Case Summary: Tonopah Solar Energy Chapter 11

Tonopah Solar Energy has filed for Chapter 11 bankruptcy to pursue a Section 363 sale of its concentrated solar power facility, following chronic technical failures that necessitated a permanent capacity reduction.

Business Description

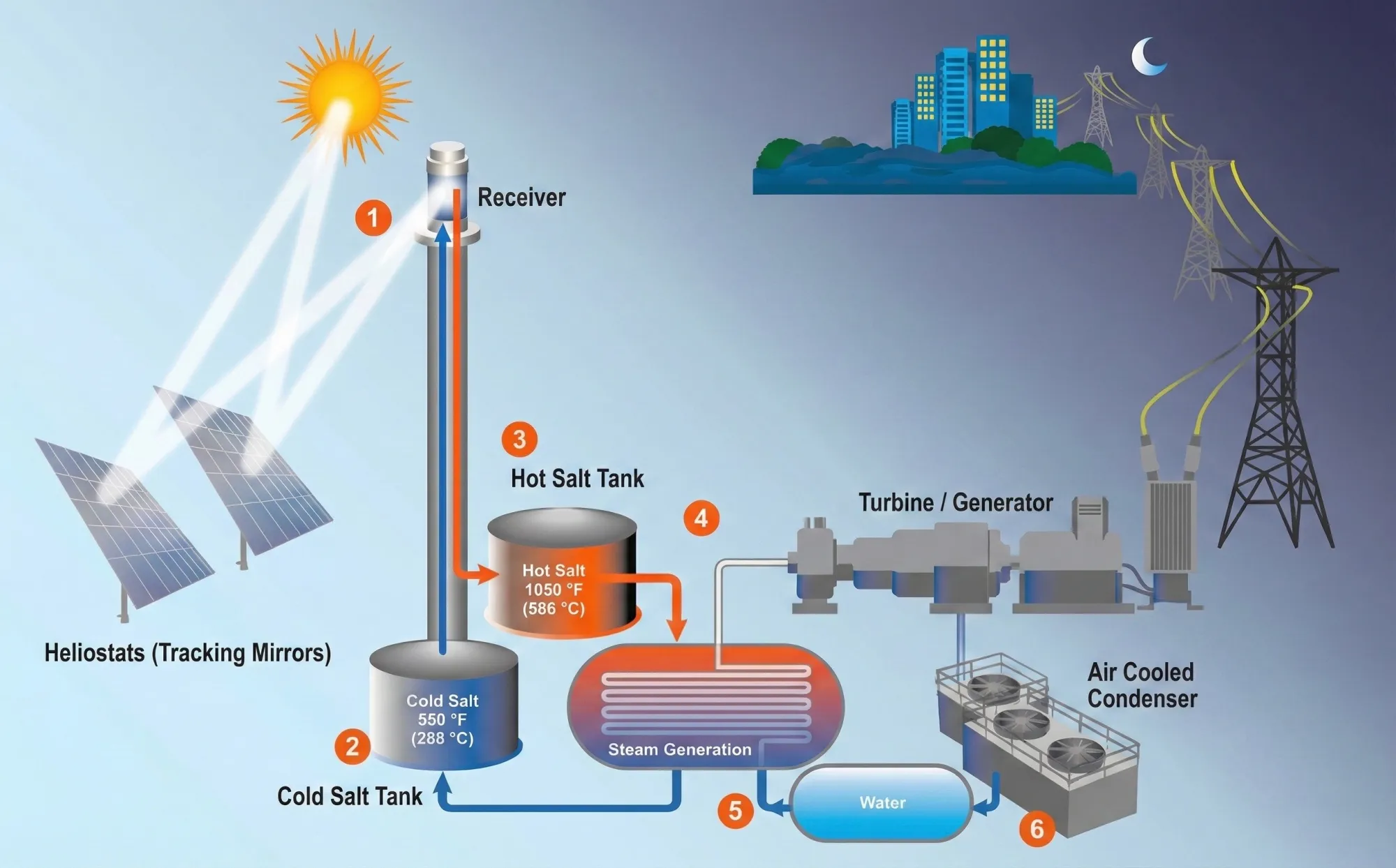

Tonopah Solar Energy, LLC ("TSE" or the "Debtor") owns and operates the Crescent Dunes Solar Energy Project (the "Power Plant"), a 110 MW concentrated solar power ("CSP") facility located in Nye County, Nevada. The Power Plant was the first utility-scale CSP plant in the United States to be fully integrated with molten salt thermal energy storage technology.

