Case Summary: Synthego Chapter 11

Synthego has filed for Chapter 11 bankruptcy amid sustained cash burn from heavy R&D and operational investments and rising debt service, supported by a $50M DIP and $85M stalking horse credit bid from an existing lender.

Business Description

Headquartered in Redwood City, CA, Synthego Corporation ("Synthego" or the "Company") is a biotechnology company specializing in CRISPR-based genome engineering solutions. Founded in 2012 by former SpaceX engineers, Synthego aims to automate genome engineering, offering end-to-end CRISPR tools and services to researchers, drug developers, and biopharmaceutical companies.

- Synthego's flagship offering is synthetic guide RNA (gRNA), the molecule that directs CRISPR enzymes to target DNA sequences. Its CRISPRevolution line (launched 2016) provides high-purity synthetic single-guide RNAs (sgRNAs) and kits, designed to reduce the cost and turnaround time of gene editing experiments.

- The Company claims it is the sole U.S. manufacturer of both research- and therapeutic-grade gRNAs.

- Beyond gRNAs, Synthego's portfolio includes licensed CRISPR nucleases (e.g., Cas9, Cas12, eSpOT-ON), ancillary enzymes, bioinformatic software for guide design, and, historically, engineered cell lines and libraries.

Synthego developed a “smart factory” model using robotics and machine learning to optimize gRNA production. It also provides consultation services through its team of chemists, biologists, and regulatory specialists to support clients in navigating IND-enabling studies and regulatory approval processes, positioning itself as a comprehensive CRISPR solutions provider—from discovery through clinical trial preparation.

- As of the Petition Date, the Company employed approximately 150 individuals.

Synthego Corporation filed for Chapter 11 protection on May 5, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $50 million to $100 million in assets and $100 million to $500 million in liabilities.

Corporate History

Synthego was co-founded in July 2012 by Paul and Michael Dabrowski and Alex Pesch with $250,000 in seed funding, initially focusing on applying engineering principles to biology before concentrating on CRISPR technology.

Funding and Product Expansion

- 2013 (Series A): Secured ~$8.3 million in Series A funding.

- 2017 (Series B): Raised $41 million (Series B), launching its CRISPRevolution synthetic sgRNA portfolio, claiming significant cost and time reductions for gene editing.

- 2018 (Series C): A $110 million Series C (2018) funded expanded CRISPR access.

- Introduced Engineered Cells and Arrayed Screening Libraries (2018), and CRISPR-edited iPS cells and new software tools for gRNA design and analysis (2019).

- 2020 (Series D): A $100 million Series D supported investment in Good Manufacturing Practice (GMP) capabilities.

- Launched "GMP Factory 1"; produced its first clinical-grade GMP gRNA in May 2020.

- 2022 (Series E): Closed a $200 million Series E by early 2022, led by Perceptive Advisors.

- Capital was used to scale automation, expand product lines, and build "GMP Factory 2" (launched 2023) for high-volume clinical-grade production. Total funding exceeded $450 million.

Challenges and Restructuring Efforts

- Patent Litigation (2021–2023): Engaged in an IP dispute with Agilent Technologies over CRISPR guide RNA patents. In May 2023, the PTAB invalidated two Agilent patents in Synthego's favor; Agilent appealed.

- Layoffs (Nov 2022): Reduced workforce by ~20% (105 employees) due to the biotech market downturn.

- Strategic Shift (Mar 2024):

- Divested its Engineered Cells and screening library business to Telegraph Hill Partners (forming EditCo Bio, Inc.), retaining core gRNA operations.

- Co-founder Paul Dabrowski stepped down as CEO; Craig Christianson appointed President and CEO to focus on commercialization.

Operations Overview

Synthego provides a range of off-the-shelf and custom genome engineering products, services, and IP, supporting therapeutic developers from discovery and screening through preclinical development and clinical/regulatory approvals.

Products and Services

- Synthetic Guide RNAs (gRNAs): Chemically synthesized gRNAs for research or clinical-grade GMP use. Manufactured in-house.

- CRISPR Nucleases: Provides CRISPR enzymes, often through partnerships and licensing agreements. Offerings include Cas9 nuclease and high-fidelity Cas12 variants (e.g., an engineered Cas12a, hfCas12Max, licensed from HuidaGene) and AstraZeneca’s "eSpOT-ON" CRISPR enzyme (under a global exclusive license). These nucleases, manufactured by third parties such as Biotechrabbit and Kactus Bio, can be bundled with Synthego’s gRNAs.

- RNA Enzymes, Software & Support: Supplies ancillary enzymes (T7 RNA polymerase, RNase inhibitors), bioinformatics software (web-based CRISPR design tool), and regulatory/technical support for clients.

