Case Summary: The Bellevue Hospital Chapter 11

The Bellevue Hospital has filed for Chapter 11 bankruptcy, citing systemic challenges facing rural hospitals, with plans to sell to Firelands Health.

Business Description

Headquartered in Bellevue, OH, The Bellevue Hospital (“TBH” or the “Debtor”) is a not-for-profit healthcare provider that delivers a broad range of medical services to the residents of Bellevue, Clyde, and Fremont, Ohio, as well as the surrounding communities.

Established as a community hospital, TBH operates with a mission to provide personalized and local healthcare services on a 24/7 basis. The hospital is accredited by The Joint Commission, signifying compliance with national standards for healthcare quality and safety.

- Accreditations extend to its Laboratory Department and Sleep Disorders Center.

TBH is a member of the American Hospital Association, the Ohio Hospital Association, and the Hospital Council of Northwest Ohio.

In 2023 and 2024, the Debtor reported total gross revenue of approximately $53.9 million and $59.2 million, respectively.

- Net operating losses for the same periods were ($9.8 million) and ($4.1 million), reflecting ongoing financial challenges.

TBH filed for Chapter 11 protection on Feb. 5 in the U.S. Bankruptcy Court for the Northern District of Ohio. As of the Petition Date, the Debtor reported $10 million to $50 million in both assets and liabilities.

Corporate History

Originally established in 1914 as The Bellevue Hospital Association, TBH was formally reorganized under its current name in 1974 as an Ohio not-for-profit corporation. The governance structure of TBH consists of a board of trustees, with membership ownership distributed among:

- The Bellevue Hospital Association (60%)

- Firelands Regional Health System (“Firelands”) (20%)

- Fisher-Titus Health (“Fisher Titus”) (20%)

TBH holds a controlling membership interest or is the sole member in several subsidiary entities, including:

- The Bellevue Hospital Foundation: A not-for-profit entity that raises and transfers funds to TBH, including managing TBH’s capital campaign. TBH holds sole membership.

- Bellevue Professional Services, Inc.: Provides clinical and medical professional services to Bellevue, Clyde, and surrounding areas. TBH is the sole shareholder.

- Bellevue Hospital Pain Management, LLC: A pain management practice operating on TBH’s main medical campus. TBH holds a 51% controlling interest.

- Prairie Ridge, LLC: A real estate development entity formed to manage property adjacent to TBH. TBH holds sole membership.

- Bellevue Hospital Medical Holdings, LLC: Holds a membership interest in Northern Ohio Medical Specialists, LLC. TBH is the sole member.

Operations Overview

TBH operates as a full-service acute care hospital, offering a diverse range of medical services aimed at providing high-quality, community-centered healthcare.

Core Healthcare Services

- Cancer care and infusion therapy

- Cardiac and pulmonary rehabilitation

- Diagnostic imaging and laboratory services

- Emergency care

- Occupational health

- Orthopedics

- Physical rehabilitation and respiratory therapy

- Surgical services

Workforce and Community Impact

- As of the Petition Date, TBH employed approximately 360 individuals.

- The hospital serves as a critical healthcare provider in its four-county service area, ensuring access to essential medical care for local residents.

Commitment to Quality and Safety

- TBH has earned the Joint Commission’s “Gold Seal of Approval” for maintaining national standards in patient safety and quality of care.

