Case Summary: TPI Composites Chapter 11

TPI Composites has filed for Chapter 11 bankruptcy to implement a lender-led reorganization amid macroeconomic headwinds and operational setbacks, backed by a $27.5 million new-money DIP and a $55 million roll-up.

Business Description

Headquartered in Scottsdale, AZ, TPI Composites, Inc. (Nasdaq: TPIC), along with its Debtor⁽¹⁾ and non-Debtor affiliates (collectively, "TPI" or the "Company"), is a leading U.S.-based independent manufacturer of composite wind turbine blades for the global onshore wind energy market. The Company serves as a critical outsourcing partner to major original equipment manufacturers ("OEMs"), including GE Vernova and Vestas, by collaborating on the design, prototyping, and large-scale manufacturing of advanced wind blades.

- TPI’s business model is centered on long-term supply agreements, under which it dedicates manufacturing lines to specific OEM customers and blade models, enabling them to reduce time-to-market and capital expenditures.

- In addition to its core manufacturing operations, TPI provides a range of field services, including wind blade inspection, maintenance, and repair for both OEMs and wind farm operators.

TPI held approximately 27% of the global onshore wind blade market in 2024 (on a MW-basis, excluding China), according to Wood Mackenzie’s Global Wind Power Market Outlook: Q1 2025. The Company reported approximately $1.3 billion in net sales and produced 6,525 blades during the year.

On August 11, 2025 (the "Petition Date"), TPI Composites, Inc. and 21 of its affiliates filed for Chapter 11 protection in the U.S. Bankruptcy Court for the Southern District of Texas.

