Case Summary: Shannon Wind Chapter 11

Shannon Wind has filed for Chapter 11 bankruptcy to pursue a Section 363 sale of its 204 MW wind farm, driven by legacy hedge liabilities stemming from Winter Storm Uri.

Business Description

Shannon Wind, LLC ("Shannon Wind" or the "Company") is a single-purpose entity that owns and operates a 204.1 MW wind energy generation facility in Clay County, north Texas—one of the strongest wind resource regions in the United States. The project consists of 119 General Electric 1.7-103 wind turbines (1.7 MW each, 103-meter rotor diameters), which commenced commercial operations in December 2015 and deliver power into the ERCOT grid via interconnection with Oncor Electric Delivery Company.

As a merchant renewable generator in ERCOT's energy-only market, which provides no capacity payments, Shannon Wind historically relied on hedging contracts and attribute sales to stabilize revenue against volatile spot prices.

Revenue Model

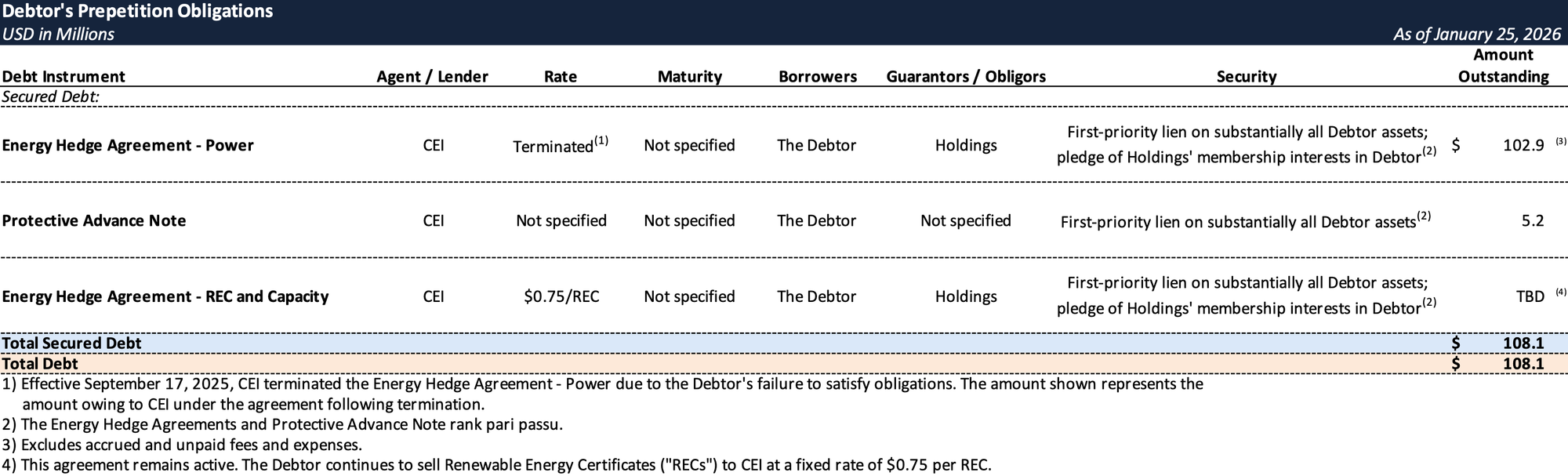

- Energy Hedge (Terminated): At inception, the Company entered into a 13-year energy hedge with Citigroup Energy Inc. ("CEI") at a fixed price of approximately $26.20/MWh for the majority of the project's output. CEI terminated this agreement on September 17, 2025, due to the Company's failure to satisfy its obligations. Shannon Wind now operates with full merchant exposure.

- REC Sales (Continuing): Shannon Wind secured a 13-year agreement to sell its Renewable Energy Certificates to CEI at $0.75/MWh. This agreement remains in effect.

The Company has no direct employees; all operations, maintenance, and management services are provided by third-party contractors.