Manufacturing Facilities

Synthego operates automated production across two Redwood City, CA factories (three leased sites) for Research Use Only (RUO) and GMP-grade RNA:

- GMP Factory 1 (Haven Avenue): A 9,600 sq. ft. facility (with an 11,300 sq. ft. support site) for RUO and INDe product manufacturing. It produced Synthego's first GMP gRNA in May 2020.

- GMP Factory 2 (Charter Street): An over 18,000 sq. ft., 24/7 GMP-compliant facility launched by 2023 for multi-gram scale sgRNA synthesis, featuring advanced controls and dedicated suites.

Customer Base & Partnerships

- Customers include large pharma/biotech (25%), small/mid-sized biotech (50%), and academic medical centers (25%). Synthego estimates ~25% of the ~1,000 global cell/gene therapy companies have used its products.

- Collaborated with over 50 institutions/companies, including 8 of the 10 largest biotech firms. Products adopted by top universities in 30+ countries, contributing to 190+ peer-reviewed publications.

- Notable partnerships include a January 2025 agreement with AstraZeneca for global rights to its eSpOT-ON CRISPR enzyme, and the March 2023 launch of the CRISPR Discovery Partners network with specialized Contract Research Organizations (CROs).

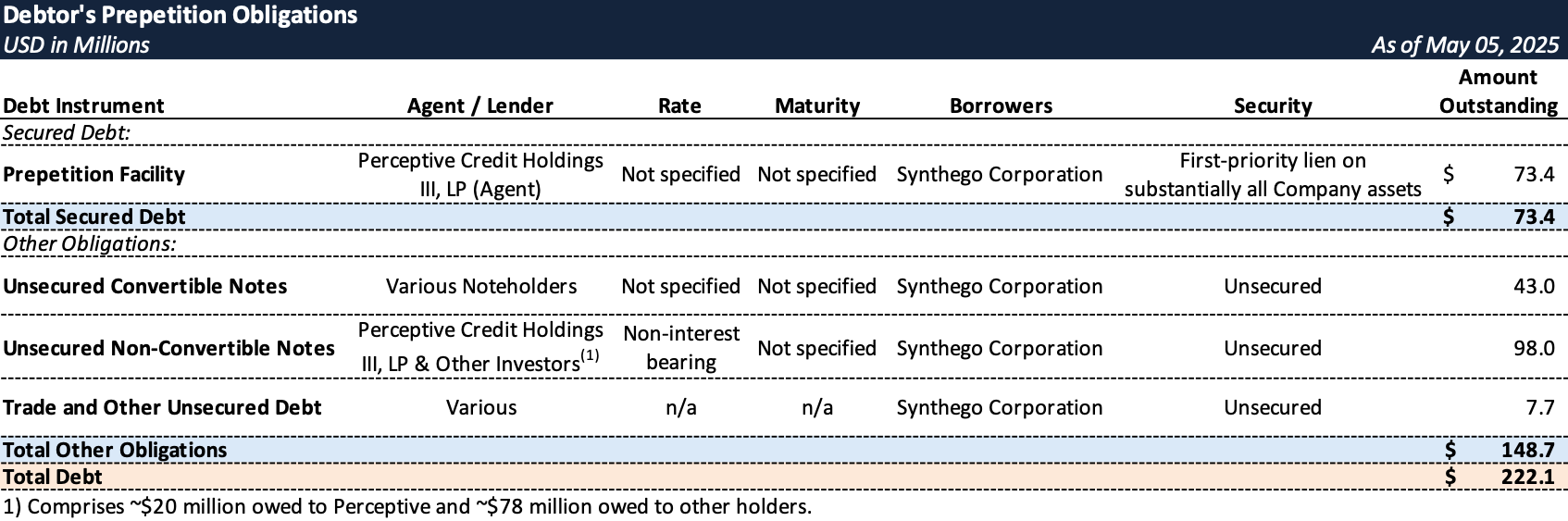

Prepetition Obligations

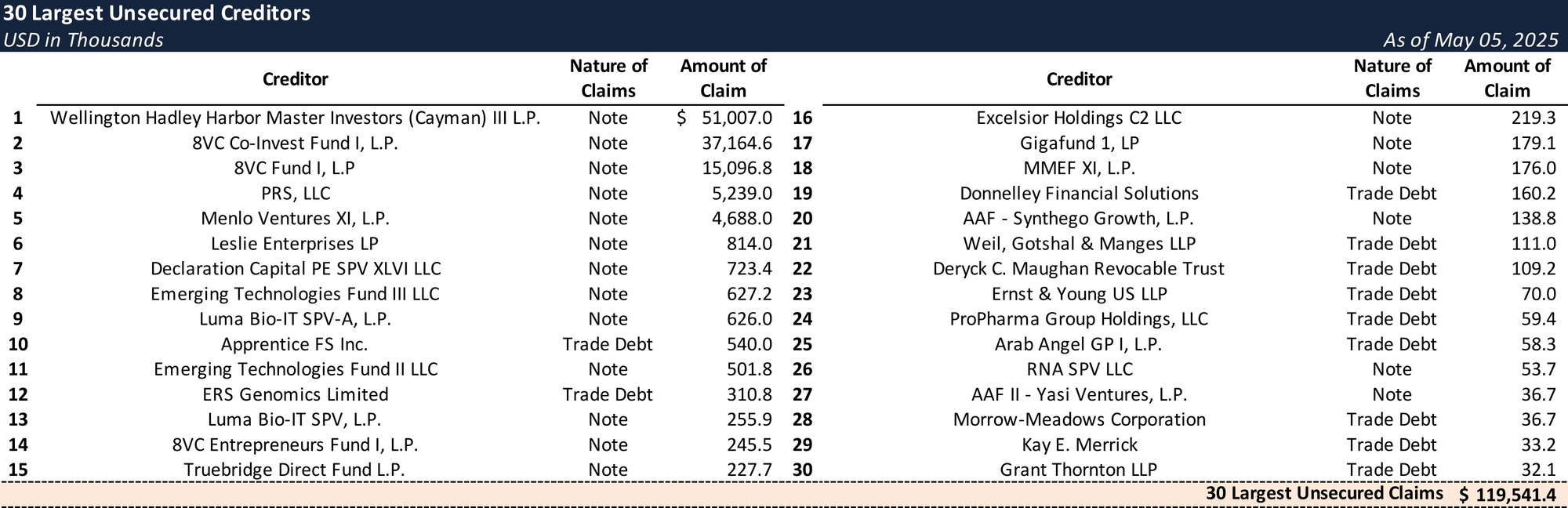

Top Unsecured Claims

Events Leading to Bankruptcy

Heavy Investment Outpacing Revenue and Mounting Debt

- Despite rapid revenue growth (2020-2023), heavy investment in technology and operations outpaced income, leading to declining margins, persistent net losses, and significant cash burn.

- Synthego increasingly turned to debt financing to support its growth, with interest expense reportedly rising more than tenfold by YE 2023 compared to 2020–2021 levels.

Biotech Market Downturn and Operational Adjustments

