Case Summary: The Villages Health Chapter 11

The Villages Health has filed for Chapter 11 bankruptcy following the discovery of significant Medicare overpayment liabilities, supported by $39 million in DIP financing to facilitate a sale to CenterWell Senior Primary Care and ensure continuity of care for more than 55,000 patients.

Business Description

The Villages Health System, LLC ("TVH" or the "Company") is a healthcare provider operating a network of primary and specialty care centers. The Company was developed to offer high-quality care by reducing the physician-to-patient ratio, allowing for enhanced patient-provider interactions.

- TVH provides essential care to over 55,000 patients, many of whom are participants in Medicare Advantage plans.

- Its services are targeted at residents of The Villages, a large 55-plus master-planned community, and the surrounding areas.

In addition to primary care, TVH offers a range of specialty medical services, including cardiology, neurology, rheumatology, podiatry, gynecology, and pain management, through 10 clinic locations (eight primary care and two specialty care centers).

- The Company reports high patient satisfaction, evidenced by a Net Promoter Score of 96 out of 100, and strong staff retention, with an employee satisfaction rate of over 80% and staff vacancy rates below 7%.

- As of the Petition Date, TVH employs more than 800 team members, including over 80 physicians.

The Villages Health System, LLC filed for Chapter 11 protection on July 3, 2025 (the "Petition Date") in the U.S. Bankruptcy Court for the Middle District of Florida, reporting assets of $50 million to $100 million and liabilities of $100 million to $500 million, the latter of which is dominated by a substantial contingent claim from the U.S. government.

Corporate History

TVH was established in 2012 through a collaboration between The Villages and the University of South Florida (USF). The partnership aimed to deliver high-quality care by enhancing patient resources, reducing physician-to-patient ratios, and increasing access to primary and specialty providers.

Early Setbacks and Independent Growth

- The USF Health Specialty Care Center opened in late 2013, but the partnership ended less than a year later after lower-than-expected enrollment in the affiliated Medicare Advantage plan led to significant losses for USF Health.

- TVH continued operations independently. As of the Petition Date, the Villages’ developer retains majority ownership through Villages Health Holding Company, which holds a 66.3% equity stake. The remaining equity is owned by physician leaders and management, including founding Chairman Dr. Elliot Sussman, who holds an 8% stake.

- In 2016, TVH made a controversial decision to stop accepting original Medicare and Medigap insurance, requiring patients to enroll in specific Medicare Advantage plans to receive care, a move intended to support its value-based care strategy.

Expansion and Strategic Alliances

- The Company continued to expand, opening the state-of-the-art, 285,000-square-foot Center for Advanced Healthcare at Brownwood in 2020, envisioned as a "bedless hospital" for outpatient procedures.

- In 2019, The Villages announced a broad strategic alliance with University of Florida Health (UF Health). Around the same time, UF Health also acquired The Villages Regional Hospital and Leesburg Regional Medical Center.

Governance Restructuring

- In May 2025, facing significant financial and strategic challenges, the Board appointed seasoned restructuring expert Anna Phillips as an independent manager.

- A Restructuring Committee was formed with Ms. Phillips as its sole member, tasked with evaluating strategic alternatives. Shortly thereafter, Neil Luria of SOLIC Capital was appointed Chief Restructuring Officer (CRO) to guide the Company through the restructuring process.

Operations Overview

TVH operates a fully integrated outpatient healthcare network across 10 locations, including eight primary care clinics strategically located in The Villages’ neighborhoods and two major specialty centers: the Spanish Springs Specialty Care center and the Center for Advanced Healthcare at Brownwood.

Asset-Light, Value-Based Model

- The Company does not own any hospitals and instead coordinates inpatient care through a partnership with UF Health. Its "asset-light" strategy relies on leasing all clinic facilities and most major medical equipment, allowing it to focus resources on its clinical team and patient services.

- TVH’s operations are aligned with a value-based care framework, primarily serving its 55,000 patients through capitated Medicare Advantage plans. Under this model, TVH receives a fixed monthly payment per patient (PMPM) to manage their overall health, incentivizing preventive care and chronic disease management to reduce costly hospitalizations.

Workforce and Patient Engagement

- TVH’s primary assets are its workforce of over 800 employees, including more than 80 physicians, and its strong patient relationships. The Company boasts high employee satisfaction (over 80%) and low staff vacancy rates (below 7%), ensuring continuity of care.

- Patient engagement is a cornerstone of TVH’s model. Recognized as a Patient-Centered Medical Home, the system offers over 1,600 wellness classes annually, including nutrition workshops and disease management seminars, to promote healthy living among its senior patient base.

