Case Summary: Royal Paper Chapter 11

Royal Paper has filed for Chapter 11 bankruptcy following operational disruptions, supply chain challenges, and a looming debt maturity, supported by a $10 million DIP facility and a $126 million stalking horse bid from Sofidel America.

Business Description

Headquartered in Phoenix, AZ, Royal Interco, LLC, along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Royal Paper" or the "Company"), is a vertically integrated manufacturer and national supplier of tissue paper products.

- The Company produces a full range of bath tissue, paper towels, facial tissue, and paper napkins, offered across a value spectrum from premium to budget-friendly grades.

Royal Paper serves the consumer "At-Home" market (approx. 70% of revenue) primarily through private label programs for major U.S. retailers like Trader Joe’s, Kroger, and Aldi, and the commercial "Away-from-Home" market (approx. 30%).

- The Company also markets its own proprietary brands, such as Earth First, SuperSoft, and EcoFirst for the At-Home market, and BradyPlus, Staple, and Serenade for the Away-from-Home market.

The Debtors filed for Chapter 11 protection on April 8, 2025, in the U.S. Bankruptcy Court for the District of Delaware. As of the Petition Date, the Debtors $100 million to $500 million in both assets and liabilities.

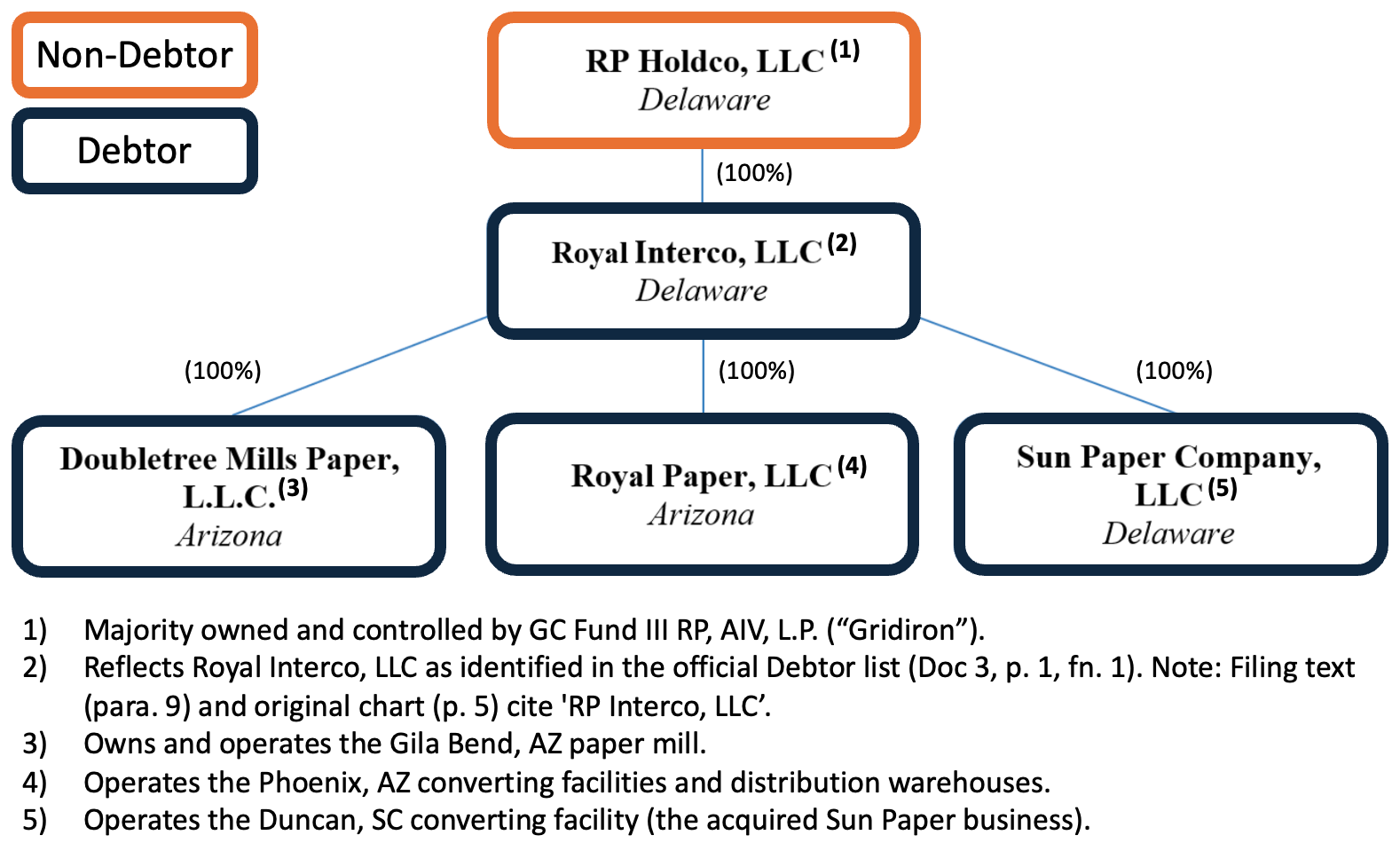

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

Royal Paper was founded in 1992 in Phoenix, AZ, initially operating as a family-owned business with a single converting line supplying paper napkins and bath tissue to local retailers.

