Case Summary: Sunnova Chapter 11

Sunnova has filed for Chapter 11 bankruptcy, citing elevated inflation, prolonged high interest rates, and policy uncertainty, with plans to sell assets and wind down operations.

Business Description

Headquartered in Houston, TX, Sunnova Energy International Inc., along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "Sunnova" or the "Company"), is a residential solar and energy storage services provider. Operating primarily in the United States, including Puerto Rico and island territories, Sunnova offers solar panel installations, battery storage systems, and related services through an "energy-as-a-service" model.

- The Company leverages a network of approximately 450 local, independent dealers and contractors (collectively, the "Dealers") who market, design, and install Sunnova-approved solar systems, while Sunnova provides financing, monitoring, and maintenance.

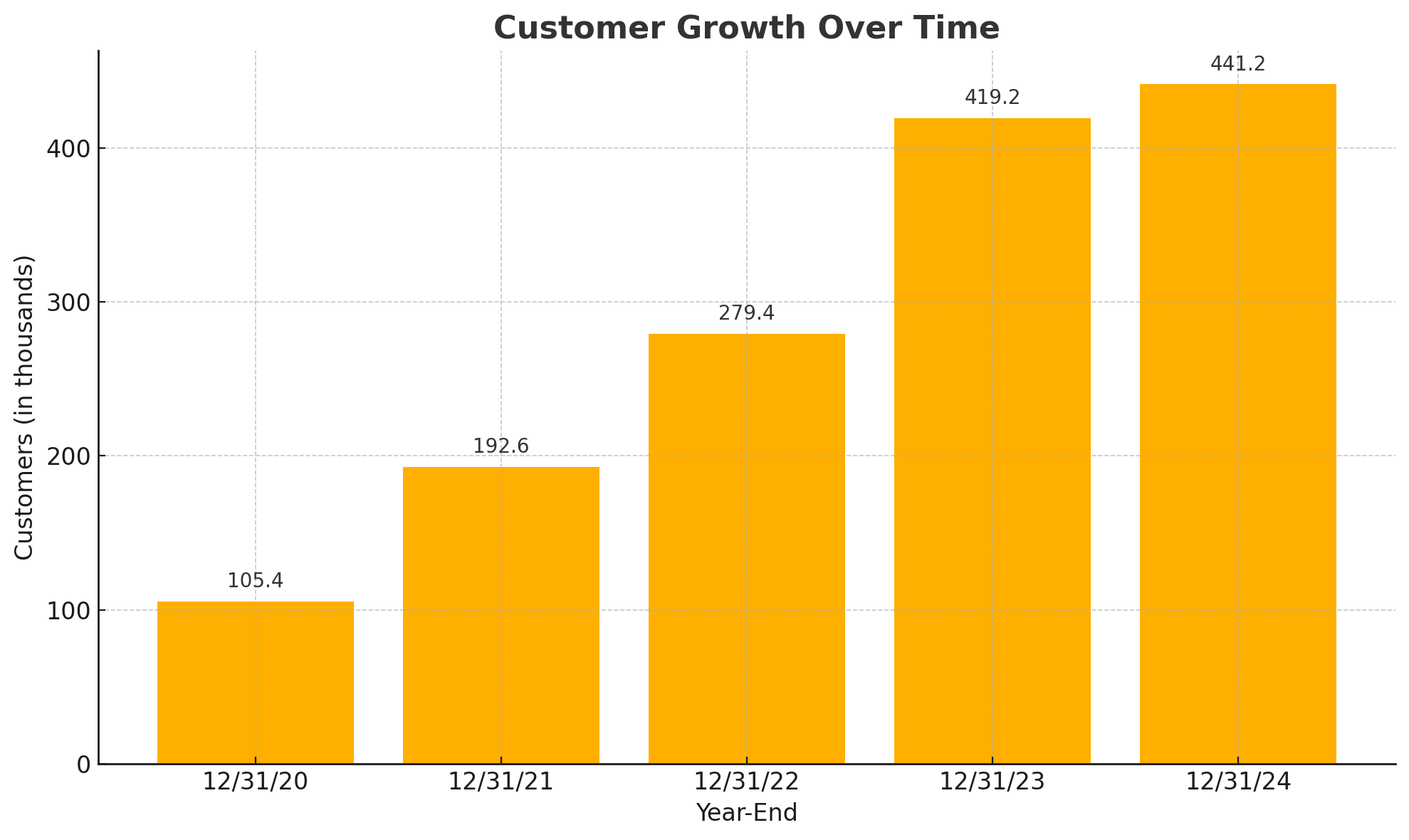

- As of December 31, 2024, Sunnova served over 441,000 customers and managed approximately 3 gigawatts (GW) of solar and battery storage systems across more than 50 U.S. states and territories, with a significant presence in California, New Jersey, and Puerto Rico.

Sunnova generates revenue primarily through long-term customer agreements. Until recently, its offerings included:

- Solar Leases: Long-term agreements with fixed monthly payments for the use of Sunnova-owned Solar Systems.