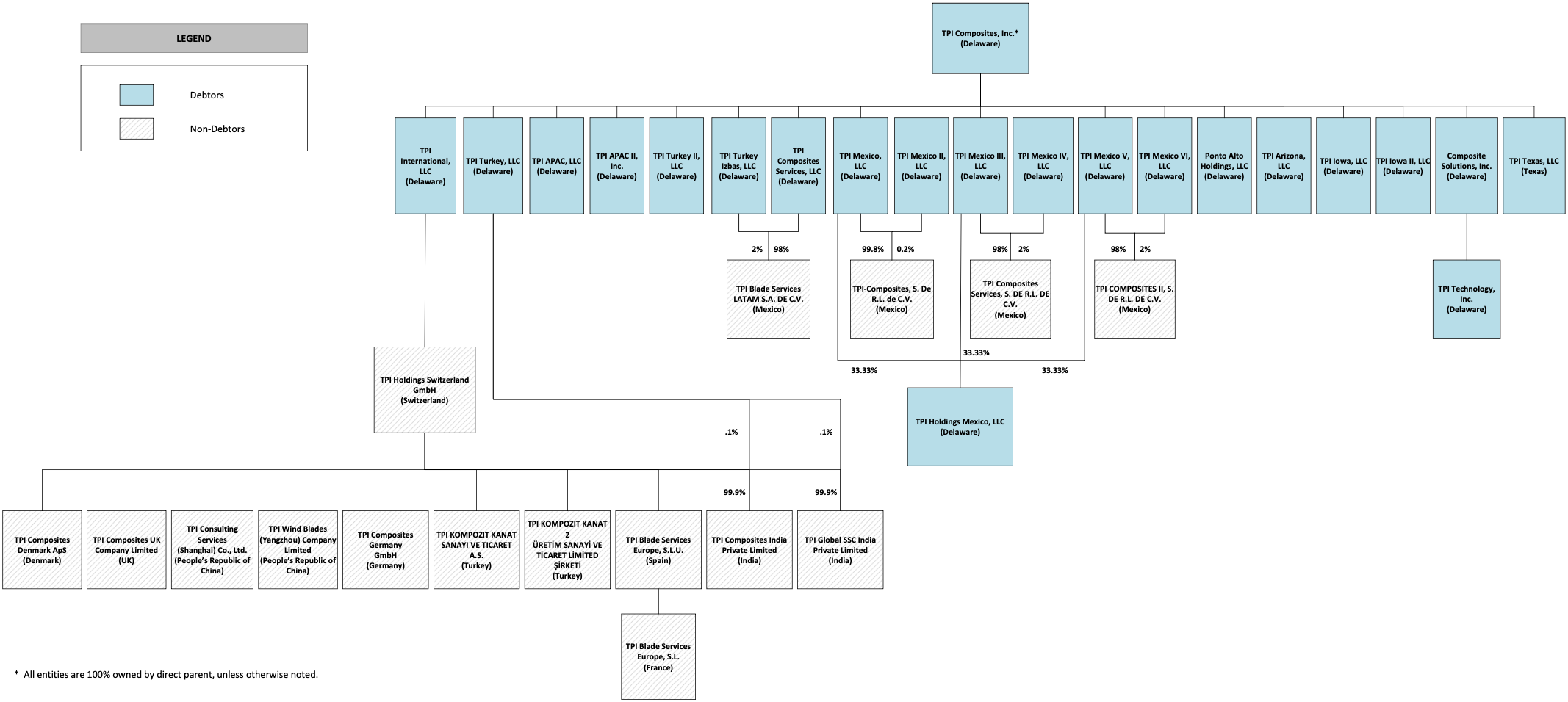

⁽¹⁾ For a complete list of debtor entities, see the organizational structure chart below.

Corporate History

TPI’s origins trace back to 1968 with the founding of Tillotson-Pearson Inc. in Warren, RI, which initially specialized in manufacturing high-performance composite products for the marine industry, such as sailboats and powerboats.

Pivot to Wind Energy and Global Expansion

- Recognizing the growing opportunity in renewable energy, the Company pivoted its strategy in 1999 and produced its first composite wind blades in 2001. In 2004, TPI formally separated its legacy boat business to become a pure-play wind energy supplier.

- Over the next decade, TPI executed a significant global expansion to establish a manufacturing footprint close to key wind markets:

- Mexico: Opened its first international plant in Ciudad Juárez in 2002, later expanding with additional facilities in Juárez (2016-2017) and a hub in Matamoros (2018).

- United States: Established a major manufacturing facility in Newton, IA, in 2008 to serve the Midwestern wind market.

- China: Entered via Taicang (Jiangsu) in 2008; expanded with blade plants in Dafeng (2014) and Yangzhou (2019); exited/wound down China operations in 2022–2023.

- Türkiye: Entered the European, Middle Eastern, and African markets with a plant in Izmir in 2012, followed by a second facility in 2015.

IPO and Recent Strategic Developments

- In July 2016, TPI completed its initial public offering on the Nasdaq Global Market under the ticker "TPIC," providing capital to fund further growth. A leadership transition occurred in May 2020, with William E. Siwek succeeding long-time CEO Steven Lockard.

- The Company continued to expand its global reach, opening a new manufacturing hub in Chennai, India, in 2020 to serve both domestic and export markets.

- Facing a severe industry downturn, TPI secured a critical $350 million preferred equity investment from Oaktree Capital Management in November 2021 to refinance debt and fund operations.

- In June 2024, TPI divested its non-core automotive composites business to sharpen its focus on the wind energy sector.

Corporate Organizational Structure

Operations Overview

TPI operates a global manufacturing network with facilities in the United States, Mexico, Türkiye, and India, supported by engineering centers in Denmark and Germany. At its peak, the Company’s manufacturing footprint spanned over 6 million square feet and employed more than 14,000 associates worldwide.

Manufacturing and Technology Assets

- United States: The principal U.S. plant in Newton, IA, supplies the North American market. TPI’s corporate headquarters is in Scottsdale, AZ, and a technology center in Warren, RI, produces precision molds and tooling.

- Mexico: Operations in Ciudad Juárez and Matamoros serve the U.S. and Latin American markets, leveraging a lower-cost production base with strategic logistical access to key wind farm sites.

- Türkiye: Two facilities in Izmir historically served the European, Middle Eastern, and African markets for customers including Vestas and Nordex, though the Company began exploring an exit from this market in 2025.

- India: A modern facility in Chennai, opened in 2020, produces blades for both the Indian domestic market and for global export.

Business Capabilities and Service Offerings

Following the divestiture of its transportation division in 2024, TPI operates almost exclusively within the wind energy segment, offering an end-to-end value proposition built on its specialized composites expertise.

- Design & Engineering: TPI collaborates with OEMs to co-develop or adapt blade designs for manufacturability, leveraging advanced materials research and prototyping capabilities.

