Case Summary: Saks Global Chapter 11

Saks Global has filed for Chapter 11 bankruptcy following a liquidity crisis triggered by its $2.7 billion Neiman Marcus acquisition, which saddled the luxury retailer with unsustainable debt and strained vendor relationships.

Business Description

Headquartered in New York, NY, Saks Global Enterprises LLC ("SGE"), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Saks Global" or the "Company"), is the largest multi-brand luxury retailer in the world, operating a portfolio of iconic American retail brands including Saks Fifth Avenue, Saks OFF 5TH, Neiman Marcus, Neiman Marcus Last Call, Bergdorf Goodman, and Horchow.

- The portfolio spans approximately 70 full-line luxury locations, additional off-price stores, and five e-commerce platforms, with approximately 8.4 million square feet of owned or ground-leased U.S. real estate.

The Company generates revenue through owned merchandise sales at wholesale margins, consigned merchandise, revenue share from in-store "shop in shop" concessions, and revenue share from e-commerce merchandise shipped directly by brand partners.

As of the Petition Date, the Debtors employed approximately 14,610 full-time and 2,220 part-time employees, supplemented by seasonal associates during peak periods. A small number of employees are unionized under seven collective bargaining agreements.

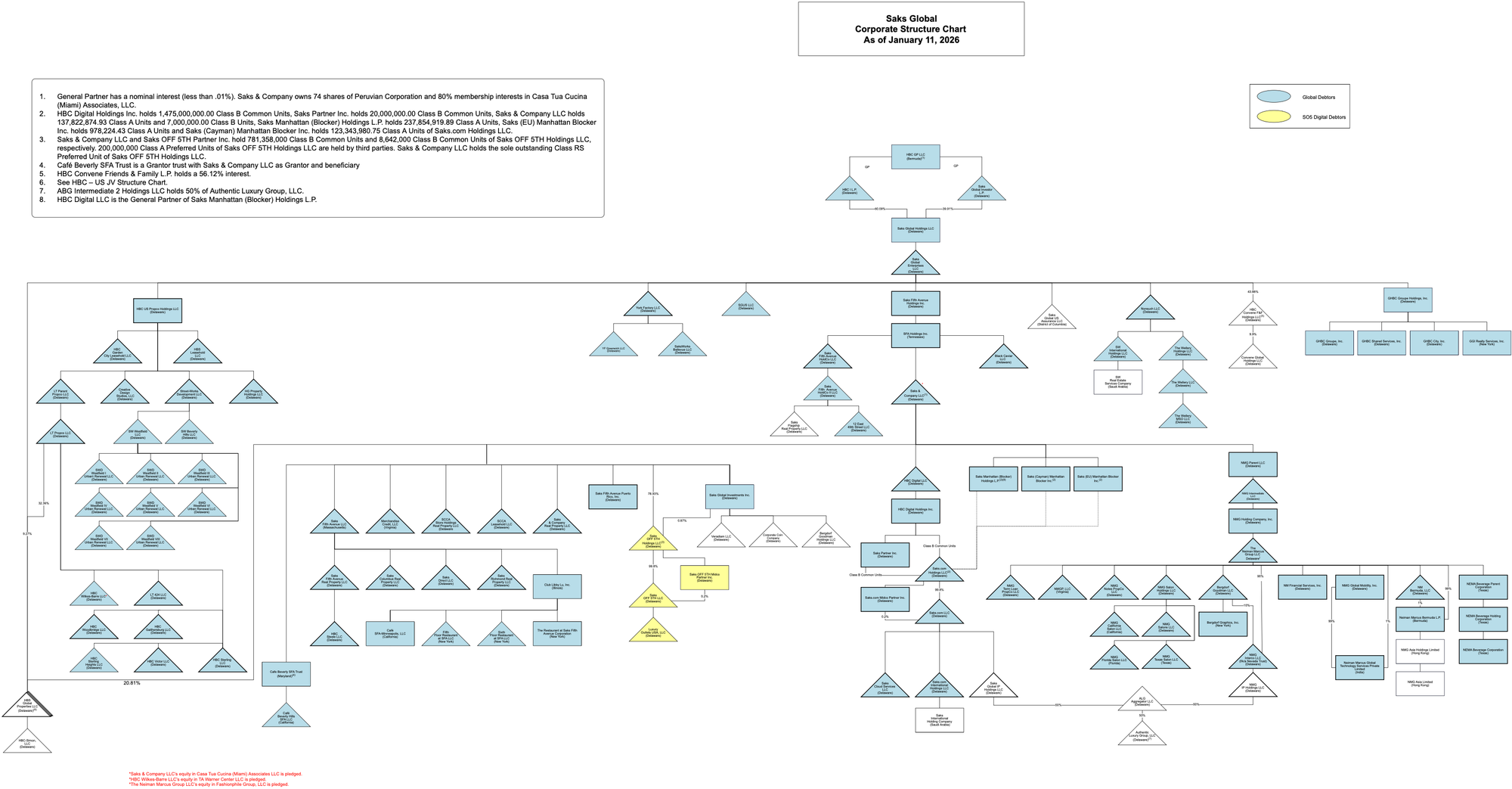

Saks Global Enterprises LLC and certain affiliates (collectively, the "Global Debtors") filed for Chapter 11 protection on January 14, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $1 billion to $10 billion in both assets and liabilities. Affiliates operating the Saks OFF 5TH e-commerce business (the "SO5 Digital Debtors," and together with the Global Debtors, the "Debtors") filed concurrently and are seeking joint administration of their cases.