Prepetition Obligations

- TVH’s funded debt consists solely of a $15 million first-lien revolving credit facility with PMA Lender LLC, secured by a blanket lien on all assets. Other secured obligations are limited to customary equipment leases.

- Unsecured claims are modest, including approximately $200,000 in trade payables across about 100 vendors and small patient refund obligations. Notably, the majority of TVH’s general unsecured debt is expected to arise from historical billing issues (as discussed further below).

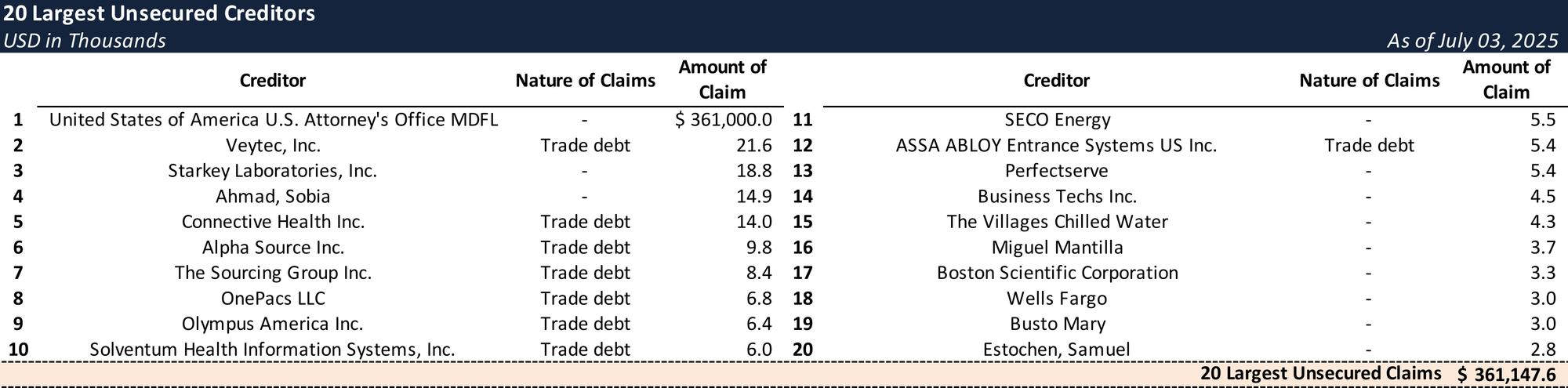

Top Unsecured Claims

Events Leading to Bankruptcy

TVH’s path to Chapter 11 was driven by the discovery of significant historical Medicare billing irregularities, which occurred in the midst of a strategic sale process.

Strategic Sale Process and Discovery of Coding Issues

- In September 2022, TVH retained Evercore Group LLC to explore strategic alternatives, including a sale of the Company. A formal marketing process was launched in September 2023, targeting buyers experienced in value-based, senior-focused primary care.

- By April 2024, CenterWell Senior Primary Care, a subsidiary of Humana Inc., emerged as the leading suitor and signed a non-binding term sheet for a stock purchase of TVH.

- The transaction was abruptly halted in mid-2024 when TVH’s management uncovered significant issues with its historical Medicare risk-adjustment coding practices.

- An internal investigation, supported by Goodwin Procter and FTI Consulting, revealed that a retrospective chart review program initiated around 2020 was inconsistent with Medicare guidelines.

- The program resulted in the submission of unsupported Hierarchical Condition Category (HCC) codes, which improperly inflated patient Risk Adjustment Factor (RAF) scores and, consequently, the capitated payments TVH received from Medicare Advantage plans.

- By April 2025, a preliminary analysis estimated the potential overpayment liability to be approximately $350 million or more.

Remediation, Self-Disclosure, and Renewed Sale Efforts

- Upon discovery, TVH immediately terminated the non-compliant coding program and enhanced its compliance infrastructure, appointing a new Chief Compliance Officer, establishing a Board Compliance Committee, and retaining Alvarez & Marsal for remediation guidance.

- In a critical step, TVH voluntarily self-disclosed the matter to the Department of Health and Human Services’ Office of Inspector General (OIG) in December 2024 and was formally accepted into the OIG’s self-disclosure protocol on January 31, 2025.

- With the massive liability now in the open, CenterWell re-engaged in negotiations, shifting the deal structure from a stock purchase to an asset purchase to be executed through a Chapter 11 proceeding, allowing the buyer to acquire the assets "free and clear" of the historical liabilities.

Chapter 11 Filing and Stalking Horse Agreement

- TVH filed for Chapter 11 protection on July 3, 2025, in the U.S. Bankruptcy Court for the Middle District of Florida, to facilitate a going-concern sale process.

