Case Summary: Shoosmith Sanitary Landfill Chapter 11

Shoosmith Landfill operators have filed for Chapter 11 bankruptcy following the site’s closure, mounting environmental costs, and an underperforming gas contract; DIP financing talks underway to support planned asset sale.

Business Description

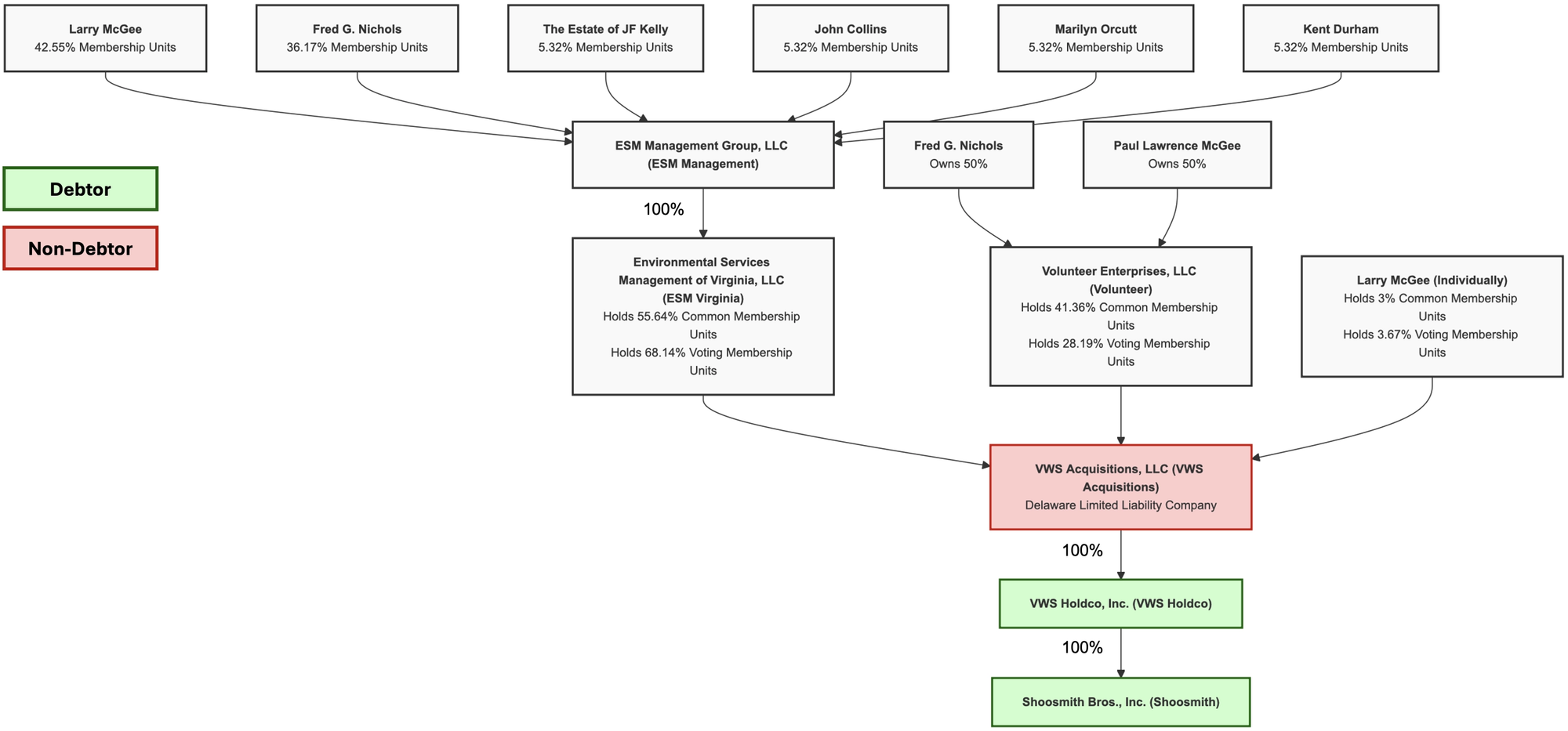

VWS Holdco, Inc. ("VWS Holdco") and its primary operating subsidiary, Shoosmith Bros., Inc. ("Shoosmith") (collectively, the "Company" or the "Debtors"), constitute a privately held waste management enterprise centered on the Shoosmith Landfill, a municipal solid waste (MSW) facility in Chester, VA, approximately ten miles south of Richmond. Shoosmith directly owns and operates the landfill (VA DEQ Solid Waste Permit No. 587), while VWS Holdco serves as its parent company.