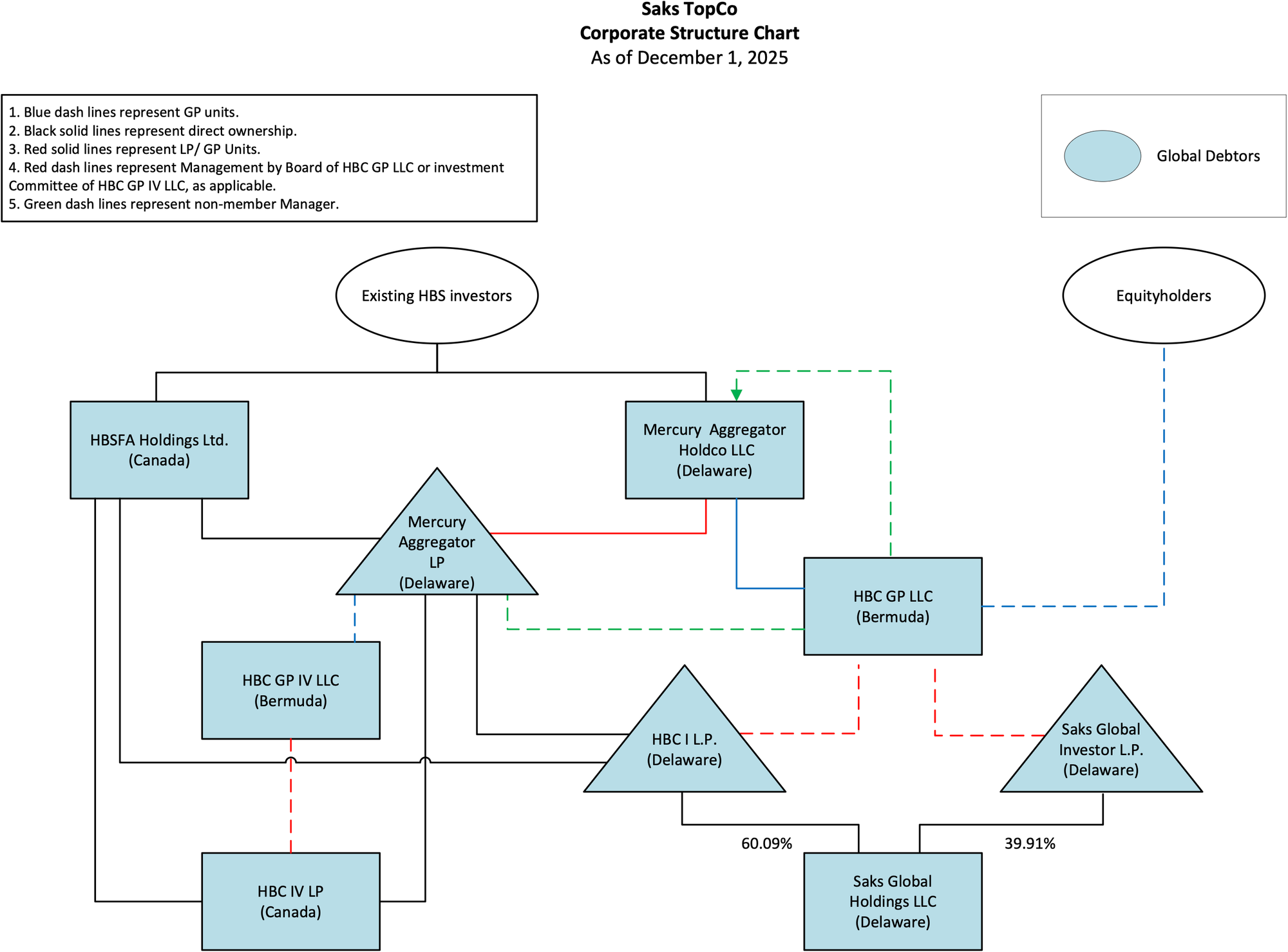

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

Saks Fifth Avenue traces its origins to 1867 in Washington, D.C. The iconic flagship at 50th Street and Fifth Avenue opened September 15, 1924, becoming the first large retailer in what was then a residential Manhattan district. The brand expanded coast-to-coast and now operates 33 locations.

The off-price concept began in 1992 with "Saks Clearinghouse" in Franklin Mills, Pennsylvania. Following its success, Saks OFF 5TH launched in 1995 and now operates 81 stores and an e-commerce platform launched in 2013.

HBC Era

Hudson's Bay Company ("HBC"), then publicly-traded under Governor and Executive Chairman Richard Baker, acquired Saks Incorporated (the predecessor to Saks Global) in November 2013 for approximately $2.9 billion (including assumed debt), funded through new term loans, an ABL facility, and approximately $1 billion in new equity. The transaction combined Saks Fifth Avenue with HBC's existing Hudson's Bay and Lord & Taylor banners.

In 2015, HBC formed the HBS JV with Simon Property Group, contributing 42 owned or leased properties. Following a November 2015 equity sale to institutional investors, HBC retained approximately 63% of the JV.

Macro headwinds, including the shift to e-commerce and declining foot traffic, led to continued underperformance, prompting HBC to complete a take-private in March 2020, just before COVID-19 shuttered stores.

In 2021, capitalizing on pandemic-accelerated e-commerce growth, HBC separated its e-commerce operations into standalone entities to attract technology-focused capital.

- In March, Saks Fifth Avenue's e-commerce business raised $500 million from Insight Partners at a $2 billion valuation; in June, Saks OFF 5TH's e-commerce business raised $200 million at a $1 billion valuation.

- The physical store fleets remained wholly owned by HBC and were financed together as a single credit group, while the e-commerce entities operated with separate capital structures.

The December 2024 Neiman Marcus acquisition (as discussed below) reunified the Saks Fifth Avenue e-commerce and physical store businesses under the newly formed Saks Global.