- The Power Plant's design addresses the core limitation of renewable energy sources such as solar and wind, namely intermittency, by storing heat in molten salt and generating electricity on demand, including during nighttime hours.

- The facility consists of 10,347 heliostats (mirror assemblies) arranged in a circular solar field that focus sunlight onto a 640-foot central receiver tower, where molten salt is heated to a design temperature of 1,050°F.

- The thermal storage system provides up to 10 hours of full-load generation capacity, allowing the plant to function as a dispatchable generator capable of supplying firm power during peak evening demand.

The Power Plant occupies approximately 1,620 acres on a 2,250-acre site leased from the Bureau of Land Management, with the lease term running through December 31, 2039. The facility connects to the Nevada electricity grid via a 5.6-mile, 230kV transmission line linking the plant to a nearby substation.

TSE's business model relies on the sale of electricity and renewable energy credits through power purchase agreements. The Debtor has no direct employees; plant operations and maintenance are performed by ACS Industrial Activities, Inc. (f/k/a Cobra Industrial Services, Inc.) under an O&M Agreement executed in connection with TSE's 2020 bankruptcy case.

- As of the Petition Date, TSE operates under a short-term PPA with Switched On, LLC ("Switch"), a major data center operator in Nevada, which is set to expire on February 21, 2026.

Due to persistent technical challenges requiring the plant to operate at reduced temperatures, the Power Plant's maximum output has been derated to approximately 55 MW—roughly half of its original design capacity.

Tonopah Solar Energy, LLC filed for Chapter 11 protection on January 21, 2026 (the "Petition Date") in the U.S. Bankruptcy Court for the District of Delaware, reporting $10-50 million in assets and $100-500 million in liabilities.

Corporate History

TSE was formed in February 2008 by SolarReserve, Inc., a U.S. startup focused on commercializing molten salt CSP technology originally developed by Rocketdyne. The project was conceived as the first utility-scale power tower with integrated molten salt storage in the United States.

- In November 2009, TSE entered into a 25-year Power Purchase Agreement with Nevada Power Company (d/b/a NV Energy), securing a purchase price of approximately $135 per MWh.

- In December 2009, TSE executed an engineering, procurement, and construction contract with Cobra Thermosolar Plants, Inc. ("CPI").

- In September 2011, the U.S. Department of Energy approved a $737 million loan guarantee for the project under the Section 1705 Loan Guarantee Program, part of the American Recovery and Reinvestment Act.

- Equity investments were obtained from SolarReserve, Cobra Energy Investment, LLC (a subsidiary of ACS), and Banco Santander, S.A.

Construction and Commercial Operations (2011-2015)

Construction began in late 2011 near Tonopah, a site chosen for its high Direct Normal Irradiance solar resource. The project involved the installation of over 10,000 heliostats and erection of the central receiver tower, with CPI agreeing to complete construction at a fixed price and secure "Provisional Acceptance" before tendering a turnkey facility to TSE.

- Commercial operations commenced in November 2015 upon synchronization with NV Energy's utility grid.

- At that time, Crescent Dunes was the flagship of the U.S. CSP industry—the first utility-scale plant with fully integrated molten salt storage, promising to deliver baseload renewable energy.

Technical Failures and PPA Termination (2016-2019)

The plant's operational success was short-lived, as chronic technical failures plagued the facility from its early months of operation.

- October 2016: Less than a year into operations, a leak in the hot salt storage tank forced an eight-month shutdown for repairs.

- 2017-2018: Upon restart, the plant struggled to achieve its nameplate capacity. In 2018, its most productive year, the facility generated only 196 GWh—a capacity factor of approximately 20%, far below the planned 52%.

- March 2019: A second catastrophic hot salt tank failure halted operations entirely, with no prospect of immediate repair.