- The Shoosmith Landfill historically served the greater Richmond region, catering to commercial and industrial waste disposal needs, and had accepted an average MSW volume of 2,562 tons/day (365-day basis) or 3,270 tons/day (286-operating-day basis).

- In addition to landfill operations, the Debtors, often operating as Virginia Waste Services, provided ancillary services such as portable toilet rentals and maintained a Material Recovery Facility (MRF) for recyclables.

The Landfill, which commenced operations in 1976 and was managed by the current ownership group⁽¹⁾ since June 2008, ceased accepting waste on December 30, 2022, resulting in minimal revenue thereafter and necessitating staff downsizing and the engagement of consultants for its complex closure process.

The Debtors filed for Chapter 11 protection on June 1, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $0 to $50 thousand in assets and $100 million to $500 million in liabilities.

⁽¹⁾ See the organizational structure chart below.

Corporate History

Shoosmith Bros., Inc. was originally founded by the Shoosmith family, prominent landowners in Chesterfield County, who established the landfill in 1976. The family also operated Shoosmith Construction Inc. for site development and landfill cell construction.

- The Debtors are led by Fred G. Nichols ("Mr. Nichols"), President, and Paul Lawrence McGee ("Mr. McGee"), Vice President.

Expansion Efforts and Regulatory Challenges

- Throughout the 2000s, the Company expanded its waste operations under the Virginia Waste Services brand. A significant early development was the Virginia Department of Environmental Quality's (VDEQ) conceptual approval (late 1990s) for expanding the landfill into an adjacent granite quarry.

- However, this expansion faced persistent local opposition. In July 2018, the Chesterfield County Board of Supervisors denied the necessary land-use application for the quarry expansion. Subsequent litigation against the county was unsuccessful, preventing the expansion and forcing the Company to write off approximately 17 million tons of planned future capacity. This denial significantly shortened the landfill's operational lifespan and curtailed its permitted design capacity.

- In 2020, the Company supported a landfill gas-to-renewable natural gas (RNG) project, with Chesterfield Planning Commission approving a biogas processing facility on Shoosmith property to be developed by Morrow Energy.

Corporate Organizational Structure

Operations Overview

The Debtors' core operations revolved around the Shoosmith Landfill, a large sanitary landfill historically permitted for municipal solid waste, including household, commercial, and industrial non-hazardous wastes. The facility, operating under VDEQ Permit No. 587, also handled special waste streams like sewage sludge and ash in controlled quantities.

Landfill Capacity and Clot

- The Landfill operated with Cells 1–26. The denial of the quarry expansion (planned Cells 27-28) by Chesterfield County significantly impacted its long-term capacity.

- Initially, the VDEQ permit designated 506 acres as the Waste Management Unit Boundary (WMUB) with a 374-acre landfill footprint. A planned quarry conversion, permitted by VDEQ in February 2016, was expected to add approximately 30 million tons of airspace.

- Following the successful challenge to the quarry permit by Chesterfield County and subsequent property transfers in 2024, the Landfill's total area was reduced to 335 acres (261 acres in WMUB), decreasing its permitted design capacity from 75.89 million cubic yards to 42.1 million cubic yards.

- The Landfill ceased accepting waste on December 30, 2022, which led to minimal revenue, staff reductions, and the engagement of consultants to manage the complex closure process and ensure regulatory compliance.

- Shoosmith Construction, an affiliated company, historically performed cell construction and daily cover, and more recently, partial closure activities.

Environmental Systems and Compliance

- The Landfill is equipped with environmental control systems, including landfill gas collection wells, flares, leachate collection and storage, and groundwater monitoring.

- The facility has faced ongoing regulatory scrutiny from the VDEQ, particularly concerning odor and leachate management. A February 5, 2024, VDEQ inspection resulted in a Warning Letter in March 2024 due to violations including three active leachate seeps and excess blown litter.

Surety Bonds

VDEQ required the Debtors to secure substantial surety bonds from Evergreen National Indemnity Company to guarantee proper landfill closure and post-closure care:

- A Closure Bond, valued at approximately $6.6 million, secured by approximately $2 million of the Debtors' cash collateral.

- A Post-Closure Bond, valued at approximately $12.7 million, secured by approximately $12.7 million of the Debtors' cash collateral.

