Case Summary: STG Logistics Chapter 11

STG Logistics has filed for Chapter 11 bankruptcy to pursue a dual-track sale or recapitalization, following a severe freight market downturn and liquidity constraints despite a prior refinancing, supported by $294 million in DIP financing.

Business Description

Headquartered in Dublin, OH, STG Logistics, Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "STG" or the "Company"), is North America's leading provider of integrated port-to-door logistics solutions, operating the largest network of neutral container freight stations ("CFS") and ranking as the fourth-largest asset-based intermodal marketing company ("IMC") and one of the largest drayage providers in the country.

- The Company offers a comprehensive suite of multimodal transportation and warehousing services, spanning asset-based intermodal transportation, marine and rail drayage, nationwide warehousing and transloading, and over-the-road trucking (including full-truckload and less-than-truckload).

- STG's extensive network encompasses approximately 130 leased and partnership facilities, enabling the Company to service all major U.S. ports and inland logistics corridors from coast to coast.

STG controls significant logistics assets, including approximately 15,000 domestic intermodal containers, approximately 3,300 chassis, and a fleet of approximately 2,150 drivers. The Company also maintains approximately 4.5 million square feet of warehousing space to support its logistics services, including CFS operations, transloading, contract logistics, and less-than-truckload ("LTL") business segments.

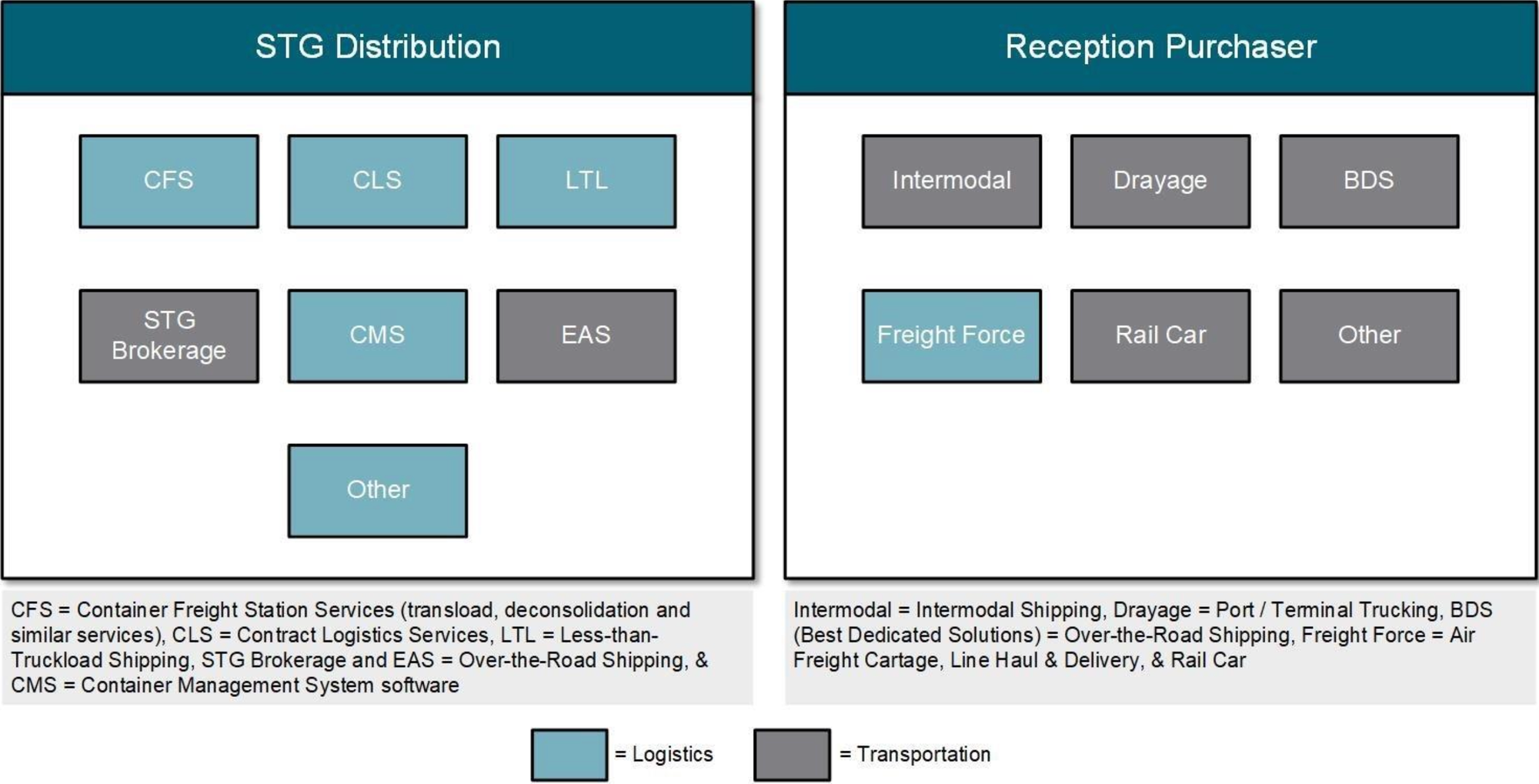

STG's diverse customer base includes importers, exporters, beneficial cargo owners, freight forwarders, and other third-party logistics providers who rely on STG for efficient consolidation, transportation, and distribution of containerized freight. The Company organizes its business into two principal divisions: Transportation (intermodal, drayage, and over-the-road) and Logistics (CFS and transloading, contract logistics, LTL, and Freight Force).