Shannon Wind filed for Chapter 11 protection on January 25, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $100 million to $500 million in both assets and liabilities.

Corporate History

Shannon Wind’s ownership history follows a common U.S. wind project pattern, originating with a regional developer and transitioning through institutional capital partnerships, before operational challenges reshaped its ownership structure.

Development and Acquisition

- The project was developed by Horn Wind, LLC, a Texas-based renewable energy developer, which assembled leases and easements in Clay County near Windthorst and secured a Chapter 313 property tax limitation agreement with Midway Independent School District.

- In February 2014, Alterra Power Corp. ("Alterra"), a Vancouver-based IPP, acquired 100% of the late-stage project and advanced it through final development, including a $4.5 million interconnection deposit with Oncor and engagement of Mortenson Construction as EPC contractor.

Construction Financing and Commercial Operation

- In June 2015, Alterra partnered with Starwood Energy Group Global, LLC ("Starwood Energy"), closing a comprehensive financing package on June 29, 2015:

- $212 million construction loan (Citi, Santander, RBC affiliates) plus $75 million LC facility;

- $219 million tax equity commitment from Citicorp North America and MidAmerican (Berkshire Hathaway Energy); and

- $125 million sponsor equity (Alterra/Starwood, 50/50).

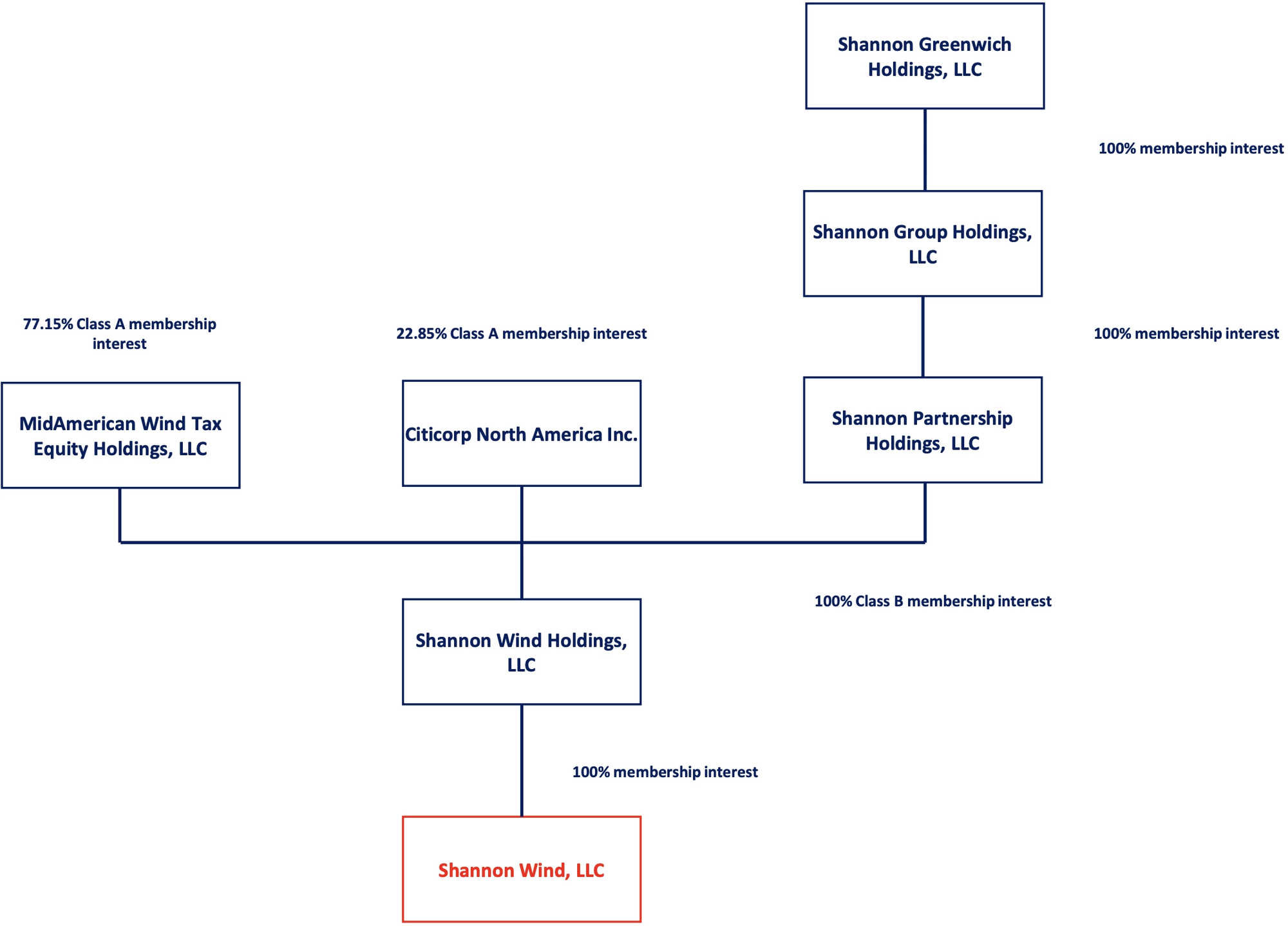

- Shannon Wind Holdings, LLC was formed as the holding company, with Citicorp and MidAmerican as Class A tax equity members and Shannon Partnership Holdings, LLC (sponsors' affiliate) as Class B member.

- The project achieved COD in December 2015, on time and under budget. Tax equity proceeds fully repaid the construction loan by year-end.

Ownership Consolidation

- In February 2018, Innergex Renewable Energy Inc. ("Innergex") acquired Alterra, assuming its 50% sponsor interest alongside Starwood.

- Following Winter Storm Uri in February 2021, Innergex recognized a CAD $58.8 million (~US$47 million) impairment, classifying Shannon Wind as "held for sale."

