Case Summary: Scanrock Oil & Gas Chapter 11

Scanrock Oil & Gas has filed for Chapter 11 bankruptcy, citing commodity price volatility and lender enforcement actions, with plans to sell the Ochoco Ranch.

Business Description

Headquartered in Odessa, TX, Scanrock Oil & Gas, Inc., along with its Debtor affiliates⁽¹⁾ (collectively, "Scanrock" or the "Company"), operates an integrated oil and gas exploration and production platform.

- Core Operations: The Company maintains oil and gas operations across key Texas basins, with a focus on the Smackover Formation and the Todd Deep Field.

- Workover Program: A targeted program to complete horizontal well workovers in the Smackover Formation is expected to materially increase production and liquidity.

As of the Petition Date, the Company employs 18 full-time employees and 12 independent contractors.

Scanrock filed for Chapter 11 protection on Feb. 3 in the U.S. Bankruptcy Court for the Northern District of Texas. As of the Petition Date, the Debtors reported $10 million to $50 million in assets and $50 million to $100 million in liabilities.

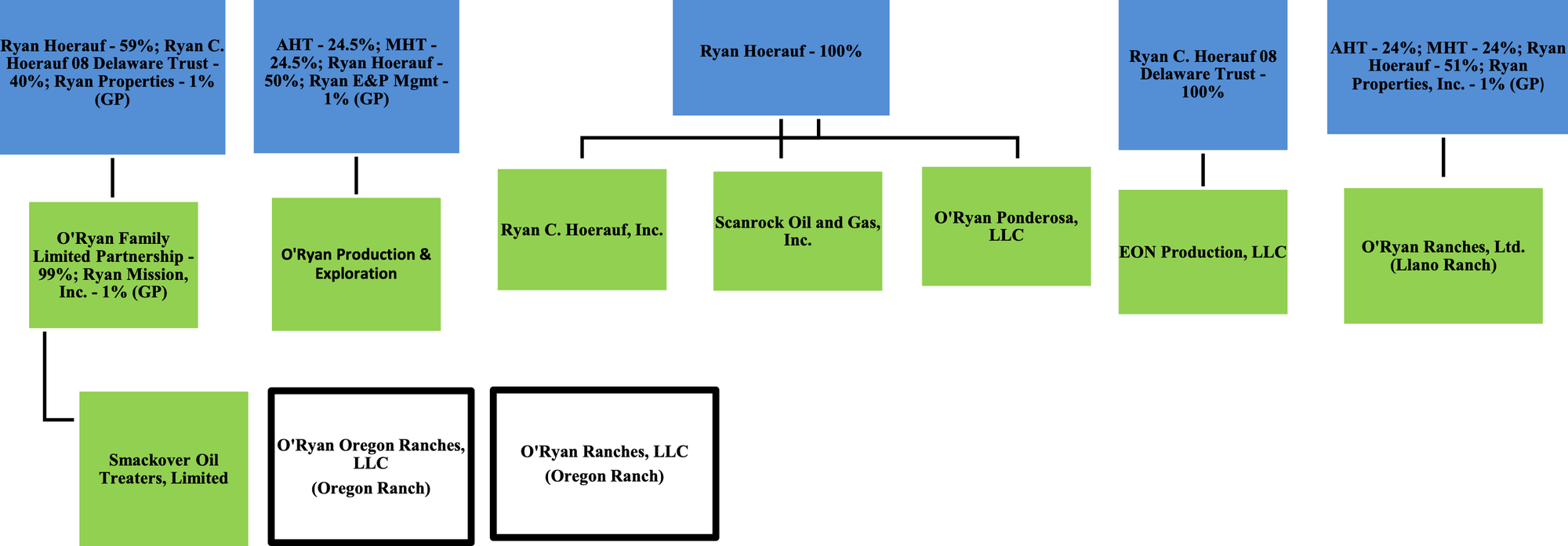

⁽¹⁾ O’Ryan Family Limited Partnership; O’Ryan Production & Exploration Ltd.; O’Ryan Ranches, Ltd.; Ryan C. Hoerauf, Inc.; Smackover Oil Treaters, Ltd.; O’Ryan Ponderosa, LLC; EON Production, LLC.

