Case Summary: Splashlight Chapter 11

Splashlight has filed for Chapter 11 bankruptcy, citing excessive leverage and lender disputes, with plans for an asset sale and creditor litigation.

Business Description

Headquartered in New York, NY, Splashlight Holding LLC ("Splashlight" or the "Company") serves as the majority equity holder of the Splashlight Companies⁽¹⁾ and Telmar Parent Corporation ("Telmar Parent")⁽²⁾.

- The Splashlight Companies are prominent providers of visual content creation services, catering to global brands and numerous Fortune 500 companies such as Target, Nike, and David Yurman.

- The Telmar Companies⁽³⁾, now operating as TelmarHelixa, provide advanced advertising and media planning solutions through a data-driven audience intelligence platform.

Splashlight filed for Chapter 11 protection on Feb. 12 in the U.S. Bankruptcy Court for the Southern District of New York. As of the Petition Date, the Debtor reported $39 million in assets and $53.5 million in liabilities.

⁽¹⁾ Includes Splashlight LLC, Mahogany Fine Foods and Catering LLC ("Mahogany"), Splashlight Photographic & Digital Studios, LLC ("Photo & Digital"), and Splashlight Technologies LLC ("Splashlight Technologies").

⁽²⁾ Telmar Parent is the sole shareholder of Telmar Group, Inc. (“Telmar Group”) and Helixa, Inc. ("Helixa").

⁽³⁾ Includes Telmar Group and its subsidiaries: Telmar Information Services, Corp. ("Telmar Information") (NY), Telmar HMS (Canada), Telmar Europe Limited (UK), Telmar CEE Limited ("Telmar CEE") (NY), Telmar International, Inc. ("Telmar International") (NY), and Telmar Communications, Inc. ("Telmar Communications") (NY).

Corporate History

Splashlight was formed on October 8, 2018, at the behest of Boathouse Capital II LP ("BHC II") to facilitate the acquisition of Telmar Parent.

- The Company is majority-owned by Liiv LLC ("Liiv"), which holds approximately 79% of its membership interests, with the remaining stake held by BHC II, a Small Business Investment Company.

In 2022, Telmar Parent acquired Helixa, an AI-driven insight research company.

Operations Overview

The Company's operations are divided into two main segments: visual content production and advertising solutions.

Visual Content Production

- Studio and Location Services: Splashlight LLC and Photo & Digital offer comprehensive production services for film and still shoots, including directing, casting, production, and post-production. These services are delivered both in their NYC studios and on-location, covering a wide range of media forms.

- Hospitality Services: Mahogany provides tailored catering and hospitality services designed to support production clients and enhance the overall service experience.

Advertising and Media Planning

TelmarHelixa leverages a data-driven platform to offer advanced media planning solutions. Its tools for digital and social media analysis—complemented by access to global data sets—enable clients to gain deeper audience insights and optimize campaign execution across various media channels.