- Manufacturing: The Company’s core business involves the serial production of large-scale wind blades (typically 50–80 meters in length) using proprietary processes.

- Maintenance & Repair: A growing field services unit supports wind farm operators by providing inspection and repair services, extending the operational life of the more than 100,000 blades TPI has produced to date.

Recent Performance and Trends

- FY 2024 vs. FY 2023:

- Net sales: $1.33 billion (–7.1% YoY); ~98% from blades ($1.3 billion). Field services declined to $32.8 million.

- Drivers: 16% volume reduction tied to Türkiye/India ramp-downs, a Matamoros closure and program transitions; partially offset by higher average blade pricing and the restart of an idled Juárez facility.

- Customer concentration: Top three customers accounted for ~92.5% of FY24 net sales (GE Vernova 34.9%, Nordex 33.2%, Vestas 24.4%). FY23: ~92.1% (Vestas 36.3%, Nordex 30.8%, GE 25.0%).

- Profitability: Net loss from continuing operations attributable to common shareholders widened to $210.1 million (vs. $127.8 million in 2023), reflecting the non-recurrence of a 2023 debt extinguishment gain, start-up/transition costs, higher interest and restructuring charges.

- H1 2025: Net sales of $612.4 million; net loss attributable to common shareholders of $116.5 million; cash and equivalents of $106.4 million against a $632.3 million working capital deficit.