- The broader biotech funding environment deteriorated significantly from late 2022, with venture capital receding and IPO opportunities diminishing. This created a more challenging landscape for companies like Synthego to raise additional equity on favorable terms.

- In November 2022, Synthego implemented a 20% workforce reduction (approximately 105 employees) as a cost-cutting measure to extend its cash runway, though this proved insufficient to offset ongoing operating losses.

Strategic Responses and Continued Financial Pressures

- In March 2024, Synthego divested its Engineered Cells division (spun out as EditCo Bio, Inc.) to focus on its core gRNA reagents business. Craig Christianson was appointed CEO to spearhead a renewed commercialization strategy.

- While these measures reportedly reduced operating losses by about a third by Spring 2024, the Company remained cash-flow negative and, by February 2025, was unable to generate sufficient cash flow to service its debt obligations.

Liquidity Crisis and Insolvency

- By Q1 2025, Synthego faced a severe liquidity crisis with dwindling cash reserves and limited financing options.

- As of the Petition Date, the Company's liabilities ($100M-$500M) significantly outweighed assets ($50M-$100M).

- The Company's primary secured lender, Perceptive Credit Holdings III, LP ("Perceptive"), provided additional bridge funding of $3.5 million (late March 2025) and $4.3 million (late April 2025) to bridge Synthego's funding needs to a Chapter 11 filing.

Chapter 11 Filing and Proposed Sale

- Synthego filed for Chapter 11 on May 5, 2025, citing liquidity pressures from high investment costs and debt.

- The Company entered bankruptcy with a stalking horse APA with Perceptive for substantially all assets, involving a credit bid up to approximately $85 million.