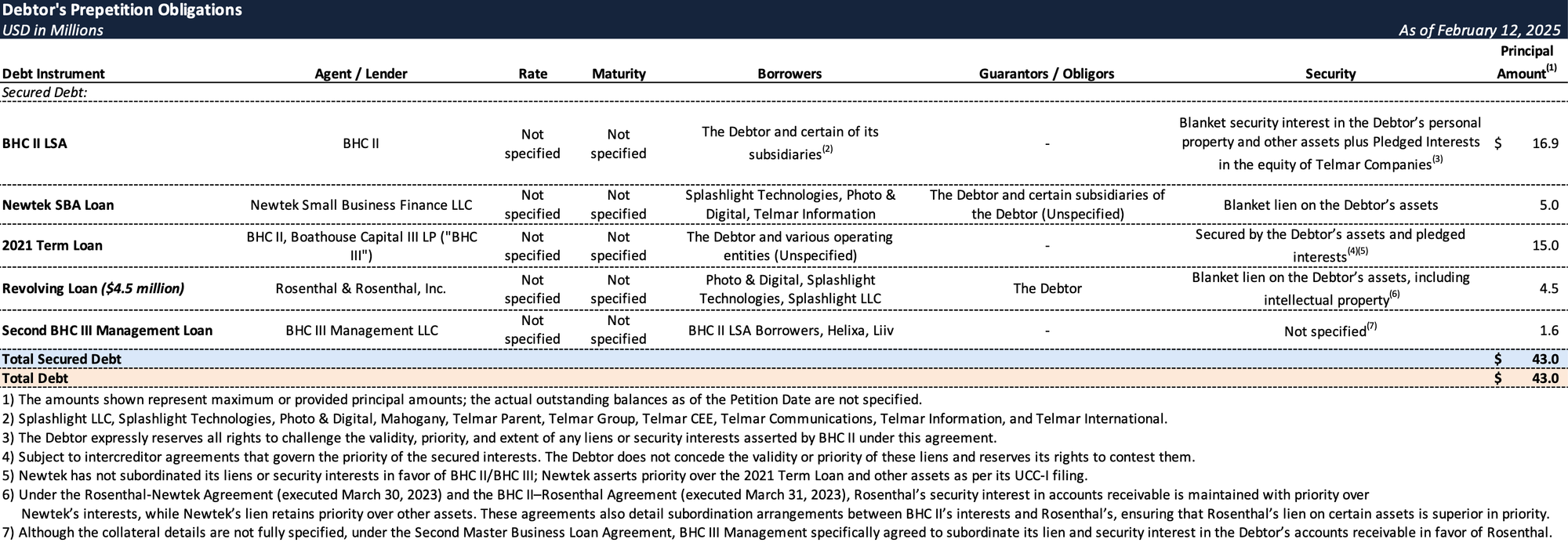

Prepetition Obligations

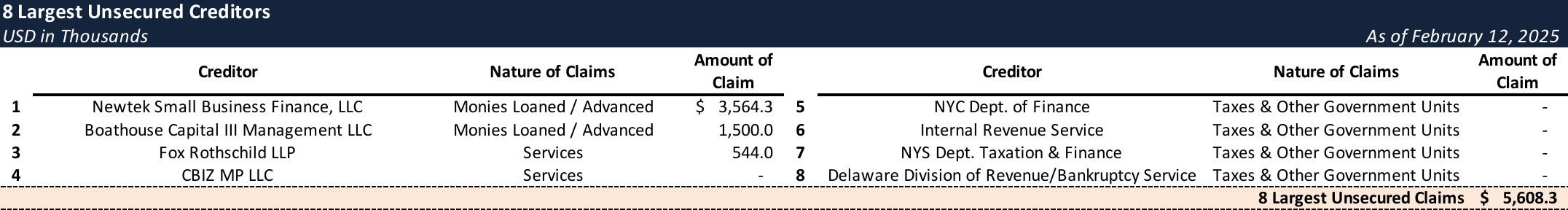

Top Unsecured Claims

Events Leading to Bankruptcy

Overleveraging and the Helixa Acquisition

- Splashlight’s financial distress was largely driven by excessive leverage, exacerbated by a highly burdensome 2021 Term Loan used to finance the 2022 acquisition of Helixa.

- The $15 million loan featured an accelerated repayment schedule, creating immediate liquidity constraints and severely limiting the Company’s financial flexibility.

Customer Attrition Due to Twitter Dependency

- Helixa’s core data analytics business was heavily reliant on Twitter as a primary data source. Following Elon Musk’s acquisition of Twitter, market uncertainty surrounding the platform prompted many of Splashlight’s customers to shift to competitors that did not depend on Twitter-derived data.

Disputes with Helixa’s Former Owners and Resulting Litigation

- Post-acquisition, the former owners of Helixa allegedly engaged in unauthorized competitive activities, leveraging Helixa’s engineering team to develop a rival business.

- The Company initiated legal action to enjoin these efforts. While the litigation was ultimately settled, it consumed critical management resources, incurred significant legal expenses, and delayed essential product enhancements, further hampering competitiveness.

Operational Challenges and Delayed Integration

- The litigation with Helixa’s former owners compounded existing integration challenges, delaying the realization of anticipated synergies between Helixa and the broader Telmar Companies.

- Effective integration would have reduced overhead, improved efficiency, and generated cash flow to support the 2021 Term Loan and other obligations.

- As operational challenges persisted, management recognized that the Company’s capital structure was unsustainable given Helixa’s underperformance and the broader deterioration of its financial position.

Engagement of BrightTower LLC and Forbearance Agreement

- In an effort to explore strategic alternatives, the Company engaged BrightTower LLC to solicit potential buyers for the Splashlight Companies.

- Despite securing multiple offers, BHC II—the Company’s senior lender—declined to accept any proposals, resulting in the Company’s default under its BHC loan agreements.

- On November 23, 2023, the Company and BHC II executed a Forbearance Agreement, under which BHC II agreed to temporarily refrain from exercising its rights and remedies, provided that the Company pursued an orderly sale of the Splashlight Companies and the Telmar Companies while complying with other financial covenants.

- Efforts to restructure or refinance the Company’s debt—including securing capital from strategic investors or selling assets—ultimately proved unsuccessful. The Company attributes this outcome, in part, to alleged interference from BHC II, BHC III, BHC III Management, and their appointed representative on the Company’s Board of Managers.

Termination of Forbearance and Foreclosure Actions

- As part of its restructuring efforts, Telmar retained Stephens, an investment banker recommended by BHC II, to pursue a sale of the Telmar Companies or raise alternative financing.

- Despite receiving multiple bids, BHC II rejected the offers, and Stephens was unable to secure financing that met BHC II’s requirements.

- BHC II subsequently terminated the forbearance period and assumed greater control over the Company’s decision-making process.

- Management changes were implemented, including the removal of key executives, while a BHC II representative allegedly engaged in covert communications that disrupted ongoing efforts to secure a merger, obtain financing, or execute asset sales that could have alleviated the Company’s financial distress.

- In January 2025, BHC II commenced a public non-judicial foreclosure sale targeting the Pledged Interests in the equity of Telmar Companies, as well as certain intercompany notes.

Chapter 11 Filing and Strategic Path Forward

- On February 12, 2025, Splashlight filed for Chapter 11 protection in the United States Bankruptcy Court for the Southern District of New York to stay the foreclosure auction scheduled for February 13, 2025.

- The foreclosure sale sought to liquidate the Company’s equity holdings in Telmar Parent and Splashlight LLC, as well as multiple intercompany promissory notes.

- In response to its liquidity crisis and in preparation for restructuring, the Company is actively evaluating a potential Section 363 sale of the Telmar Companies.

- The Company is in advanced discussions with investment bankers to assess the valuation of the Telmar Companies as going concerns and to identify prospective buyers.

- Additionally, the Company intends to pursue litigation against BHC II, BHC III, BHC III Management, and their designated Board appointee, alleging wrongful interference in its restructuring efforts and seeking subordination of the BHC-related debt.

- Management believes that a successful sale of Telmar Parent, coupled with potential recoveries from litigation, will provide the necessary foundation for a confirmed plan of reorganization and an orderly exit from Chapter 11.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.