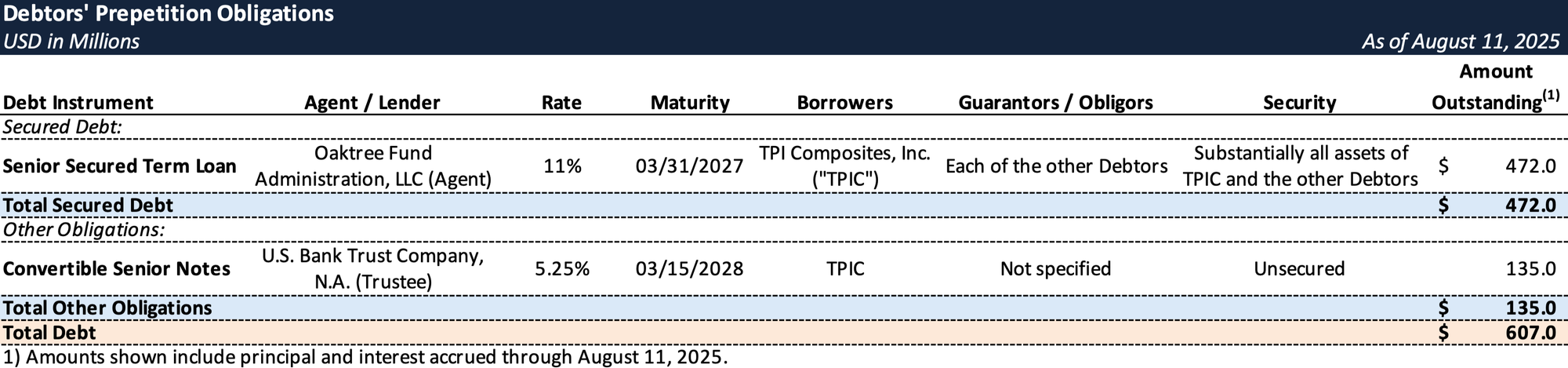

Prepetition Obligations

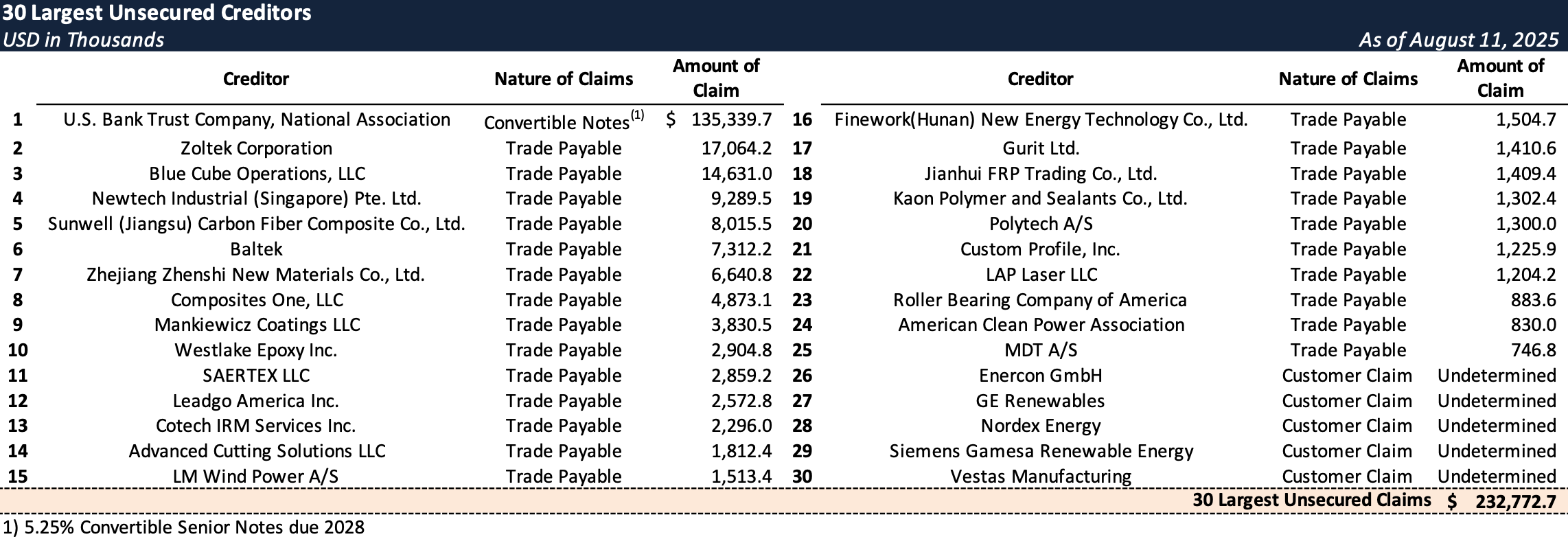

Top Unsecured Claims

Events Leading to Bankruptcy

The Company's Chapter 11 filing was the culmination of a multi-year period of severe industry-wide headwinds, operational challenges, and an unsustainable capital structure that multiple out-of-court initiatives failed to resolve.

Market Downturn and Policy Uncertainty

- TPI was adversely affected by a boom-and-bust cycle in the wind industry. A rush to complete projects before the anticipated 2020 expiration of the U.S. Production Tax Credit (PTC) was followed by a sharp downturn beginning in 2021, driven by:

- Inflation and Supply Chain Disruptions: Surging costs for raw materials (resins, fiberglass) and logistics severely squeezed margins on fixed-price blade contracts.

- Demand "Vacuum": The 2022 Inflation Reduction Act (IRA), while positive long-term, extended tax credits and removed the near-term urgency for project construction, causing U.S. wind installations to drop significantly in 2022-2023.

- Policy Whiplash: The July 2025 enactment of the One Big Beautiful Bill Act (OBBB) and a related Executive Order accelerated the phase-out of PTC benefits, injecting significant uncertainty into the project pipeline and causing OEMs to hesitate on long-term volume commitments.

Operational and Contractual Challenges

- The Company's financial performance was further eroded by deteriorating contract economics and operational setbacks:

- Unfavorable Contract Terms: OEM customers shifted away from "take-or-pay" agreements with minimum volume guarantees, exposing TPI to greater risk from demand fluctuations.

- International Strain: TPI's global footprint became a source of financial distress.

- In Türkiye, the unexpected loss of all major customer contracts in 2024, combined with hyperinflation and a protracted labor strike, rendered its operations there unviable.

- In Mexico, production delays and quality control issues on complex new blade models led to significant warranty claims and liquidated damages, which customers began withholding from payments via setoffs, directly impacting TPI's cash flow.

- Intense competition from state-subsidized manufacturers in China forced TPI to exit the market by early 2023 after writing off its investments.

Financial Decline and Recapitalization Efforts

- Persistent operating losses, including a net loss of approximately $210 million in 2024, led to a severe liquidity crisis. To address its deteriorating balance sheet, TPI undertook several major capital initiatives:

- March 2023 Convertible Notes Issuance: Raised $132.5 million in cash through the issuance of 5.25% convertible senior notes, providing a temporary liquidity bridge.

