Filing Alert: Tilson Chapter 11

Tilson Files Chapter 11 in District of Delaware

Tilson Technology Management, Inc. ("TTMI") and its debtor affiliates⁽¹⁾, a Portland, ME-based digital infrastructure consulting, design-build, and maintenance firm specializing in fiber and wireless networks, filed for Chapter 11 protection on May 29 in the U.S. Bankruptcy Court for the District of Delaware.

The filing follows significant financial distress stemming from its largest client, Gigapower (a Blackrock and AT&T JV), withholding payments and ultimately terminating "for convenience" major fiber network projects in Las Vegas and Arizona in March and April 2025. This consumed TTMI's free cash flow, destroyed its ability to raise new equity, and precipitated a liquidity crunch despite a $10 million bridge loan from principal Joshua Broder in late Q1 2025. Prepetition efforts to secure new senior credit or equity were unsuccessful.

The Chapter 11 cases are intended to provide a "breathing spell to reset its business model post-separation from Gigapower while it continues to service its significant customer opportunities" and re-establish vendor relationships.

TTMI reports $100 million to $500 million in both assets and liabilities. The filing indicates that there will be funds available for distribution to unsecured creditors. The case number is 25-10949. The cases will be jointly administered under the Chapter 11 case of Boundless Broadband, LLC. (Case No. 25-10948).

⁽¹⁾ Boundless Broadband, LLC and Tilson Middle Street Holding, LLC.

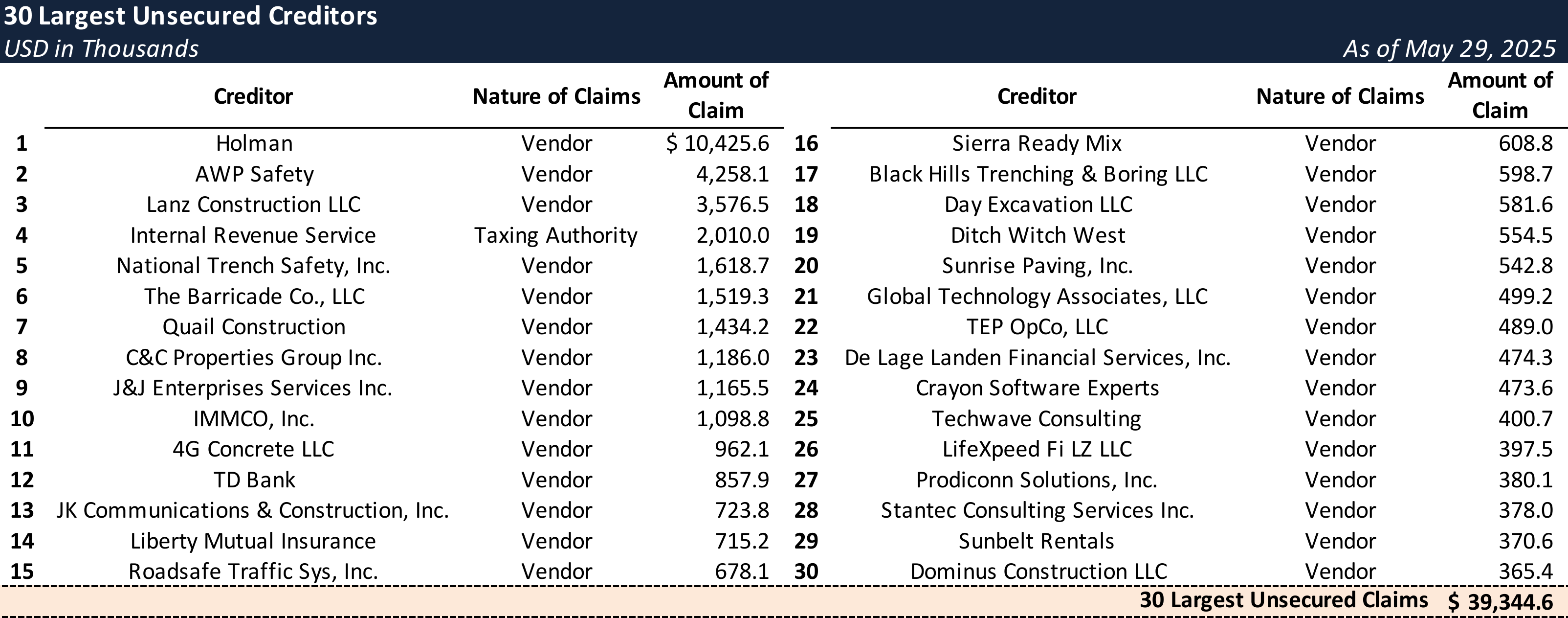

Top Unsecured Claims

Key Parties

Counsel:

- Evan T. Miller

- Saul Ewing

- Email: [email protected]

Co-Counsel:

- Bernstein, Shur, Sawyer & Nelson, P.A.

Financial Advisor / CRO:

- Alastar Partners, LLC (Rick Arrowsmith)

Signatories:

- Darrell Ingram – Chief Executive Officer

Claims Agent:

Equity Security Holders:

- Josh Broder – 33.7% Equity Interest

- SDC Tilson Investor, LLC – 22.3% Equity Interest

- Paul Anderson – 12.8% Equity Interest

- Rand Capital SBIC, Inc. – 10.0% Equity Interest

- Other Minority Holders – 21.2% Equity Interest

Bondoro Insights is continuing to monitor this case and will provide further coverage as appropriate.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

If you're already a subscriber and would like to receive timely filing alerts, please reach out and we'll add you to the distribution list.