- October 2019: NV Energy terminated the 25-year PPA, stripping TSE of its sole revenue source.

- By 2019, solar PV costs had dropped dramatically; NV Energy was paying approximately $135/MWh for Crescent Dunes' power while new solar resources could deliver energy for under $30/MWh.

2020 Bankruptcy and ACS Takeover

Facing serious liquidity issues, TSE filed for Chapter 11 protection on July 30, 2020, implementing a pre-negotiated restructuring support agreement.

- DOE Settlement: TSE negotiated a settlement under which the DOE accepted a $200 million cash payment for the outstanding loan balance (which had grown to approximately $425 million), plus a contingent note of up to $100 million (which expired on December 31, 2023).

- Ownership Transfer: 100% ownership of TSE was transferred to Crescent Dunes Investment, LLC ("CDI"), a newly formed holding company wholly owned by ACS's energy division. SolarReserve's equity interest was extinguished following its liquidation through an Assignment for the Benefit of Creditors.

- Exit Financing: Crescent Dunes Finance, Inc. ("CDF"), an ACS affiliate, provided exit financing under a loan agreement approved by the Bankruptcy Court, consisting of a $100 million term loan and a $64 million revolving line of credit at 2.9% interest.

- The plan was confirmed on December 9, 2020, allowing TSE to emerge with a significantly deleveraged balance sheet.

Post-2020 Recovery Efforts and Corporate Changes

Following emergence from bankruptcy, TSE attempted to rehabilitate the facility under ACS ownership.

- After extensive remediation of the hot salt tank (including replacement of the baseplate and repair of the tank floor), the Power Plant restarted operations in July 2021.

- In December 2021, ACS Group sold its Cobra Industrial Services and energy construction businesses to VINCI SA (France), but carved out the Crescent Dunes asset from that transaction, retaining ownership through CDI.

- O&M operator Cobra Industrial Services, Inc. was renamed ACS Industrial Activities, Inc. ("ACSIA").

Continued Technical Challenges (2021-2025)

Despite the 2021 restart, the project continued to suffer recurrent technical failures.

- February 2022: A third hot salt tank leak forced another shutdown; operations resumed on August 20, 2022.

- February 2023: A fourth leak shut down operations again; service resumed on July 13, 2023.

- July 2023: Following a root cause analysis by CADE Engineered Technologies, TSE permanently lowered the operating temperature of the hot salt tank from approximately 1,050°F to 850-900°F to prevent future leaks.

- This derating has stabilized operations, with no leak-related shutdowns for over two years, but constrains generation to approximately 55 MW, or roughly half of design capacity.

Governance Enhancements and Restructuring Preparations

- On May 1, 2025, TSE retained Development Specialists Inc. ("DSI") and appointed Yale Scott Bogen as Chief Restructuring Officer.

- On March 20, 2025, TSE adopted a Sixth Amended and Restated Limited Liability Company Agreement, and on March 21, 2025, appointed two independent managers to the Board.

- On March 27, 2025, a Special Committee was established to investigate potential claims against insiders; the committee concluded in August 2025 that TSE held no material causes of action against its affiliates.

Operations Overview

Technology and Infrastructure

The Crescent Dunes facility employs a "central receiver" power tower CSP design with integrated molten salt thermal energy storage, distinct from photovoltaic solar farms.

- Solar Field: 10,347 computer-controlled heliostats track the sun on two axes, reflecting concentrated solar radiation onto a receiver atop the 640-foot tower. Each heliostat measures approximately 115.7 square meters.

- Thermal Storage: Molten salt with a mixture of sodium nitrate (60%) and potassium nitrate (40%) is pumped from a "cold tank" (approximately 550°F) to the receiver, where it is heated to design temperatures exceeding 1,050°F, then stored in an insulated "hot tank."

- Power Generation: The facility uses a conventional cycle steam turbine system; hot salt is pumped through a steam generator train to boil water and create high-pressure steam that drives a 110 MW turbine generator.

- Storage Capacity: The system was designed to provide approximately 10 hours of full-load generation (1.1 GWh of thermal storage), enabling the plant to produce electricity on demand, including at night, without backup fossil fuel systems.