- Power Purchase Agreements (PPAs): Long-term agreements for customers to purchase power generated by Sunnova-owned Solar Systems.

- Solar Loans: Customer financing for the purchase of Solar Systems, with Sunnova providing monitoring and warranty services. (Origination paused indefinitely in January 2025).

- New Home Products: Solar leases, PPAs, or cash sales of Solar Systems through homebuilder-Dealers for new home constructions. (New sales/originations paused indefinitely as of the Petition Date).

- Service and Warranty Agreements: Monitoring, maintenance, and repair/replacement services for Sunnova-originated and third-party installed Solar Systems, sometimes including production guarantees. Sunnova also historically offered Accessory Loans for other sustainable home products, the origination of which was also paused.

As of December 31, 2024, customer contracts were distributed as follows: approximately 31% solar leases, 28% PPAs, 24% solar loans, and 12% service and accessory loan agreements, with the remaining 5% representing cash purchases. The Company also offers add-on home energy products such as EV chargers, smart home devices, generators, HVAC systems, and roofing services.

For the fiscal year ended December 31, 2024, Sunnova reported total revenue of $839.9 million, an increase from $720.7 million in 2023. Despite revenue growth, the Company incurred a net loss of $447.8 million for FY 2024 and had a history of significant operating losses.

Sunnova Energy International Inc. and certain affiliates filed for Chapter 11 protection on June 8, 2025 (the "Petition Date")⁽²⁾ in the U.S. Bankruptcy Court for the Southern District of Texas, reporting $10 billion to $50 billion in both assets and liabilities⁽³⁾.