- The Company entered into a $50 million all-cash stalking horse APA with CenterWell Senior Primary Care (Vitality), Inc. The proposed transaction is designed to preserve operations and maintain continuity of care for TVH’s approximately 55,000 patients.

- Under the APA, CenterWell has agreed to offer employment to substantially all of TVH’s 800+ employees.

- The agreement is not subject to financing contingencies and is subject to higher or otherwise better bids at an auction scheduled for August 25, 2025.

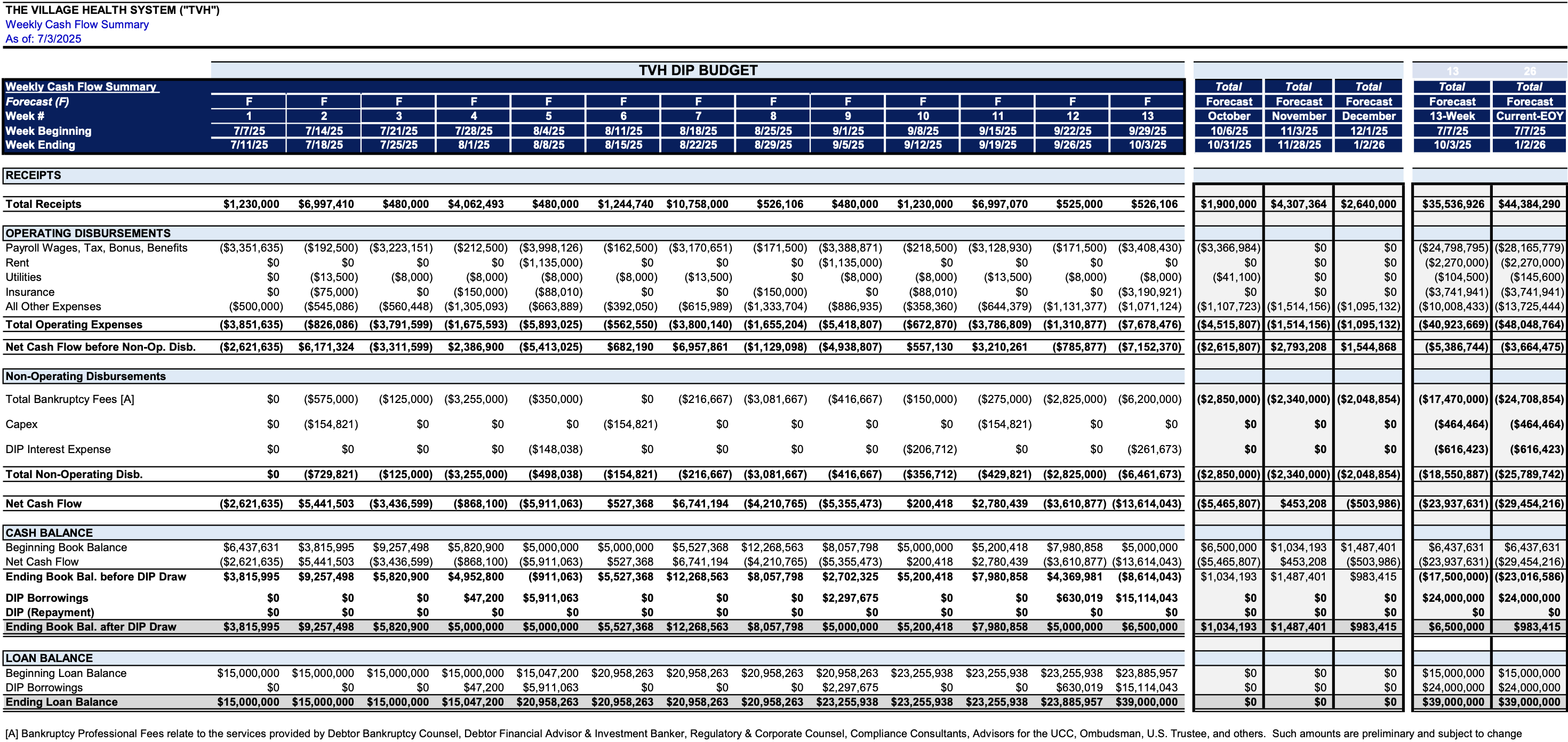

- To fund operations during the Chapter 11 process, TVH secured up to $39 million in DIP financing from PMA Lender LLC, including $24 million in new money advances and a $15 million roll-up of prepetition debt.

- The financing was approved on an interim basis on July 11, 2025, authorizing $5 million immediately, with a final hearing set for August 11, 2025.

Approved DIP Budget

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.