- The Saks OFF 5TH e-commerce business (now the SO5 Digital Debtors) remained a separate entity, approximately 80% owned by Saks Global with the remainder held by outside investors, including Insight Partners affiliates.

Meanwhile, HBC's Canadian operations continued to deteriorate. In March 2025, Hudson's Bay Company filed for CCAA protection in Canada and ultimately liquidated, closing all stores by June 2025.

Neiman Marcus Acquisition

On December 23, 2024, Saks Global acquired Neiman Marcus Group for $2.7 billion in enterprise value, adding Neiman Marcus, Bergdorf Goodman, and Last Call to its portfolio.

- New equity investors included Amazon, Authentic Brands Group, and Salesforce.

- The Company raised $275 million in seller financing, a $1.8 billion ABL facility, and $2.2 billion in senior secured notes.

- The combination created a $7 billion real estate portfolio across top-tier luxury destinations.

The acquired brands carry their own histories:

- Neiman Marcus, founded in Dallas in 1907, pioneered ready-to-wear fashion and customer loyalty programs.

- Bergdorf Goodman traces to a Manhattan tailor shop in 1899 and spun off into Neiman Marcus Group in 1987.

- Horchow, founded in 1973 as the first luxury mail-order catalog without stores, was acquired by Neiman Marcus in 1988 and now operates as horchow.com.

SO5 Digital Governance

The SO5 Digital Debtors maintain their own capital structure and governance; Saks Global owns approximately 80% with remaining equity held by outside investors, including Insight Partners affiliates. Certain operations remain consolidated within the Global Debtors under intercompany reimbursement arrangements.

Given potential conflicts with the Global Debtors, the SO5 Digital Debtors implemented independent governance for these cases.

- Gary Begeman was appointed Independent Director on December 31, 2025. Andrew Hede was retained as Chief Restructuring Officer reporting to Begeman.

- The SO5 Digital Debtors separately retained Accordion Partners, LLC as financial advisor and Bradley Arant Boult Cummings LLP as independent bankruptcy counsel.