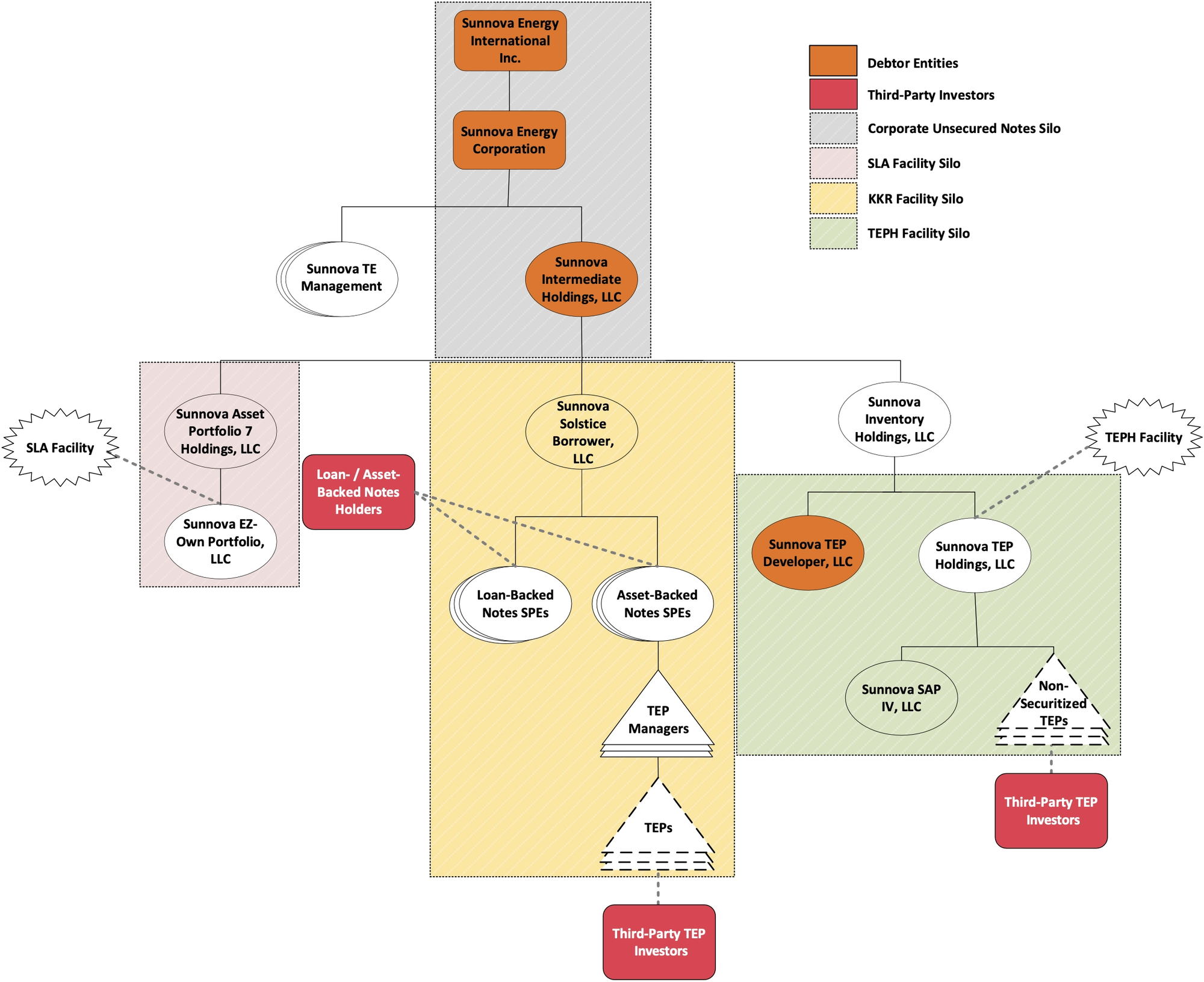

⁽¹⁾ For a complete list of Debtor entities, see organizational structure chart below. ⁽²⁾ Debtor Sunnova TEP Developer, LLC filed its own petition on June 1, 2025. ⁽³⁾ As of December 31, 2024, Sunnova reported total assets of $13.4 billion and liabilities totaling $10.7 billion.

Corporate History

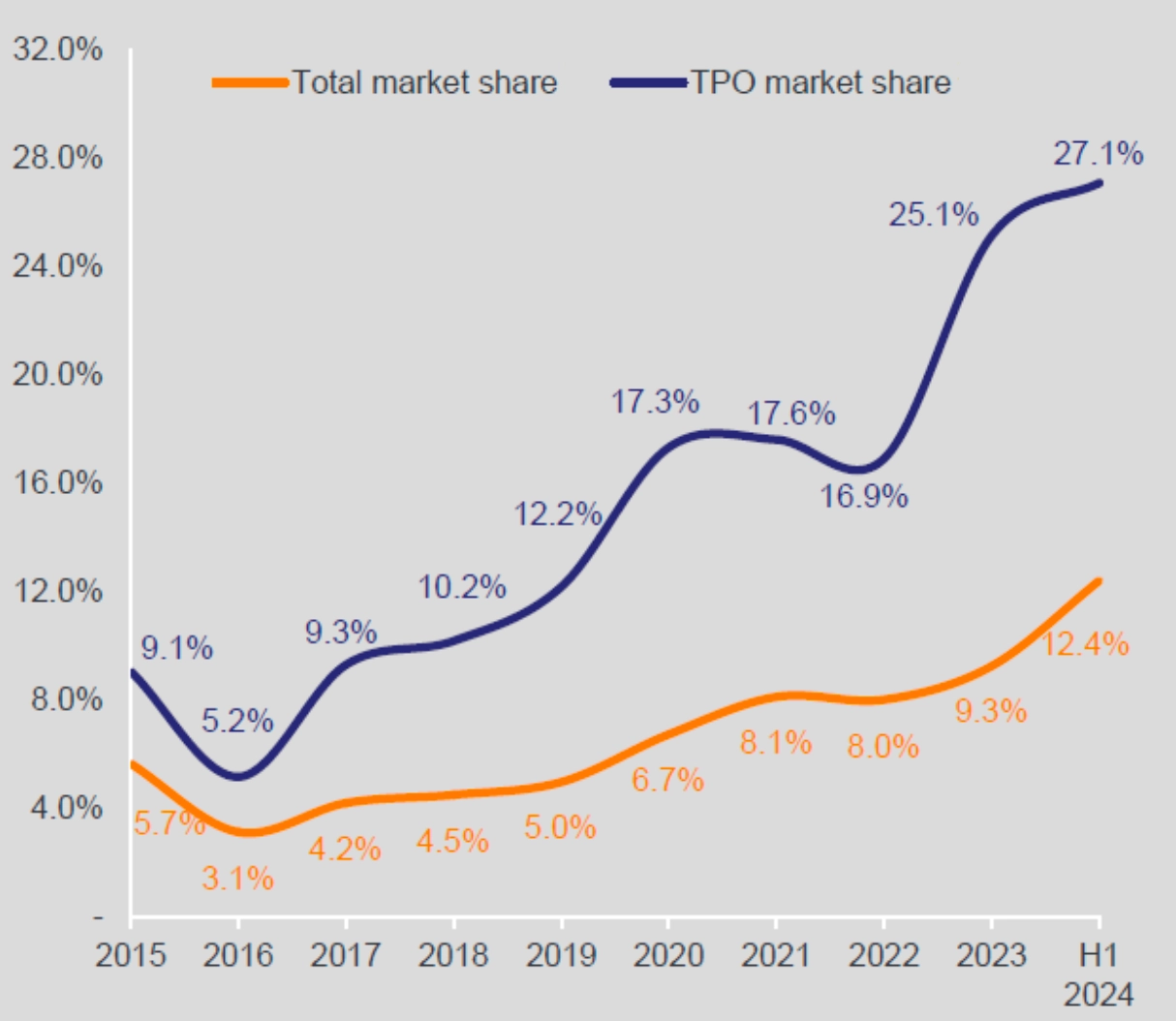

Sunnova was founded in 2012 by William J. “John” Berger with the mission to provide affordable, clean, and reliable solar power to residential customers. The Company expanded rapidly by focusing on third-party ownership (TPO) models and utilizing a dealer-partner approach.