- In March 2022, Innergex sold its 50% stake for an undisclosed "non-material" price.

Transition to Lotus Infrastructure

- In January 2023, Starwood Energy rebranded as Lotus Infrastructure Partners ("Lotus"), retaining the Shannon Wind project.

- As of the Petition Date, Shannon Wind, LLC is wholly owned by Shannon Wind Holdings, LLC (“Holdings”), which is owned by Class A tax equity members (Citicorp North America and MidAmerican) and Class B sponsor member Shannon Partnership Holdings, LLC (controlled by Lotus).

Legal Structure

Operations Overview

Shannon Wind is a single-purpose entity that operates as a project-financed IPP with fully outsourced operations.

Turbine Technology and Facility

- The wind farm comprises 119 GE 1.7-103 turbines totaling 204.1 MW nameplate capacity. At the time of commencing operations, the 103-meter rotor diameter maximizes capacity factor for north Texas wind conditions.

- Turbines are installed across leased land in Clay County, TX, interconnecting with Oncor's transmission network for delivery into ERCOT West. Under normal conditions, the facility generates sufficient electricity to power approximately 60,000 homes annually.

Third-Party Service Providers

- Operations & Maintenance: GE Vernova International LLC ("GEV") provides comprehensive O&M under a long-term contract, including turbine maintenance, remote monitoring, and operations support.

- Asset Management: Consolidated Asset Management Services ("CAMS") handles day-to-day project and administrative management.

- Energy Management: Tenaska Power Services Co. ("Tenaska") serves as Qualified Scheduling Entity and energy manager, handling the ERCOT interface for scheduling, forecasting, and settlement. Since hedge termination, Tenaska sells Shannon Wind's electricity on the spot market.

Real Estate and Regulatory

- The Company holds long-term land and wind rights through leases and easements with local landowners.

- Shannon Wind benefits from a Chapter 313 property tax limitation agreement with Midway ISD which reduces annual property tax obligations.

- The project participated in the federal Production Tax Credit program with credits allocated to Class A tax equity investors.