Corporate Organizational Structure

Operations Overview

The retail footprint comprises 33 Saks Fifth Avenue stores (~4.36 million sq. ft.), 81 Saks OFF 5TH stores (~2.39 million sq. ft.), 36 Neiman Marcus stores (5.24 million sq. ft.), two Bergdorf Goodman stores at 58th Street and Fifth Avenue in Manhattan, and five Last Call stores (~15,000-45,000 sq. ft. each). Distribution, support, and office facilities support store and online operations.

Real Estate Portfolio

Saks Global owns or controls ground leases on 39 retail properties totaling more than 5.5 million square feet, concentrated in top metropolitan regions with high population density and above-average household income. The portfolio includes the Saks Fifth Avenue NYC flagship, recognized as one of the world's premier luxury department stores.

- The flagship building and land is owned by non-Debtor Saks Flagship Real Property LLC and is subject to a $1.25 billion securitized mortgage.

- The property was appraised at $3.7 billion in 2014 and valued at $3.6 billion in March 2024.

- Monthly ground lease payments total approximately $7.7 million, with CMBS debt service of approximately $4.7 million per month.

HBS Joint Venture

As of the Petition Date, the Company holds approximately 62.4% of the equity in the HBS JV. The HBS JV owns 31 U.S. properties through separate SPEs operating as landlords; properties contributed by the Company are leased back under 20-year portfolio operating leases with five six-year extension options. Certain HBS JV interests secure a $428.1 million securitized real estate loan.

Key Commercial Arrangements

Authentic Brands Joint Venture: Saks Global and Authentic Brands Group each own 50% of Authentic Luxury Group LLC ("ALG"), which holds licensing rights to the Saks Fifth Avenue, Saks OFF 5TH, Neiman Marcus, and Bergdorf Goodman brands outside of U.S. and Canadian retail store operations.

- Certain agreements provide that upon bankruptcy filing by certain Global Debtors, Authentic Brands' preferred equity in Saks Global Investor L.P. becomes exchangeable for newly-issued ALG equity.

- Notably, intellectual property related to Saks, Saks Fifth Avenue, Saks OFF 5TH, Neiman Marcus, and Bergdorf Goodman was transferred to subsidiaries that are not guarantors on the Debtors' funded debt. The Company's ALG equity is unpledged.

Amazon Partnership: Certain Global Debtors maintain a commercial agreement with Amazon for a "Saks on Amazon" virtual storefront launched April 2025. SGE pays referral fees with potential true-up payments based on annual minimums aggregating up to $900 million over eight years.

Footprint Optimization

On the Petition Date, the Global Debtors sought to reject 26 unexpired leases covering former Lord & Taylor locations and a closed Saks store in downtown San Francisco. These rejections will not impact employees or day-to-day operations.