- Over the subsequent years, the Company expanded its production capacity and modernized its equipment, incorporating high-speed converting lines and robotic handling systems.

Vertical Integration and Expansion

- Gila Bend Mill (2008): Integrated upstream by building a two-machine paper mill in Gila Bend, AZ, enabling in-house parent roll production and featuring advanced water recycling technology.

- Gridiron Capital Investment (Nov 2018): Private equity firm Gridiron Capital acquired a majority stake (80% as of the Petition Date), injecting capital and installing new management to drive national expansion.

- Sun Paper Acquisition (Dec 2020): Acquired Duncan, SC-based converter Sun Paper, establishing an East Coast presence and creating a coast-to-coast manufacturing footprint.

Organizational Structure

- The Debtors are indirectly majority-owned and controlled by Gridiron, a private equity fund. The remaining equity is held by current/former officers, owners, and board members.

- Gridiron owns 80% of non-Debtor RP Holdco, LLC ("Holdco"), which wholly owns Royal Interco, LLC ("Interco"). Interco owns 100% of Doubletree Mills Paper, L.L.C. ("Doubletree"), Royal Paper, LLC ("Royal LLC"), and Sun Paper Company, LLC ("Sun Paper").

Operations Overview

Royal Paper operates a vertically integrated model with manufacturing and distribution assets across the U.S.

Manufacturing Assets

- Gila Bend, AZ Paper Mill: Features two tissue machines (approx. 61,000 MT annual capacity) producing parent rolls from varied fiber sources, supported by proprietary water recycling systems.

- Converting Facilities: Three plants (two in Phoenix, AZ; one in Duncan, SC) convert parent rolls into finished goods using modern, automated equipment for diverse product specifications.

Distribution and Supply Chain

- Warehousing and distribution centers are co-located with converting plants in Arizona and South Carolina, facilitating nationwide shipment.

- Vertical integration provided control over raw materials (pulp, recycled fiber) but entailed managing the complexities of mill operations.

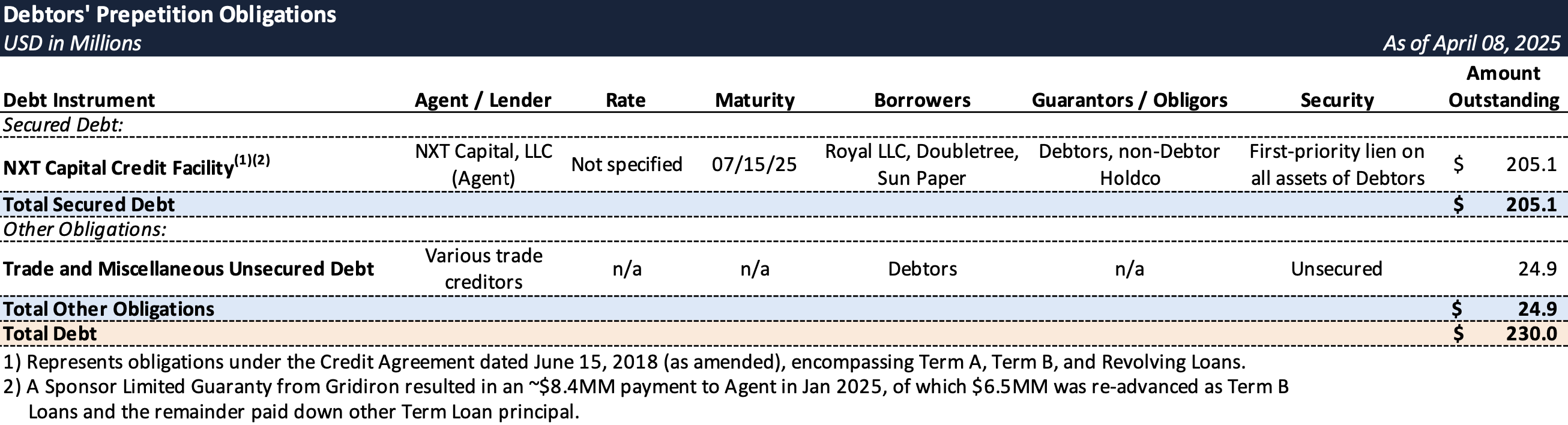

Prepetition Obligations

- In addition to the capital structure outlined above, Debtors Royal LLC and Sun Paper entered into a sale-leaseback transaction in September/October 2024 with Clarus Capital Funding I, LLC.