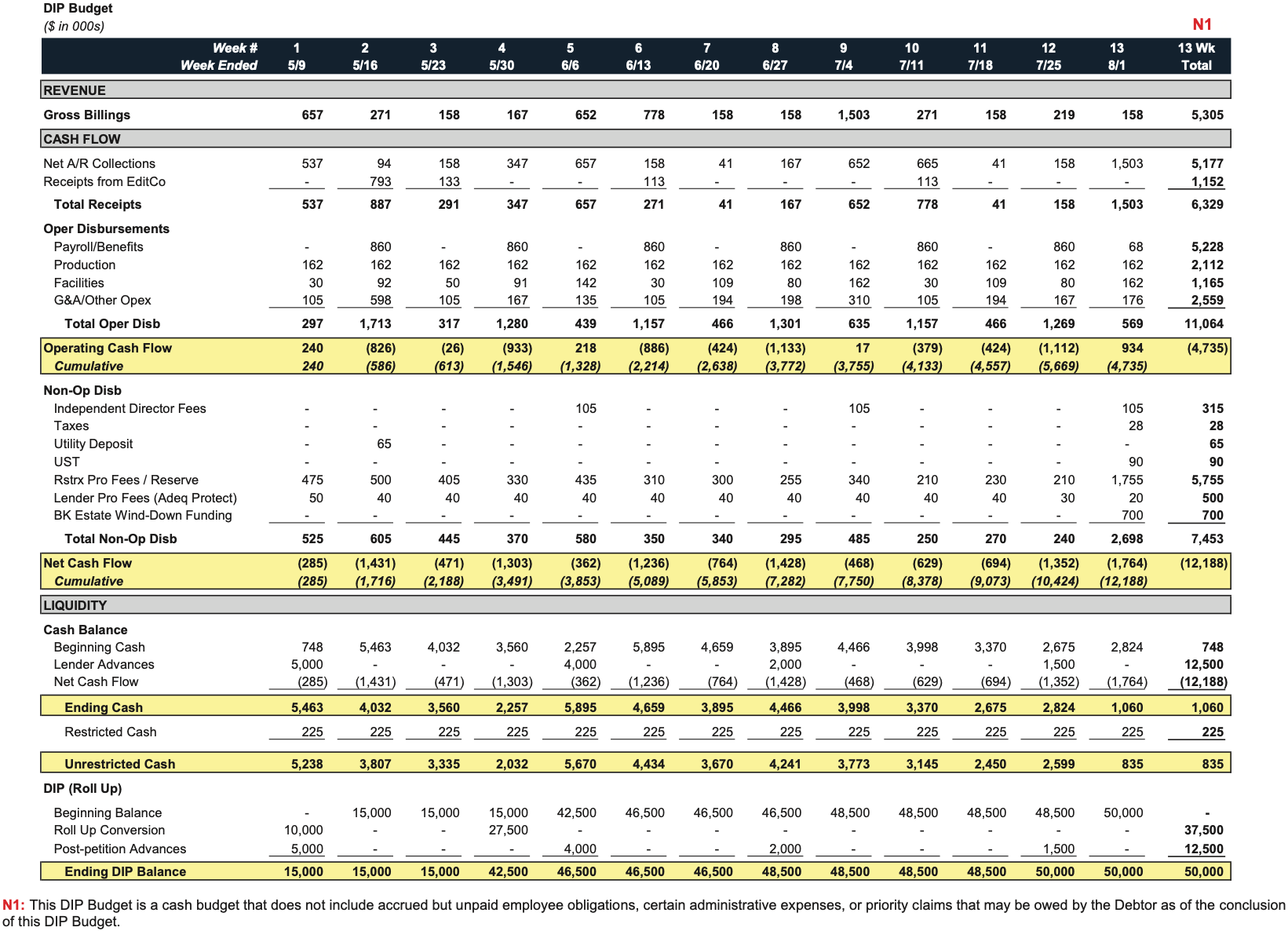

- On May 9, 2025, Synthego received interim approval for a $50 million DIP facility from Perceptive, comprising $12.5 million in new money ($5 million interim) and a $37.5 million roll-up of prepetition debt ($10 million interim), secured by a first-priority priming lien on substantially all assets.

- Projected cash operating losses were ~$4.7 million for the first 13 weeks of the case, with non-operating/restructuring costs around $7.5 million.

Governance and Oversight

- Paladin was engaged as financial advisor in early 2024 and appointed Allen Soong as CRO in March 2025.

- A Board Restructuring Committee (Craig Barbarosh, Robert Warshauer, John T. Young) was formed on April 25, 2025.

- CEO Craig Christianson recused himself from Board matters involving Perceptive due to a $1.5 million retention loan from Perceptive.

Path Forward

- The asset sale is expected to close by July 14, 2025 (70 days post-filing).

- Synthego plans to file a liquidating Chapter 11 plan within 21 days of the Petition Date to distribute residual assets.

Key Advisors

- Bankruptcy Counsel: Pachulski Stang Ziehl & Jones LLP

- Corporate Counsel: Fenwick & West LLP

- Financial Advisor / CRO: Paladin Management Group (Allen Soong)

- Investment Banker: Raymond James & Associates, Inc.

- Claims Agent: Epiq Corporate Restructuring LLC

Approved DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.