No major operational disruptions have been reported outside Winter Storm Uri. The CRO affirmed he was "not aware of any financial or operational concerns that threaten the ongoing viability of the Project" from an operational standpoint.

Prepetition Obligations

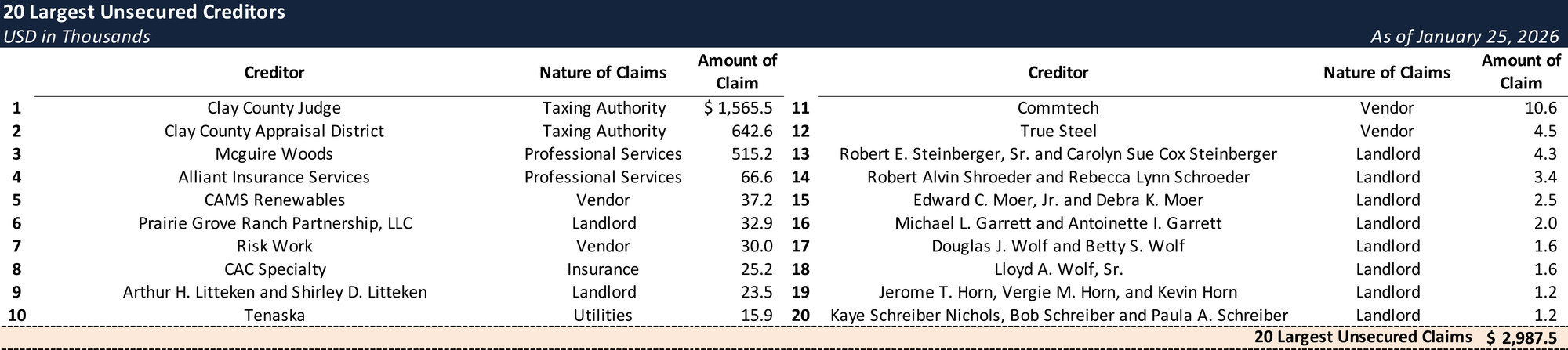

Top Unsecured Claims

Events Leading to Bankruptcy

Shannon Wind's Chapter 11 filing on January 25, 2026, resulted from a cascade of financial challenges rooted in Winter Storm Uri (February 2021) and its multi-year fallout. The Company's insolvency stems not from asset quality or operational failure, but from a legacy energy hedge that converted an extreme weather event into a $39.5 million balance sheet liability the Company could not satisfy.

Winter Storm Uri and Hedge Losses

- Winter Storm Uri struck Texas severely in February 2021. Sub-freezing temperatures caused widespread outages and dramatically reduced wind generation statewide. Shannon Wind's turbines suffered significant blade icing, which impeded production during the critical period.

- ERCOT and the PUCT raised electricity prices to the $9,000/MWh regulatory ceiling for approximately four days.

- Unable to deliver electricity at the ~$26.20/MWh hedge price, the Company was liable to purchase replacement energy at $9,000/MWh—a loss of approximately $8,974/MWh of shortfall.

- Shannon Wind issued force majeure notices to CEI; CEI rejected the claim.

- In March 2021, CEI invoiced $39.5 million. The Company disputed the invoice but lacked funds to satisfy it. CEI issued notices of default.

Litigation with CEI

- In April 2021, Shannon Wind and Shannon Wind Holdings sued CEI in Harris County District Court seeking declaratory judgments that: (i) the storm constituted force majeure; (ii) CEI's invoice was improperly calculated and unenforceable; (iii) no default had occurred; and (iv) CEI's default notice was invalid. The Company also asserted breach of contract.

- The court granted a TRO but denied preliminary injunction. The litigation proceeded through 2022 but was ultimately dismissed in February 2023, leaving Shannon Wind fully liable for hedge losses.

Defaults and Prolonged Negotiations

- On April 13, 2022, CEI exercised secured creditor remedies, directing Citibank (as collateral agent) to sweep the Company's collateral accounts, capturing approximately $14 million in partial satisfaction of outstanding amounts.