- Under this arrangement, the Debtors sold certain equipment for approximately $8.5 million and subsequently leased it back under a master lease agreement with an initial four-year term and monthly rent payments of approximately $178,218.

- The Debtors intend to seek assignment of this lease to the Stalking Horse Bidder in connection with these Chapter 11 cases.

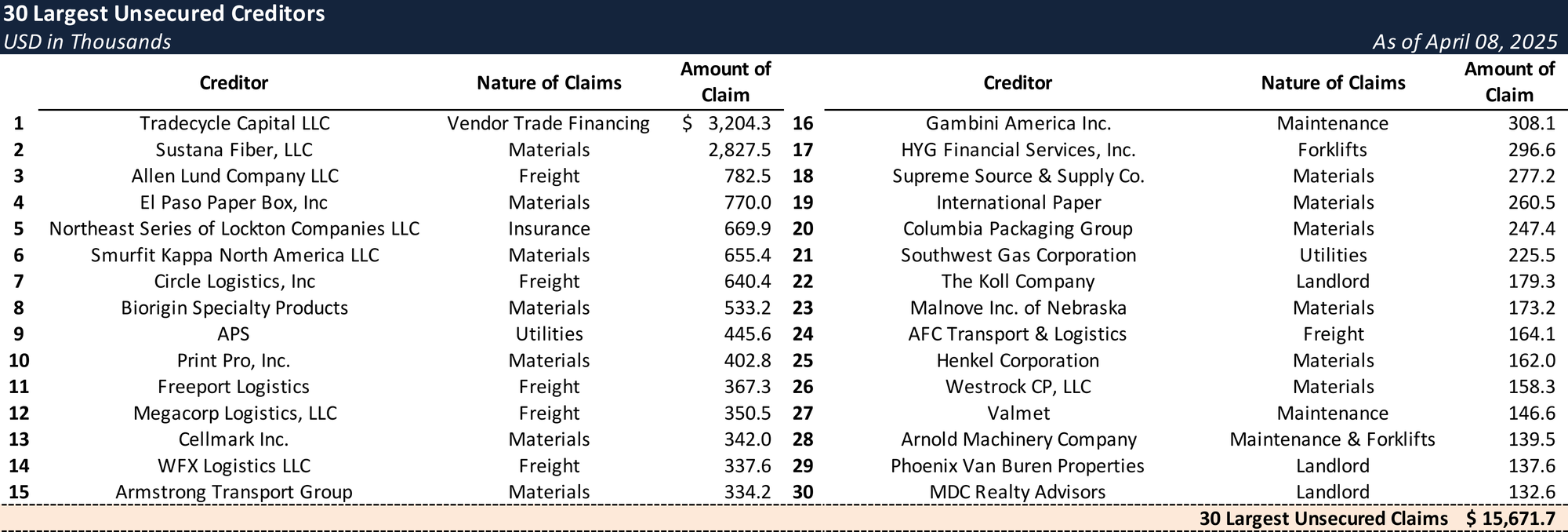

Top Unsecured Claims

Events Leading to Bankruptcy

Operational Disruptions and Financial Strain

- Royal Paper entered 2024 with a strong order book and projected revenues of approximately $220 million across about 105 active customers; however, operations were materially disrupted in early 2024 by a February fire at one of its distribution centers and ongoing labor shortages.

- Consequently, the Company failed to meet customer demand for roughly H1 2024, leading to reduced revenue, cash depletion, and strained customer relations.

Liquidity Crisis and Debt Concerns

- With senior secured debt maturing on December 31, 2024, Royal Paper faced a liquidity crunch in mid-2024 as suppliers tightened credit terms amid operational challenges and repayment concerns.

- Reduced credit availability, combined with the Company’s inability to timely pay suppliers, limited access to raw materials—most critically, pulp—hindering order fulfillment.

Debt Extension and Governance Changes

- Facing imminent default, the Company negotiated with its senior lenders, securing an extension of the debt maturity to July 15, 2025. This provided temporary breathing room to pursue a restructuring or sale.

- Around the same time, the Board amended the LLC agreements of Holdco and Interco to appoint Craig S. Dean as an Independent Manager, vesting him with exclusive authority over major restructuring decisions, including asset sales or a bankruptcy filing, to ensure independent oversight.