In 2024, STG generated approximately $1.6 billion in revenue, though consolidated revenues declined by approximately $65 million between 2023 and 2024, with projections indicating a $162 million decline between 2024 and 2025.

- The Company's financial performance has been severely impacted by the "Great Freight Recession," a prolonged industry-wide downturn that began in March 2022, characterized by excess capacity, collapsing freight rates, and softening demand.

- Adjusted EBITDA declined approximately 95% year-over-year in the second quarter of 2024, placing significant pressure on the Company's liquidity and debt service capabilities.

As of the Petition Date, STG employed approximately 1,170 individuals across the United States, virtually all of whom are full-time employees. Twenty employees are members of one labor union. The Company also utilizes temporary staff to support warehousing and dock operations.

STG Logistics, Inc. and certain affiliates filed for Chapter 11 protection on January 12, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the District of New Jersey, reporting $1 billion to $10 billion in both assets and liabilities.

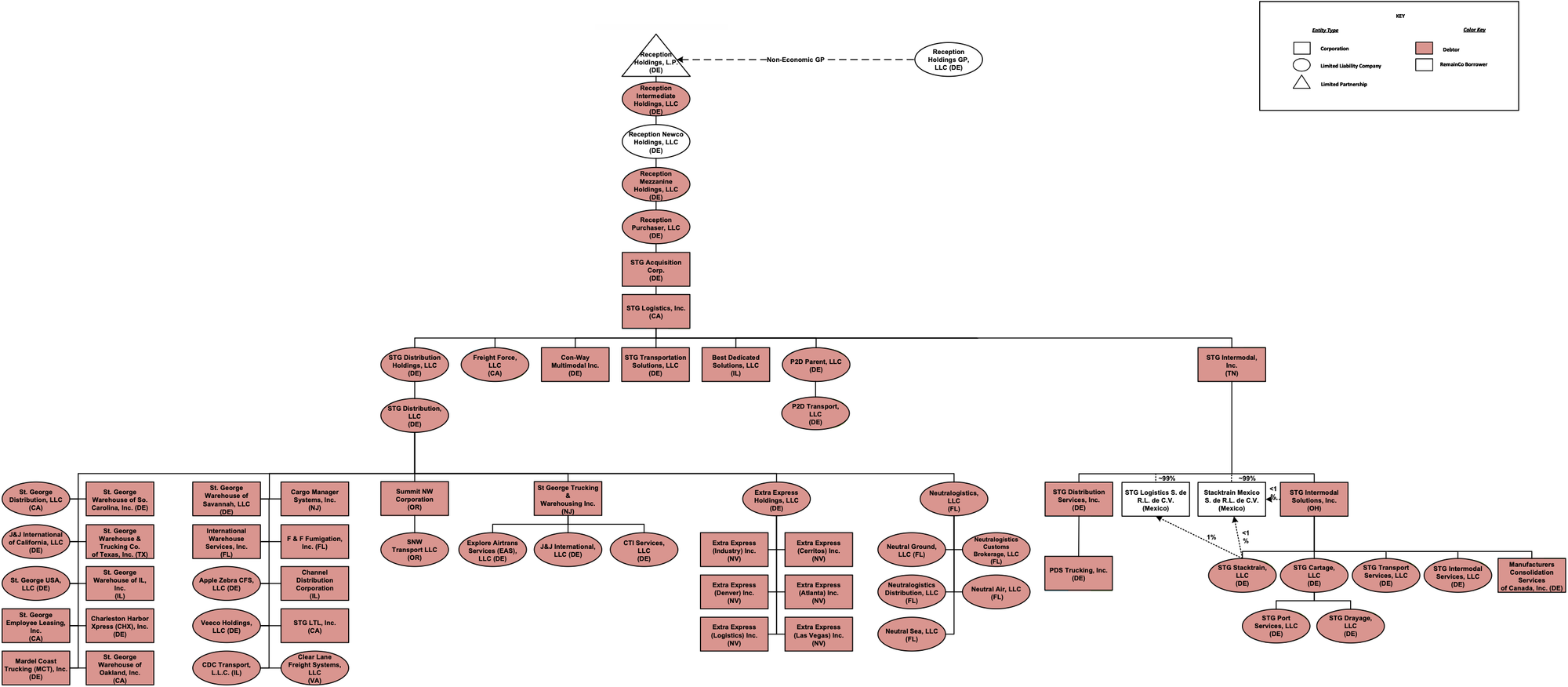

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below.