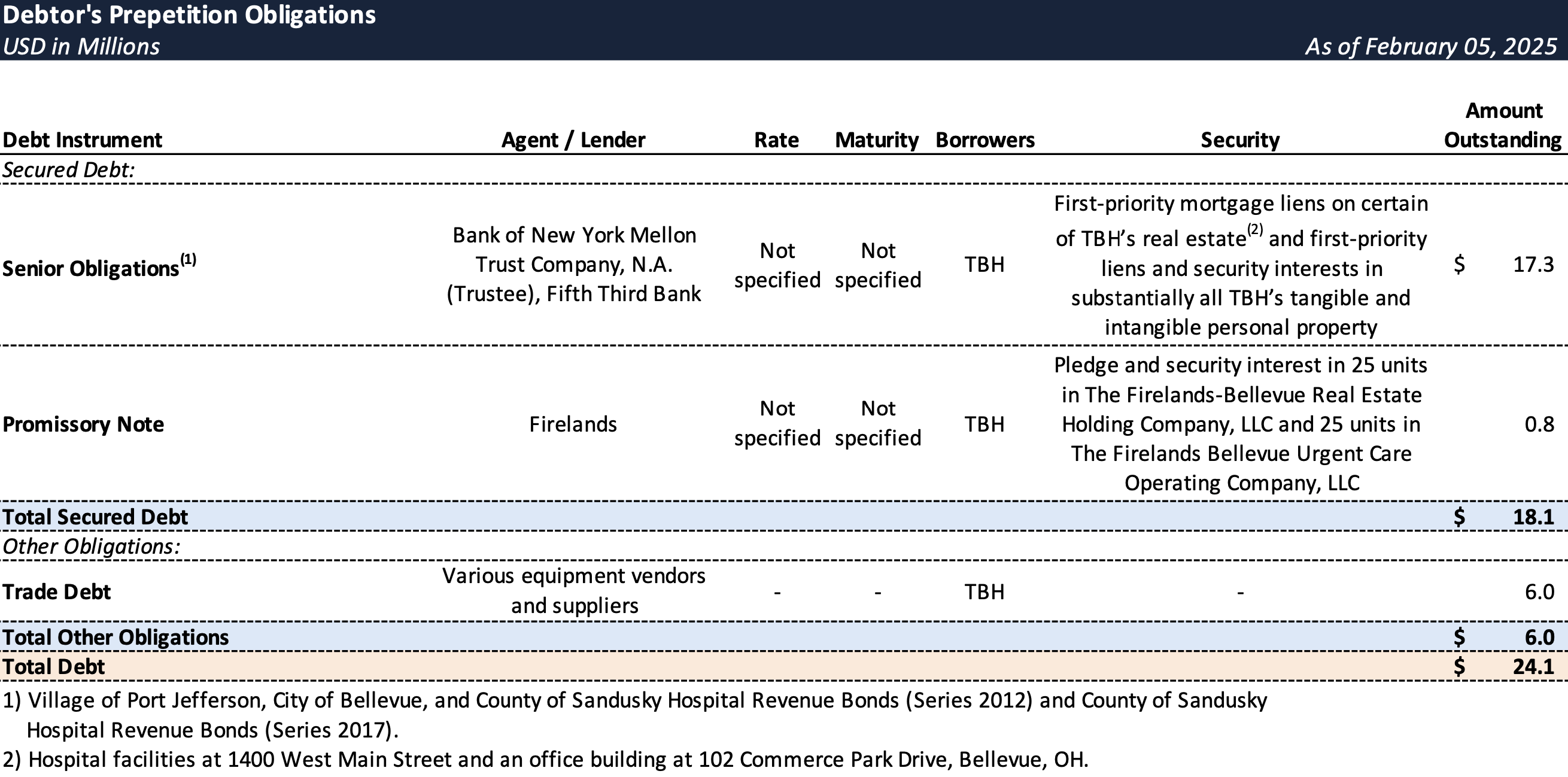

Prepetition Obligations

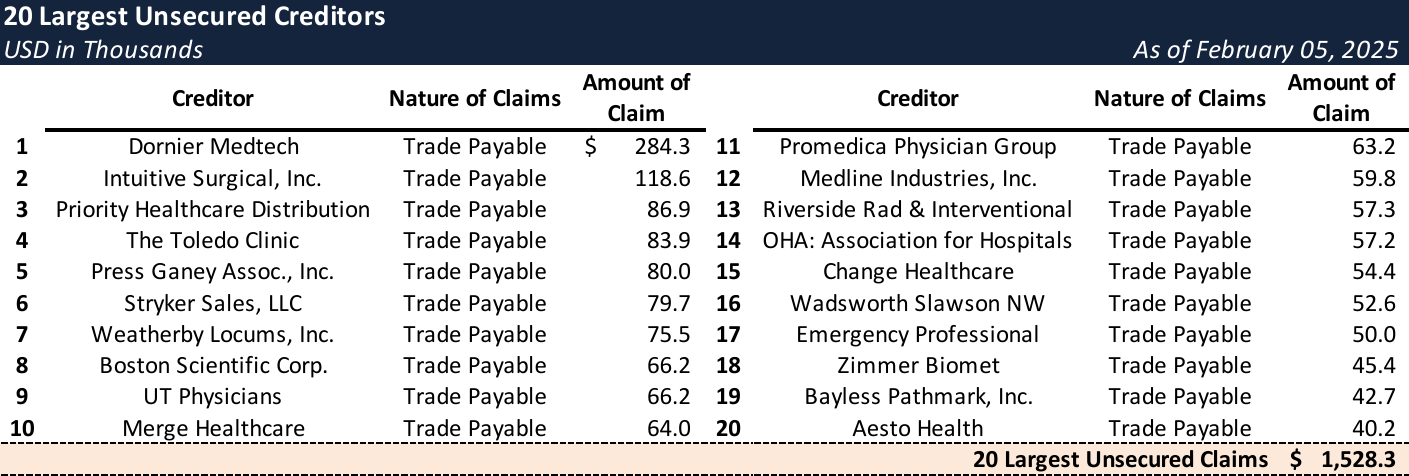

Top Unsecured Claims

Events Leading to Bankruptcy

Industry-Wide Challenges Facing Community Hospitals

- The Debtor’s financial distress was exacerbated by broader industry pressures affecting rural and community hospitals nationwide:

- Inflation-driven cost increases outpacing reimbursement gains from Medicare and Medicaid.

- Growing payer denials delaying payments for care, disproportionately impacting community hospitals operating on thin margins.

- Provider shortages, with rural areas accounting for approximately 66% of all shortages, according to the Debtor.

- The expiration of pandemic-related funding, leaving small hospitals with the same structural financial challenges they faced pre-pandemic.

- Limited access to economies of scale, supply chain efficiencies, and operational resources due to lack of affiliation with larger health systems.

- In response, the Debtor pursued revenue-enhancing initiatives, including expanding service lines in orthopedics, midwife deliveries, pediatrics, general and vascular surgery, and oncology. A revised hospitalist program and a renegotiated commercial payer contract also sought to improve financial performance.

- Concurrently, cost-cutting measures were implemented through workforce reductions, adjustments to employee benefit programs, and modifications to third-party service agreements in laboratory services, pathology, anesthesia, and debt collection.

Liquidity Challenges and Strategic Alternatives Process

- Despite operational improvements, TBH encountered severe liquidity constraints by mid-2024, prompting the retention of VMG Health ("VMG") to explore strategic alternatives:

- Initially, VMG was engaged to assess long-term sustainability and potential acquisition opportunities.

