Filing Alert: Synthego Chapter 11

Synthego Files Chapter 11 in District of Delaware

Synthego Corporation, a Redwood City, CA-based provider of end-to-end CRISPR tools and solutions, filed for Chapter 11 protection on May 5 in the U.S. Bankruptcy Court for the District of Delaware.

The filing is driven by mounting liquidity pressures stemming from rapid growth that was consistently outpaced by heavy investments in technology and operations. Despite strong revenue growth between 2020 and 2023 driven by sales of its gene-editing tools and solutions to leading biopharmaceutical and research institutions, Synthego experienced significant margin compression, escalating operating losses, and a substantial increase in debt-servicing costs. Although the 2024 sale of its engineered cell division reduced losses, the company remained cash-flow negative through early 2025.

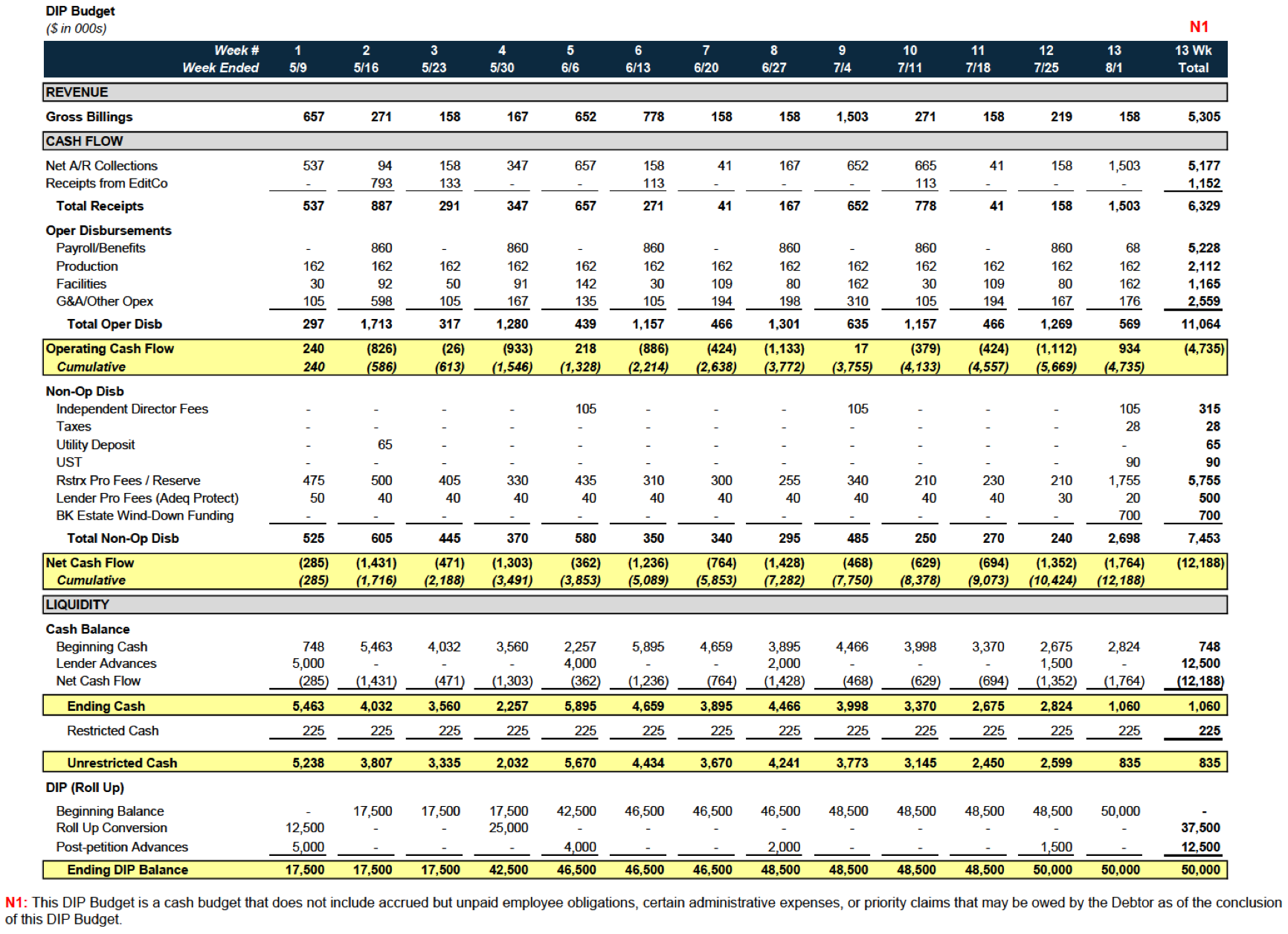

The company entered Chapter 11 with a $50 million DIP facility from prepetition lender Perceptive Credit Holdings III, LP ("Perceptive"), including $12.5 million in new money and a $37.5 million roll-up of prepetition debt. Perceptive, an affiliate of private equity firm Perceptive Advisors, also submitted a stalking horse credit