The Hot Tank Failure Pathology

The critical failure point of the Crescent Dunes project was the Hot Salt Storage Tank. Engineering forensics identified fundamental design flaws that could not accommodate the extreme thermal-mechanical stresses inherent in daily cycling.

- Thermal Expansion: As the tank fills with 1,050°F salt, the floor plates expand, but friction between the tank floor and the concrete foundation restricts movement.

- Buckling and Ratcheting: Constrained thermal expansion forces the floor plates to buckle upward (plastic deformation); upon cooling, the plates do not return to their original shape, accumulating strain over time.

- Low Cycle Fatigue: Repeated buckling creates high residual stresses at weld seams, leading to Stress Relaxation Cracking and eventual rupture of the floor plates or floor-to-wall annular welds.

Derating Strategy

Following the fourth leak in 2023, TSE implemented a derating strategy that lowered the hot salt operating temperature to a range of 850°F to 900°F.

- The reduced temperature significantly lowered thermal expansion stress on the tank floor, bringing it within the material's yield limits and effectively stopping the leaks.

- However, the thermodynamic penalty was substantial: lower input temperature reduces the quality of steam produced, capping the plant's output at approximately 55 MW—roughly half of design capacity.

Commercial Arrangements

Following termination of the original 25-year PPA in October 2019, TSE operated under a series of short-term agreements with NV Energy:

- 2021 Short-Term PPA: NV Energy agreed to pay only $21/MWh off-peak and $63/MWh during a 7-hour peak window (3:00-10:00 PM); NV Energy also decreased energy purchases to approximately 40 MWh total due to limited transmission capacity.

- 2021 PPA (November 2021-2024): Significantly better terms, including a "take-or-pay" obligation, expanded 12-hour peak window (noon to midnight), and improved pricing ($122.84/MWh during summer peak, $62.50/MWh off-season peak, $31.25/MWh off-peak). The average sales price in 2023 was $66.16/MWh.

- January-May 2025: After NV Energy declined to extend the PPA, the Power Plant went into standby mode, delivering no energy through May 2025.

- Switch Short-Term PPA (May 30, 2025-present): Month-to-month agreement with Switched On, LLC, a data center operator; currently set to expire February 21, 2026.

Workforce and O&M Structure

TSE has no direct employees. Under the O&M Agreement with ACS Industrial Activities, Inc. (executed July 30, 2020), the O&M Operator supplies all personnel needed to operate the Power Plant.

- The O&M Operator collects a monthly management fee of $15,000 (subject to inflation adjustment) plus reimbursement for expenses.

- TSE currently utilizes three independent contractors to perform key services unrelated to direct plant operations, including bookkeeping, financial and accounting, management advisory, and general counsel legal support.