Public Listing and Strategic Expansion

- In July 2019, Sunnova completed its initial public offering (IPO) on the New York Stock Exchange (NYSE: NOVA), raising approximately $168 million (net $158 million).

- Approximately 126 million shares of common stock and 200,000 shares of Series D preferred stock are outstanding as of the Petition Date.

- In April 2021, Sunnova acquired SunStreet, the residential solar development arm of homebuilder Lennar Corporation, becoming Lennar’s exclusive solar and storage provider for new home communities nationwide.

Capital Structure and Growth Funding

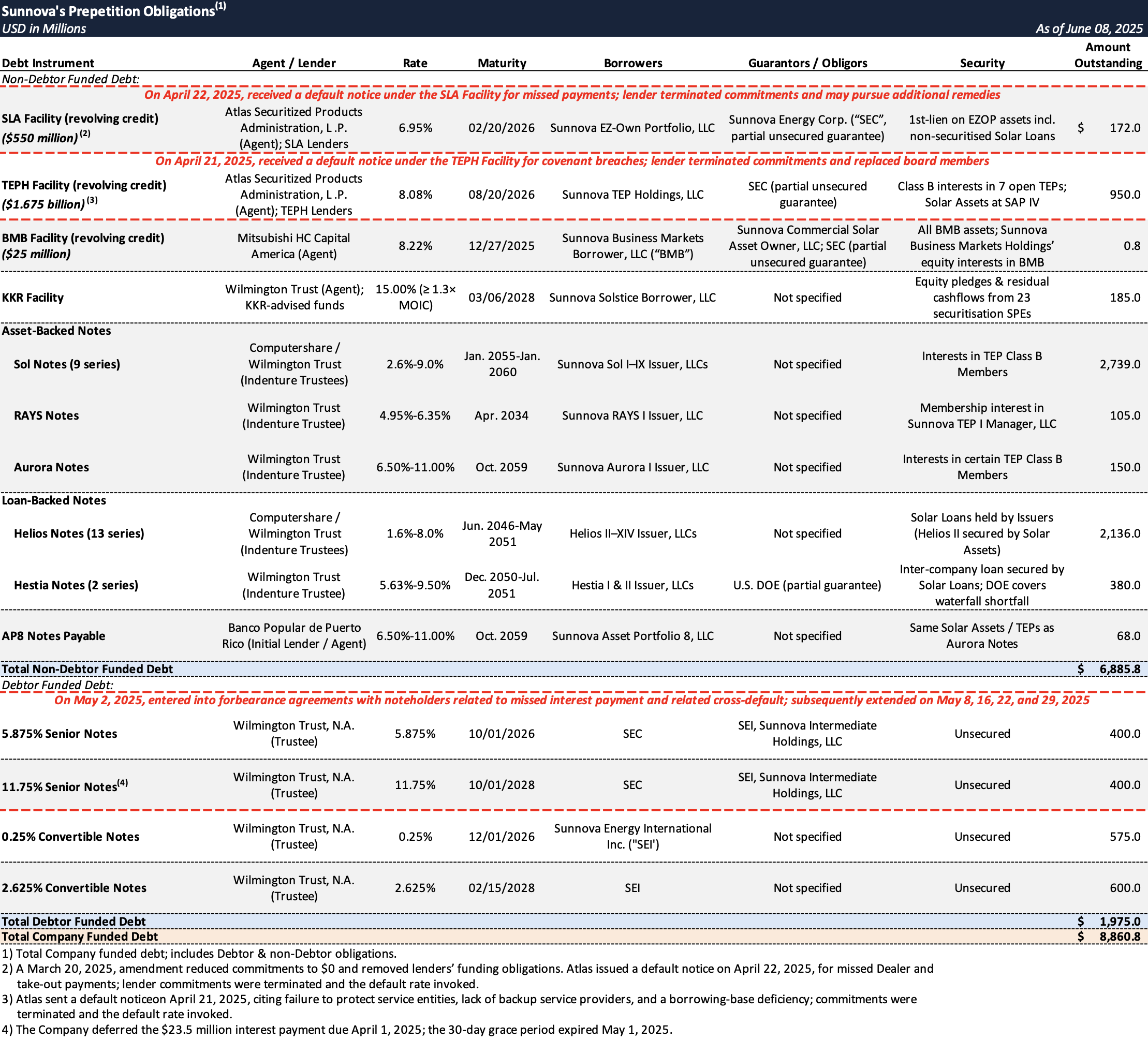

- Sunnova's growth was significantly fueled by capital raised through sophisticated financing structures, primarily unsecured corporate notes, Tax Equity Partnerships (TEPs), non-recourse revolving Warehouse Facilities, and securitization facilities (Asset-Backed Notes and Loan-Backed Notes).

- Historically, Sunnova sponsored at least 26 special-purpose entities (SPEs) for securitizations and 34 TEPs. By December 31, 2024, Sunnova had established 26 SPEs for securitizations of customer contracts and utilized warehouse credit facilities to bridge funding.