bid valued at up to $85 million, comprising the new-money DIP loans and substantially all of the company's senior prepetition obligations. The bid sets the floor for a sale of substantially all assets under section 363, to be followed by a liquidating Chapter 11 plan.

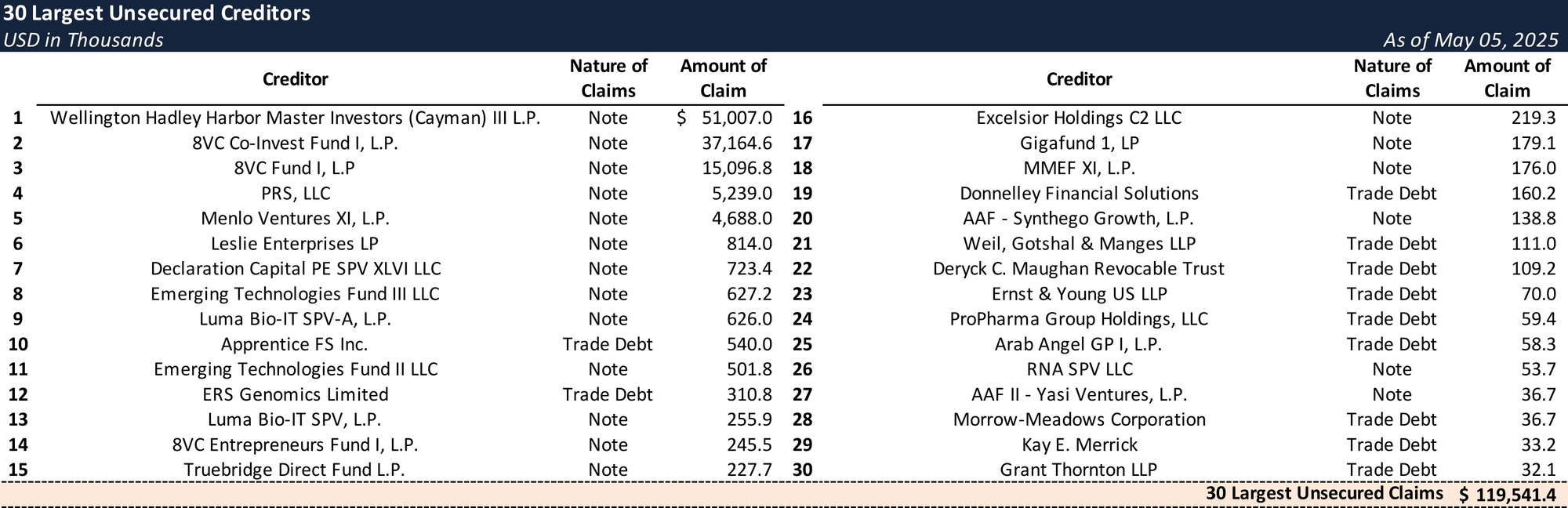

The company reports $50 million to $100 million in assets and $100 million to $500 million in liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-10823.

Initial DIP Budget

Top Unsecured Claims

Key Parties

Bankruptcy Counsel:

- James E. O'Neill

- Pachulski Stang Ziehl & Jones LLP

- Email: [email protected]

Corporate Counsel:

- Fenwick & West LLP

Financial Advisor:

- Paladin Management Group

Investment Banker:

- Raymond James & Associates, Inc.

Signatories:

- Allen Soong – Chief Restructuring Officer

Claims Agent:

Equity Security Holders:

- 8VC Fund I, L.P. – 11.9% Equity Interest

- Menlo Ventures XI, L.P. – 9.1% Equity Interest

- Wellington Hadley Harbor Master Investors (Cayman) III L.P. – 8.8% Equity Interest

- The Founders Fund VI, LP – 7.0% Equity Interest

- 8VC Co-Invest Fund I, L.P. – 6.0% Equity Interest

- Other Minority Holders – 57.2% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.