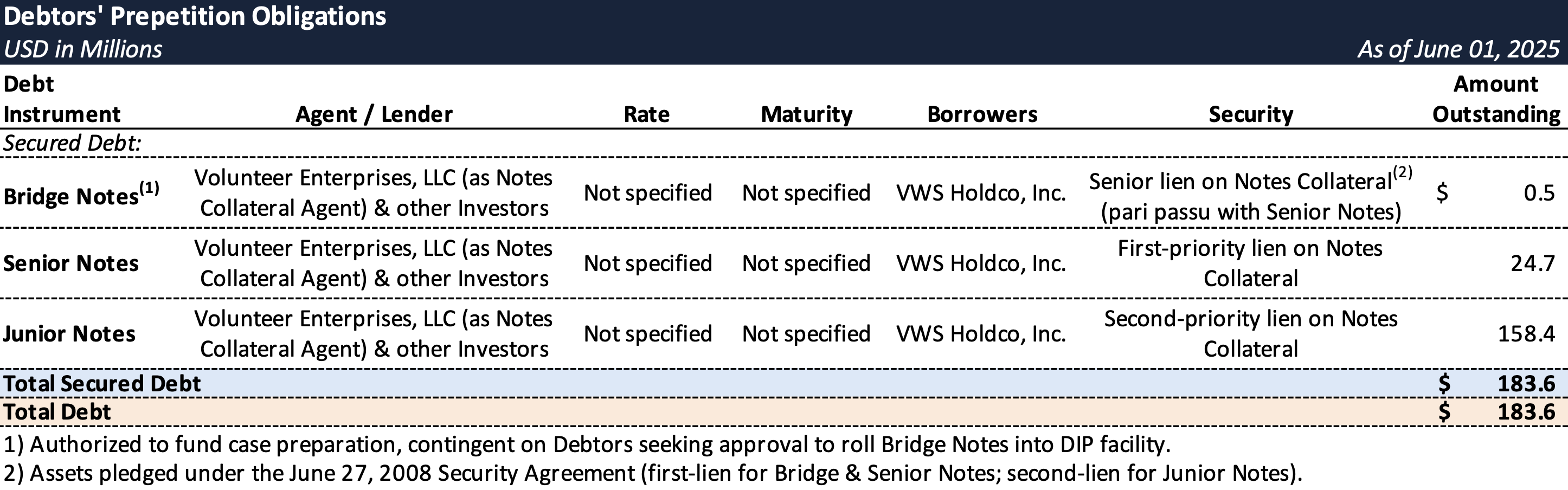

Prepetition Obligations

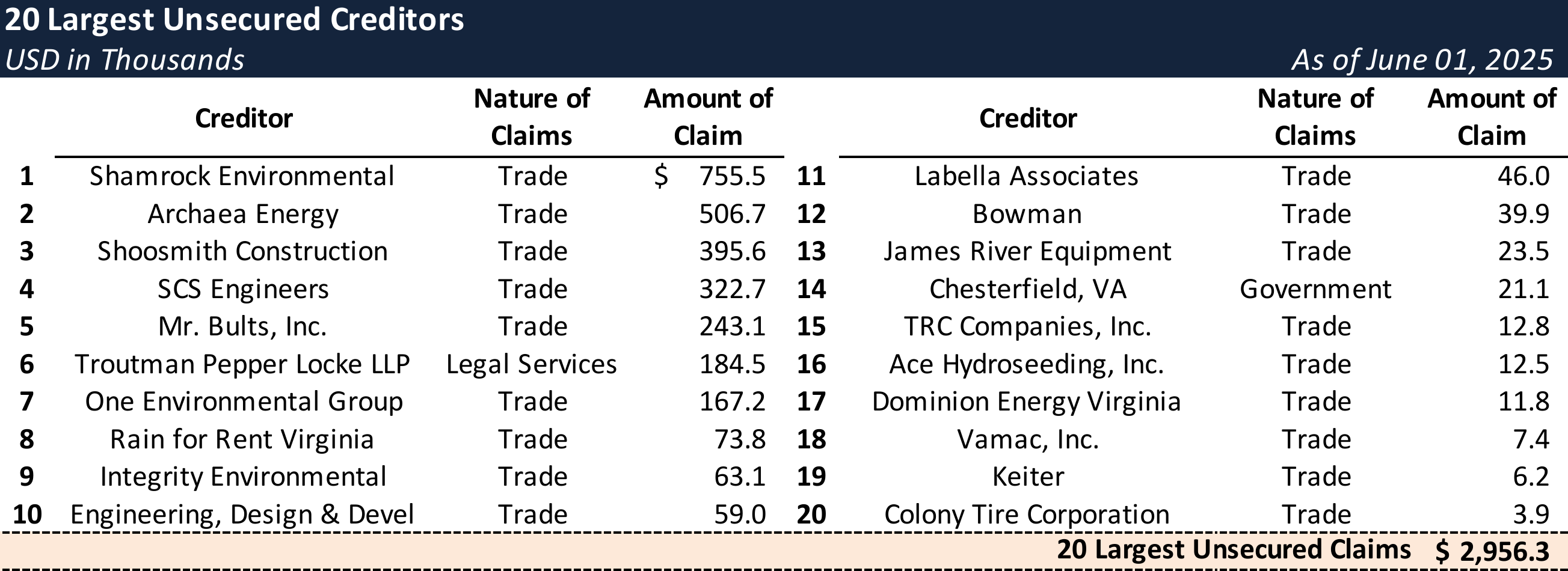

Top Unsecured Claims

Events Leading to Bankruptcy

Denied Quarry Expansion and Operational Wind-Down

- The July 2018 denial of the critical quarry expansion by Chesterfield County, and the subsequent failure of legal challenges, eliminated approximately 17 million tons of future landfill capacity. This decision severely curtailed the Landfill's operational lifespan and revenue-generating potential.

- The Landfill ceased accepting waste on December 30, 2022, resulting in minimal revenue thereafter and forcing the Company to downsize staff and focus on the costly closure process.

The Swift Creek Renewables (SCR) Methane Gas Agreement

- In April 2020, Shoosmith entered into an agreement with Swift Creek Renewables ("SCR") (a Morrow Energy subsidiary) to capture, treat, and sell methane gas from the Landfill.

- To facilitate this, Shoosmith acquired gas rights from Ingenco (now owned by Archaea Energy, a BP company) for $6.8 million, payable in 64 monthly installments of $126,682. Gas transfer to SCR commenced on September 13, 2023.

- According to the Debtors, SCR projected monthly royalties to Shoosmith exceeding $1 million and estimated that construction of the on-site gas plant would cost approximately $40 million. However, actual royalties were drastically lower (e.g., $44,379 for February 2025 gas; an estimated $13,920 for March 2025 gas).

- A contractual provision allowed SCR to recoup "Reimbursable Costs" (RC) before Shoosmith received its full royalty. These RCs, initially estimated by SCR not to exceed $8 million, escalated to over $42 million.

- The SCR agreement became a major financial liability, with Shoosmith incurring substantial monthly payments for gas rights while receiving negligible offsetting income.

- Furthermore, Shoosmith asserts that SCR's drilling methods for methane gas capture caused environmental damage, leading to a VDEQ letter on June 20, 2024, alleging potential air pollution violations, including high-temperature wells and compromised cap integrity.