Corporate History

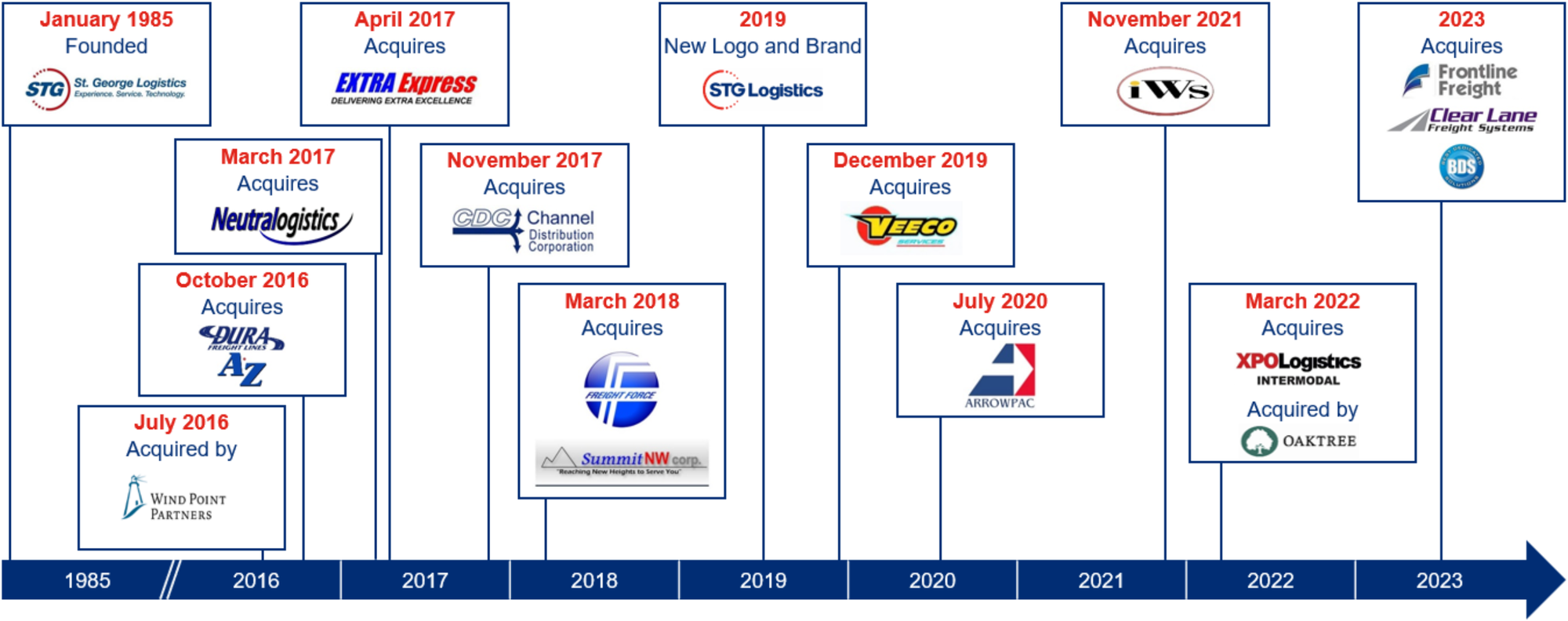

Founded in 1985 as "St. George Warehouse," STG began as a warehousing company headquartered in South Kearny, NJ, initially focused on container freight station services in the Port of New York and New Jersey. For its first three decades, the Company built a reputation for reliability in its core CFS market.

Private Equity Acquisition and Expansion Strategy

- A major turning point came in July 2016, when Wind Point Partners, a Chicago-based private equity firm, acquired the Company. Backed by Wind Point, STG embarked on an aggressive growth-by-acquisition strategy, executing approximately eight strategic acquisitions between 2016 and 2019.

- Notable acquisitions during this period included Dura Freight & AZ CFS (October 2016), Neutralogistics (March 2017), Extra Express (April 2017), Channel Distribution Corporation (November 2017), Freight Force & Summit NW Corp (March 2018), and Veeco (December 2019). These transactions expanded STG's geographic footprint and bolstered its third-party logistics, container drayage, warehousing, freight, and intermodal transport capabilities.

- In 2019, the Company rebranded from St. George to "STG Logistics," unifying all operations under one banner with the vision of operating as "One Team, One Company, One STG Logistics."

Transformational XPO Intermodal Acquisition

- By March 2022, STG had quadrupled in size since Wind Point's initial acquisition. To capitalize on surging logistics demand during the pandemic, the Company acquired XPO Logistics' intermodal division ("XPO Intermodal") for approximately $710 million.

- This transformative deal added intermodal and drayage services across approximately 48 locations, approximately 11,000 intermodal containers, and long-term rail partnerships with Class I railroads, providing seamless intermodal solutions across North America.

- The acquisition was accompanied by a significant recapitalization, with Oaktree Capital Management and Duration Capital Partners joining Wind Point as co-sponsors and injecting fresh capital to support the transaction.

- The Company subsequently expanded its intermodal container fleet to approximately 15,000 by 2023.

Continued Expansion and Diversification

- In 2023, STG continued its acquisition strategy, targeting truck transportation capabilities to diversify beyond port-centric operations:

- The Company acquired Frontline Carrier Systems (USA), Inc. and Clear Lane Freight Systems, LLC, as well as Best Dedicated Solutions, LLC ("BDS"), expanding STG's service offerings to include deferred LTL and over-the-road truck brokerage capabilities.

- The Company's existing equity sponsors Wind Point, Oaktree, and Duration, backed a $300 million investment in 2024 intended to support ongoing strategic initiatives.

Industry Recognition

- Throughout its 40-year history, STG has received industry recognition for operational excellence, including the 2025 Top Supply Chain Projects Award for its sustainability initiative, "Green Haul Solution."

- The Company has established long-term partnerships with major Class I railroads, including CSX and Union Pacific, to enhance its intermodal service offering.

Corporate Organizational Structure

Operations Overview

STG's operations are organized into two principal divisions—Transportation and Logistics—that together provide integrated door-to-door supply chain coverage across North America.