- The Company's debt grew substantially, with annual interest expenses reaching $491 million by December 2024.

Leadership and Pre-Bankruptcy Restructuring

- Founder John Berger served as CEO, President, and Chairman until March 2025, overseeing customer growth from over 100,000 in 2020 to more than 444,000 by the end of 2024.

- As financial pressures mounted, John Berger stepped down as CEO in March 2025, replaced by Paul Mathews (then-COO). Robyn Liska was appointed Interim CFO on April 1, 2025. On April 27, 2025, Ryan Omohundro of Alvarez & Marsal North America, LLC was appointed Chief Restructuring Officer (CRO).

- The Debtors engaged Moelis & Company LLC ("Moelis") as proposed investment banker on March 17, 2025, and Alvarez & Marsal ("A&M") as financial advisor in March 2025 to assist with liquidity management, strategic alternatives, and contingency planning. Kirkland & Ellis LLP was engaged as restructuring counsel.

- Prior to the Petition Date, new leadership initiated an operational restructuring, pausing new originations of Solar Leases, PPAs, and Solar Loans, and divesting from underperforming segments, including its commercial-grade business and new homebuilder partnerships (excluding the then-pending Lennar Sale). The company also reduced its workforce by over 50%.

- On April 11, 2025, the Board appointed two disinterested directors, Jeffrey Stein and Anthony Horton, to a newly-formed special committee (the "Special Committee") to review restructuring transactions and investigate potential conflicts of interest.

Corporate Organizational Structure

Operations Overview

Sunnova's core business provides solar-as-a-service through an asset-light, distributed model that leverages a network of independent Dealers. These Dealers, numbering approximately 175 active partners at the time of filing, handle customer origination, system design, and installation per Sunnova's standards. Sunnova, in turn, provides financing, branding, training, an online platform for system design (e.g., via OpenSolar), and centralized customer service. Revenue is primarily generated from long-term service agreements, solar renewable energy certificates ("SRECs"), and historically, solar loan interest.

Financing Operations and Capital Structure

- Tax Equity Partnerships (TEPs): Sunnova formed TEPs with institutional investors to monetize federal ITCs and depreciation. In typical "partnership flip" structures, investors contributed capital for Solar Systems in exchange for tax benefits and initial cash flows, with Sunnova retaining a residual interest. These TEPs were generally bankruptcy-remote. Sunnova had 34 active TEPs as of December 2024.

- Securitizations and Warehouse Facilities:

- Sunnova regularly securitized pools of customer receivables (leases, PPAs, loans) through SPEs, issuing Asset-Backed Notes and Loan-Backed Notes to raise upfront cash.

- Warehouse credit facilities, such as the TEPH Facility (for Solar Assets) and the SLA Facility (for Solar Loans), provided short-term funding. These were largely non-recourse.

- Debtor Sunnova TEP Developer, LLC ("TEP Developer") held title to inactive Solar Systems purchased with TEPH Facility proceeds before transfer to TEPs.

- O&M and Administrative Fees: Sunnova earned critical O&M and Management Fees for servicing Solar Assets and Solar Loans within TEPs, Securitizations, and Warehouse Facilities, paid with priority under distribution waterfalls. These services were provided by entities like TE Management and ABS Manager.

Dependence on Government Incentives

- The federal Solar Investment Tax Credit (ITC) was crucial. The IRA extended a 30% ITC, but policy uncertainty grew by 2025.

- California's NEM 3.0 (April 2023) reduced export credits, impacting demand.

- A conditionally approved $3 billion DOE loan guarantee (Project Hestia) was reduced to ~$370 million in May 2025. Sunnova had not drawn on it and did not expect to, but the cut eliminates a potential source of capital. A separate $281.1 million DOE grant for Puerto Rico (Puerto Rico Energy Resilience Fund) was active, with over 1,500 systems installed.

Dealer Network and Operational Breakdown

- Dealers were responsible for marketing, customer origination, system design/installation, and were paid in installments tied to project milestones (e.g., Notice to Proceed, Mechanical Completion, Substantial Completion, Final Completion). The top twelve Dealers accounted for over 80% of originations.

