Filing Alert: Saks Global Chapter 11

Saks Global Files Chapter 11 in Southern District of Texas

Update (Jan. 20, 2026): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of Saks Global Enterprises LLC.

Saks Global Enterprises LLC and its debtor affiliates⁽¹⁾, a New York, NY-based parent of luxury retailers Saks Fifth Avenue, Neiman Marcus and Bergdorf Goodman, filed for Chapter 11 protection on Jan. 14 in the U.S. Bankruptcy Court for the Southern District of Texas.

The filing was precipitated by a liquidity crisis following the 2024 acquisition of Neiman Marcus Group, which resulted in an unsustainable capital structure and strained vendor relationships that severely limited inventory flow. Despite a mid-2025 exchange transaction and $600 million financing infusion, the company faced a "perfect storm" of liquidity challenges, including covenant step-ups under its ABL Facility and missed interest payments in late 2025.

The debtors have secured approximately $1.75 billion in new-money financing across three facilities, including a $1.5 billion ABL DIP and a $2.6 billion term loan DIP backstopped by an ad hoc group of noteholders, to fund operations and a comprehensive restructuring.

Saks Global Enterprises LLC reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 26-90103.

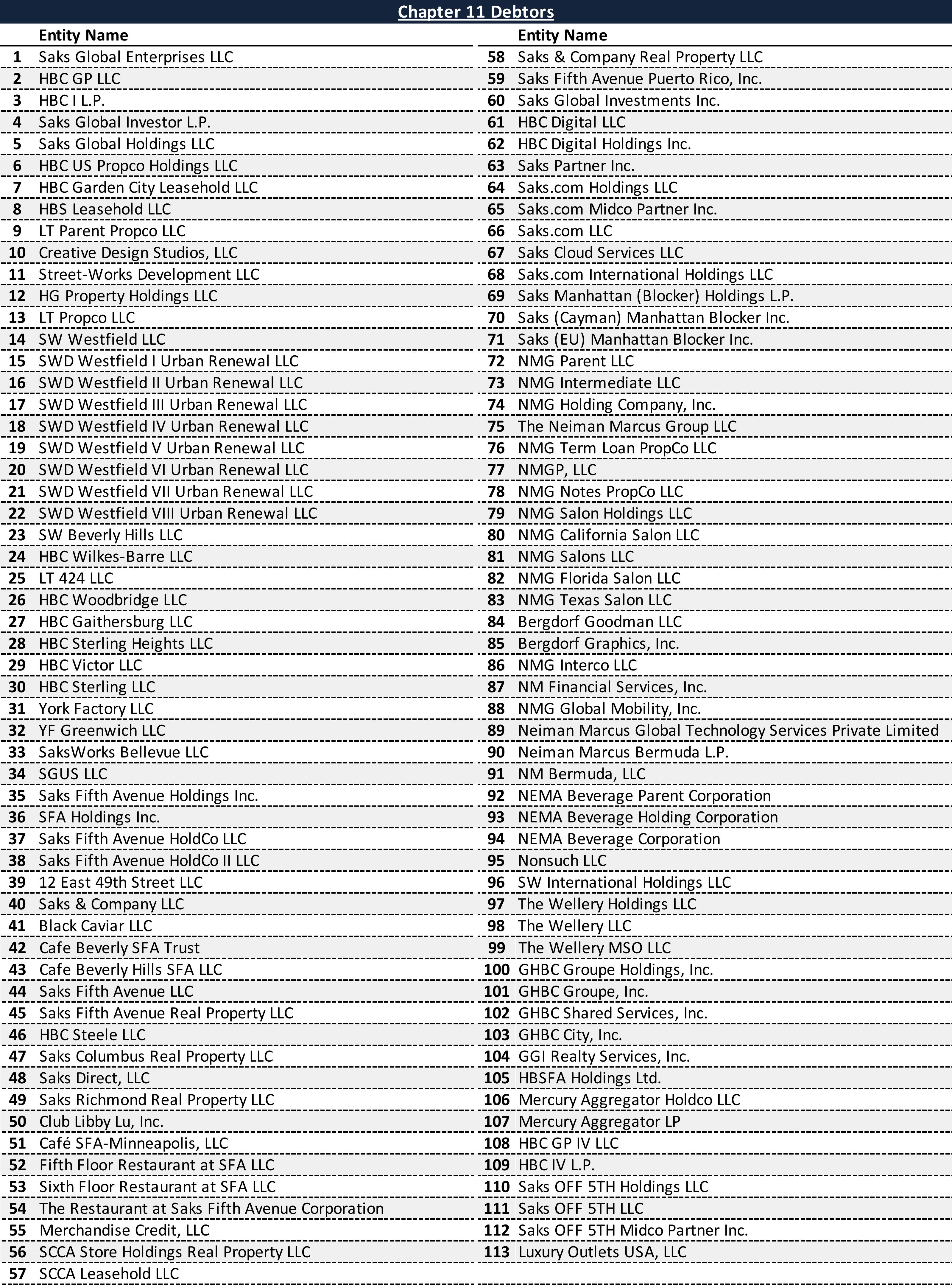

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

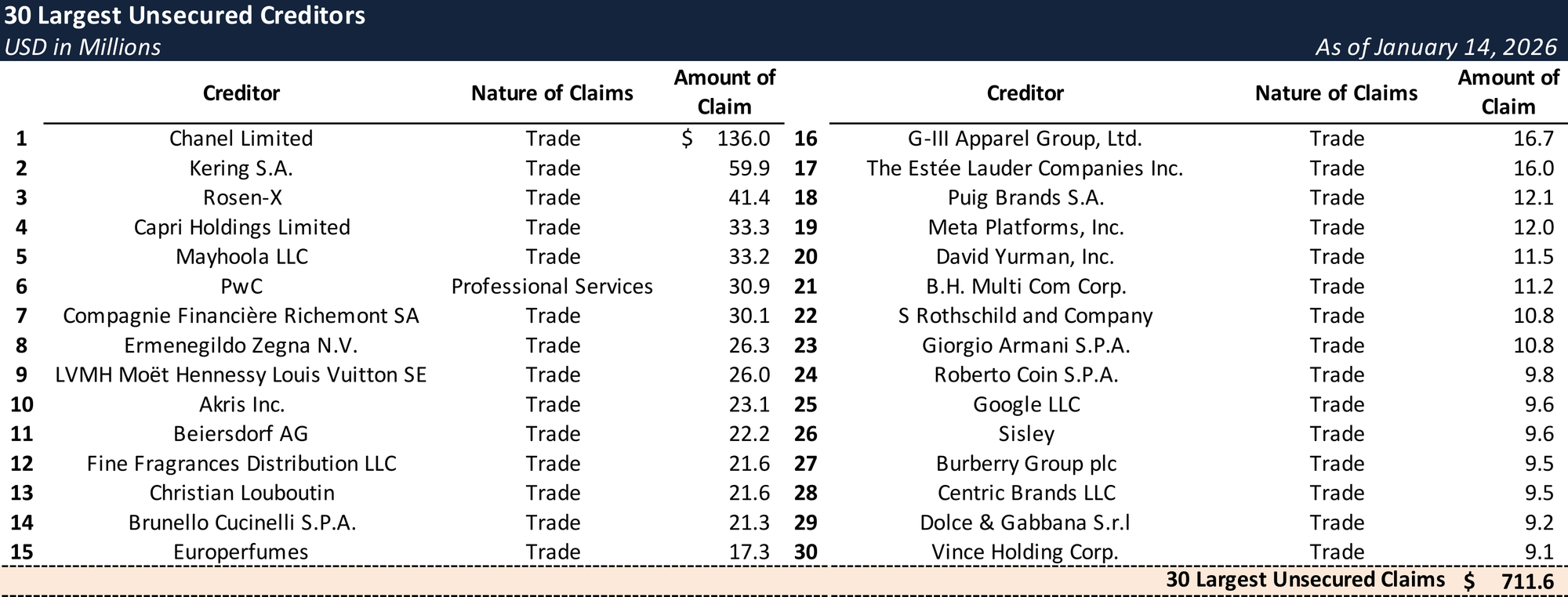

Top Unsecured Claims

Key Parties

Local Bankruptcy Counsel:

- Kelli Stephenson Norfleet

Haynes and Boone, LLP

Email: [email protected]

General Bankruptcy Counsel:

- Willkie Farr & Gallagher LLP

Financial Advisor / CRO:

- Berkeley Research Group, LLC (Mark Weinsten)

Investment Banker:

- PJT Partners, Inc.

Claims Agent:

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.