Transportation Division

The Transportation Division accounts for the majority of the Company's revenue, generating approximately $1.06 billion in the twelve-month period following October 2024. This division comprises three core segments:

- Intermodal (~$721 million revenue): STG operates one of the largest independent intermodal networks in North America. The Company's asset-based platform utilizes its domestic container and chassis fleet, coupled with long-standing partnerships with Class I railroads, to integrate rail transportation with over-the-road trucking services for long-haul containerized freight.

- Intermodal services offer shippers a reliable, cost-efficient, and sustainable alternative to exclusively trucking-based transport.

- Drayage (~$257 million revenue): STG is one of the largest U.S. drayage providers, offering critical first- and last-mile connections between ports, rail ramps, warehouses, and distribution centers.

- The Company executes hundreds of thousands of container moves each year through its fleet of drivers and international chassis, operating in more than 40 strategically located terminal locations with comprehensive coverage at all major port and rail gateways.

- Over-the-Road (~$84 million revenue): STG's over-the-road services—provided through STG Transportation Solutions, LLC (which includes BDS and Explore Airtrans Services, LLC)—encompass full truckload ("FTL") and less-than-truckload freight shipments.

- As a freight broker, STG leverages technology and relationships with approximately 25,000 third-party carriers to arrange nationwide transportation of domestic shipments.

Logistics Division

The Logistics Division accounted for approximately $368 million of the Company’s revenue and offers higher-margin services that foster deeper customer integration through value-added offerings:

- CFS & Transloading (~$243 million revenue): STG is the largest provider of container freight station services in the United States, operating approximately 20 warehouses and maintaining partnerships with roughly 60 facilities at nearly all major ports and inland hubs.

- Through its nationwide network of CFS and transloading facilities, STG offers bonded devanning, cargo consolidation, drayage, and customs bonded services, enabling the Company to break down import containers into smaller shipments, consolidate exports, and transload international freight into domestic containers and trailers.

- These locations contribute to approximately 3 million square feet of transload, consolidation, and warehousing space.

- Contract Logistics (~$77 million revenue): STG provides comprehensive contract logistics services, including warehousing, inventory management, distribution, and e-commerce fulfillment across approximately 2 million square feet of warehousing space at approximately ten retail and food-grade chilled facilities.

- LTL Logistics (~$36 million revenue): STG offers less-than-truckload services through a hub-and-spoke cross-dock network, providing cost-effective logistics solutions including deferred LTL shipments, freight class expertise, advanced booking technology, special handling, and real-time cargo tracking.

- Freight Force (~$12 million revenue): Freight Force is a cartage and truckload provider with a network of approved motor carriers providing pickup, long haul, and delivery services in more than 65 U.S. cities, addressing nationwide cartage, middle-mile, and last-mile delivery requirements.

Technology Platform

- Cargo Management Systems ("CMS"): STG maintains a proprietary platform that provides real-time inventory management and allows cargo owners to make decisions to rapidly fill or redirect orders across the entire ecosystem of shipment recipients.

- All of STG's major logistics services utilize CMS technology, including CFS, contract logistics, and LTL Logistics. The Company also licenses the platform to third parties.

Geographic Footprint

- STG's national network includes approximately 60 leased sites nationwide, with gateway warehouses at major ports (Los Angeles/Long Beach, New York/New Jersey, Savannah) and inland depots near rail hubs (Chicago, Dallas, Memphis).

- The Company's geographic coverage effectively spans coast-to-coast, maintaining a presence at every major U.S. ocean port and inland logistics corridor, with cross-border service capability into Mexico.