Corporate History

The Company’s operations are anchored by the entrepreneurial background of its principal, Ryan C. Hoerauf. Ryan began his career at Getty Oil, where he gained end-to-end operational experience before departing in 1990 to establish his own independent oil and gas company in Midland County, TX.

Key Milestones and Expansion

- Early Operations: After leaving Texaco (which acquired Getty Oil in 1984), Ryan built an independent platform by acquiring producing assets and leases across Texas, Louisiana, and New Mexico.

- Strategic Focus on Marginal Fields: The Company established a competitive edge by deploying vertically integrated treatment facilities to convert low-grade crude (e.g., West Texas Sour) into higher-value products (e.g., Louisiana Sweet Crude).

- Diversification Initiatives: Scanrock expanded into ancillary businesses, including sand, gravel, and limestone production for fracking operations and mineral processing for hydrocarbons.

Today, Ryan maintains active oversight of exploration, drilling, and production activities.

Organizational Chart

The non-Debtor ownership entities and individuals are highlighted in blue, the Debtors are shown in green, and the non-Debtor affiliates holding the Oregon Ranch are presented in white.

Operations Overview

Scanrock’s operations span oil and gas production, real estate holdings, and ancillary revenue streams. The Chapter 11 filing centers on optimizing the Company’s asset portfolio and driving cash flow improvements through near-term well workover projects.

Oil & Gas Operations

- Primary Fields: Operations are concentrated in the Smackover Formation (Kaufman, Navarro, and Henderson Counties) and the Todd Deep Field (Crockett County). As of October 1, 2022, proved developed producing (PDP) reserves carried a discounted net present value of approximately $24.6 million, per a reserve report from Russell K. Hall and Associates.

- Workover Program: The Company is advancing two well workovers targeting horizontal wells beneath Cedar Creek Lake in the Smackover Formation, which are expected to deliver significant production uplift and bolster cash flow.

- Infrastructure Holdings: Scanrock controls gathering systems, rights-of-way, and processing facilities supporting production from their Texas assets.

Real Estate Holdings

- Oregon Ranch (“Ochoco Ranch”): Non-Debtor affiliates O’Ryan Ranches LLC and O’Ryan Oregon Ranches LLC hold the 44,329-acre timbered ranch in Crook County, OR. The property includes multiple structures, energy facilities, and timber operations generating carbon tax credits. The ranch, appraised at $60.95 million in March 2023, is currently marketed for sale at $60 million.

- Llano Ranch: Debtor O’Ryan Ranches, Ltd. owns this 1,740-acre working ranch in Llano County, TX, which features infrastructure, wells, and interior roads. Market value is estimated at up to $25 million, reflecting demand for premium properties in the Texas Hill Country.