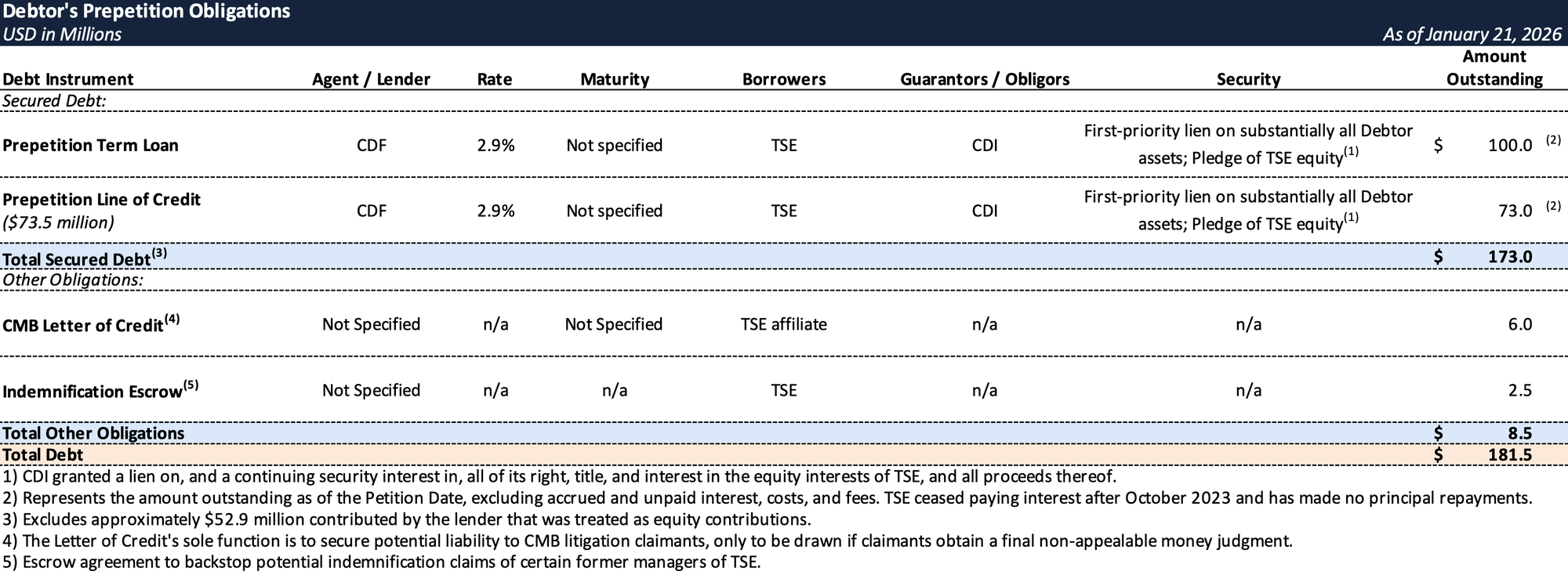

Prepetition Obligations

Events Leading to Bankruptcy

Technical Failures and Operational Challenges

- The Crescent Dunes project did not achieve the reliable performance expected, and its technical problems directly undermined TSE's financial viability:

- The first hot salt tank leak in October 2016 caused an eight-month outage, eliminating revenue generation for most of a year.

- The second leak in March 2019 proved even more damaging, halting operations for over two years (through mid-2021).

- Between October 2016 and July 2021, Crescent Dunes was offline more often than it was online due to these major repairs.

- Post-2020, two additional leaks (February 2022 and February 2023) continued to disrupt operations and erode revenues.

- The July 2023 decision to operate at reduced temperatures (850-900°F versus 1,050°F design) stabilized the asset but permanently impaired its revenue-generating capacity:

- Maximum output dropped from approximately 100 MWh to 55 MWh.

- This fundamental mismatch between the project's fixed cost structure (designed for a 110 MW facility) and its derated revenue capacity rendered the existing business model unsustainable.

Loss of Long-Term Offtake Agreement

- NV Energy's October 2019 termination of the original 25-year PPA stripped TSE of its sole source of contracted revenue. The termination was driven by both the project's operational failures and the dramatic decline in solar PV costs:

- By 2019, new solar resources in Nevada could deliver energy for under $30/MWh, compared to the approximately $135/MWh TSE received under the original PPA.

- The 2021 PPA with NV Energy, while providing significantly better terms than the initial post-restart arrangements, expired at the end of 2024 with NV Energy declining to extend or renew.

- From January through May 2025, the Power Plant operated in standby mode with no revenue generation.

- The current Switch Short-Term PPA is a month-to-month arrangement insufficient to support long-term operations.

Exhaustion of Affiliate Support

- Since emerging from the 2020 bankruptcy, TSE has survived predominantly on the balance sheet of its parent entities:

- By October 2022, the $64 million revolving line of credit approved as exit financing was fully drawn.

- CDF (the "Prepetition Lender") subsequently contributed approximately $52.9 million of additional funding, which was recharacterized as equity contributions.

- Beginning in October 2023, TSE ceased making interest payments on its approximately $173 million secured debt; CDF voluntarily forbore from exercising remedies to allow TSE to remain current on ordinary course trade obligations.

- As of the Petition Date, TSE had only approximately $598,000 in available cash, all of which constituted cash collateral of the Prepetition Lender.

Failed Prepetition Marketing Process

- In the second half of 2024, TSE engaged its former investment banker to pursue a sale of the Power Plant, conducting targeted outreach to over 120 strategic and financial buyers. The process did not yield an actionable offer.

