Filing Alert: STG Logistics Chapter 11

STG Logistics Files Chapter 11 in District of New Jersey

Update (Jan. 15, 2026): A comprehensive case summary is now available for the Chapter 11 bankruptcy filing of STG Logistics, Inc.

STG Logistics, Inc. and its debtor affiliates⁽¹⁾, a Dublin, OH-based provider of integrated port-to-door logistics and transportation services, filed for Chapter 11 protection on Jan. 12 in the U.S. Bankruptcy Court for the District of New Jersey.

The debtors attribute the filing to a prolonged freight market recession, inflationary pressures, and the impact of tariffs, which offset operational improvements and liquidity from a 2024 out-of-court recapitalization.

The filing aims to implement a comprehensive balance sheet recapitalization pursuant to a Restructuring Support Agreement (RSA) with an ad hoc group of lenders, certain other supporting lenders, and sponsors Wind Point Partners and Oaktree/Duration. The RSA contemplates equitizing all or a portion of the DIP claims and certain prepetition term loans, while providing an option to toggle to a sale process.

The company enters Chapter 11 with approximately $1.16 billion in funded debt and has secured a $294 million delayed-draw priming DIP facility from the ad hoc group, consisting of up to $150 million in new money and a $144 million roll-up.

STG Logistics, Inc. reports $1 billion to $10 billion in both assets and liabilities. The filing indicates that no funds will be available for distribution to unsecured creditors after administrative expenses are paid. The case number is 26-10258.