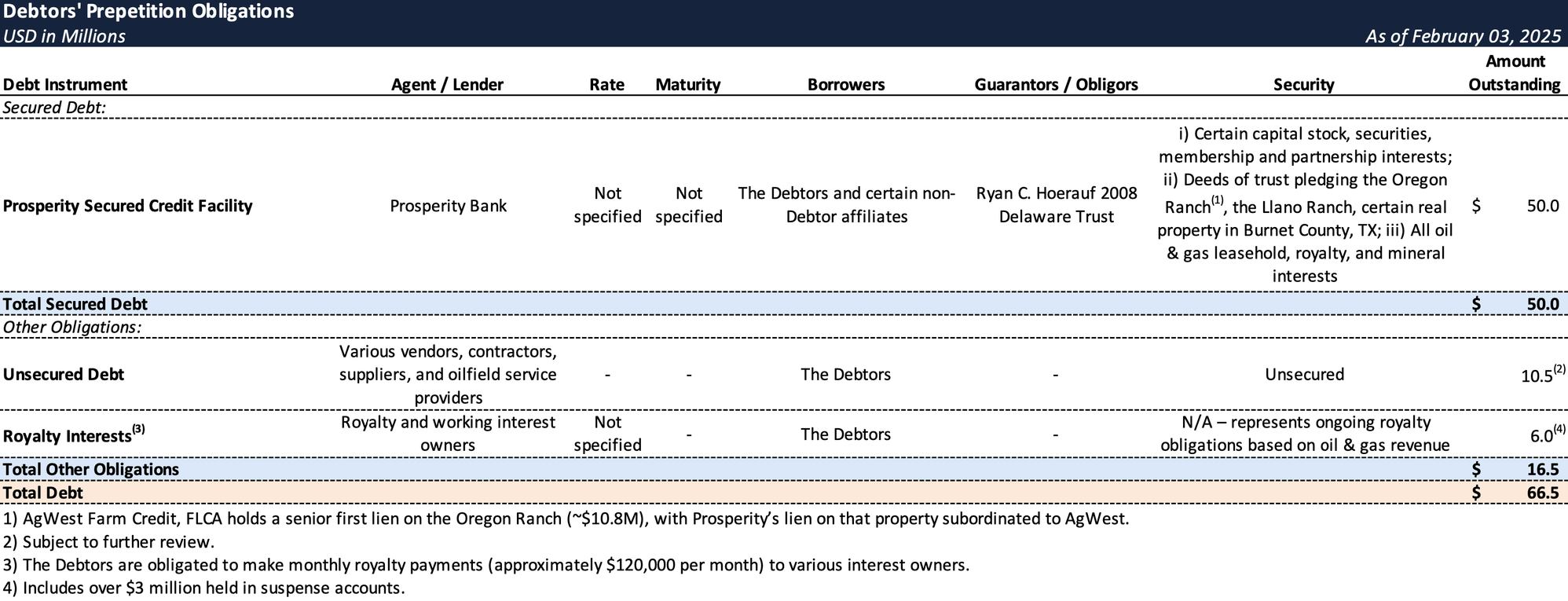

Prepetition Obligations

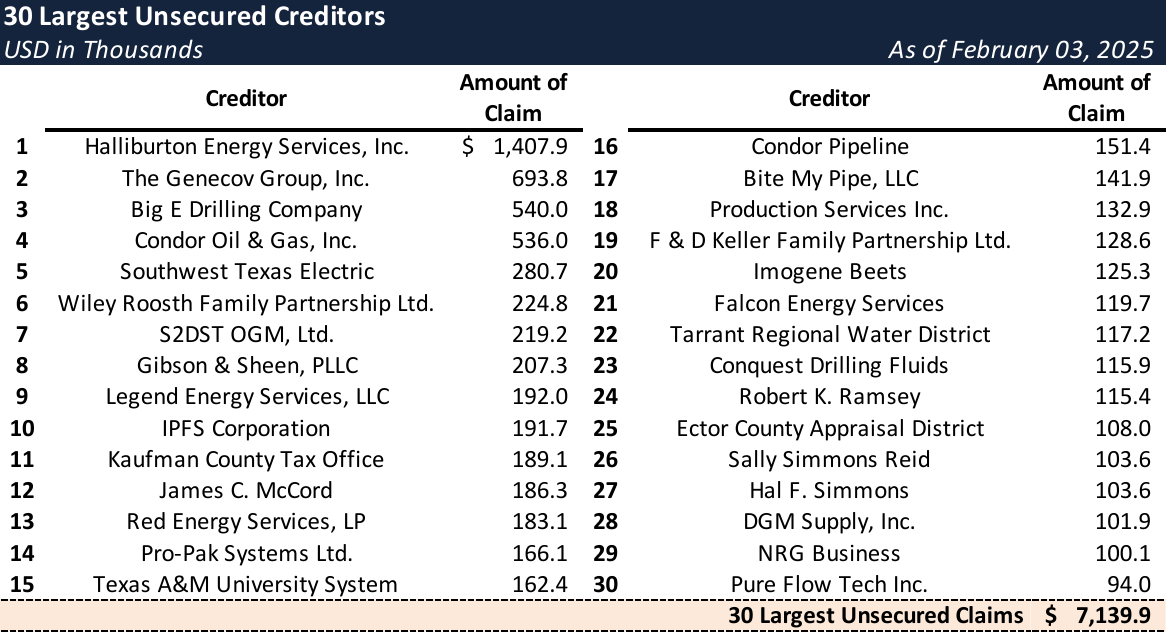

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic and Industry Challenges

- Scanrock has navigated significant volatility in the oil and gas industry over the years, having bought and sold numerous assets during periods of fluctuating commodity prices. However, the sector faced heightened challenges beginning in late 2014, when crude oil prices sharply declined, followed by a continued drop in natural gas prices. This led to a substantial contraction in drilling activities and capital spending by exploration and production companies.

- Although crude oil prices partially recovered in 2016, another downward trend emerged in late 2018, further straining the Company’s ability to generate historical revenue levels. Additionally, the Company encountered difficulties in selling certain oil and gas assets in East and West Texas at prices close to their previous market value, exacerbating financial pressures.

Liquidity Crisis and Refinancing Efforts

- The Company’s financial position deteriorated as interest rates rose sharply from approximately 4% to 8.75% in 2021, increasing liquidity strain and limiting the Company’s ability to satisfy more than the minimum interest payments to Lone Star State Bank of West Texas (predecessor to Prosperity).

- In 2023, Scanrock initiated negotiations with Lone Star State Bank of West Texas to refinance the Prepetition Loan, but these efforts stalled. Following Prosperity’s acquisition of Lone Star State Bank of West Texas in August 2024, the Company engaged with Prosperity to explore workout strategies, including asset sales, to address principal payments on the Prepetition Loan.

Forbearance Agreement and Default

- After the Prepetition Loan matured on September 3, 2024, Prosperity issued a demand letter on October 8, 2024, requiring full payment of all unpaid obligations under the Prepetition Loan Documents. In response, the Company proposed a plan on October 11, 2024, to bring the loan into compliance, contingent on the sale of the Oregon Ranch pursuant to a letter of intent dated September 17, 2024.