- September 2023 Oaktree Recapitalization: In a pivotal transaction, Oaktree exchanged its $436 million in Series A Preferred equity for a new $393 million senior secured term loan and TPI common stock. This deal eliminated costly preferred dividend obligations and deferred cash interest payments but transformed Oaktree from an equity holder into TPI’s senior secured lender.

- Despite these efforts, the Company remained overleveraged. As of the Petition Date, TPI carried approximately $607 million in funded debt, comprising a $472 million balance on the Oaktree-led term loan and $135 million on the convertible notes.

Prepetition Negotiations and Chapter 11 Filing

- In 2025, a special committee of the Board, with its advisors, engaged in extensive negotiations with key stakeholders—including core customers GE Vernova and Vestas, as well as its term loan lenders led by Oaktree—to orchestrate an out-of-court restructuring.

- While substantial progress was made, the Company’s liquidity position became untenable in late July 2025 when a key customer began setting off substantial liquidated damages against payments owed to TPI.

- To preserve value, TPI filed for Chapter 11 protection on August 11, 2025. The Company has secured an $82.5 million DIP financing facility from its senior lenders, consisting of $27.5 million in new money and a $55 million roll-up of prepetition debt.

- The new money is structured in two tranches: an initial $7.5 million draw and a subsequent $20 million draw, which is conditioned on the Company securing new supply agreements with GE Vernova and Vestas and delivering a reorganization plan acceptable to the lenders.

- The proposed path forward contemplates a debt-for-equity swap that is expected to cancel existing common stock and transfer ownership of the reorganized Company to its senior lenders.

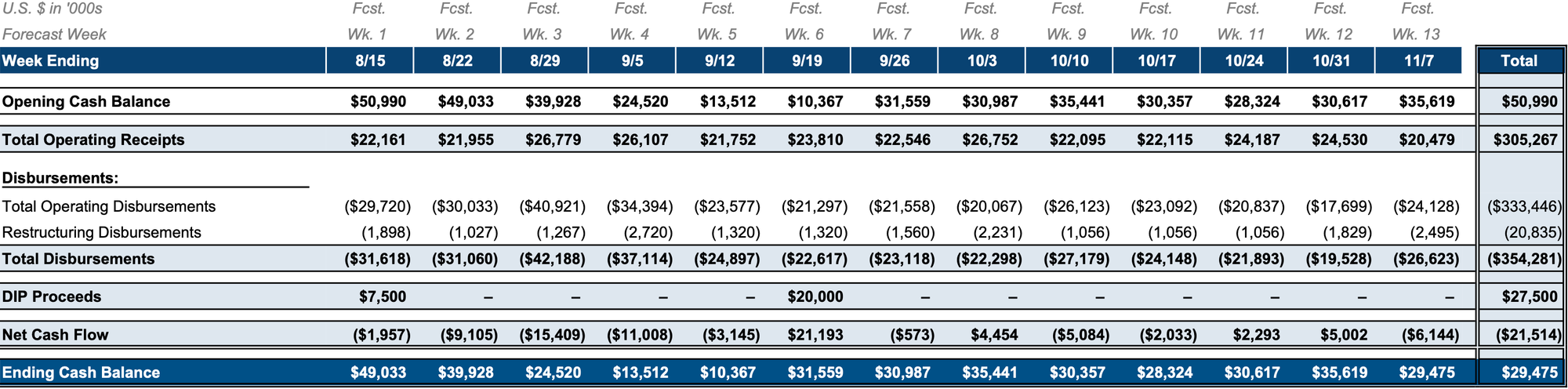

Initial DIP Budget

Key Parties

- Weil, Gotshal & Manges LLP (counsel); Alvarez & Marsal North America, LLC (financial advisor); Jefferies LLC (investment banker); Kroll Restructuring Administration LLC (claims agent).

Stay informed on every Chapter 11 bankruptcy case with liabilities exceeding $10 million. Subscribe for free to have our coverage delivered directly to your inbox, and explore our full archive of past summaries.

Subscribers can also opt in to timely filing alerts by updating their email preferences in Account Settings.