Sale Process and Chapter 11 Filing

- Restructuring advisors (CRO Michael Ragano of Novo Advisors, IB Livingstone Partners) were engaged in January 2025 to pursue a sale.

- A marketing process yielded 14 IOIs by March 2025, with the highest bids requiring a Chapter 11 sale.

- The Debtors filed for Chapter 11 protection on April 8, 2025, in the District of Delaware and retained Morris Nichols as bankruptcy counsel.

- Concurrently, the Debtors entered into a $126 million stalking horse APA with Sofidel America Corp. for substantially all assets, subject to higher bids and court approval. Potential HSR review is noted.

- The Debtors secured approval for a $10 million new-money, superpriority DIP facility from existing lenders (with NXT Capital as agent) to fund operations during the sale process.

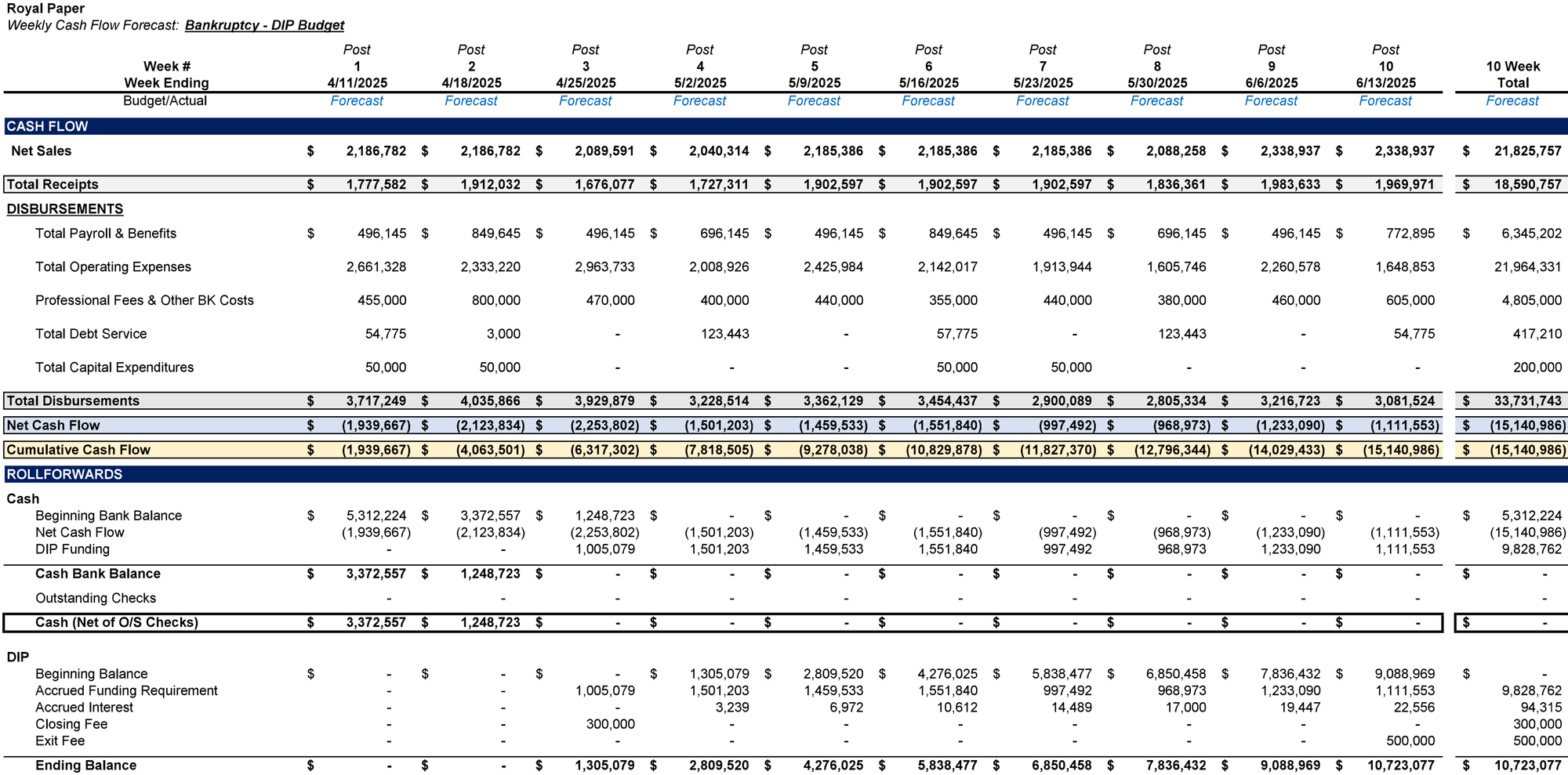

DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.