- Scanrock and Prosperity entered into a Forbearance Agreement on December 2, 2024, under which Prosperity agreed to forbear from exercising its remedies until March 31, 2025 (the "Forbearance Period"). The agreement required the Company to deliver a fully executed purchase and sale agreement for the Oregon Ranch by December 15, 2024, for at least $50 million.

- Prosperity terminated the Forbearance Period on December 17, 2024, after the Company failed to meet the purchase and sale agreement requirement. Prosperity then demanded immediate payment of all outstanding obligations under the Loan Documents.

Precipitating Events and Bankruptcy Filing

- Prosperity escalated its enforcement actions, notifying the Company on January 8, 2025, of its intent to foreclose on the Llano Ranch at a state foreclosure sale scheduled for February 4, 2025.

- On January 29, 2025, Prosperity issued a notice of disposition for certain common shares of PB Materials Holdings, Inc. stock held by the Company, with the disposition scheduled for February 10, 2025.

- On January 31, 2025, a state-court-appointed receiver sought to freeze the bank accounts of Debtor Ryan C. Hoerauf, Inc. based on a turnover order from the 152nd District Court of Harris County, TX.

- Facing these mounting pressures, the Company retained legal and financial advisors on January 30, 2025, and filed these Chapter 11 Cases on an emergency basis to address its financial distress and prevent further asset foreclosure.

Restructuring Initiatives and Path Forward

- Following extensive negotiations, Prosperity agreed to allow the Company’s interim use of cash collateral, subject to court approval, to support ongoing operations and facilitate the restructuring process.

- The Company is pursuing the sale of the Oregon Ranch and anticipates increased cash flow from its Workover Wells, which are expected to support its reorganization efforts. A potential purchaser has expressed continued interest in acquiring the Oregon Ranch, with several other parties also engaged in discussions.

- The Company believes that, with the continued use of cash collateral, the proposed sale of the Oregon Ranch, and improved cash flow from operations, it can successfully reorganize and potentially pay all creditors in full through a Chapter 11 plan.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.