- Over several years, CEI, Citibank, and Lotus principals engaged in extensive negotiations including "dozens of discussions and exchanges" regarding amounts owed and resolution proposals. No actionable agreement was reached.

CRO Appointment and Interim Funding

- On September 16, 2025, CEI exercised remedies to force governance changes, directing Citibank to cause Shannon Wind to engage Accordion Partners, LLC, appointing John Shepherd as CRO.

- Concurrently, effective September 17, 2025, CEI terminated the Energy Hedge Agreement – Power, with approximately $102.9 million owed thereunder.

- On November 5, 2025, CEI provided a $5.15 million Protective Advance to fund the business and operations of the Debtor.

- Using the Protective Advance, the CRO cured GE Vernova’s termination notice arising from past-due invoices and is actively pursuing a repower option to maximize asset value.

- The CRO's efforts to broker a consensual resolution did not yield a pre-bankruptcy settlement.

Independent Manager and Pre-Filing Preparations

- On January 22, 2026, CEI exercised further remedies to appoint John D. Jones (through Redbud New Energy, LLC) as Independent Manager.

- Pre-petition, the Company engaged Nomura Securities International, Inc. as investment banker to market the project. The sale process was in early stages at filing.

Chapter 11 Filing and Sale Strategy

- Shannon Wind filed Chapter 11 on January 25, 2026, to effectuate a going-concern sale of the Project through a competitive bidding process.

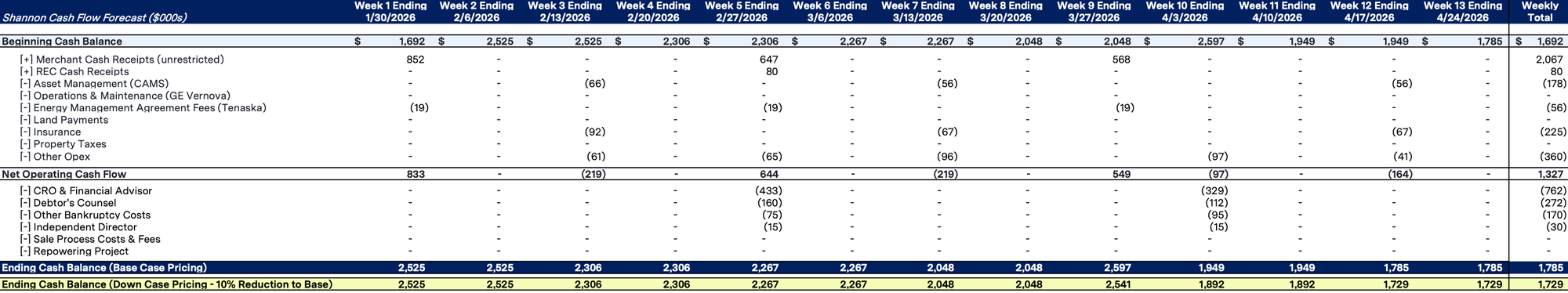

- The Company entered with approximately $2.5 million cash on hand, substantially all constituting cash collateral subject to CEI liens. CEI has consented to cash collateral use under a 13-week budget.

- Target closing is within 150 days of the Petition Date, followed by a liquidating plan to distribute proceeds.

- As a secured creditor, CEI has the right to credit bid its ~$108 million claim.

Mass Tort Litigation

- As of the Petition Date, Shannon Wind was among hundreds of defendants named in Winter Storm Uri litigation, with over 100 pending actions and hundreds of individual plaintiffs. The Company disputes all claims. The automatic stay halts these suits, and the court approved streamlined notice procedures to serve claimants through counsel of record.

Initial Budget

Key Parties

- Bradley Arant Boult Cummings LLP (general bankruptcy counsel); Accordion Partners, LLC (financial advisor / CRO, John Shepherd); Nomura Securities International, Inc. (investment banker); KPMG LLP (valuation advisor); Kurtzman Carson Consultants, LLC dba Verita Global (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.