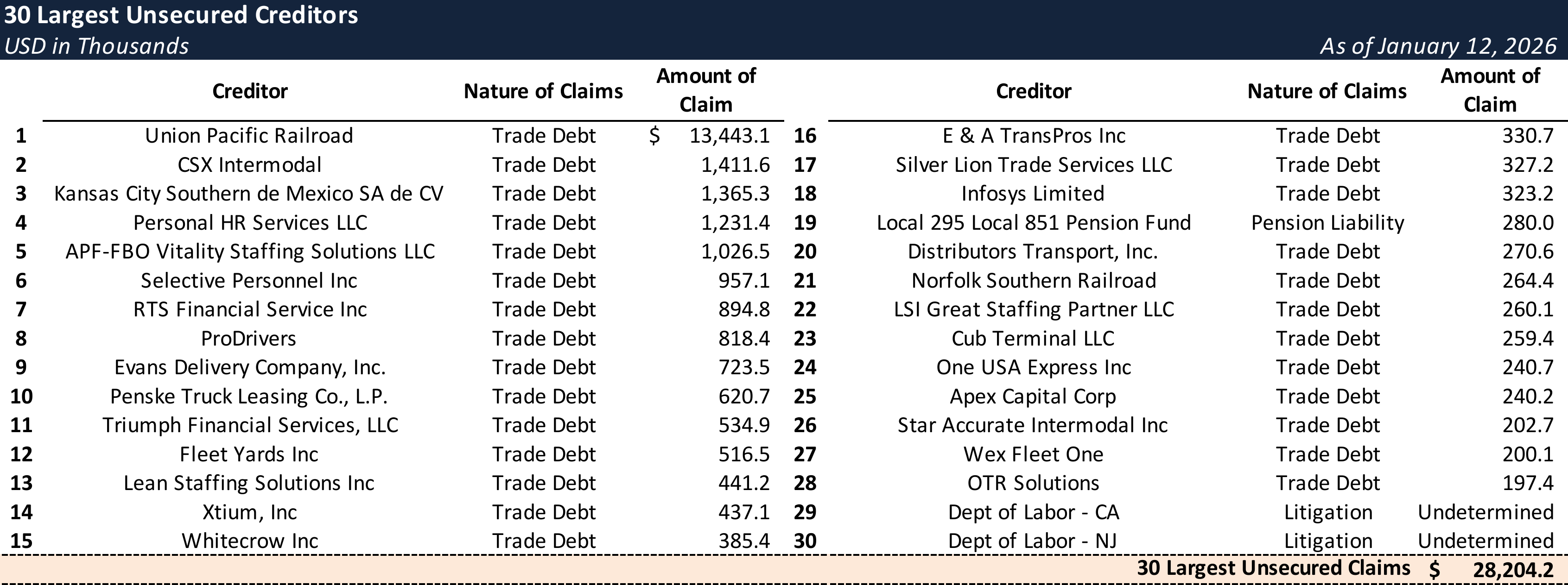

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Macroeconomic Headwinds and the "Great Freight Recession"

- STG experienced tremendous growth during the COVID-19 pandemic, with revenue increasing over 60% in the aggregate between 2020 and 2022 as consumer spending shifted from services to goods. The Company significantly expanded capacity via the XPO Intermodal acquisition to meet surging demand.

- However, beginning in March 2022—shortly after the leveraged XPO acquisition closed—the logistics industry entered the "Great Freight Recession," one of the longest and deepest downturns in the history of the U.S. surface transportation sector.

- Excess capacity built during the pandemic years, fueled by high freight rates, cheap credit, and government stimulus, led to a collapse in freight rates and a years-long freight market depression.

- Additional macroeconomic pressures compounded the Company's challenges:

- A rapid and dramatic rise in interest rates increased borrowing costs on the Company's predominantly floating-rate debt.

- Persistent inflation drove up operating expenses, including insurance costs (projected to increase 48% between 2023 and 2025) and real estate expenses.

- Beginning in January 2025, shifting tariff regimes ranging from 10% to 145% depending on the country of origin created import volume uncertainty, with forecasts indicating a 14% year-over-year decline in import volumes for the second half of 2025.

Competitive and Structural Challenges

- The trucking industry faced intense price-based competition arising from market oversaturation and a trend of large shippers internalizing trucking operations. Private fleets now handle an all-time high of 70% of outbound shipments in the U.S.

- Market consolidation among third-party logistics providers, where the four largest companies now account for approximately 85% of total market share, further pressured STG's revenue generation and bargaining power.

- Evolving regulatory requirements, including California Air Resources Board regulations impacting transportation and warehousing and independent contractor classification issues under the Fair Labor Standards Act, raised operating and compliance costs.

Fifth Amendment Transactions (May 2024)

- Facing deteriorating market conditions and rapidly declining adjusted EBITDA, the Company and its advisors approached existing stakeholders in early 2024 to discuss strategic options.

- After months of arm's-length negotiations, STG and a majority of the Reception Purchaser Lenders executed the Fifth Amendment to Credit Agreement in May 2024, which provided a critical equity injection of $30 million from Wind Point and Oaktree/Duration (the "Consenting Sponsors").

- The Fifth Amendment also provided a seven-quarter holiday from financial maintenance covenant compliance through Q3 2025.

October 2024 Refinancing and Liability Management Transaction

- Despite the Fifth Amendment's additional liquidity, the expected market recovery failed to materialize, and adjusted EBITDA continued to deteriorate—falling approximately 95% year-over-year by Q2 2024. Beginning in August 2024, STG proactively engaged with the Consenting Sponsors and an ad hoc group of Reception Purchaser Lenders, which held a majority of Reception Purchaser Loans, on a deleveraging transaction.

- In October 2024, STG consummated a comprehensive refinancing (the "October 2024 Refinancing") supported by over 93% of holders of Reception Purchaser Term Loans and 97% of holders of Reception Purchaser RCF Loans.

- The transaction generated over $327 million in incremental value, including $137 million of new money "first out" term loans, $50 million of new equity from the Consenting Sponsors, and over $140 million in cash interest and amortization savings through 36 months of paid-in-kind interest. In total, the Company also captured approximately $62 million of discount.