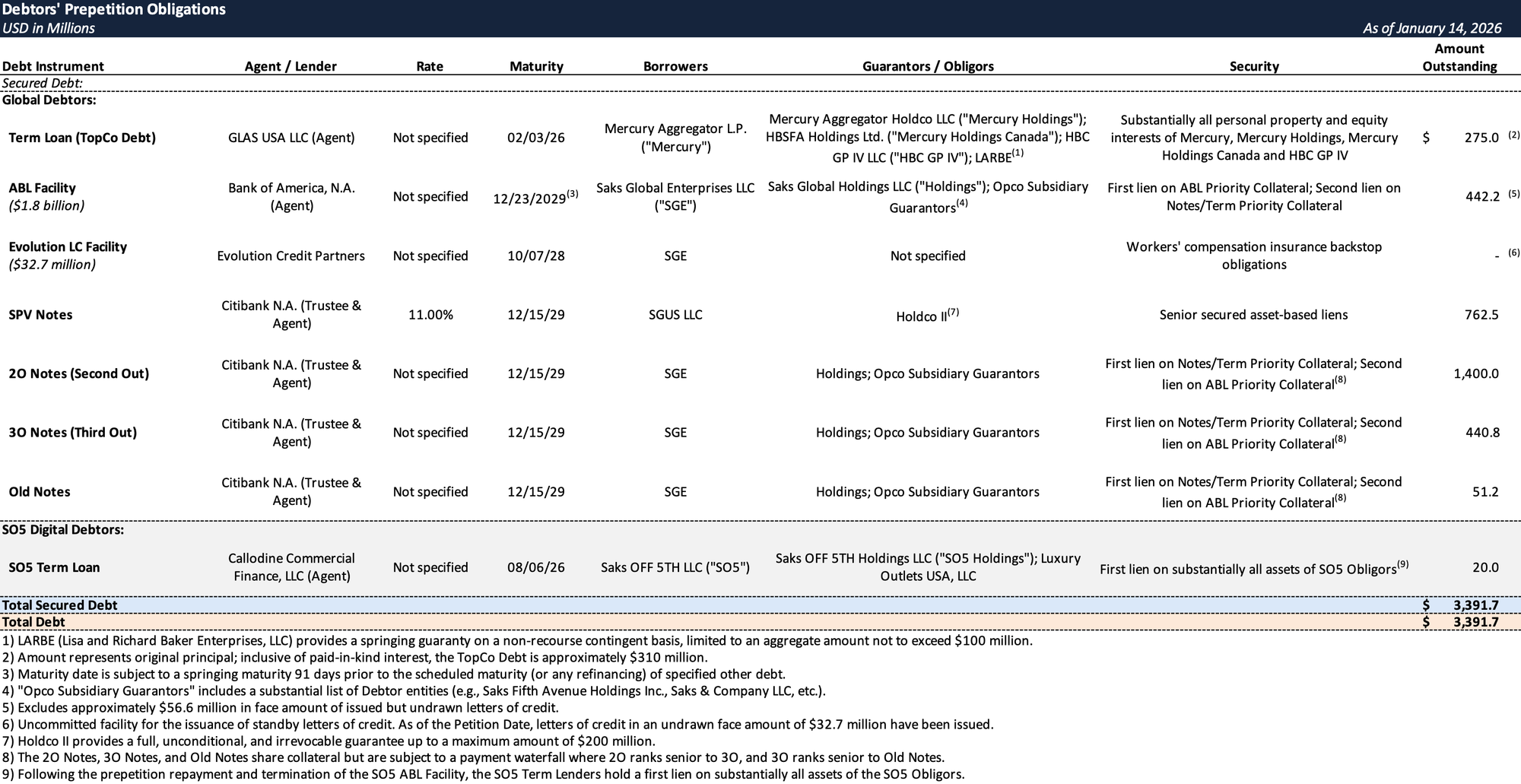

Prepetition Obligations

Excluded Non-Debtor Debt

The ~$3.4 billion in Global Debtor funded debt excludes two securitized CMBS loans held by non-Debtor affiliates: approximately $1.25 billion secured by the Saks Fifth Avenue NYC flagship property, and approximately $428.1 million (as of January 1, 2026) secured by certain HBS JV fee and leasehold interests.

Intercompany On-Loans

Following SPV Note issuance, Debtor SGUS LLC extended two on-loans to SGE:

- FILO On-Loan: $400 million original principal. First lien on ABL Priority Collateral; second lien on Notes/Term Priority Collateral. Ranks senior to NPC Onloan when outstanding exceeds $300 million.

- NPC On-Loan: ~$362.5 million original principal. Secured pari passu with Opco Notes (2O Notes, 3O Notes, and Old Notes). Ranks equal to FILO Onloan once FILO falls to $300 million or below.

Axonic Put Dispute

In 2021, an Axonic Coinvest II, LP affiliate purchased HBS CMBS bonds and entered Conditional Bond Purchase Agreements giving Axonic the right to put certain bonds to SGE or Saks Fifth Avenue HoldCo II LLC ("Holdco II") at specified prices. The put became exercisable March 14, 2024, but was extended multiple times through October 31, 2025 in exchange for at least $5.5 million in payments.

- On December 15, 2025, Axonic agreed to forbear until January 31, 2026, subject to an additional $13 million payment, continued good faith negotiations, no bankruptcy filing by any party, and no default under the HBS CMBS Loan. The Debtors paid the $13 million and continued negotiations.

- On January 7, 2026, amid bankruptcy rumors, Axonic sent notice purporting to exercise the put. The Debtors assert this breached the forbearance agreement and intend to bring an adversary proceeding seeking declaratory judgment and damages absent consensual resolution.