Crippling Increase in Leachate Disposal Costs

- Historically, Shoosmith benefited from a contract with Chesterfield County for leachate disposal at a favorable rate of $0.02 per gallon, resulting in monthly costs of $30,000 to $50,000.

- This contract was suspended on July 3, 2024, after the Debtors learned that a former employee had allegedly falsified leachate quantity and analysis data.

- Consequently, Shoosmith was forced to use alternate service providers, incurring costs of $0.15 per gallon for treatment plus $0.07 per gallon for transportation, totaling $0.22 per gallon—an eleven-fold increase. This surge in essential operating expenses became unsustainable with minimal revenue.

Ongoing Litigation

- Minority members of ESM Management Group, LLC have filed suit in Tarrant County, TX, asserting derivative and direct claims against Mr. Nichols and Mr. McGee for alleged breaches of fiduciary duty related to the management of ESM Shoosmith, VWS Holdco, and VWS Acquisitions, LLC. The litigation is ongoing and contested.

Appointment of CRO and Chapter 11 Filing

- The Debtors appointed Steven F. Agran of Carl Marks Advisors as Chief Restructuring Officer (CRO) on May 28, 2025, ahead of their Chapter 11 filing in the District of Delaware on June 1, 2025.

- The restructuring aims to address issues related to the SCR gas rights agreement and environmental considerations, including leachate removal. A sale process is underway to transition landfill ownership and ensure continued closure and regulatory compliance.

- DIP financing negotiations with insiders and prepetition lenders are ongoing, with terms expected to be detailed in an upcoming motion.

Key Parties

- Counsel: Pashman Stein Walder Hayden, P.C. (John W. Weiss)

- Special Counsel: Troutman Pepper Locke LLP

- CRO: Steven Agran (Carl Marks Advisory Group LLC)

- Investment Banker: Teneo Securities LLC

- Financial Advisor: Teneo Capital LLC

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.