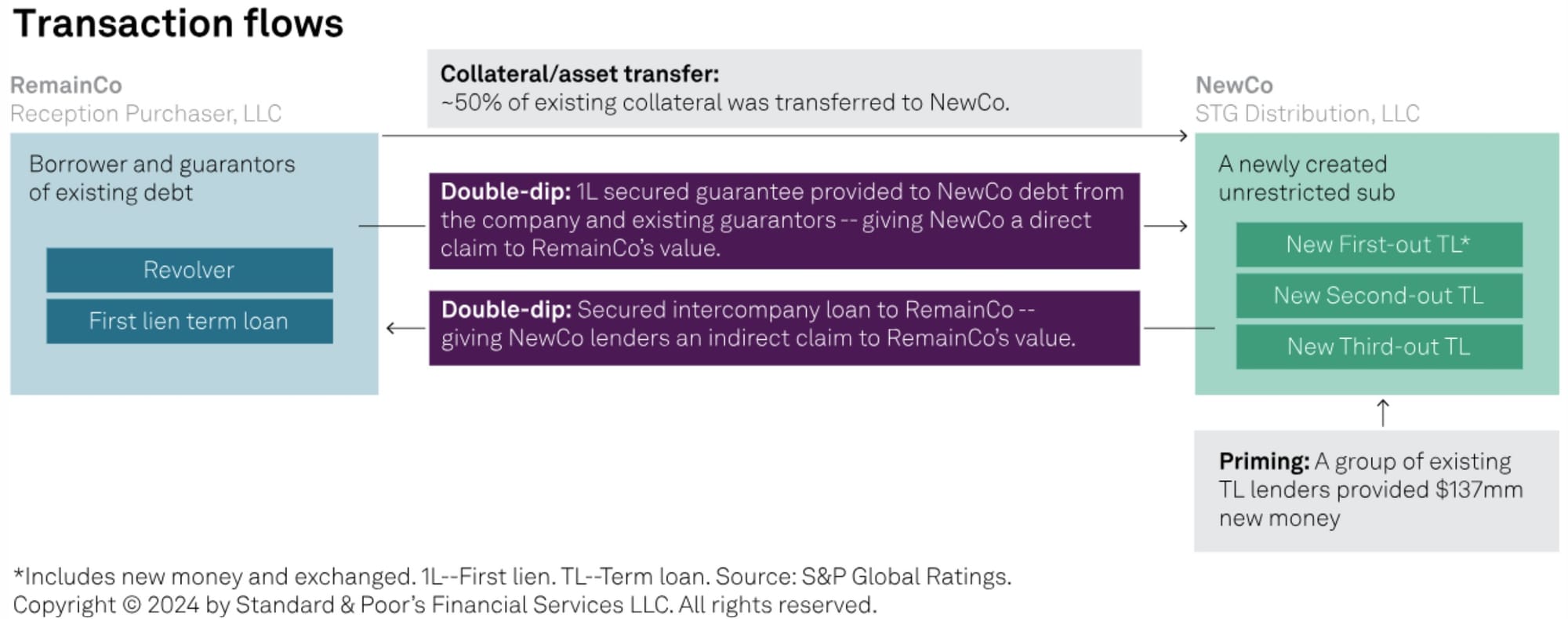

- The October 2024 Refinancing effectively separated the Company into two silos: the STG Distribution silo and the Reception Purchaser silo. The transaction—characterized by S&P as involving "collateral/asset transfer, priming, and double dip" mechanics—designated STG Distribution, LLC and STG Distribution Holdings, LLC as unrestricted subsidiaries and transferred approximately half of the Company's assets (representing 30% of EBITDA, per S&P) to these newly formed entities.

- Participating lenders received new loans at the STG Distribution level, secured by first-priority liens on both silos, as well as guarantees from the legacy entities. The structure also included an intercompany loan from the new entities back to the legacy borrower, effectively creating "double dip" claims for participating lenders against the legacy obligors. Non-participating lenders retained their loans at the Reception Purchaser level, secured only by that silo–significantly limiting their recovery prospects (estimated at 15% by S&P, compared to 95% for first-out participating lenders).

Holdout Lender Litigation

- Two lenders—Axos Financial, Inc. and Siemens Financial Services, Inc. (the "Non-Participating Holders" or "Minority Lenders")—declined to participate in the October 2024 Refinancing and were left holding approximately $56 million in term loans and $2 million in revolving loans at the Reception Purchaser silo.

- In January 2025, Axos and Siemens filed a lawsuit in New York Supreme Court against STG, the administrative agent (Antares Capital), and the participating lenders, alleging breach of contract, breach of the implied covenant of good faith, and fraudulent transfer.

- The lawsuit sought to unwind the October 2024 Refinancing, alleging that the transaction violated "sacred rights" provisions requiring adversely-affected lender consent for amendments that change lien priority or subordinate collateral positions.

- On January 3, 2026—nine days before the Chapter 11 filing—the New York court denied the defendants' motions to dismiss twelve of the Minority Lenders' thirteen causes of action, expressly finding that the plaintiffs properly alleged "a calculated plot perpetrated by Defendants... to deprive Plaintiffs of their contractual rights."

Operational Restructuring Initiatives

- To further extend its liquidity runway, in mid-2025 the Company's management implemented a series of EBITDA improvement initiatives:

- Staff reductions of 242 employees between May and July 2025, resulting in approximately $22 million of gross annualized savings.

- Real estate portfolio rationalization and network optimization.

- IT expense reductions and equipment rationalization.

- In total, the Company projected approximately $68 million in annualized cost savings as it exited 2025.

- The Company also renegotiated terms with existing equipment lessors, generating approximately $30 million of incremental liquidity.

Advisor Engagement and Governance Changes

- In May 2025, the Debtors reengaged Kirkland & Ellis LLP as restructuring counsel. In July 2025, STG engaged AlixPartners LLP as financial advisor and PJT Partners LP as investment banker to guide restructuring negotiations.

- The Company established a Special Committee of independent directors (initially David Barse, appointed July 31, 2025) to oversee restructuring alternatives, conduct an independent investigation of potential claims, and address any conflicts of interest.

- The Special Committee engaged White & Case LLP as independent counsel.

Restructuring Support Agreement and DIP Financing

- Following several months of negotiations, on January 12, 2026, the Debtors executed a Restructuring Support Agreement (RSA) with an ad hoc group of STG Distribution Lenders (the "Ad Hoc Group"), certain other lenders holding STG Distribution Loans (the "Supporting Lenders"), and the Consenting Sponsors. The RSA is supported by holders representing approximately 95% of the STG Distribution RCF, 90% of the FLFO Term Loans, 70% of the FLSO Term Loans, and 31% of the FLTO Term Loans.

