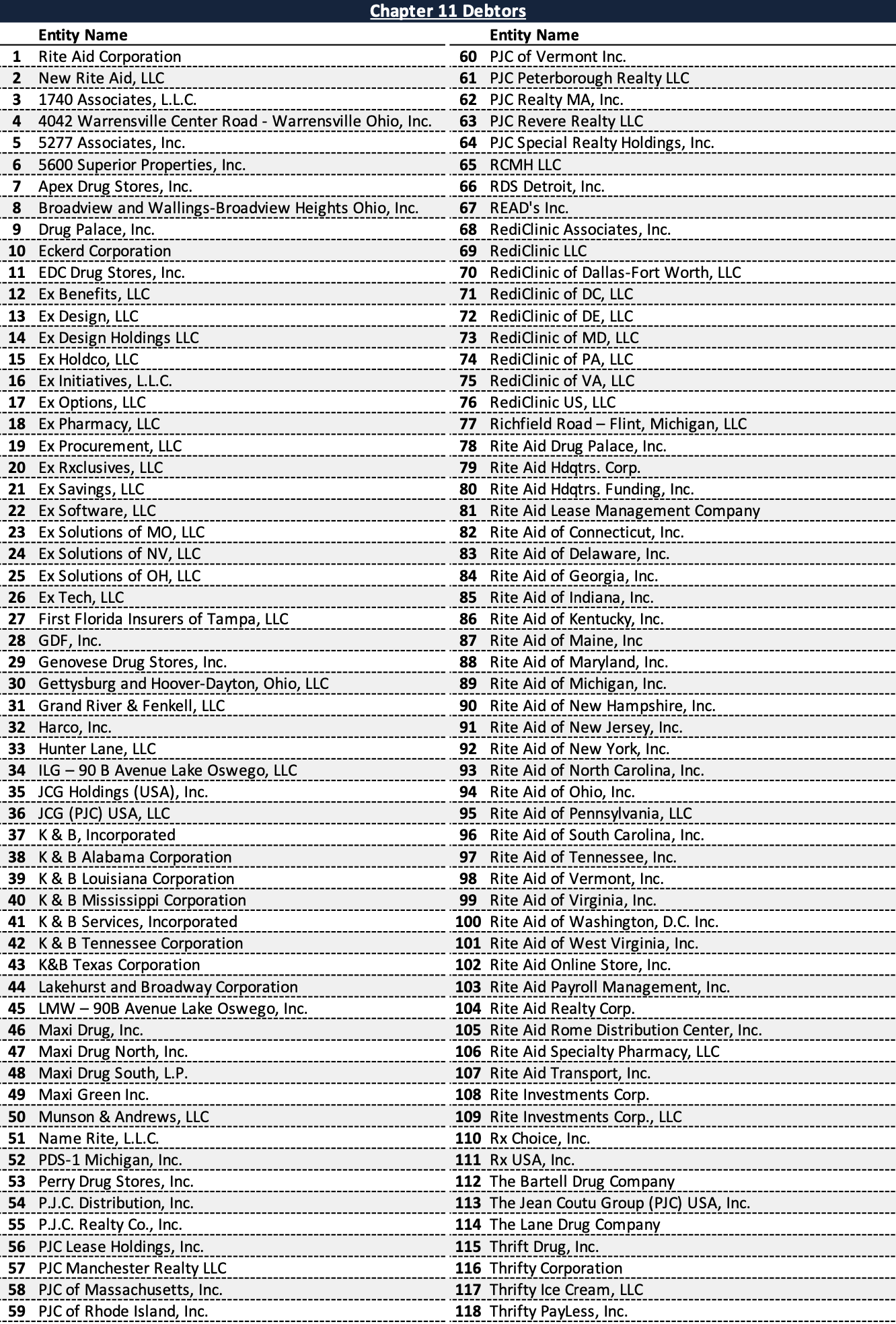

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

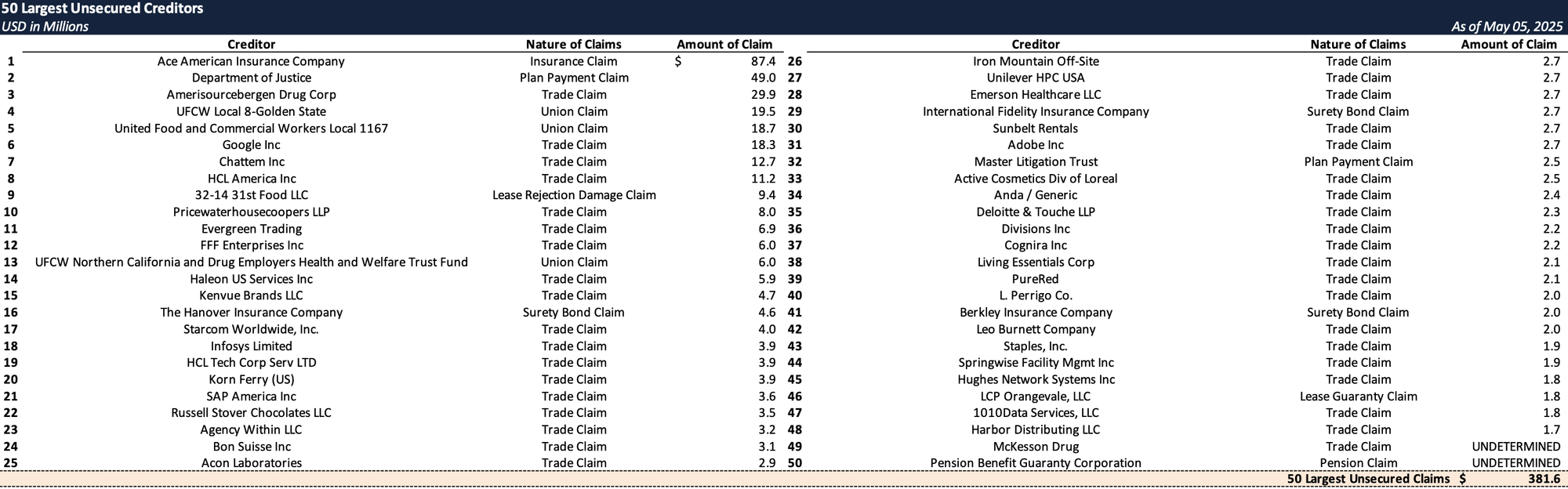

Top Unsecured Claims

Key Parties

Bankruptcy Co-Counsel:

- Michael D. Sirota

- Cole Schotz P.C.

- Email: [email protected]

Bankruptcy Co-Counsel:

- Paul, Weiss, Rifkind, Wharton & Garrison LLP

Investment Banker:

- Guggenheim Securities, LLC

Financial and Restructuring Advisor:

- Alvarez & Marsal North America, LLC

Real Estate Advisory Services:

- A&G Realty Partners, LLC

Signatories:

- Matthew Schroeder – Chief Executive Officer

Claims Agent:

Equity Security Holders:

- JPMorgan – 18.3% Equity Interest

- Sixth Street – 16.5% Equity Interest

- Thomas A Pitta in his Capacity as the Trustee of the GUC Equity Trust – 10.0% Equity Interest

- Other Minority Holders – 55.2% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.