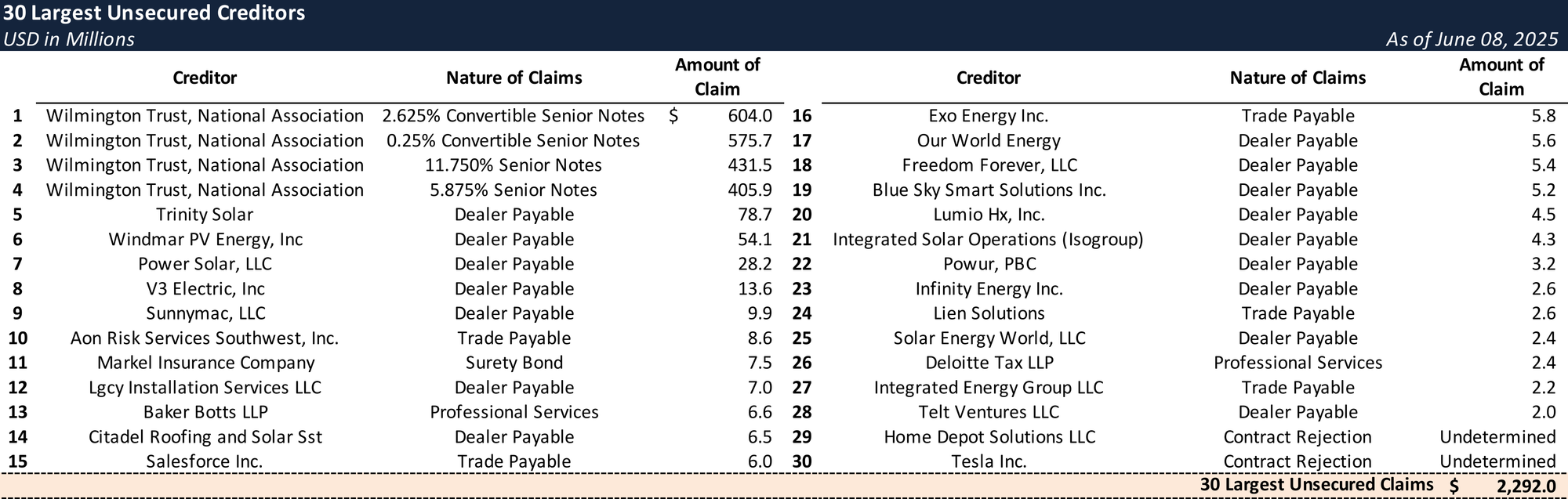

- Sunnova's deteriorating cash position led to accumulated unpaid balances to Dealers (estimated at $367 million as of the Petition Date), causing them to halt work on approximately 22,000 in-progress projects. This dealer payment freeze critically disrupted new installations and revenue streams.

Customer Growth

Prepetition Obligations

Top Unsecured Claims

Events Leading to Bankruptcy

Sunnova's Chapter 11 filing resulted from a combination of industry-specific pressures, macroeconomic headwinds, and internal financial vulnerabilities. An aggressive growth strategy reliant on substantial debt became unsustainable amid rising interest rates, inflation, and adverse regulatory shifts, culminating in a severe liquidity crisis.

Escalating Financial Distress and Prepetition Restructuring Efforts

- Market Conditions and Cost Structure:

- Rising interest rates increased Sunnova's cost of capital (e.g., Sol III ABS at 2.8% in June 2021 vs. Sol VI ABS at 6.8% three years later) and dampened customer demand.

- Sunnova's growth-oriented cost structure proved ill-suited for the changing environment, straining cash preservation despite revenue growth and efforts to reduce net operating expenses.

- Regulatory uncertainty, including potential federal subsidy cuts, California's NEM 3.0, and the cancellation of the DOE loan guarantee, further pressured the business and tightened tax equity markets.

- Liquidity Crisis and Preemptive Measures:

- By mid-March 2025, Sunnova faced "critically tight liquidity," threatening its ability to meet near-term obligations, including a ~$24 million interest payment on its 11.75% Senior Notes and ~$170 million in payments under the SLA Facility. The Company projected it would run out of cash by late April/early May 2025 absent new infusion.

- In December 2024, Sunnova began exploring liability management and engaged J.P. Morgan to market recapitalization transactions.

- On March 2, 2025, Sunnova closed a $185 million secured term loan with KKR (the "KKR Facility") at a 15% interest rate to bridge operations.

- The Company engaged A&M, Kirkland & Ellis, and Moelis in March 2025 to assist with liquidity, restructuring, and financing alternatives.

- Intensive (Failed) Search for Alternative Financing:

- Phase 1 (Bridge/Prearranged Plan DIP): Beginning April 2025, Moelis, on behalf of the Debtors, contacted seventeen prospective third-party DIP lenders to fund an out-of-court bridge period ($60 million needed) and a comprehensive pre-arranged Chapter 11 restructuring ($340 million needed). Nine NDAs were executed, but no proposals for bridge or DIP financing were submitted. KKR declined to consent to priming liens on its collateral.

- Phase 2 (Sale Process DIP): In late April/early May 2025, the Debtors developed an alternative proposal for a DIP financing to fund a sale of substantially all assets ($70-$100 million needed for a ~90-day process). Moelis contacted sixteen prospective lenders (eleven from Phase 1 plus five new). Eight conducted due diligence; two submitted highly preliminary indications but later declined; one negotiated for four weeks but dropped out due to inability to meet funding level and timeline.

- Stakeholder Negotiations and Defaults:

- The Debtors engaged in extensive discussions with the Ad Hoc Group of noteholders, Atlas (agent for TEPH and SLA facilities), and KKR.