- A targeted marketing process solicited proposals from local, regional, and national healthcare systems with strategic or geographic alignment, including Firelands and Fisher Titus.

- Following a structured evaluation, Firelands was identified as the preferred strategic partner.

- On November 12, 2024, TBH formally entered a due diligence process with Firelands, aimed at effectuating a restructuring through a sale or member substitution in a Chapter 11 process.

Pre-Negotiated Restructuring and Chapter 11 Filing

- In the lead-up to the bankruptcy filing, TBH, Firelands, and Fifth Third Bank engaged in arm’s-length negotiations to structure a restructuring transaction, culminating in a RSA that outlined:

- Firelands’ substitution as the sole holder member of the Debtor as part of a Chapter 11 plan.

- The restructuring of the Debtor's debt obligations, including the Senior Obligations and the Firelands’ Obligations.

- Fifth Third’s consent to the authorized use of cash collateral to sustain operations.

- A DIP financing facility from Firelands of up to $1.5 million to fund ongoing operations and professional fees during the Chapter 11 process.

- The member substitution agreement between TBH and Firelands will serve as a stalking horse bid, subject to higher offers through a court-supervised bidding process.

- Concurrently with the Chapter 11 filing, approximately $2.4 million in market securities held with LPL Financial were liquidated and transferred to a blocked account at Fifth Third Bank to fund operating expenses and restructuring costs pursuant to a court-approved cash collateral order.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you’re already a subscriber and would like to receive timely filing alerts, please reach out and we’ll add you to the distribution list.