- In May 2025, TSE retained SSG Advisors, LLC to recommence marketing efforts:

- SSG contacted 253 potential buyers—129 strategic energy companies and 124 financial investors.

- 13 parties executed NDAs and accessed the data room.

- The process generated several indications of interest, all of which contemplated a bankruptcy sale.

- TSE engaged in advanced discussions with one potential buyer, entering into an exclusivity agreement (ultimately extended through October 15, 2025) to negotiate a stalking horse asset purchase agreement. The process did not result in an actionable bid.

- In November 2025, a new potential buyer expressed interest; TSE provided data room access and a site visit in December 2025 and continues to advance discussions.

CMB Litigation Overhang

- Entities affiliated with CMB Infrastructure Investment Group have pursued litigation against TSE, ACS, and Cobra entities since 2020, seeking to recover losses on an allegedly defaulted $90 million loan to SolarReserve CSP Finance LLC:

- Nevada District Court Action: CMB filed suit in May 2020 asserting contract and tort claims. In January 2024, an ICC arbitration panel rejected all claims CMB brought on its own behalf (Claims 1-5) and awarded the Defendants $2,437,221 in attorneys' fees and costs. The Nevada District Court confirmed the award in October 2024 and entered judgment in favor of the Defendants in June 2025. CMB paid the judgment in October 2025 but has appealed to the Ninth Circuit (Case No. 25-4430).

- ICC Arbitration of Claims 7-10: In July 2025, CMB submitted a request for arbitration of remaining claims it purportedly holds as assignee of SolarReserve CSP Holdings.

- Qui Tam Action: In January 2020, CMB Export, LLC filed a whistleblower suit alleging False Claims Act violations. The DOJ investigated and declined to intervene in June 2023; in November 2024, DOJ moved to intervene and dismiss the action. The Nevada District Court granted dismissal in July 2025. CMB Export has appealed (Case No. 25-5835).

- While the Defendants have prevailed in all proceedings to date, the litigation remains a contingent liability. A $6 million letter of credit, obtained in connection with the 2020 plan, secures TSE's potential liability to CMB claimants.

Restructuring Support Agreement and DIP Financing

- On December 16, 2025, TSE, CDF, CDI, and ACS Industrial Activities, Inc. entered into a Restructuring Support Agreement contemplating:

- A sale of substantially all of TSE's assets under Section 363 of the Bankruptcy Code, subject to court-approved bidding procedures.

- A Chapter 11 plan providing for distribution of sale proceeds and wind-down of the Debtor's affairs.

- Key milestones: bid deadline within 50 days of filing, sale order within 80 days, plan confirmation within 125 days, and effective date within 240 days.

- To fund the Chapter 11 case, CDF agreed to provide a $10 million senior secured superpriority DIP facility:

- $5 million available upon entry of interim order; additional $5 million upon entry of final order.

- Interest at 4.5% per annum, payable monthly in kind.

- No financing fees.

- The Court entered the Interim DIP Order on January 23, 2026.

- SSG conducted a market check by seeking competing DIP financing offers from 10 third-party prospective lenders. No proposals were received due to unwillingness to provide financing subordinate to the Prepetition Lender's liens or engage in a priming fight.