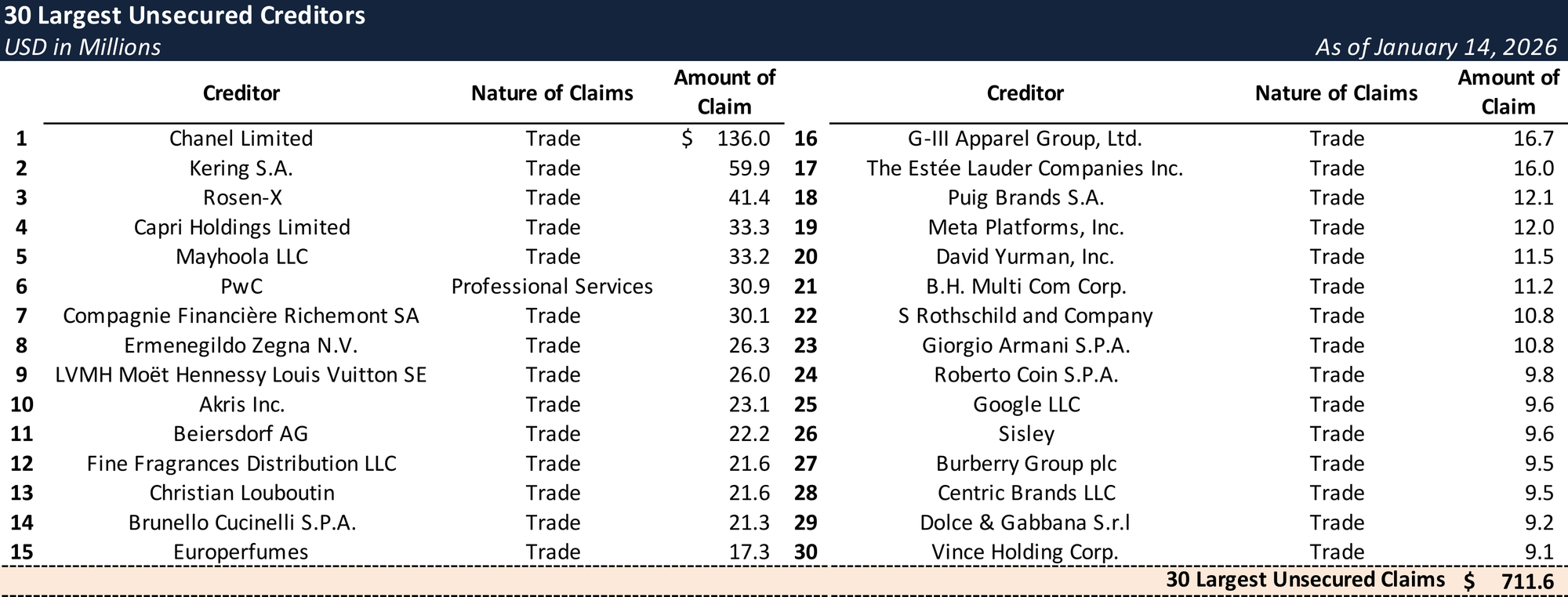

Top Unsecured Claims

Events Leading to Bankruptcy

Post-Acquisition Liquidity Crunch

The December 2024 Neiman Marcus acquisition, financed with $2.2 billion in notes, ABL drawings, TopCo seller financing, and a $1.544 billion equity contribution, left Saks Global with an unsustainable capital structure.

Although the Debtors projected $600 million in run-rate synergies over five years, near-term liquidity remained severely constrained, preventing timely vendor payments.

- According to the Debtors, the Company's challenges were not demand-driven. Where inventory was available, performance remained robust and top customers continued spending. The constraint was liquidity to acquire necessary inventory.

Vendor Spiral

Inability to pay vendors on time strained brand partner relationships and created a self-reinforcing cycle: vendors withheld shipments, preventing adequate seasonal inventory build for Spring 2025; declining inventory reduced the ABL borrowing base; the Company hit vendor credit caps, forcing accelerated payments that further limited flexibility.

Fiscal year 2025 (ending February 1, 2025) consolidated revenue declined 13.6% year-over-year on lower retail sales across all channels. Softer-than-expected Q2 2025 performance drove aged trade payables to unsustainable levels.

Failed Financing Attempts

Beginning February 2025, the Company pursued new financing to catch up on vendor payments, capture synergies, and meet a June 30 interest deadline.

On April 28, 2025, the Company announced commitments for a $300 million FILO loan from SLR Credit Solutions and a $50 million secured term loan—but the SLR financing could not close on committed terms. Delays caused incremental payables stretching, further damaging vendor relationships.

Exchange Transaction

In Summer 2025, the Global Debtors secured $600 million in new money (before fees and prepaid interest) from existing bondholders via SPV Notes funded in two tranches: $300 million in late June and an additional $300 million in August when approximately 98% of Old Notes tendered. The exchange captured approximately $115 million of discount.

Proceeds proved insufficient. Only $244 million was available for vendor catch-up; remaining funds covered working capital and Neiman Marcus integration expenses.