- The RSA contemplates a comprehensive balance sheet recapitalization that will equitize all or a portion of the DIP Claims, FLFO Term Loan Claims, and FLSO Term Loan Claims.

- The RSA also provides for an optional toggle to one or more sale transactions to the highest or otherwise best bidder(s), with a bid deadline on or about March 13, 2026.

- To support ongoing operations, the RSA provides for a DIP Facility of approximately $294 million, consisting of:

- $150 million in new money super priority DIP term loans ($85 million available on an interim basis, $40 million upon entry of a final order, and $25 million available immediately prior to the Plan effective date).

- A roll-up of approximately $144 million of FLFO and FLSO Term Loan Claims.

- On January 14, 2026, the Bankruptcy Court entered an Interim Order approving the DIP Facility on an interim basis.

- The court found that the DIP was "negotiated in good faith and at arm's length" and that the Debtors were "unable to obtain financing on more favorable terms from sources other than the DIP Lenders."

- All objections to the interim relief, including objections filed by RenWave and the Minority Lenders (as discussed below), were overruled on the merits.

Competing DIP Proposal

- RenWave Kore, LLC ("RenWave"), a special-situations private equity fund and minority holder of second-out and third-out loans, submitted a competing DIP proposal that it contended offers superior economics to the estates:

- RenWave's proposal included $150 million in DIP financing plus amounts sufficient to pay down all first-out claims in full (including allowed makewhole premiums), with no interest, no roll-up, and no commitment, backstop, or exit fees.

- RenWave alleged that the Debtors and Ad Hoc Group refused to meaningfully engage with its proposal, instead pursuing a transaction that channels value to the Ad Hoc Group at the expense of other stakeholders.

- The Minority Lenders (Axos and Siemens) also objected to the DIP Motion, arguing that the proposed financing improperly primes their collateral and seeks to finalize the allegedly unlawful value transfer from the October 2024 Refinancing.

- As noted above, all objections were overruled on the merits at the Interim Hearing. However, the Interim DIP Order expressly preserves the Minority Lenders' rights to continue pursuing their claims in the New York state court litigation.

Path Forward

- If the recapitalization transaction occurs, New Money DIP lenders would receive 57.5% of reorganized equity, FLFO term lenders takeback debt and 40.0% equity, FLSO term lenders 2.5% equity, and FLTO and general unsecured claims would be cancelled (all subject to dilution).

- The Debtors anticipate emerging from Chapter 11 within approximately 125 days of the Petition Date (by mid-May 2026) with a significantly deleveraged balance sheet and the financial flexibility to continue operations as a going concern.