- On March 3, 2025, Sunnova's 10-K included a "going concern" warning, prompting some TEP investors to withdraw capital commitments.

- On April 1, 2025, Sunnova deferred an ~$23.5 million interest payment on its 11.75% Senior Notes, entering a 30-day grace period, subsequently extended by forbearance agreements with holders of its Senior Unsecured Notes.

- On April 21 and 22, 2025, Atlas issued default notices under the TEPH Facility and SLA Facility, respectively, citing covenant breaches and missed payments, terminating commitments and increasing interest rates.

- KKR informed the Debtors it was unwilling to extend additional financing. Atlas focused on dealer-related obligations and could not provide broader restructuring financing. The Ad Hoc Group pivoted from a plan-focused DIP to a DIP funding a credit bid in a sale process. An ad hoc group of Asset-Backed Noteholders also declined to provide financing.

Chapter 11 Filing

- Facing insurmountable liquidity issues and unable to secure out-of-court solutions, Sunnova TEP Developer, LLC filed for Chapter 11 on June 1, 2025, followed by Sunnova Energy International Inc. and other key subsidiaries on June 8, 2025.

- The Debtors entered Chapter 11 with approximately $13.5 million in available cash, insufficient to fund operations. Initial liquidity was anticipated from:

- The $15 million TEPH Sale to an ATLAS SP Partners affiliate (Sunnova TEP Holdings, LLC), involving the purchase of certain solar systems and a settlement agreement to facilitate Dealer completion of WIP projects via incremental warehouse financing from Atlas. This sale was approved by the Court on June 11, 2025.

- The $16 million Lennar Sale, involving the sale of New Home Solar Assets to Lennar Homes, LLC. This sale was approved by the Court on June 12, 2025.

- On June 12, 2025, the Bankruptcy Court approved $90 million in DIP financing from an ad hoc group of noteholders (the "DIP Lenders"), authorizing $15 million on an interim basis and $75 million pending final approval.