- Merchandising system integration issues disrupted inventory receipts at Neiman Marcus and Bergdorf Goodman during the critical pre-holiday period.

- In H2 2025, the Company received over $550 million less inventory than its July forecast, negating the vendor paydown benefits.

ABL Squeeze

Liquidity pressures converged heading into the 2025 holiday season:

- Minimum excess availability covenants stepped up from $200 million to $375 million (December 1) to $500 million (December 16)

- Over $50 million in discretionary reserves were imposed throughout 2025

- On December 4, 2025, the ABL Agent triggered control over deposit accounts via DACAs

- December interest payments of approximately $126 million on the FILO Loan, NPC Onloan, SPV Notes, and OpCo Notes came due—the Company could not pay

- S&P Global downgraded Saks Global to 'SD' (selective default) from 'CCC' on January 7, 2026, citing a missed interest payment due December 30, 2025 and a reported $410 million free operating cash flow deficit year-to-date

The Company characterized this as a "perfect storm" heading into January, historically a seasonal low for sales and liquidity.

Governance and Leadership Changes

To address the crisis, the Global Debtors engaged Willkie Farr & Gallagher LLP and PJT Partners L.P. to augment Berkeley Research Group; Mark Weinsten of BRG was appointed Chief Restructuring Officer effective January 1, 2026. Independent managers Paul Aronzon and William Tracy joined the board of HBC GP LLC and subsidiaries, forming a Special Committee. Scott Vogel was approved for appointment as independent director, subject to interim DIP order entry.

On January 2, 2026, CEO Marc Metrick resigned, with Richard Baker, architect of the consolidation strategy, assuming the interim CEO role. Upon the filing, Geoffroy van Raemdonck, who had led Neiman Marcus Group through its 2020 bankruptcy, was appointed Saks Global CEO. Former Neiman Marcus Chief Merchandising Officer Lana Todorovich and former Bergdorf Goodman President Darcy Penick joined the leadership team.

Prepetition Strategic Alternatives

In late 2025, the Debtors explored out-of-court options with equity holders and third parties, including asset sales, alternative financing, and holistic restructuring transactions. No agreement was reached.

In mid-December, the Global Debtors began DIP negotiations with key creditors. An ad hoc group holding approximately 72% of SPV Notes and 50% of 2O Notes (the "Ad Hoc Group") engaged Paul Weiss, FTI Consulting, and Lazard. ABL Lenders engaged Morgan Lewis, Otterbourg, and M3 Partners.

Positive Indicators

Despite liquidity constraints, the business showed positive signs:

- When stores have inventory, it sells—no significant capex or marketing required to redirect trends

- Achieved ~$300 million in run-rate synergies, nearly double initial year-one expectations of $150 million

- Since August 2025, operating on one unified merchandising platform with margin potential from optimized inventory allocation

- Saks Fifth Avenue stores and Saks.com comparable sales improved in November 2025 on improved inventory flows

- Concession comparable sales grew 2-18% year-over-year every month of fiscal 2025

- Customer retention exceeds 90% for $10,000+ annual spenders; the top 3% of customers generate ~40% of annual GMV

DIP Financing and Path Forward

Negotiations produced three DIP facilities providing nearly $1.75 billion in new money (including exit financing commitments):

- ABL DIP Facility ($1.5 Billion): Revolving facility from existing ABL Lenders with materially improved terms including reduced reserves and minimum excess availability covenants. Provides approximately $240 million in incremental availability versus prepetition. Includes interim and final roll-up mechanisms for prepetition obligations.

- SGUS DIP Facility ($2.6 Billion): Delayed draw term loan backstopped by the Ad Hoc Group comprising $1 billion in new money first-out term loans, up to $808 million in second-out roll-up loans, and up to $751 million in third-out DIP loans. Includes $500 million exit financing commitment.

- OpCo DIP Facility ($1.75 Billion): Intercompany facility through which SGUS lends proceeds to SGE, including up to $1 billion in new money and cashless roll-ups of approximately $752 million in prepetition intercompany loans.

With DIP funding secured, the Global Debtors aim to stabilize operations, restore vendor confidence, and emerge with a right-sized capital structure.

SO5 Digital Debtors

The e-commerce business faced distinct challenges: substantial infrastructure investments did not yield anticipated returns; difficulty selling through inventory constrained working capital and prevented new inventory purchases; as the Debtors considered strategic alternatives, SO5 lenders took actions causing further liquidity constraints.