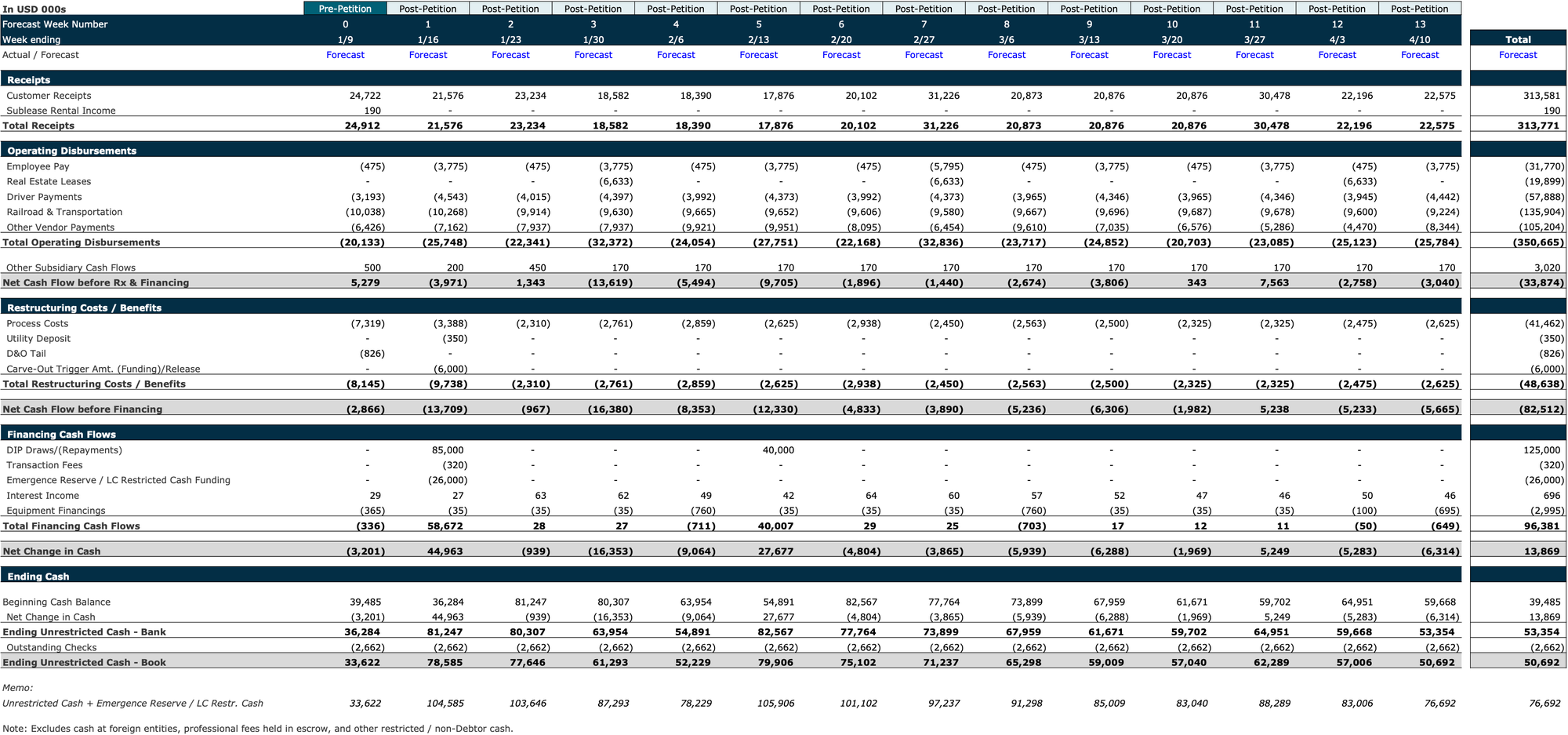

Initial DIP Budget

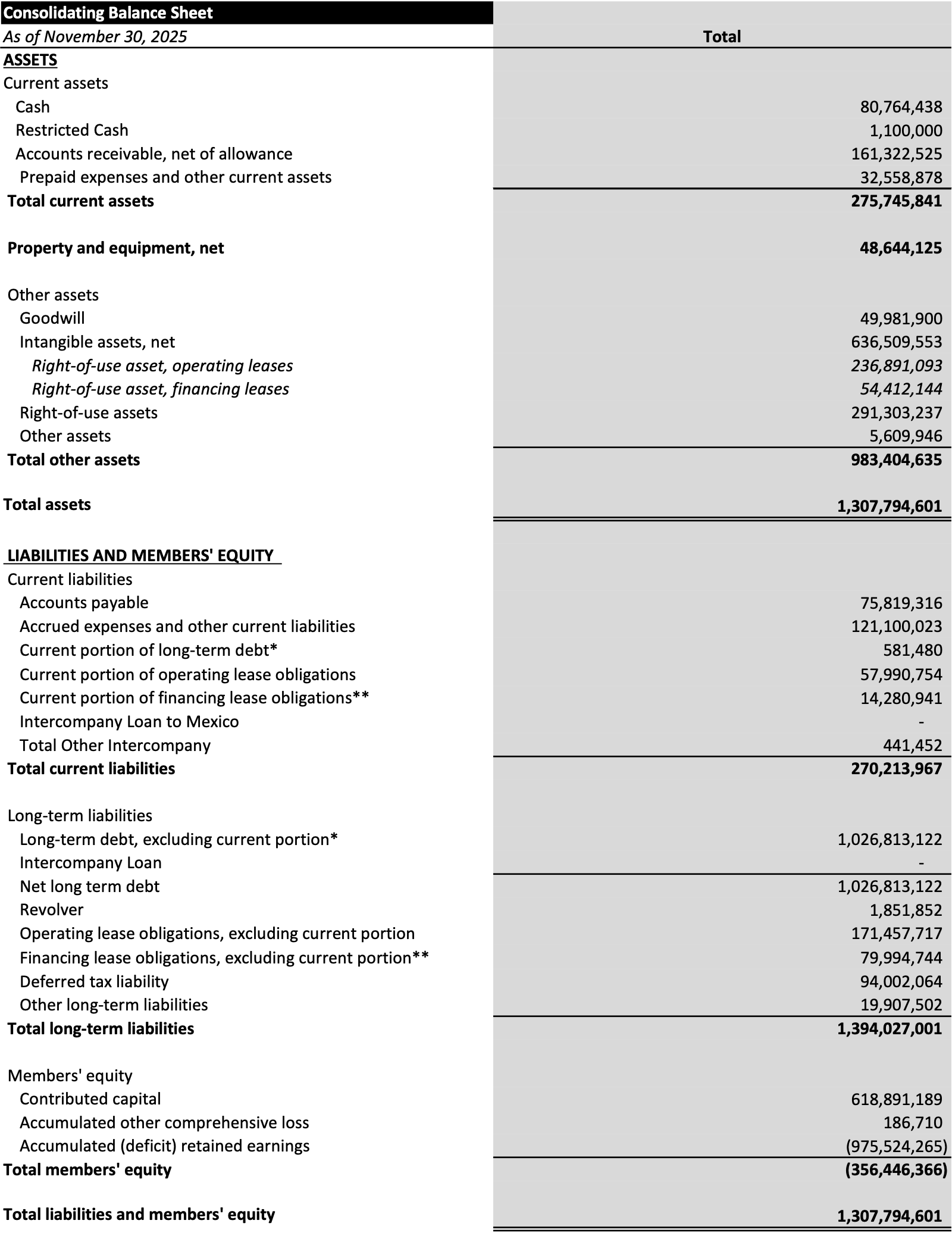

Consolidated Balance Sheet (As of November 30, 2025)

Key Parties

- Kirkland & Ellis LLP and Kirkland & Ellis International LLP (general bankruptcy counsel); Cole Schotz P.C. (local bankruptcy counsel); AlixPartners, LLP (financial advisor); PJT Partners LP (investment banker); Epiq Corporate Restructuring, LLC (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.