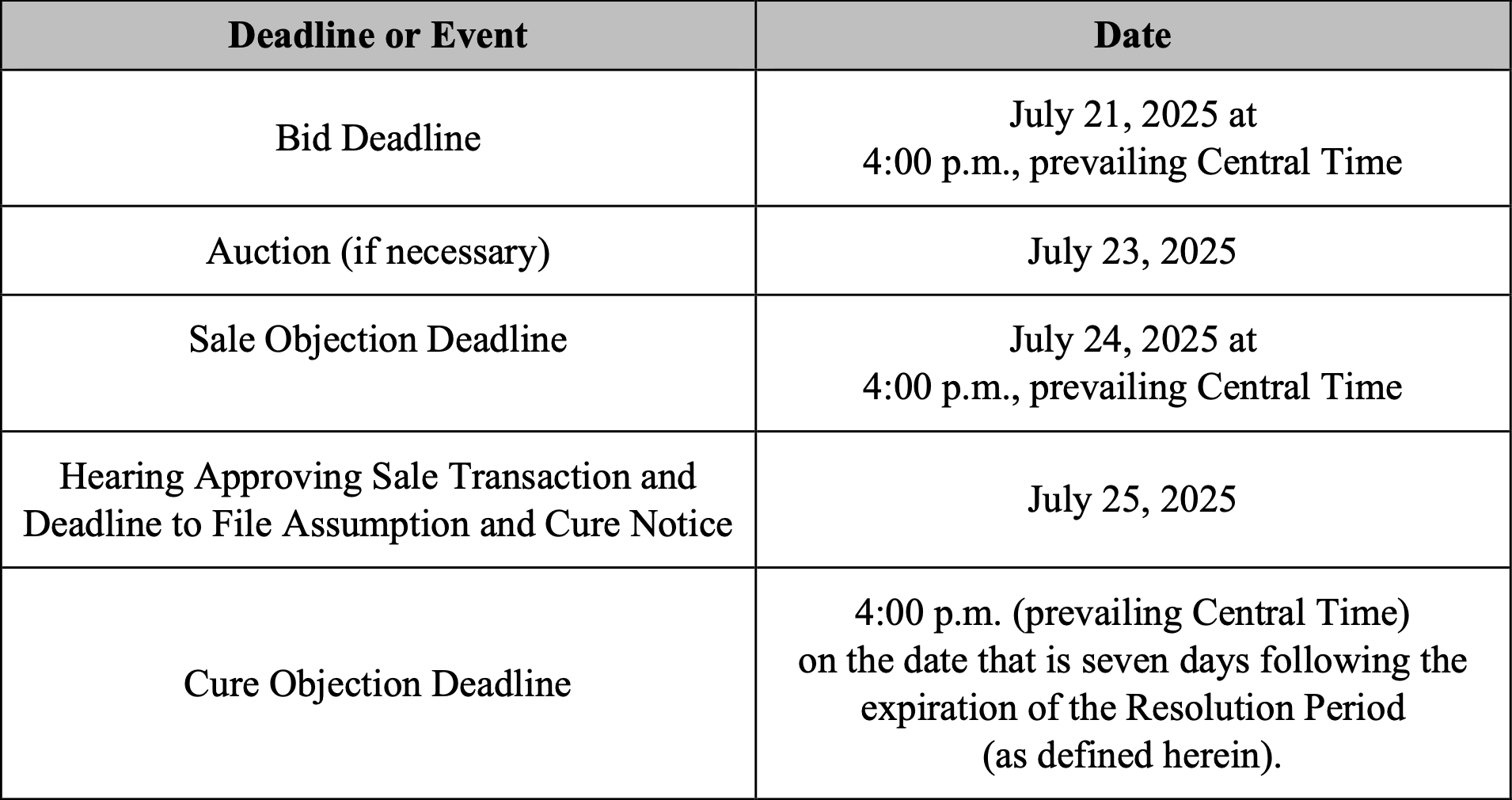

- The Debtors initiated a court-supervised sale process for substantially all assets, with the DIP Lenders as the WholeCo Stalking Horse Bidder, aiming for a sale hearing by July 25, 2025.

Proposed Schedule

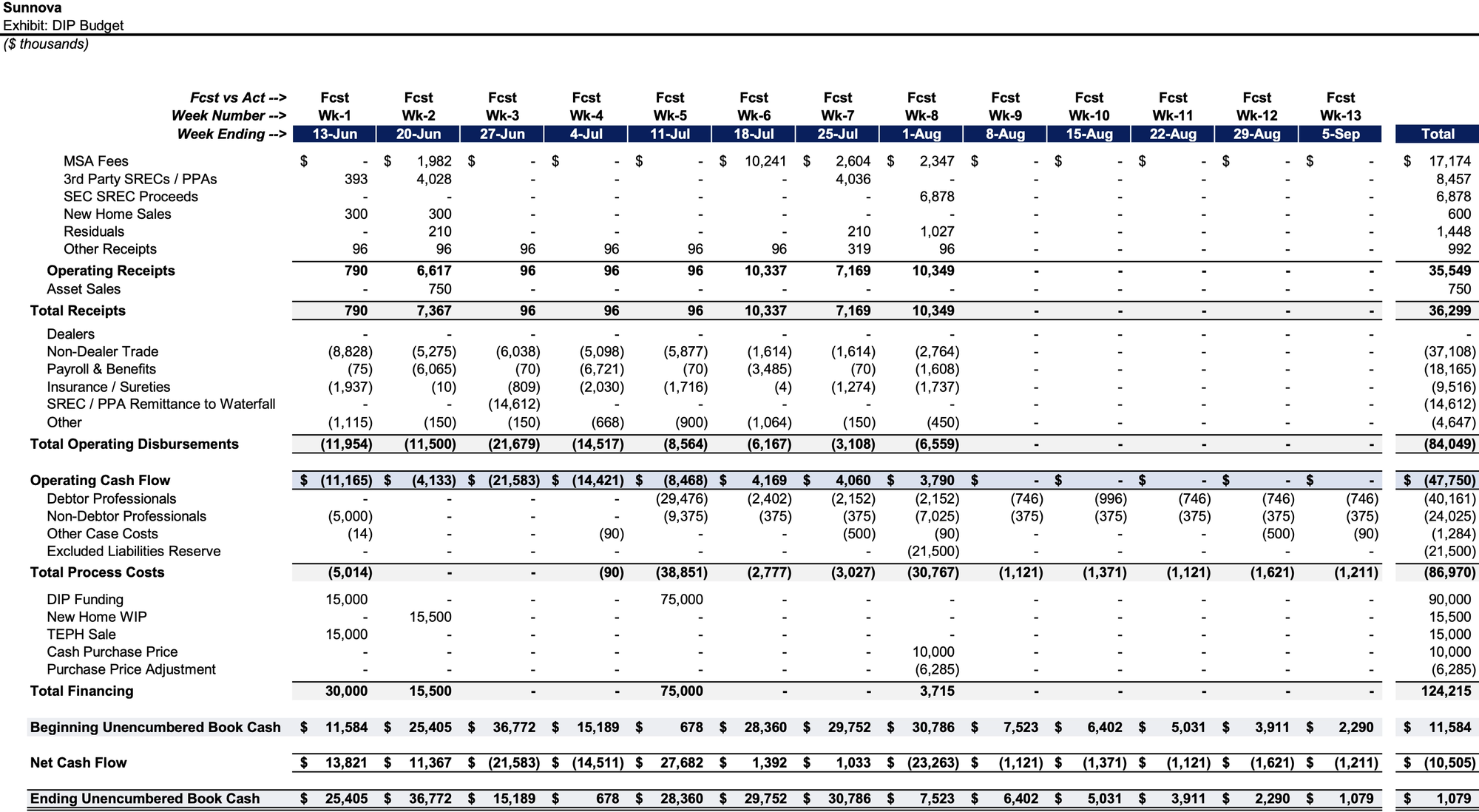

DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.