The SO5 Digital Debtors intend to conduct an orderly sale process. Based on preliminary market feedback, inventory monetization is most likely to optimize recoveries. Unless a superior alternative emerges, they will proceed with orderly self-liquidation and wind-down of the e-commerce business only (not the brick-and-mortar Saks OFF 5TH stores).

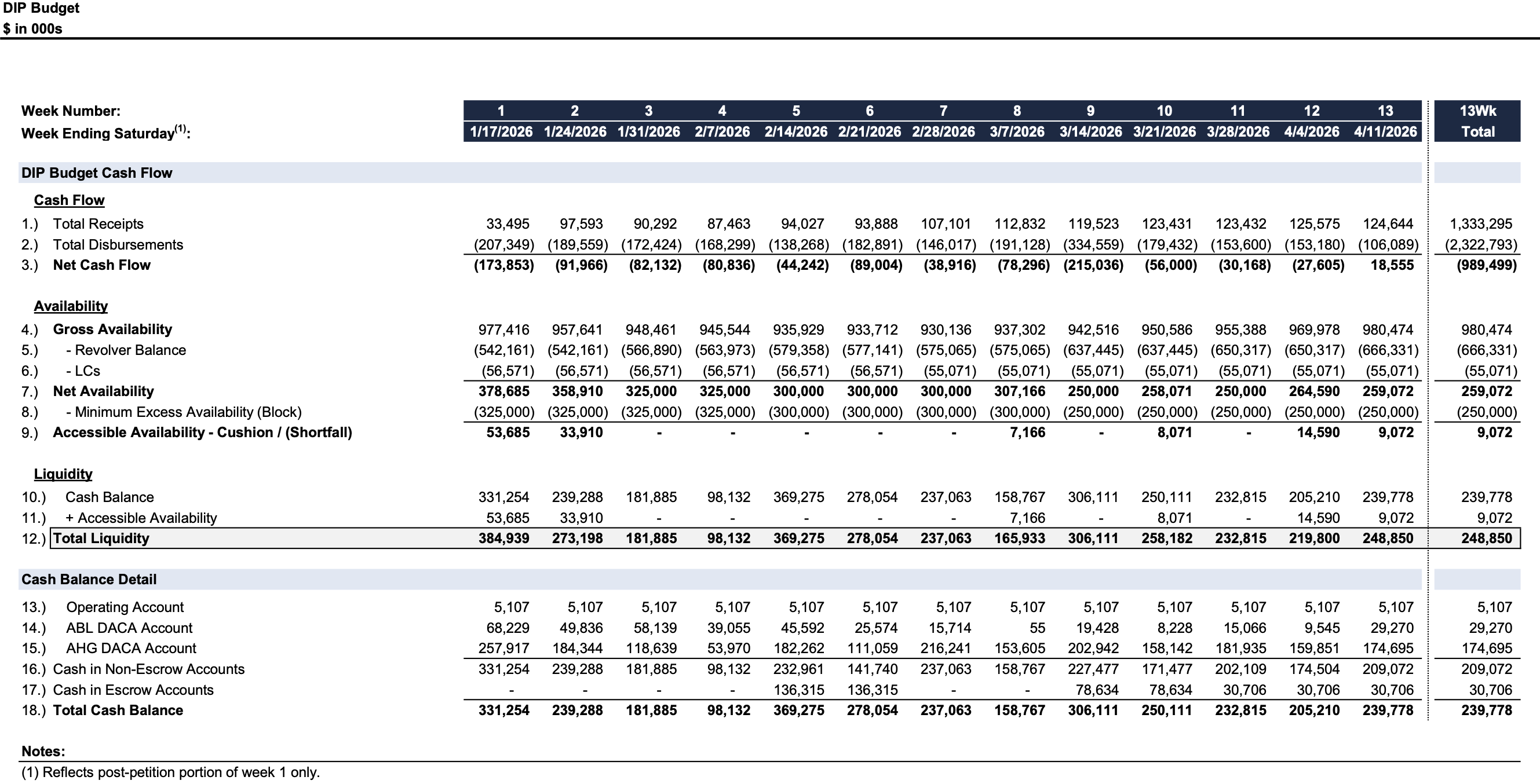

Initial DIP Budget

Key Parties

- Willkie Farr & Gallagher LLP (general bankruptcy counsel); Haynes and Boone, LLP (Texas bankruptcy counsel); Berkeley Research Group, LLC (financial advisor / CRO, Mark Weinsten); PJT Partners, Inc. (investment banker); Stretto, Inc. (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.