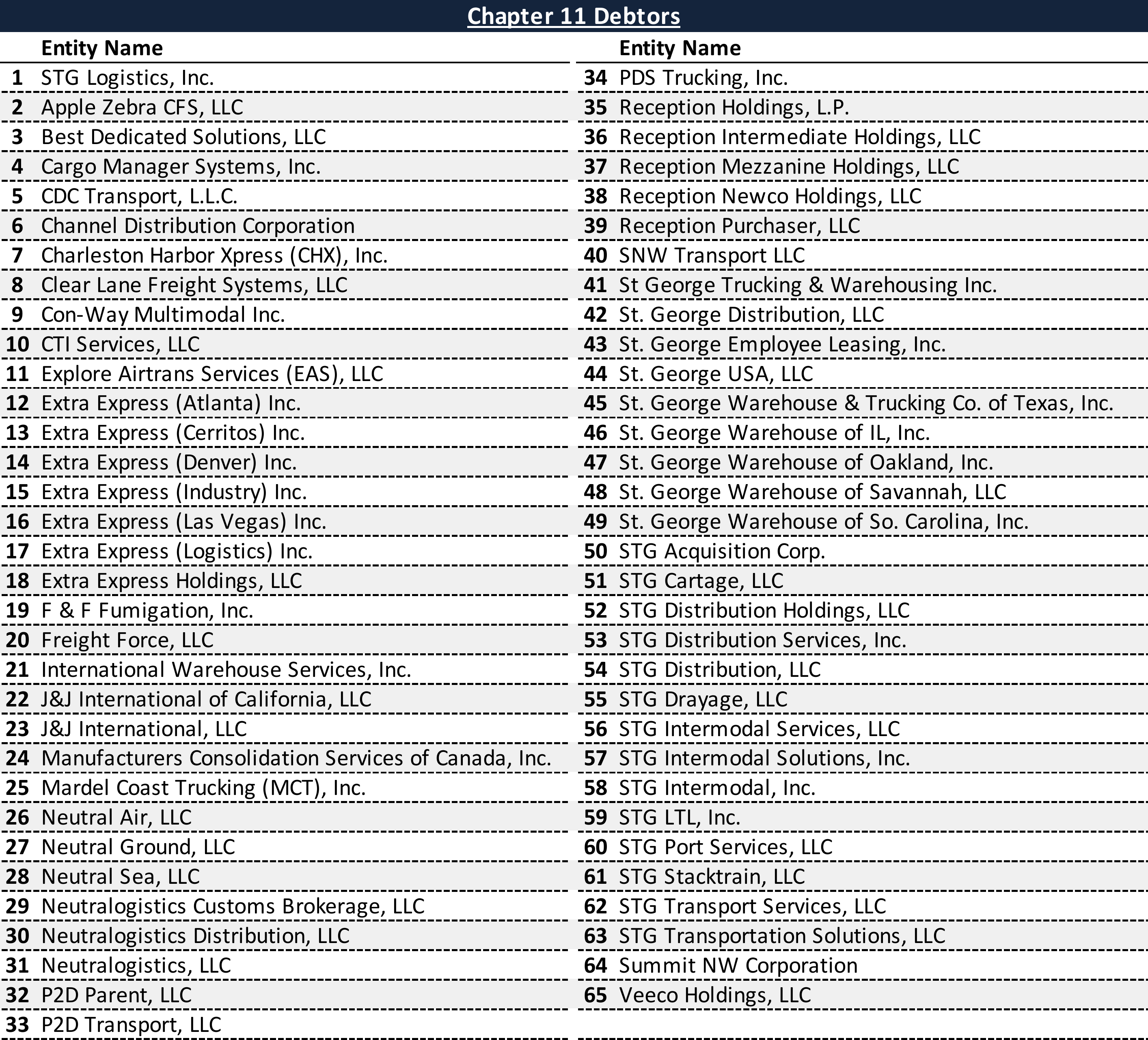

⁽¹⁾ For a complete list of debtor entities, see the Chapter 11 Debtors table.

Chapter 11 Debtors

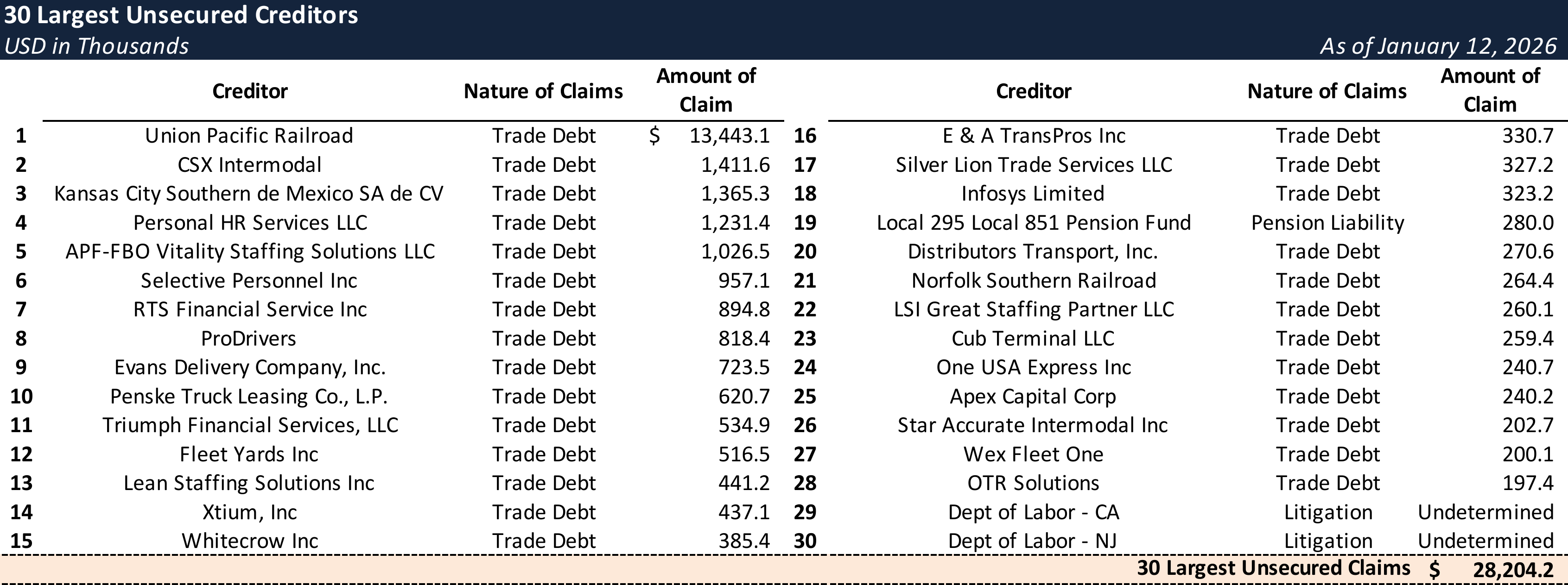

Top Unsecured Claims

Key Parties

Counsel:

- Michael D. Sirota

Cole Schotz P.C.

Email: [email protected]

General Bankruptcy Counsel:

- Kirkland & Ellis LLP

- Kirkland & Ellis International LLP

Financial Advisor:

- AlixPartners, LLP

Investment Banker:

- PJT Partners LP

Independent Counsel to Reception Holdings, L.P., Reception Mezzanine Holdings, LLC, and Reception Purchaser LLC:

- White & Case LLP

Signatories:

- Tyler Holtgreven – Chief Financial Officer

Claims Agent:

Equity Security Holders:

- STG Acquisition Corp. – 100% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.