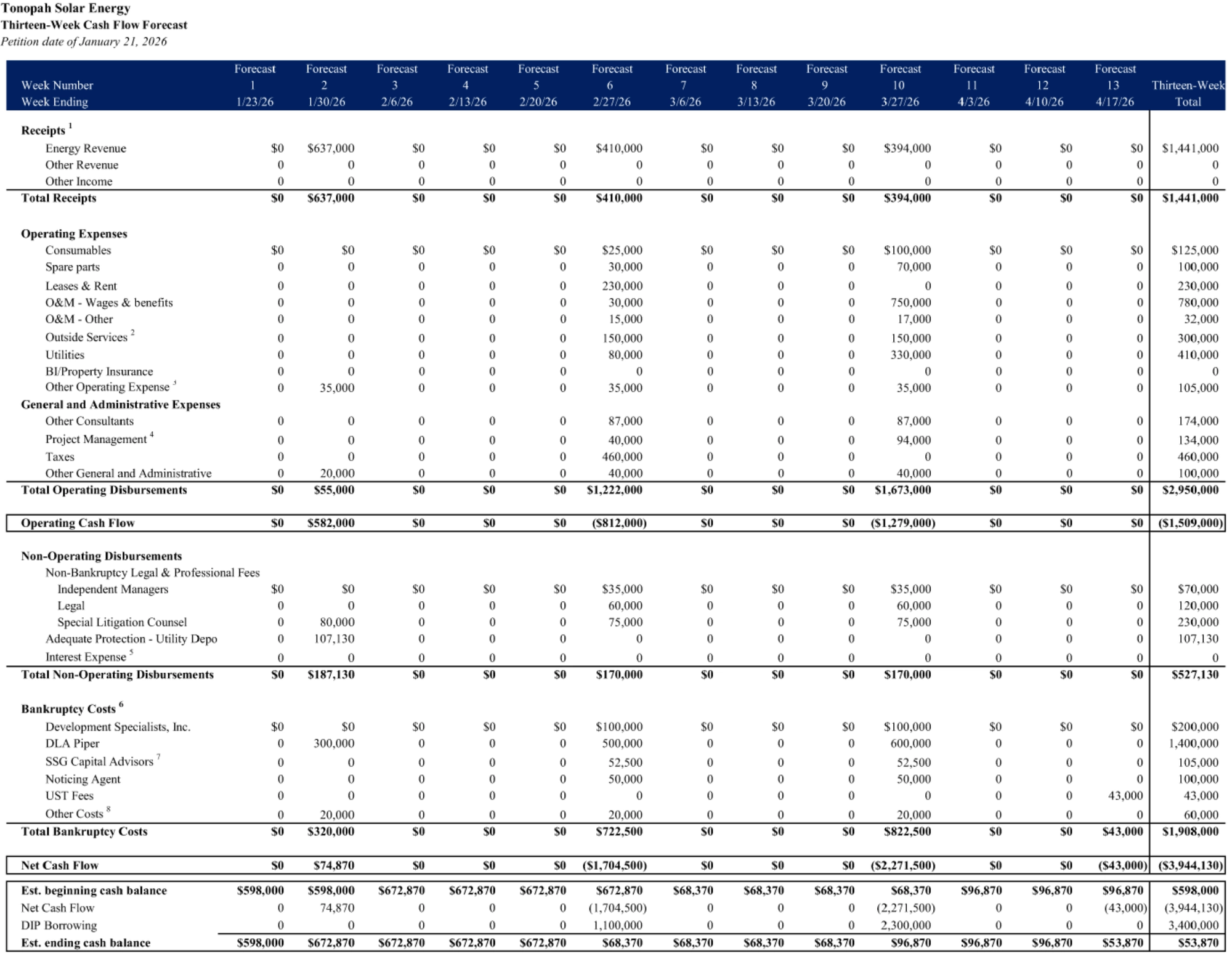

Initial Budget

Anticipated Path Forward

- The Debtor intends to pursue a court-supervised auction and going-concern sale of the Power Plant. CDF has reserved the right to credit bid its secured debt to acquire the assets if no higher or better offer is received.

- The Debtor anticipates that any recovery to allowed, undisputed, non-insider general unsecured creditors would be funded by a carve-out from CDF's collateral if sale proceeds are insufficient to pay CDF's allowed secured claim in full.

- CMB's claims are expected to be unimpaired under the plan to the extent eventually allowed, secured by virtue of the $6 million letter of credit that will remain in place post-effective date.

- Following confirmation, a plan administrator will be appointed to manage the wind-down, including continued defense of the CMB litigation and disposition of residual assets. The current Board members and independent managers will resign upon the effective date.

Key Parties

- DLA Piper LLP (US) (counsel); Development Specialists, Inc. (financial advisor / CRO, Yale S. Bogen); SSG Advisors, LLC (investment banker); Epiq Corporate Restructuring, LLC (claims agent).

Explore Bondoro Insights for live case dockets and comprehensive coverage of material filings from petition to plan confirmation.

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.